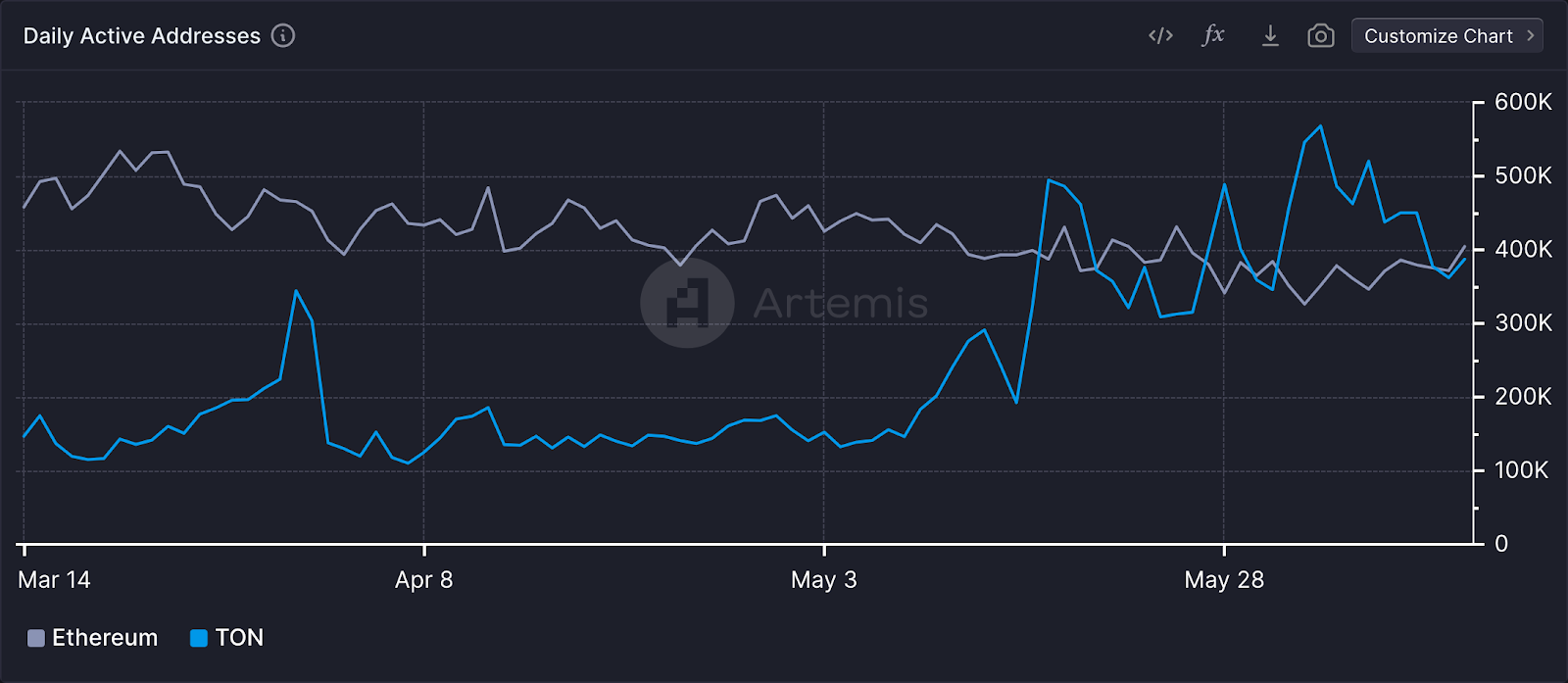

The Open Network ($TON) blockchain, backed by Telegram, has consistently recorded more daily active addresses than Ethereum nearly every day this month. While some suggest this could indicate a quiet 'flippening' driven by Telegram's massive user base, the data does not present the full picture.

According to data from Artemis, which defines 'daily active addresses' as the number of unique wallets making a daily transaction on a blockchain, TON and Ethereum have been competing closely since mid-May when Ton first surpassed Ethereum.

Source: Artemis.xyz

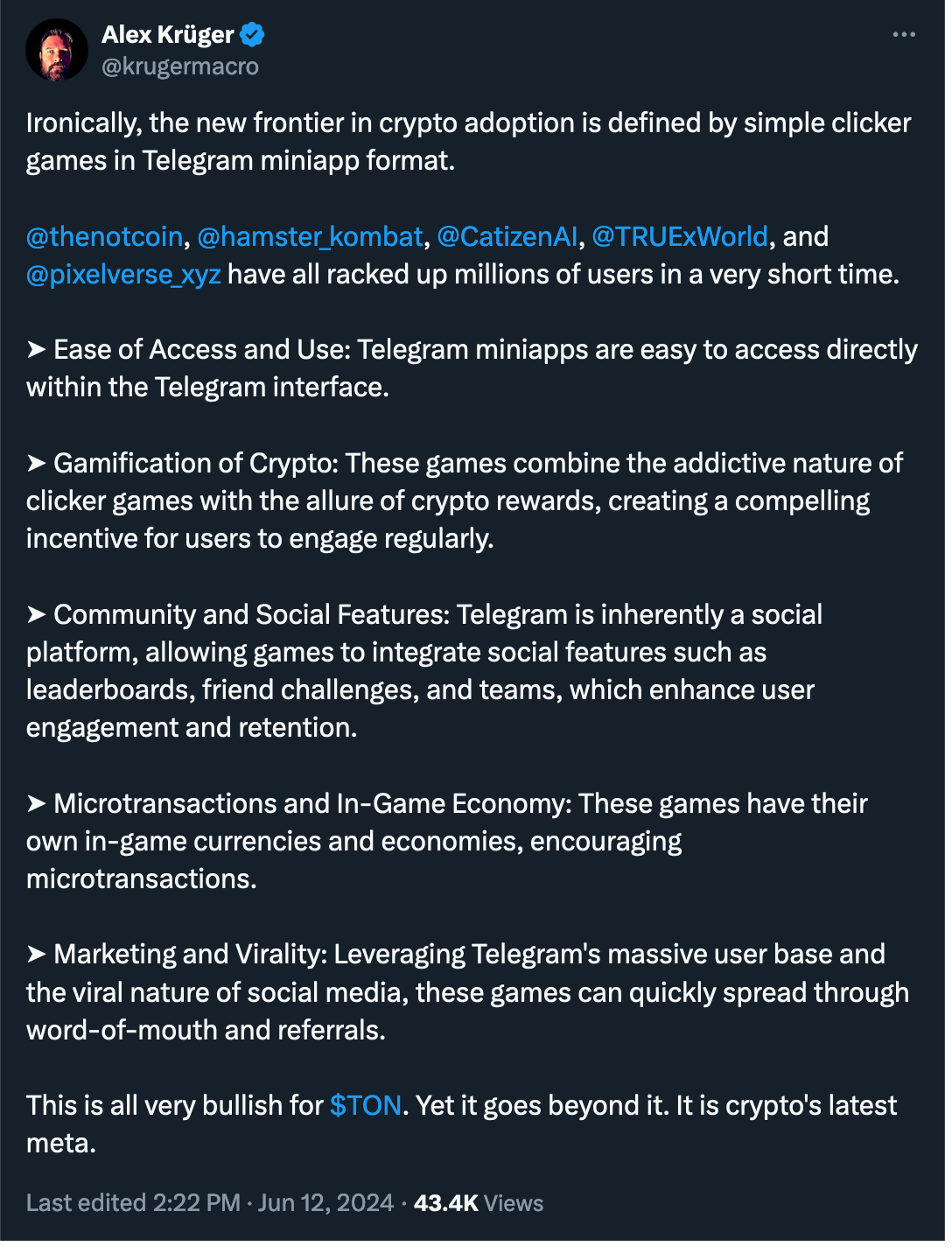

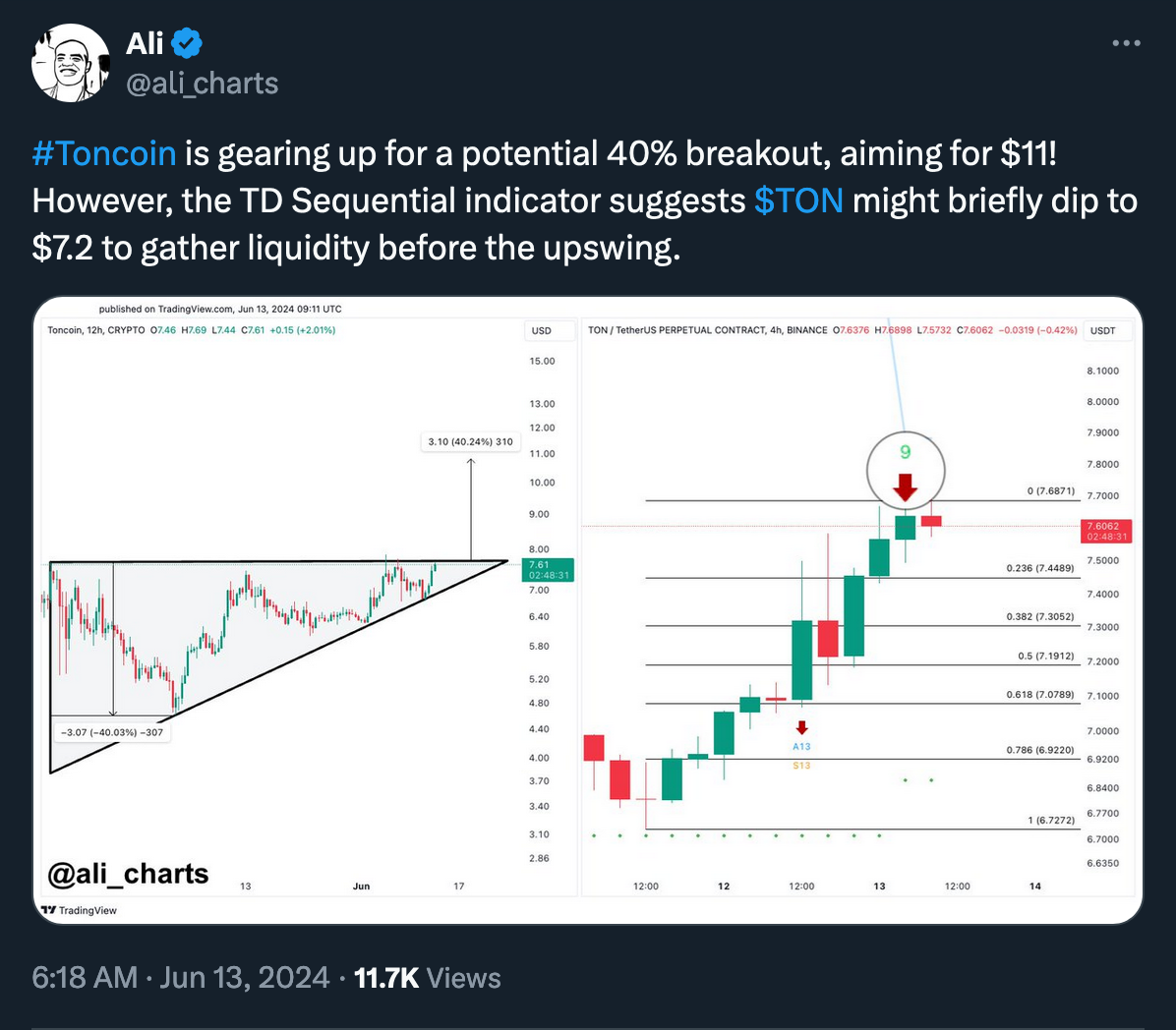

TON has experienced an impressive growth. Despite the global market downturn, the network’s native token, Toncoin ($TON), reached an all-time high of $7.76 earlier this month, thanks to Web 3 clicker games.

Although $TON has since dropped over 12%, industry analysts remain optimistic about its future.

However, an important context is missing here. Because Ethereum's transactions are being pushed to layer 2 scaling solutions, much of the ecosystem's user activity is now on L2s, which makes direct comparisons between TON and Ethereum somewhat unfair.

Ethereum co-founder Vitalik Buterin has supported using L2s to scale the main blockchain, which is part of the Ethereum roadmap. Consequently, on June 11 alone, three of the top Ethereum layer 2s—Arbitrum, Base, and Optimism—saw 1.3 million daily active addresses combined.

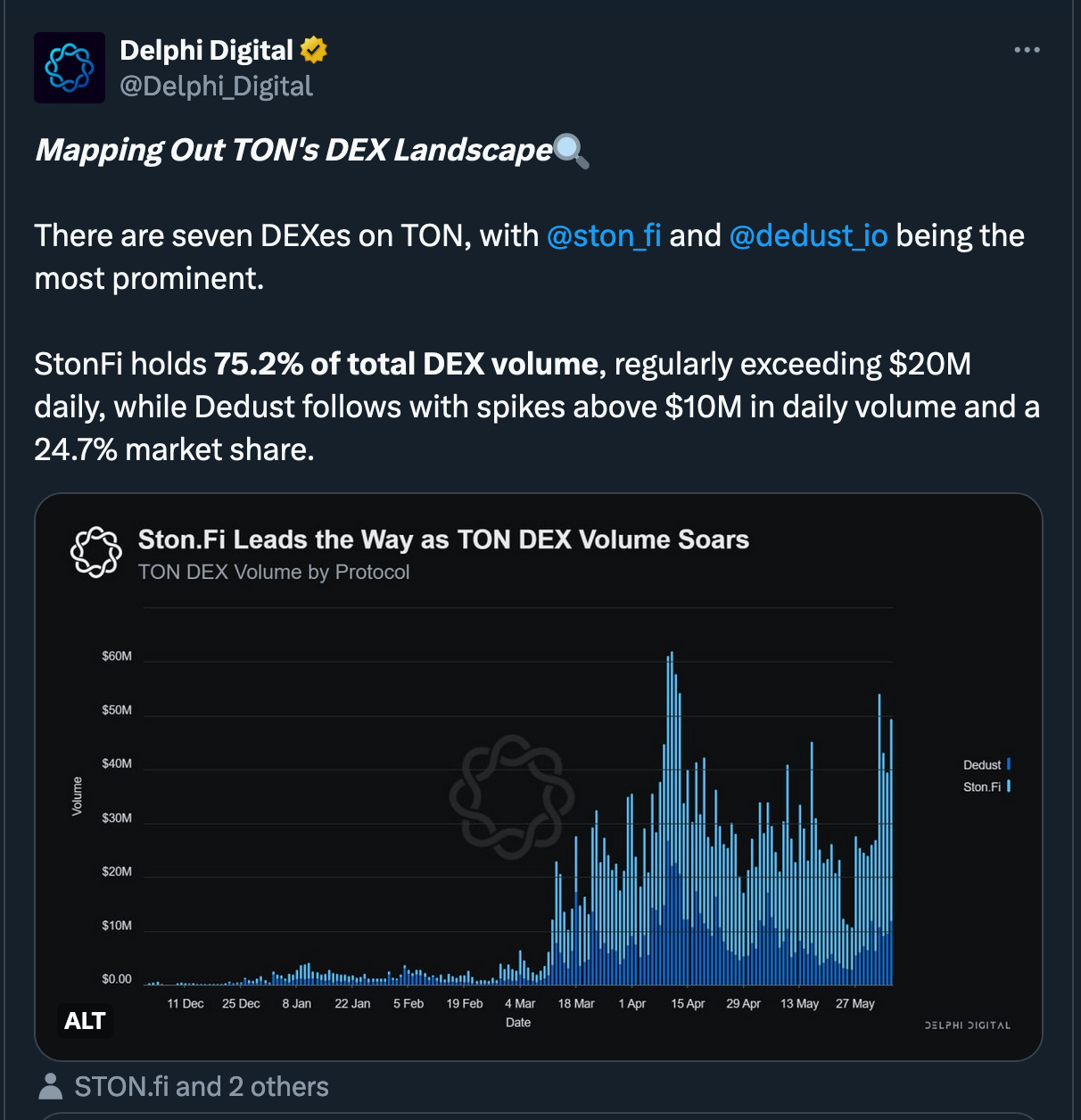

(Source: Delphidigital.io)

TON’s uptick in network activity may be attributed to Telegram recently integrating the Tether ($USDT) stablecoin on TON and 35 million users signed up to Notcoin since its launch. Notcoin is a 'tap-to-earn' token that can be earned by completing various social challenges.

Telegram also launched 'Stars' on June 6, an in-app currency used for digital purchases.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.