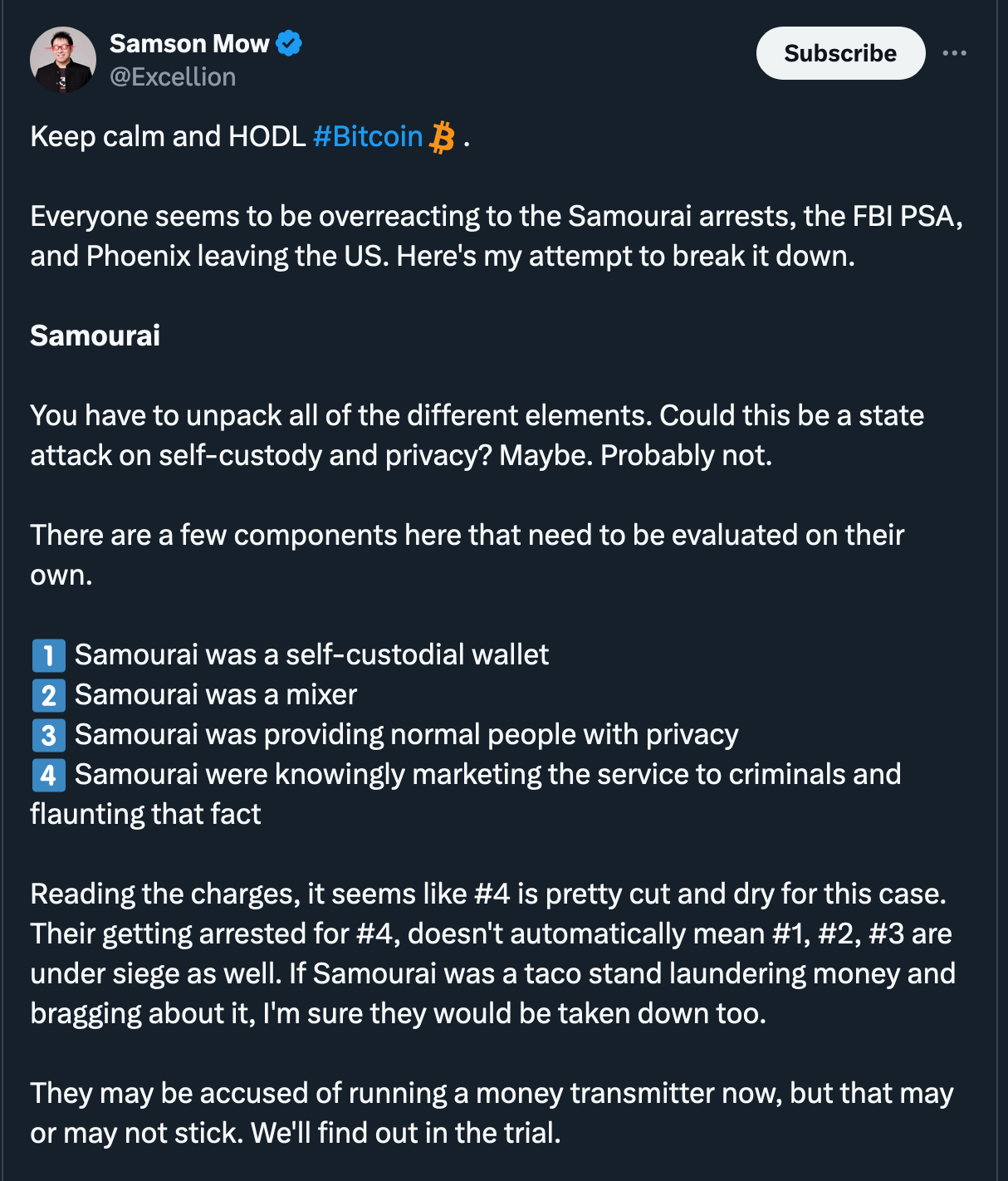

The closure of cryptocurrency mixer Samourai Wallet and the arrest of its co-founders may have deep implications for other self-custodial cryptocurrency tools, according to Cointelegraph Research. But what are these implications, and why? Let's explore.

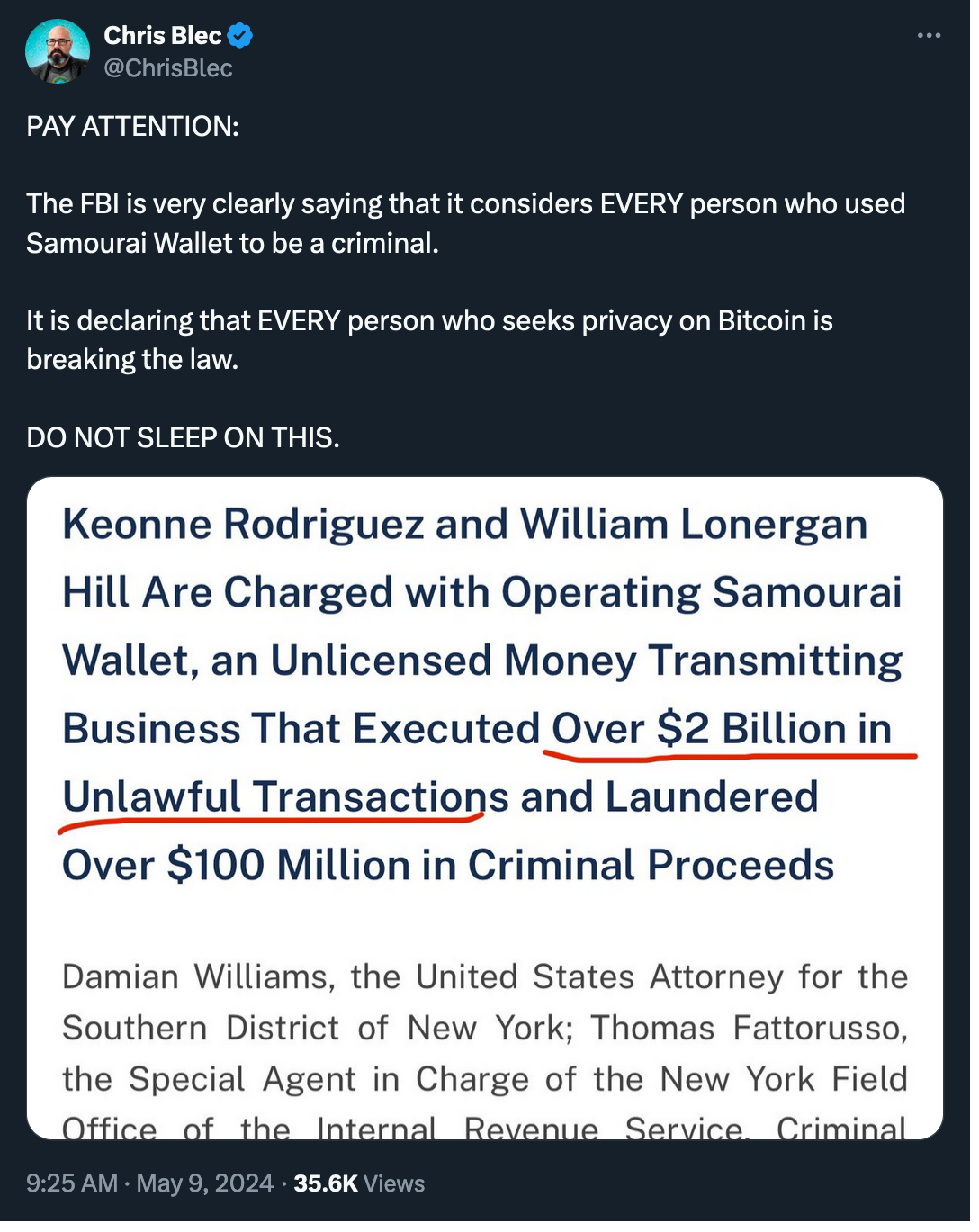

(Chris Blec on X)

Samourai Wallet co-founders Keonne Rodriguez and William Lonergan Hill were arrested on April 24, facing charges of money laundering and operating an unlicensed money-transmitting business. Rogriguez, the CEO, pleaded not guilty and was subsequently released on a $1 million bond, while Hill, the chief technology officer, is awaiting extradition to the U.S. from Portugal.

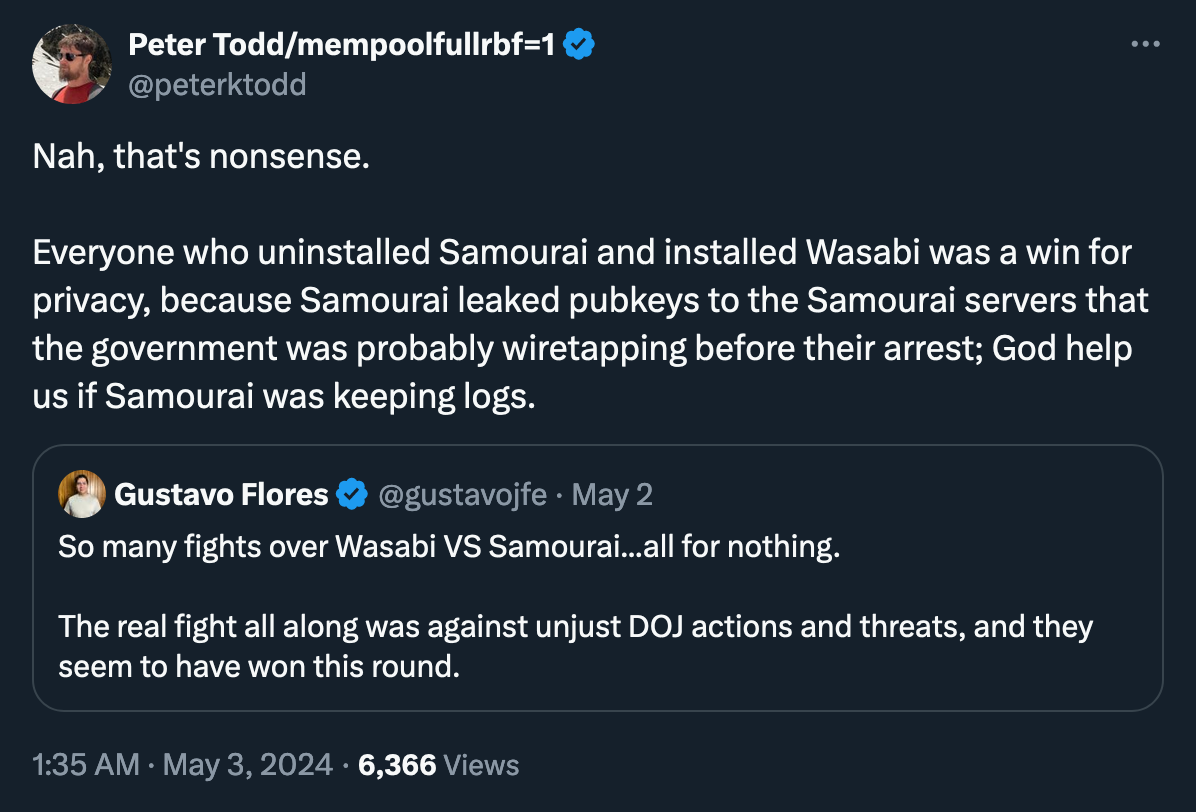

Following the indictment, the FBI warned Americans against using unregistered cryptocurrency money-transmitting services, which some believe suggests that U.S. regulators may push to make money transmitter licenses mandatory for non-custodial cryptocurrency tools.

Samourai Wallet, a self-custodial wallet, could not control funds or conduct transactions on behalf of its users.

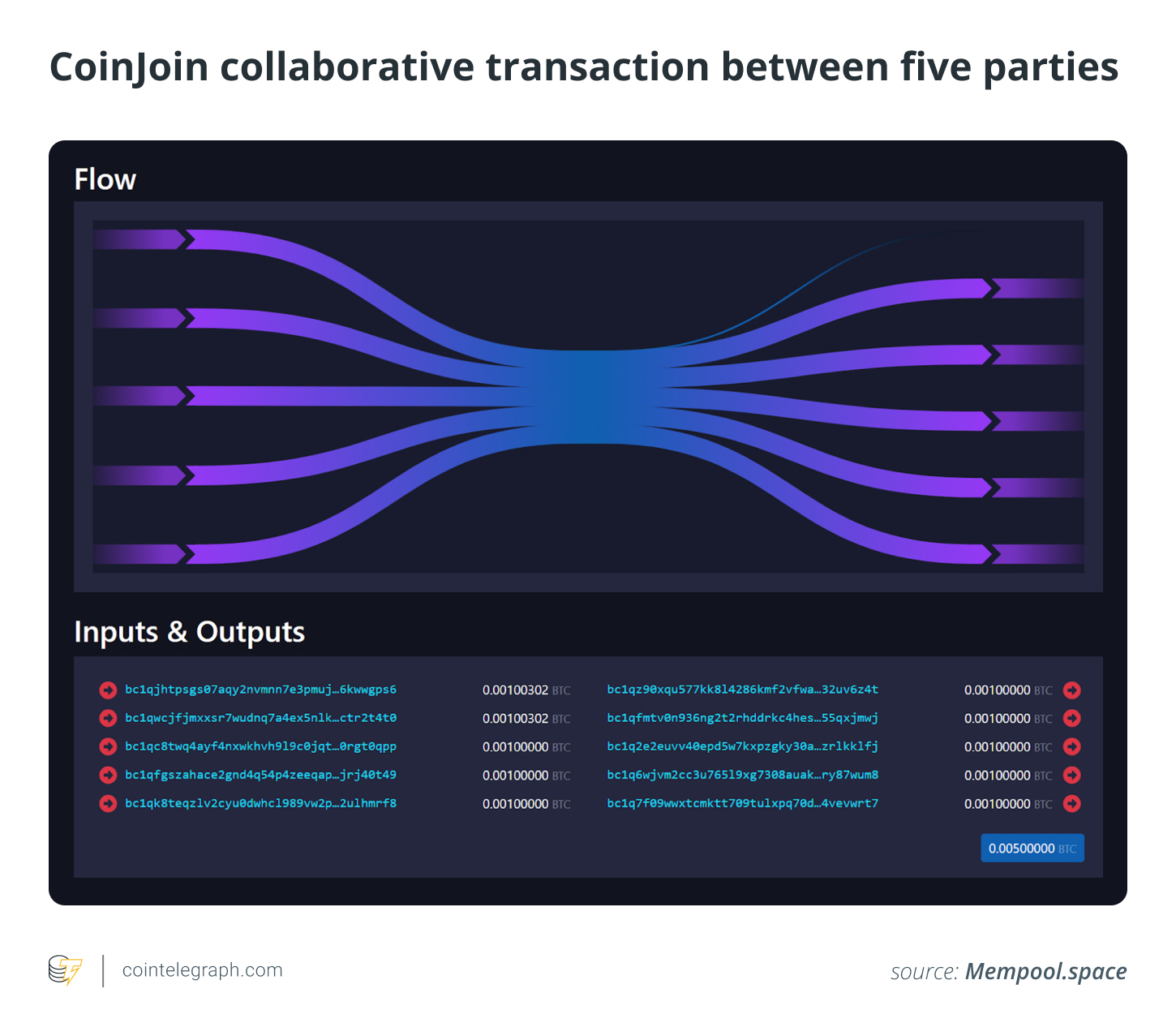

For a detailed description of how coinjoins and Samourai Wallet work, see the source

Regarding the definition of a money transmitter, in the case against Tornado Cash, another cryptocurrency mixer, the court put it as “any other person engaged in the transfer of funds” (source, PDF), arguing that control over the transferred funds is not necessary for a business to be considered as a money transmitter. However, this definition doesn't seem straightforwardly applicable to CoinJoin transactions, as no funds change hands (except for service fees).

Talking about service fees, the profits generated by Samourai Wallet may hold key legal significance. In the Tornado Cash case, the court argued that it offered "the same service to customers as other businesses that courts have held to be money transmitters,” with its founders “paid for and exercised control over critical components of the service" and reaping "substantial profits" from it.

Additionally, both Samourai Wallet founders are facing money laundering charges.

The platform was advertised as a tool for “Dark/Grey market participants,” implying operators knew about and encouraged illicit fund flows. However, they could not conduct financial transactions in a strict sense, as they were never in control of funds.

The accusations against Samourai Wallet indicate that the prosecution attempts to extend legal responsibility for laundered funds to non-custodial products if they involve maintaining server infrastructure.

(L0la L33tz on X, the 'must read')

"In the Tornado Cash opposition, the conspiracy to commit money laundering was also said to be evidenced by “(i) [the defendant’s] ongoing payments to host the website after becoming aware that it was being used to launder criminal proceeds [and] (ii) [the] payment for traffic between the UI and the blockchain to process transactions that they knew involved criminal proceeds.” (Cointelegraph)

As such, it seems to be implied that non-custodial Bitcoin wallet providers could potentially be convicted of money laundering if they run a node and host a front end, provided that they are aware of illicit activities being conducted through their wallet.

Nevertheless, if a project consists of merely code hosted on a Git repository, the distribution of privacy tools is protected by First Amendment rights in the United States.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.