Bitcoin chopped to below $63k and is back in the near-halving 'danger zone' as rate cut hopes dim following a disappointing U.S. inflation report. Increasing concerns about sticky inflation hit risk assets across all markets, including cryptos.

The disappointing inflation data report alarmed investors, diminishing hopes for interest rate cuts this year and hitting risk assets across all markets, including the S&P 500 and the tech-heavy Nasdaq.

"The Fed is boxed in a corner after today’s worse-than-expected GDP report," explains Mike Cornacchioli, senior vice president for investment strategy at Citizens Private Wealth, in a commentary to CoinDesk. "The data pushes back rate-cut expectations, and investors are wondering whether the Fed will be able to cut rates at all in 2024, which has implications throughout financial markets."

From the market cycles perspective, Bitcoin is now in the near-halving 'danger zone,' as @RektCapital pointed out in X post.

"History suggests that if downside volatility around the Re-Accumulation Range Low is going to occur in this cycle, it could occur over the next coming 15 days. The purple Post-Halving 'Danger Zone' ends in 15 days but in the meantime downside volatility at the $60600 Range Low is a possibility."

In the longer term, Bitcoin analysts agree that BTC has' a lot further to run.’ So, Charles Edwards of Capriole Investments said in the latest report that multiple on-chain metrics suggest that Bitcoin and other cryptocurrencies have “a lot further to run” in this bull market, pointing out, in particular, to the fundamental Bitcoin Production Cost indicator.

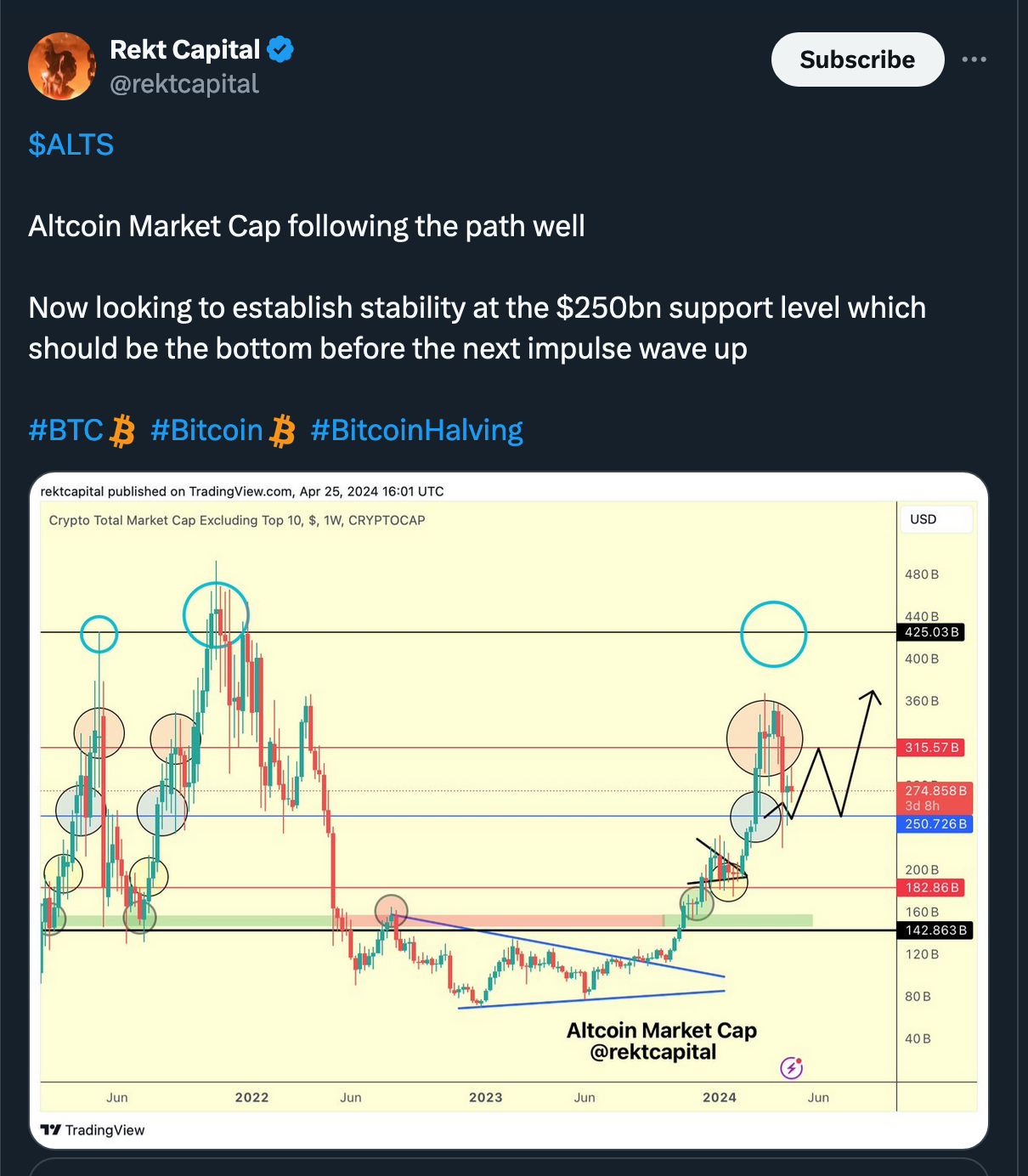

Altcoin majors tumbled even more with the current dip within that 'danger zone.' Yet here too, analysts cite a classic trading pattern and growth in the altcoin total market capitalization index as proof of an upcoming altcoin season brewing.

Meanwhile, memecoins with some of the L1s are somewhat muddling things up, outperforming Bitcoin over the past week. This once again leaves market participants uncertain whether altcoin season has arrived already or not.

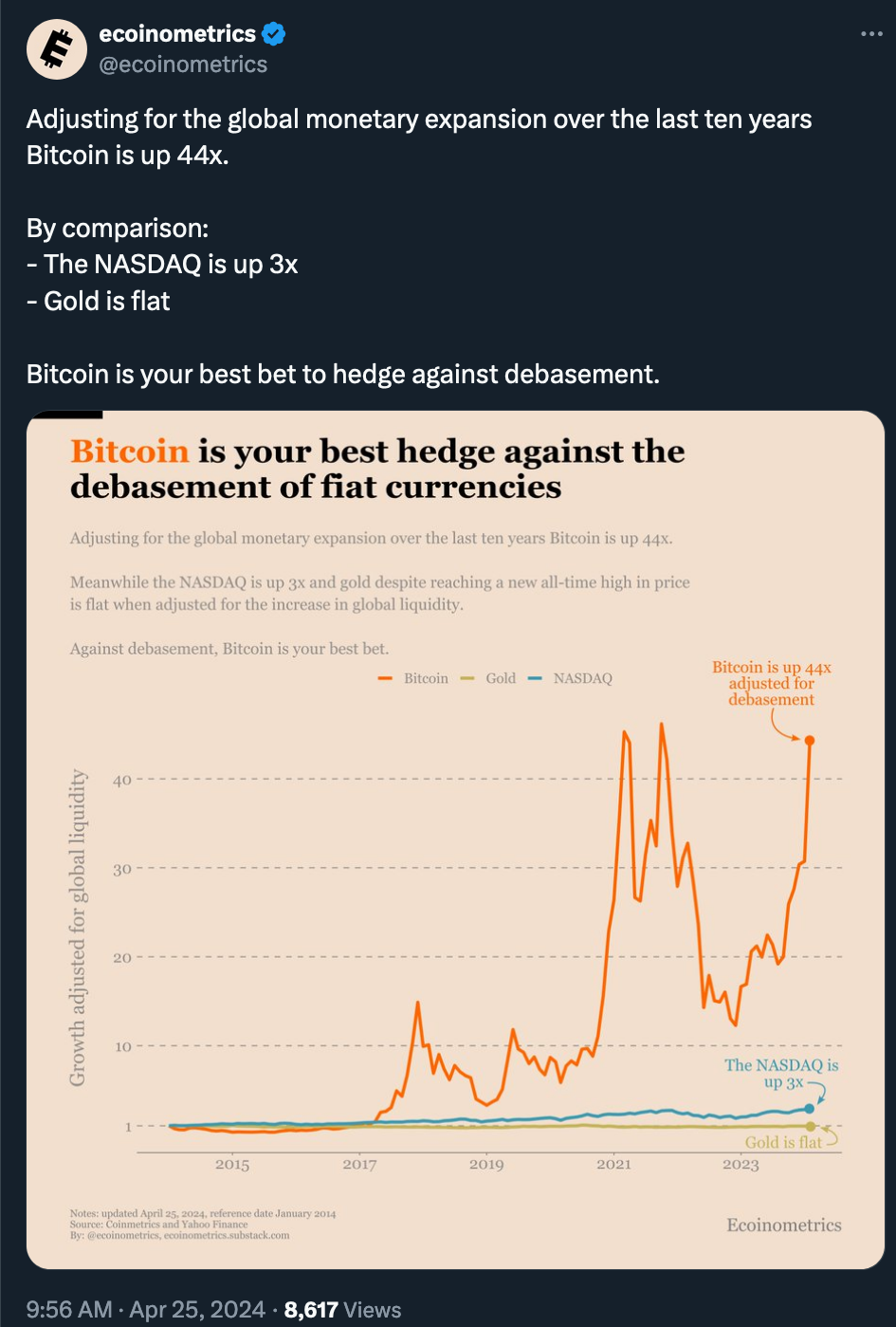

In general, according to crypto fund managers like Charles Edwards or HashKey Capital analysts, as well as market experts and professional investors like Arthur Hayes, unsustainable budget deficits and persistent inflation will be key in Bitcoin’s rise, as with the adjustment for the global monetary expansion over the last ten years Bitcoin remains "your best bet to hedge against debasement," as Ecoinometrics put it.

And through Bitcoin, capital is broadly distributed, cyclically circulating, to the rest of the crypto market, creating an 'altcoin season' effect during periods of sustained Bitcoin consolidation.

Tactical trading is hard. Risk management and position sizing are key. Without proper risk management and position sizing, you will suck at trading on a distance.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.