Already cautious, the mood in the crypto market turned firmly bearish after the first day’s trading volumes for Hong Kong’s new Bitcoin ETFs fell considerably below expectations.

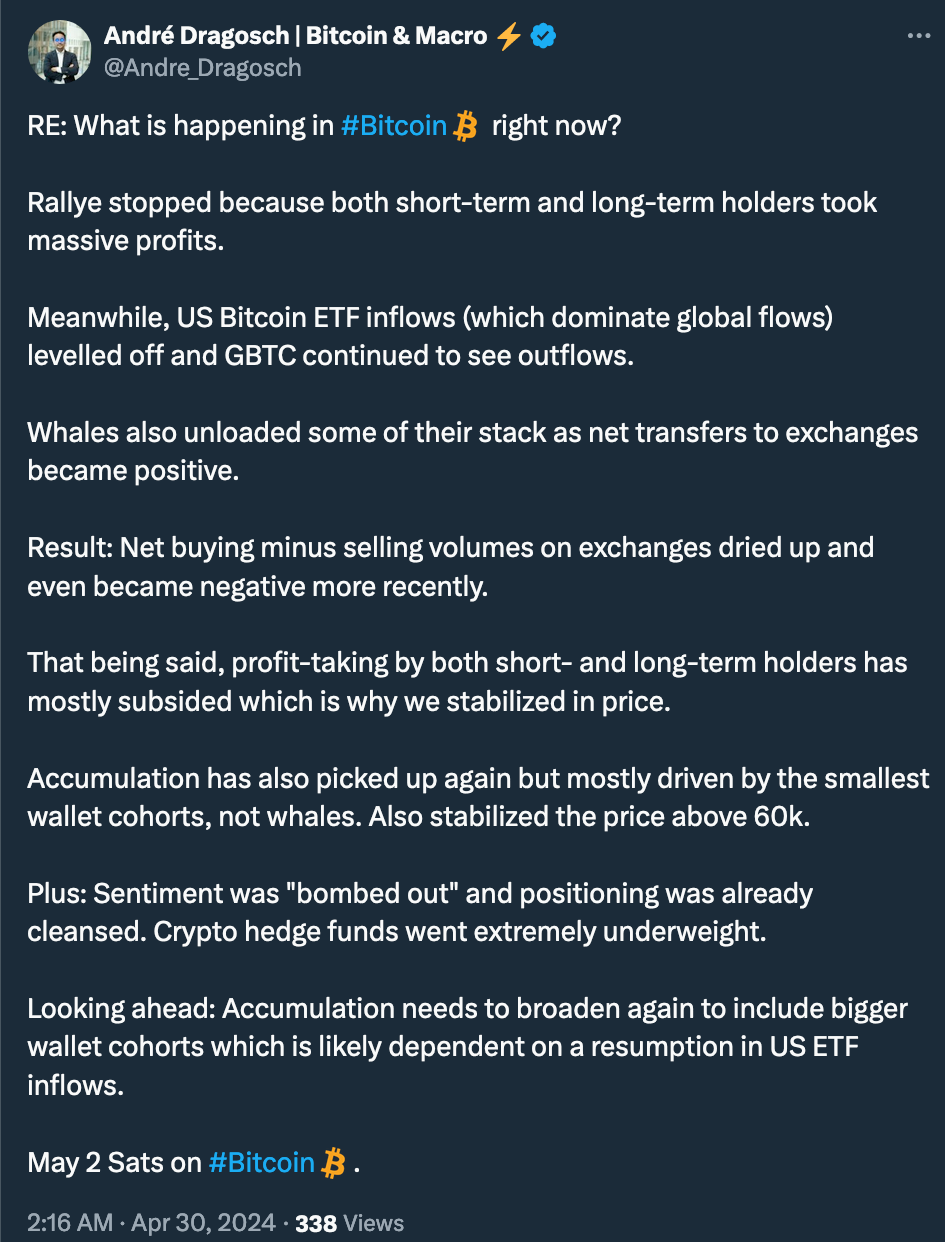

Six new crypto ETFs, the first spot bitcoin and spot ether ETFs in the region, began trading in Hong Kong on Tuesday, but the trading volumes were quite lackluster, with total trading volume barely exceeding $100 million. For context, the U.S. debut of bitcoin ETFs earlier this year saw over $4.5 billion in trading volume on the first day.

On the one hand, many industry experts note that the general interest in crypto is higher in Asia, with a larger user base than the US and Europe combined, as Willy Woo pointed out. So, this might suggest a robust investor interest in these new spot ETFs. On the other hand, one could argue that the extensive user base in Asia users might imply that many potential investors have already allocated directly to the native assets, thereby reducing interest in the ETFs.

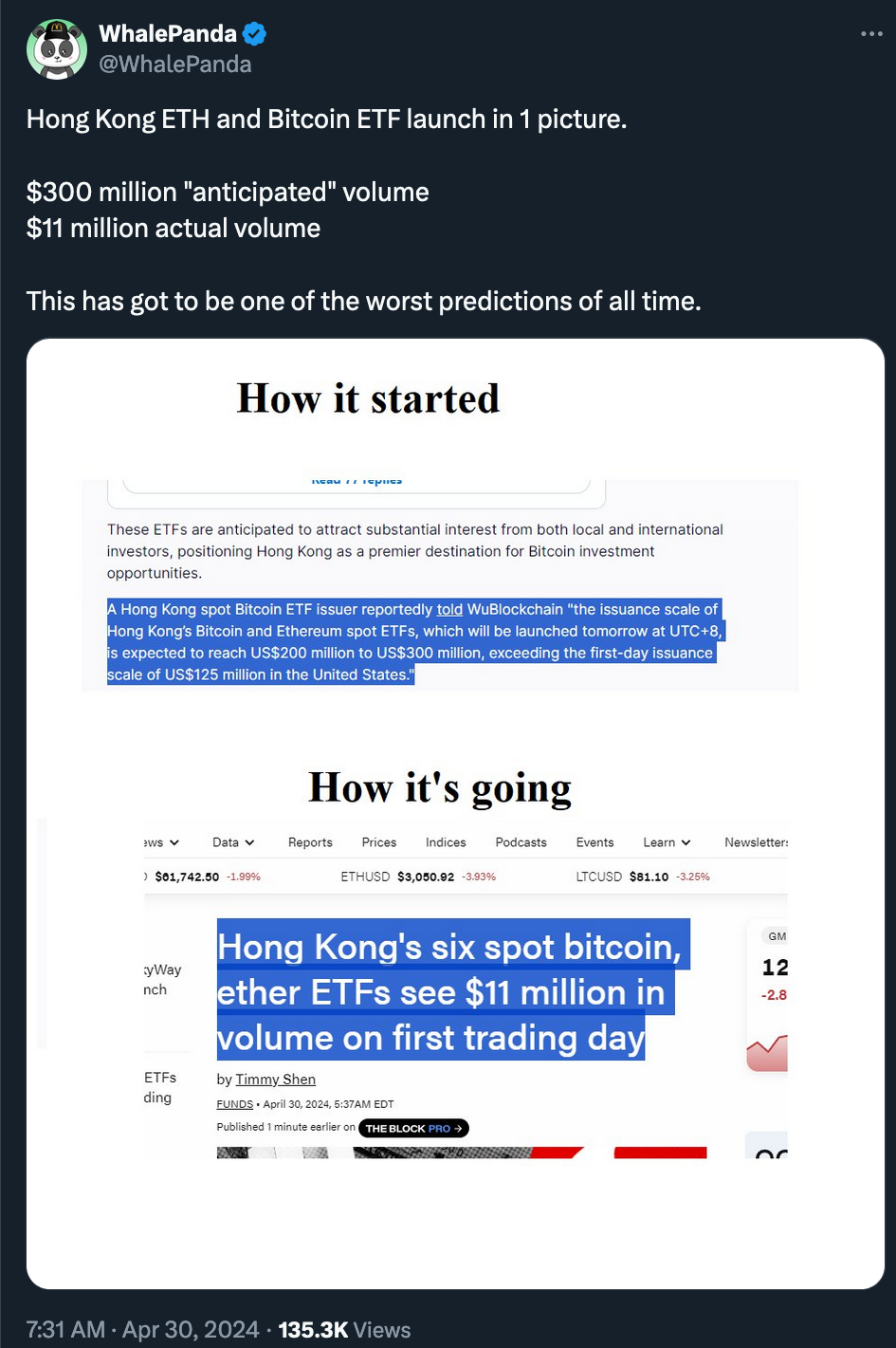

It was also noted that, unlike in the US, Hong Kong ETFs may have been preloaded considerably—on $200-300 million, as per @WhalePanda—and without that, "we would've been sub $60k now." As Cointelegraph wrote, citing Wu Blockchain, China Asset Management (CAM) Bitcoin ETF subscriptions alone totaled $140 million during the initial offering period before trading began.

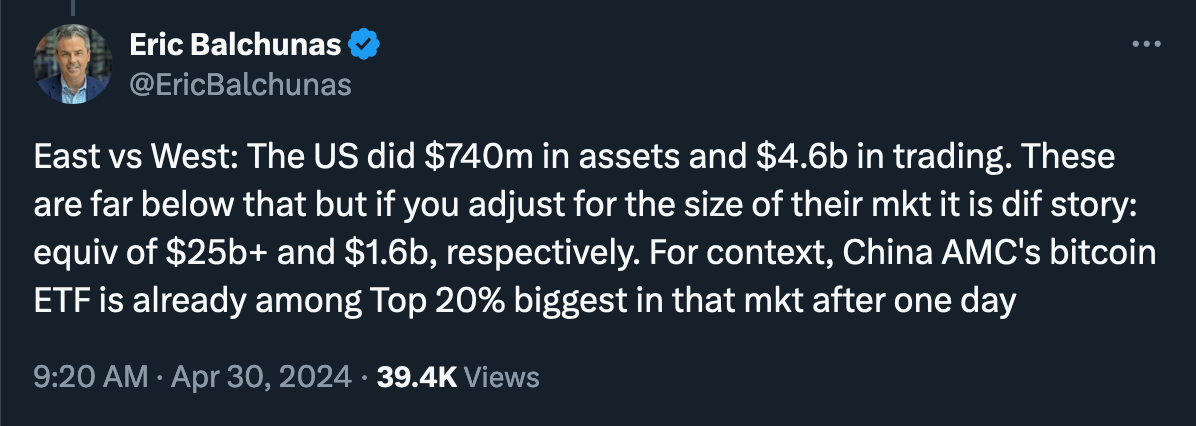

Bloomberg Intelligence analyst Eric Balchunas, too, offered a rather positive view of the Hong Kong ETFs' first-day performance when adjusted for the local market's size, also noting the good timing for the HK ETFs launch when US flows turned "slightly negative."

"It is obvious that the idea of a decentralized currency has become a global phenomenon. People are watching their currencies get debased at an accelerated rate, ... [and] Bitcoin appears to be one of the solutions that has become an accepted answer. Now we must wait and see how that popularity translates to capital flows over the next 12-18 months," — Anthony Pompliano.

Considering where the current BTC price weakness may reverse or at least bounce, market participants are now mainly watching the area slightly below $60,000.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.