The Bitcoin price has confirmed its reversal from the local month-long downtrend, but can it reclaim the $70,000 psychological mark before the end of summer?

The selling pressure from the German government has reportedly drained away, and against the backdrop of easing U.S. inflation and expectations of a Fed’s key rate cut, nothing held back BTC’s steady rebound from local lows, further boosted by Trump’s improved chances of winning the election after a failed assassination attempt.

Breaking above the 200-day moving average and flipping the nearest ~62,5k resistance level into support, we’re now in what many consider ‘full bull territory.’

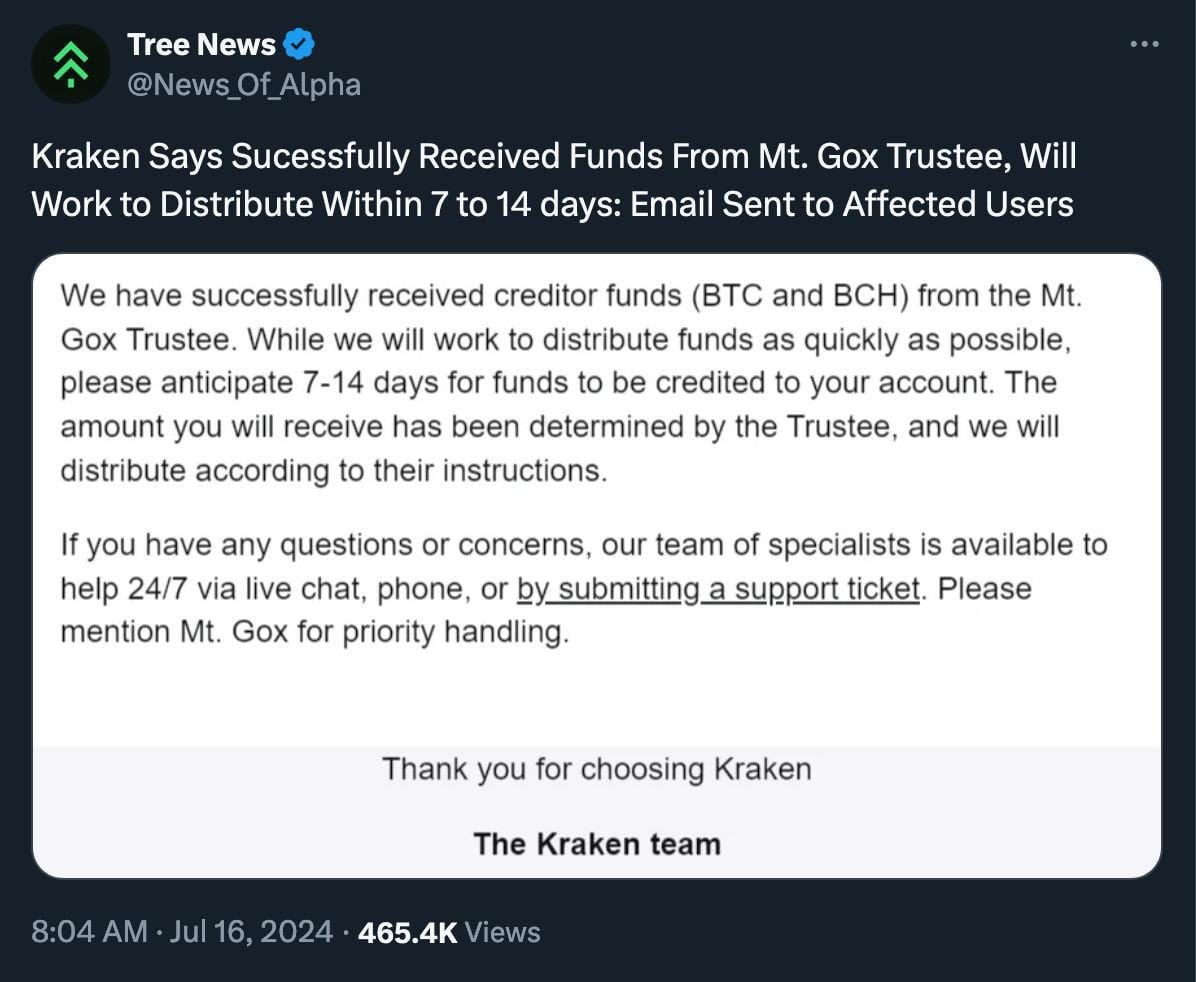

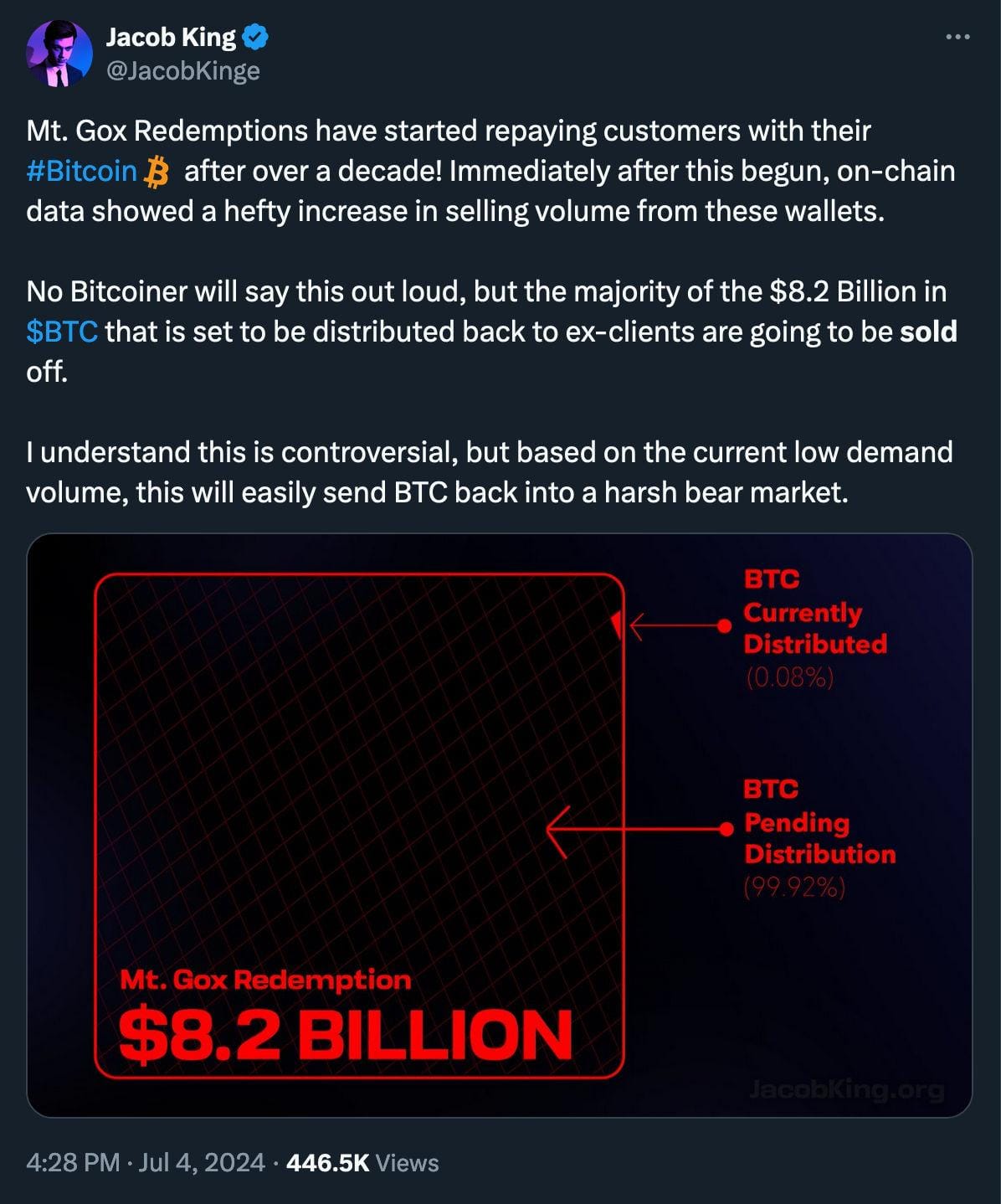

But at the same time, Mt. Gox has reportedly transferred billions of dollars worth of bitcoin to exchanges, while Kraken announced it is ready to distribute its portion to the market “within 7 to 14 days.” In aggregate, about $9 billion worth of Bitcoin will be distributed in July.

Kraken is one of five crypto exchanges working with the Mt. Gox trustee to facilitate the distribution of Bitcoin to the defunct exchange’s creditors. Bitstamp, another of these five, recently stated that it intends to make all the related payments “as soon as possible,” despite its agreement with the Mt. Gox trustee allowing up to 60 days.

Nonetheless, crypto folks appear rather optimistic about that, believing that only ‘paper hands’ will sell based on this news, and Mt. Gox distribution, as well as recent Germany selling, will eventually have no real price impact except a potential sweet buying opportunity.

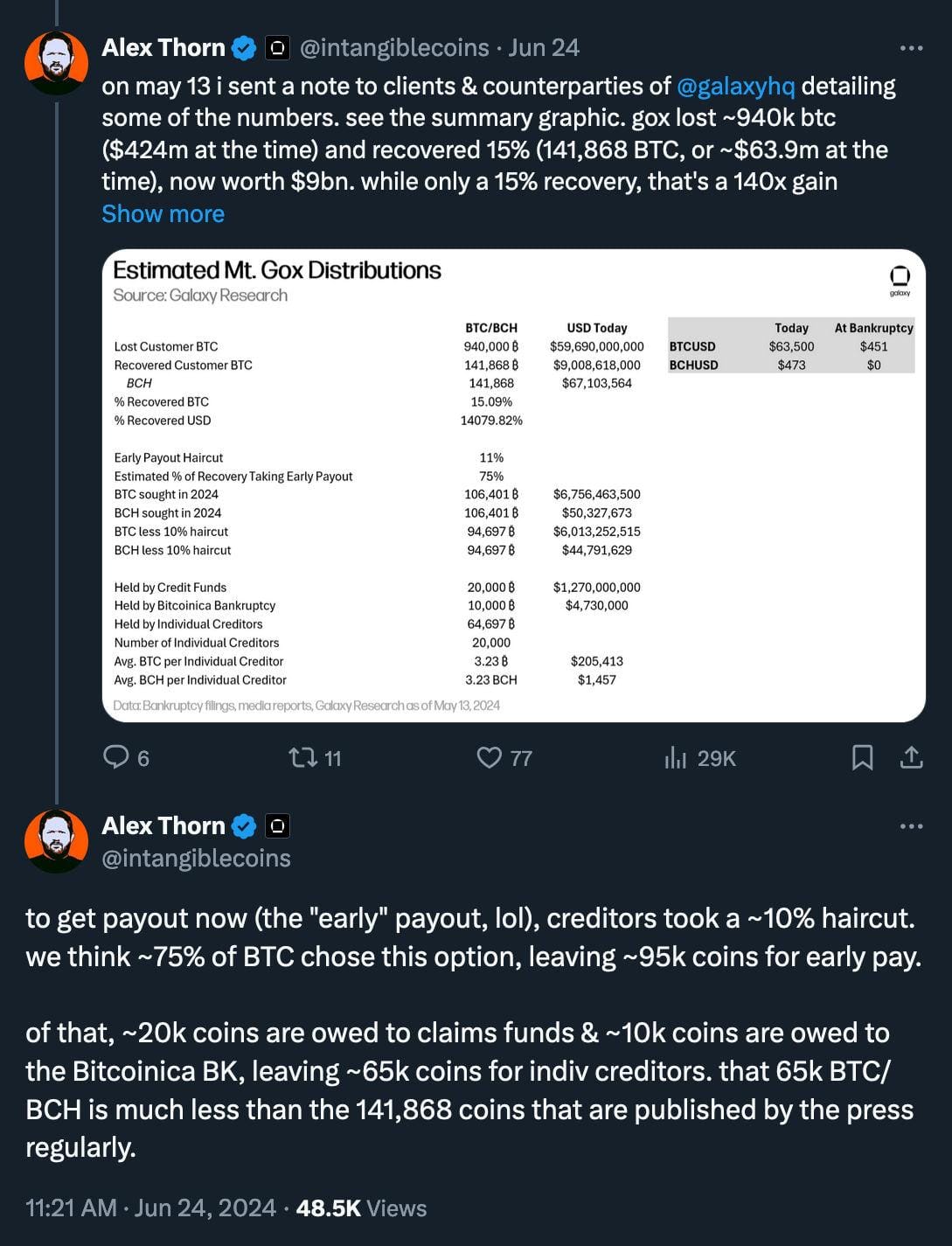

It is estimated that out of the 140k Mt. Gox’s BTC, closer to 65k BTC will be distributed to individual creditors:

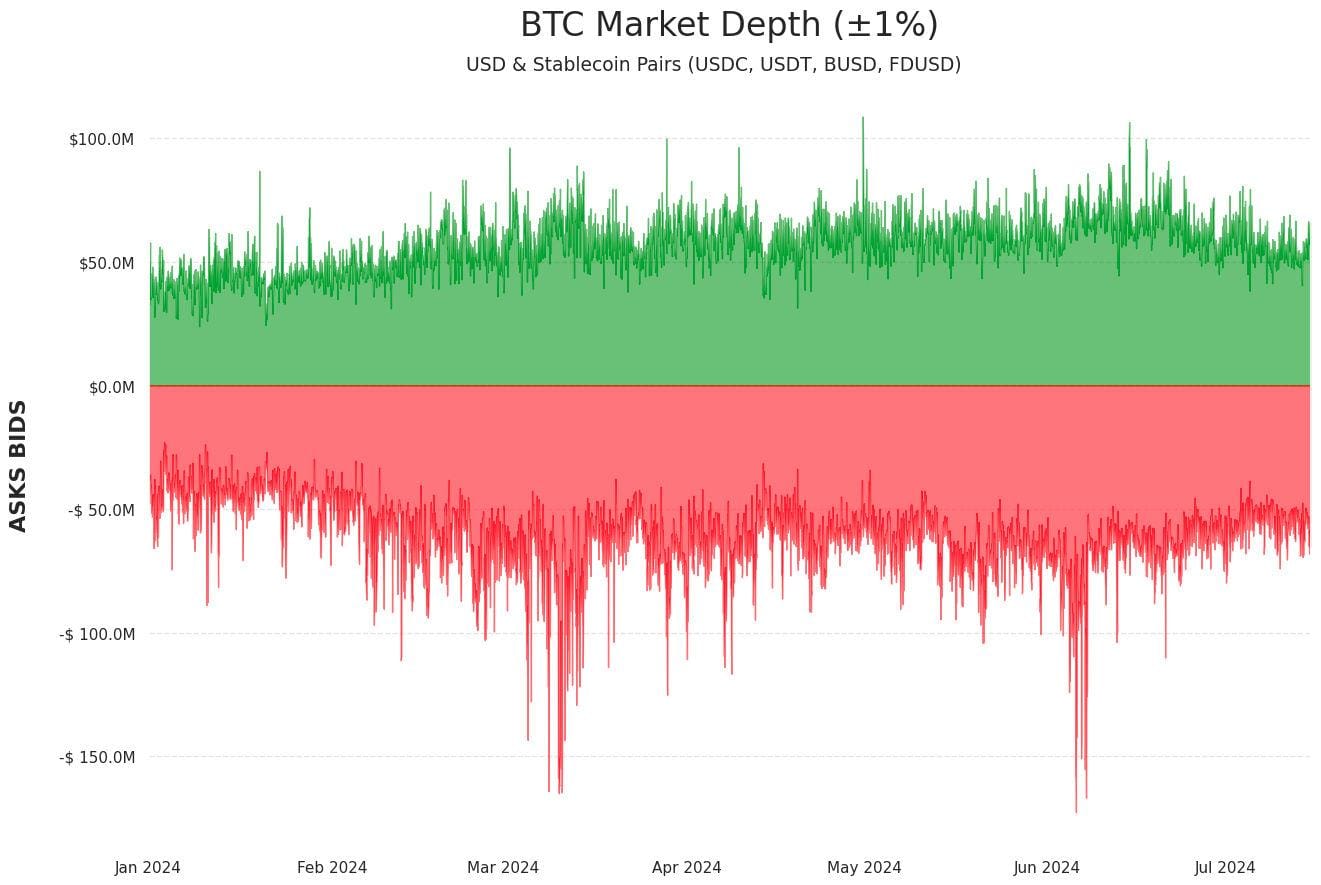

(Source: CoinMetrics)

“Given this market depth, and average daily volumes of around $15B for BTC alone, the distribution of ~65K BTC (worth approximately $1.95B at current prices) could potentially be absorbed by the market over a period of a couple weeks without causing severe disruptions, assuming the liquidations are done gradually and across multiple exchanges.” (CoinMetrics report)

And an even less predictable [in the short term] factor, Ethereum spot ETFs are reportedly coming next week.

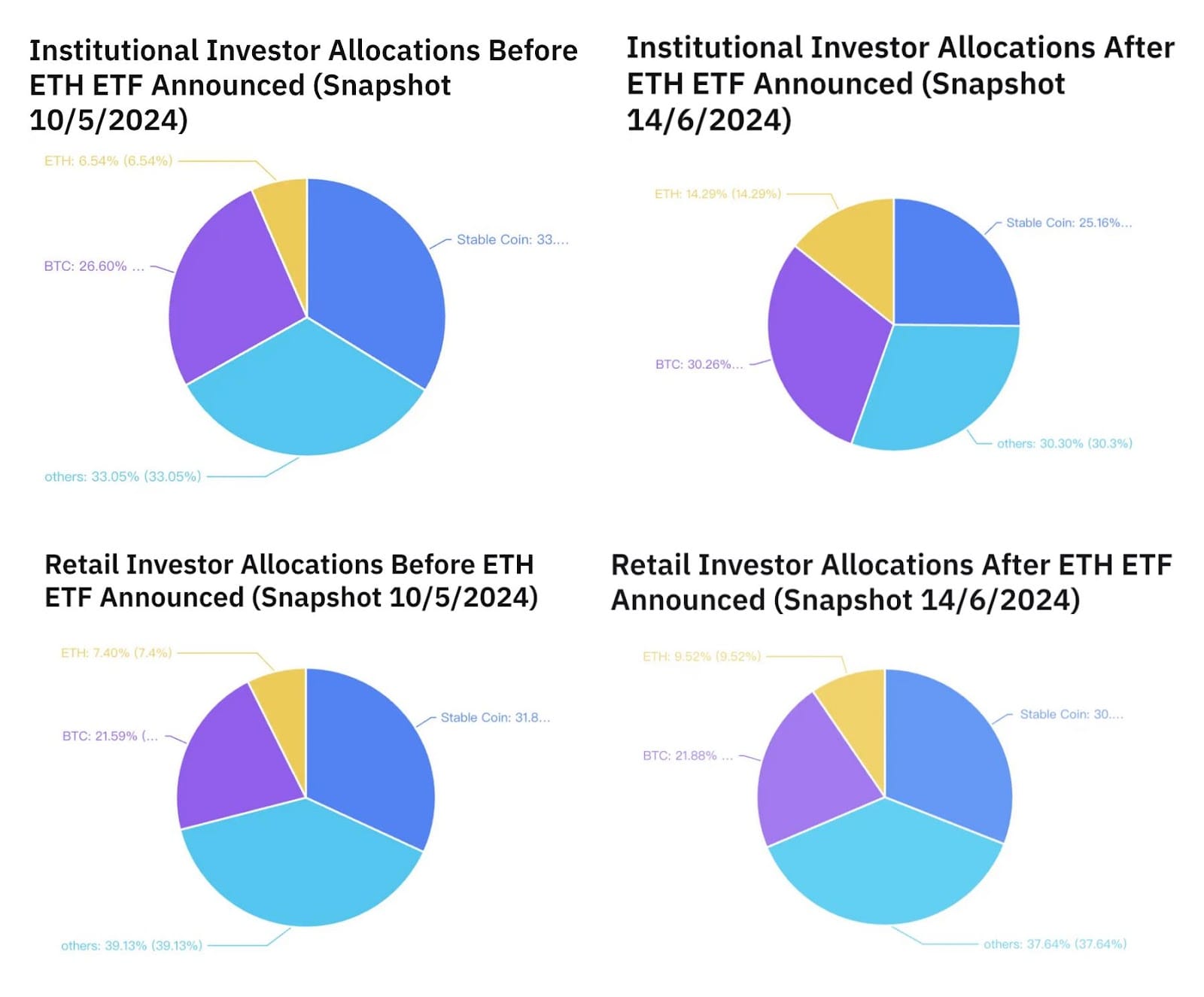

For some, the ETH ETF launch during the market rebound is the ideal scenario; others are wary of selling pressure in the early days, similar to what happened with the launch of the Bitcoin ETF in January. It is noteworthy, however, that this time, institutions may be more bullish on Ether than retail ahead of the ETH ETF launch, as the ByBit report shows.

(Source: Bybit Press)

In the long term, there is greater clarity: Ether spot ETFs are considered bullish, and experts mostly agree that [ETH](https://twitter.com/search?q=ETH) could potentially outperform Bitcoin after their launch. From a TA perspective, the breakdown from the rising wedge pattern in the #Bitcoin dominance chart only supports this so far. Fundamentally and logically, however, much more substantial factors might be at play.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.