Alameda Research, a quantitative cryptocurrency trading firm founded by Sam Bankman-Fried and linked to major crypto exchange FTX, revealed the structure of its holdings - and it seems that the company is playing with fire.

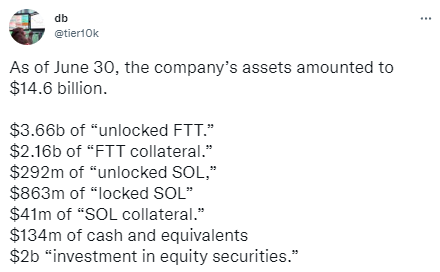

According to the document obtained by CoinDesk, as of June, 30, Alameda Research had $14.6 billion in assets and $8 billion in liabilities. FTT, a native token of the FTX exchange, accounted for one third of its holdings, or $5.82 billion of its assets. Inside this category of the firm's balance sheet, there are $3.66 billion of “unlocked FTT” and $2.16 billion of “FTT collateral”. Other assets include Solana (SOL), equity securities, and cash.

Analyst Dylan LeClair wrote:

“The total market cap of FTT is $3.35b, & the fully diluted market cap is $8.8b. You couldn’t sell $1m of this thing without pushing the market significantly lower.”

Reported structure of holdings poses high risk of low level of liwuidity and even insolvency of the firm that recently acted as a Robin Hood in the crypto industry. After Terra's crash in May, there was an avalanche of bankruptcies of crypto lending firms.

I wonder if all this altruistic "investing, buying and supporting" @SBF_FTX is doing, is doing with nonexistent borrowed funds, hoping they'll have made them back by the time anyone realizes. Both altruistic and effective at the same time.

— ⥀ (@hikikomoreh) July 22, 2022

Crypto analysts voice out fears that Alameda's liabilities overtop its liquid holdings. And this means that there can be another big BOOM in the industry involving those who seemed to be too big to fail.

9/n - Adding both numbers together, we can assume that FTX has a maximum cash hoard of 3.3bn. Of course, we need to exclude out their expenses which i have no clue about

— degentrading (@hodlKRYPTONITE) November 3, 2022