The use of stablecoins as a permissionless means to access the U.S. dollar is expanding globally, highlighting their growing impact on economic inclusivity and the transformation of traditional finance. Stablecoin issuers have become the world's 18th largest holders of U.S. debt, potentially being a critical ingredient for a 'dollar milkshake' that may help address the U.S. debt expansion problem while posing a threat to weaker emerging market currencies.

Stablecoins historically served as a primary bridge between the traditional financial system and the digital asset space. Stablecoin movements are often used to gauge the health of the crypto market and investors' convictions. Increasingly, however, stablecoins are acting as a means of permissionless access to the U.S. dollar worldwide, banking the unbanked and lowering remittance costs.

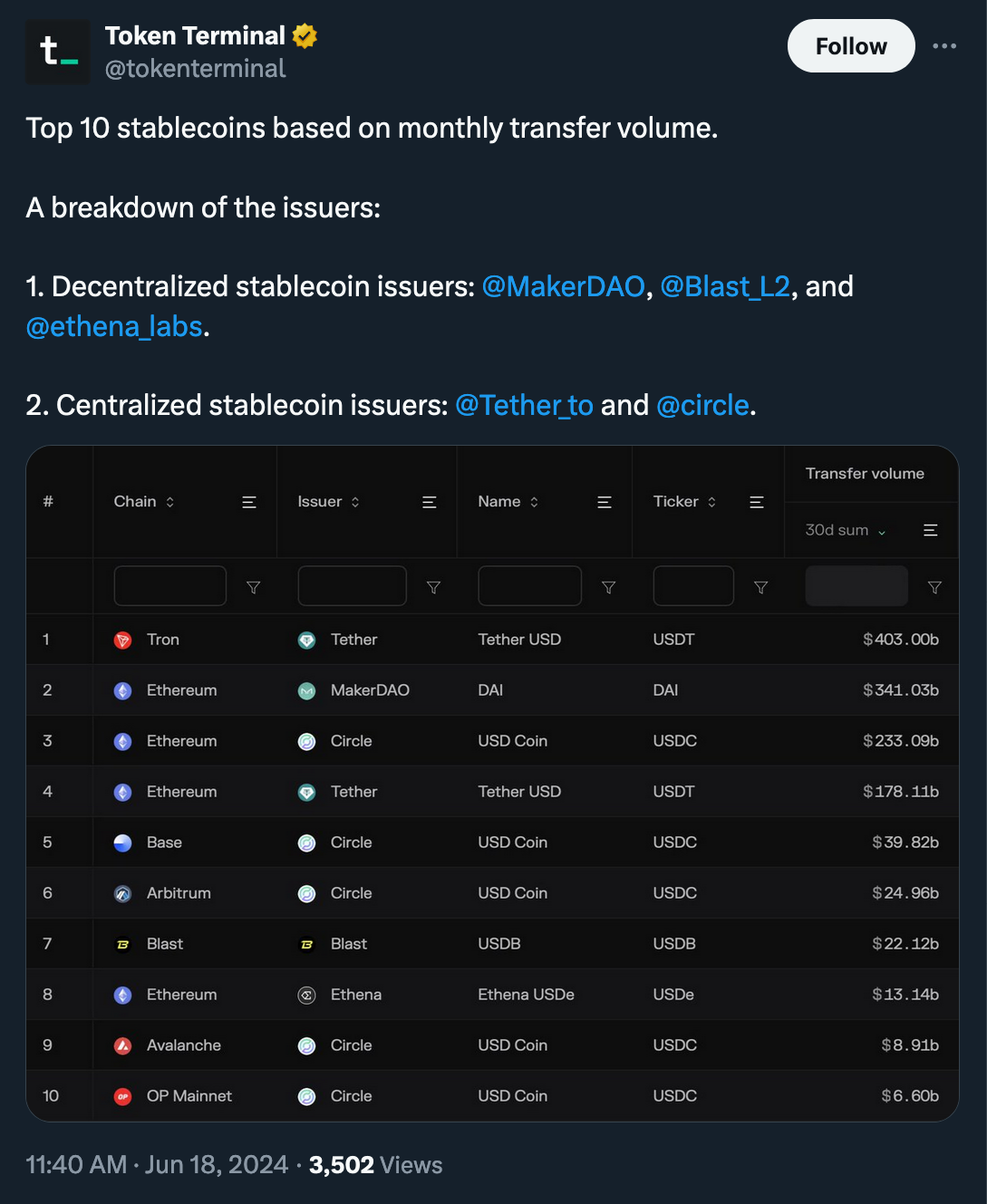

Over the past four years, stablecoin transfers have increased more than 16-fold, with monthly transfer volumes reaching a record high of $1.68 trillion in April, up from $100 billion in October 2020.

“People are now using stablecoins to purchase properties, secure loans and facilitate borderless transactions. This democratizes access to wealth, allowing anyone, anywhere, to participate in global financial markets. The expanding utility of stablecoins showcases their potential to enhance economic inclusivity and reshape traditional finance.” (Sami Start, CEO of Transak for Cointelegraph)

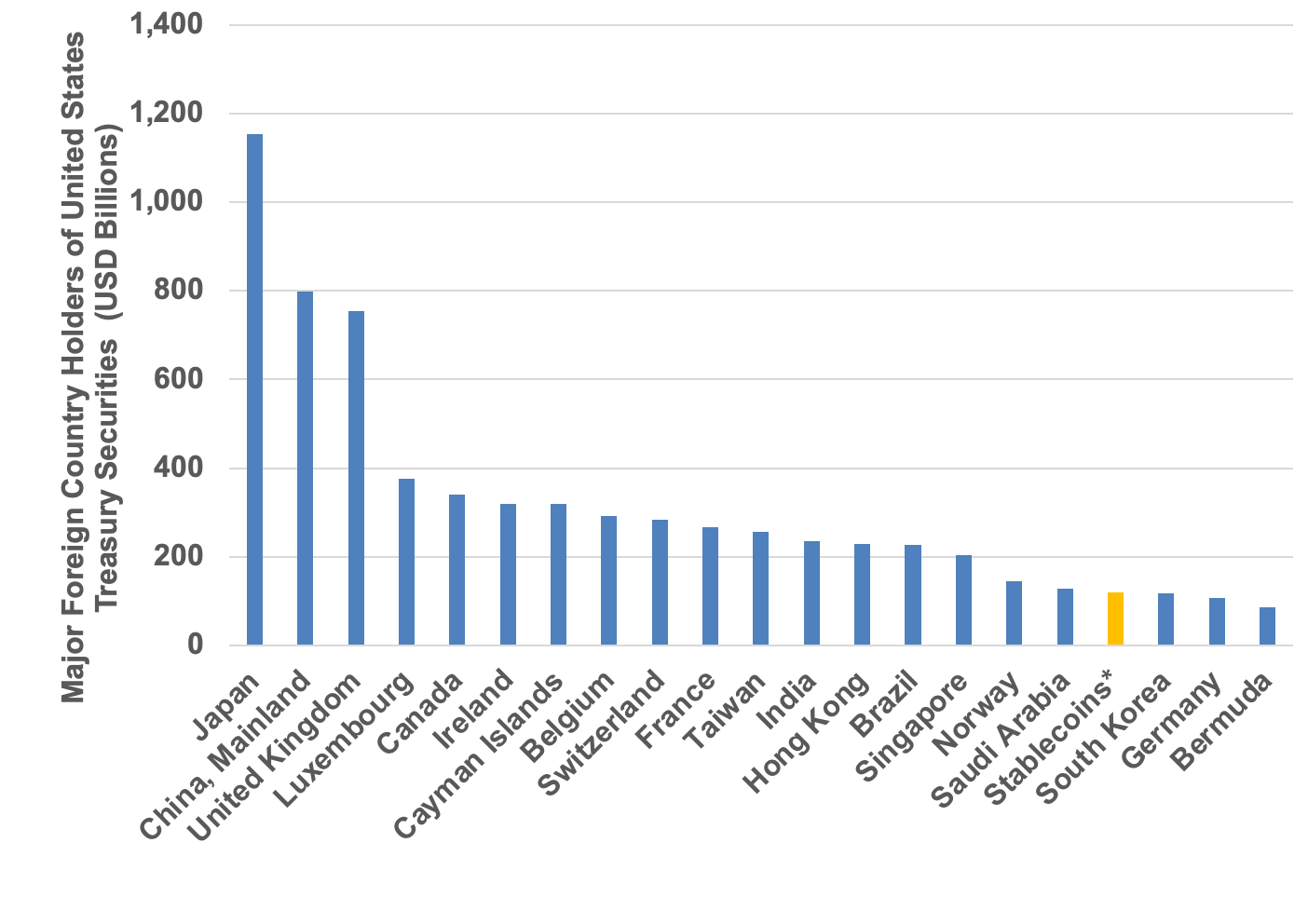

Amid rapidly growing adoption, stablecoin issuers are fast emerging as a significant source of demand for U.S. Treasury notes. They are now the world's 18th biggest holders of U.S. debt as concerns about Washington's debt management grow.

(Source: Tagus Capital)

According to data tracked by Tagus Capital, stablecoin issuers now cumulatively hold more than $120 billion in U.S. Treasury notes, surpassing major current account surplus nations like Germany and South Korea.

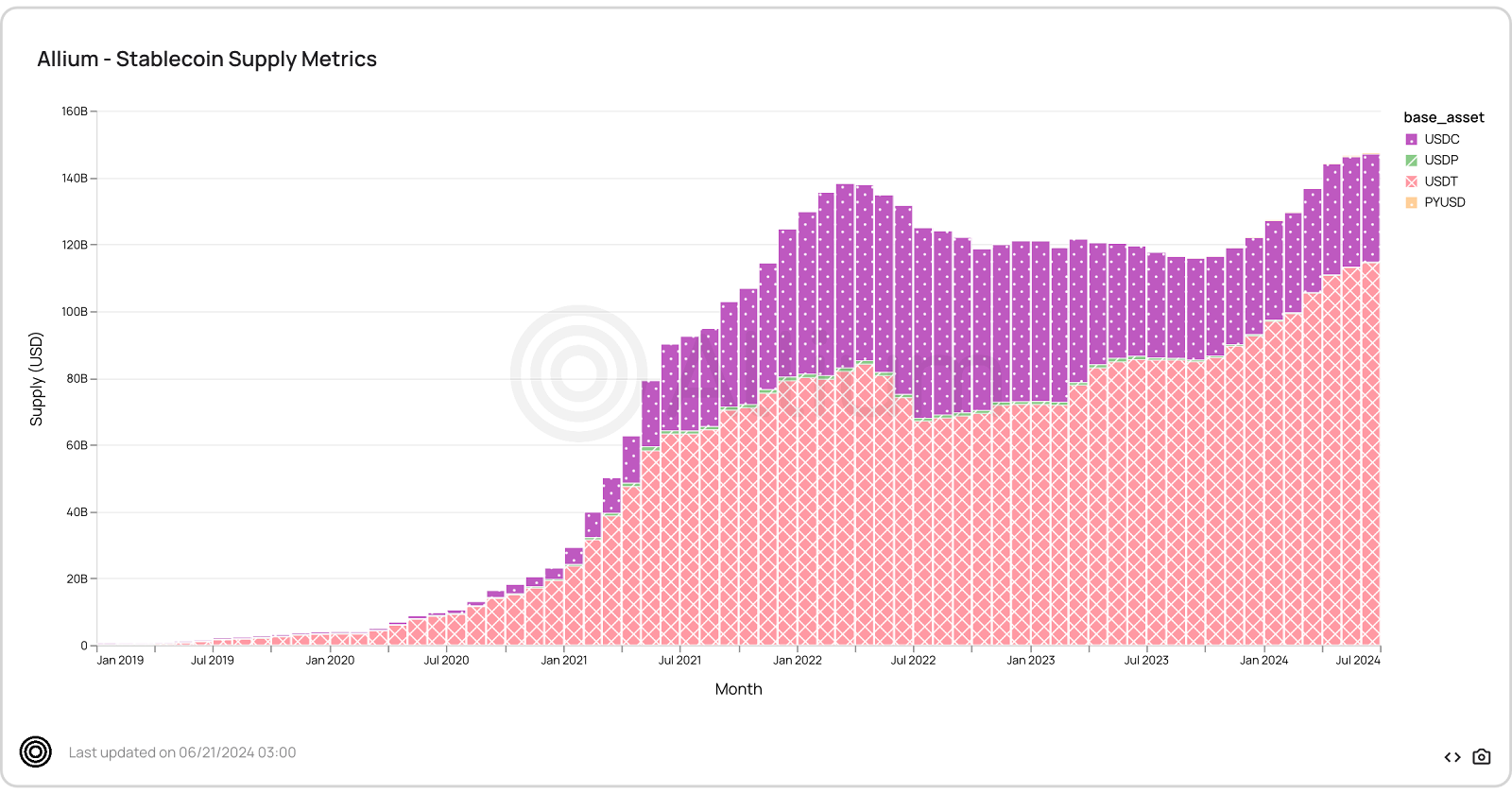

Source: Allium

Tether Ltd, the issuer of tether $USDT, alone holds around $91 billion in Treasuries, while Circle, the issuer of $USDC, holds $29 billion in short-dated U.S. debt, including repos.

The U.S. government debt surpassed $34 trillion early this year and has been growing fast, with the debt-servicing cost projected to reach $892 billion in 2024. The Congressional Budget Office estimates the national debt could reach $50 trillion by 2034, equaling 122 percent of annual economic output.

Amid the backdrop of barely controlled U.S. debt growth and the gradual diversification of sovereign reserves globally, dollar-pegged stablecoins increasingly appear to be a critical ingredient in the dollar milkshake, not only capable of prolonging the status quo in U.S. monetary policy and national debt management but also posing a threat [primarily] to the weakest emerging market currencies, as pointed out by CoinShares' research lead in his recent article.

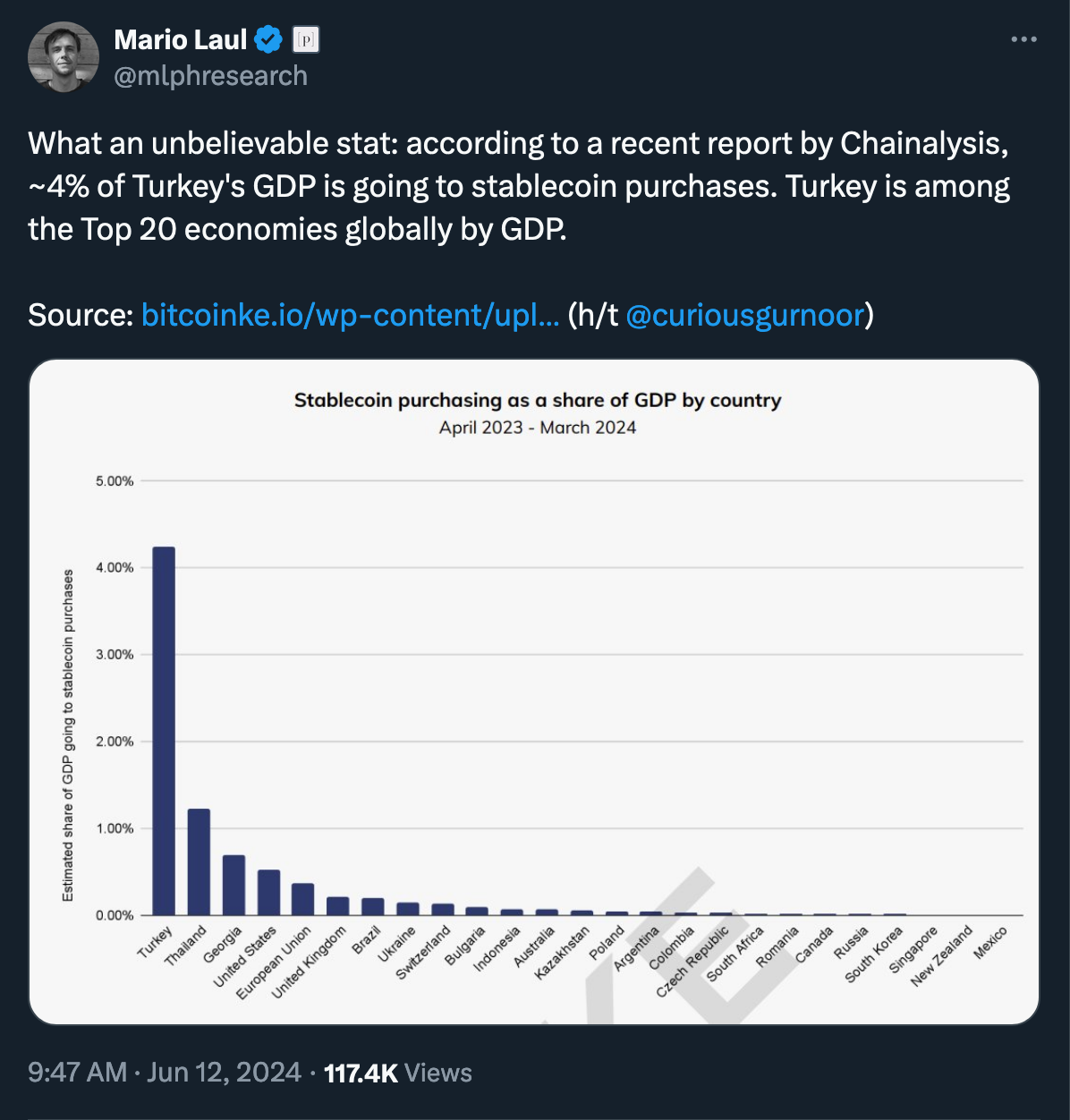

Bendiksen justifies his point by noting that countries with the highest levels of [Bitcoin and] stablecoins adoption unsurprisingly suffer from deteriorating local fiat currencies. At the same time, a gradual shift towards a more sound currency represents a natural choice for the residents of these countries—first for capital savings, then increasingly for purchases and everyday transactions—whereas with the emergence of Bitcoin and stablecoins, the entry of hard foreign currency can no longer be effectively controlled.

"...availability of a harder alternative to a weak local currency can have a huge effect on the rapidity of fiat collapse. A badly debased fiat money can only hope to survive for an extended period if its government maintains a very tight and effective control over the importation and use of harder foreign monies. Easy availability of hard monetary alternatives is unilateral bad news for a poorly managed fiat currency, and tends to accelerate dollarisation, and in many cases, full-blown fiat collapse." (Christopher Bendiksen, "Bitcoin and Stablecoins are a Threat to Weak Emerging Market Currencies")

According to an April Chainalysis report, ~4% of Turkey's GDP—one of the top-20 economies globally by GDP—is already going to stablecoin purchases.

Jeremy Allaire, CEO of Circle, believes that stablecoins could account for 10% of “global economic money” over the next decade, driven by several factors that could trigger an exponential expansion in stablecoin adoption over the next “10+ years.”

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.