Bitcoin bulls are enjoying 10% month-to-date gains, but crypto market analysts warn that the outlook for BTC price action may soon change.

Another popular trader, Daan Crypto Trades, noted that $72,000 now represents the largest resistance zone. Closer to the current spot price, liquidity concentrations are $66,500 and $67,800, respectively. Daan Crypto Trades also emphasized the significance of Bitcoin’s 100-day moving average as a long-term support level.

In the longer term, however, most crypto market watchers, like Daan Crypto Trades, have a hopeful outlook for Bitcoin, with little to no chance of a ‘deep correction.'

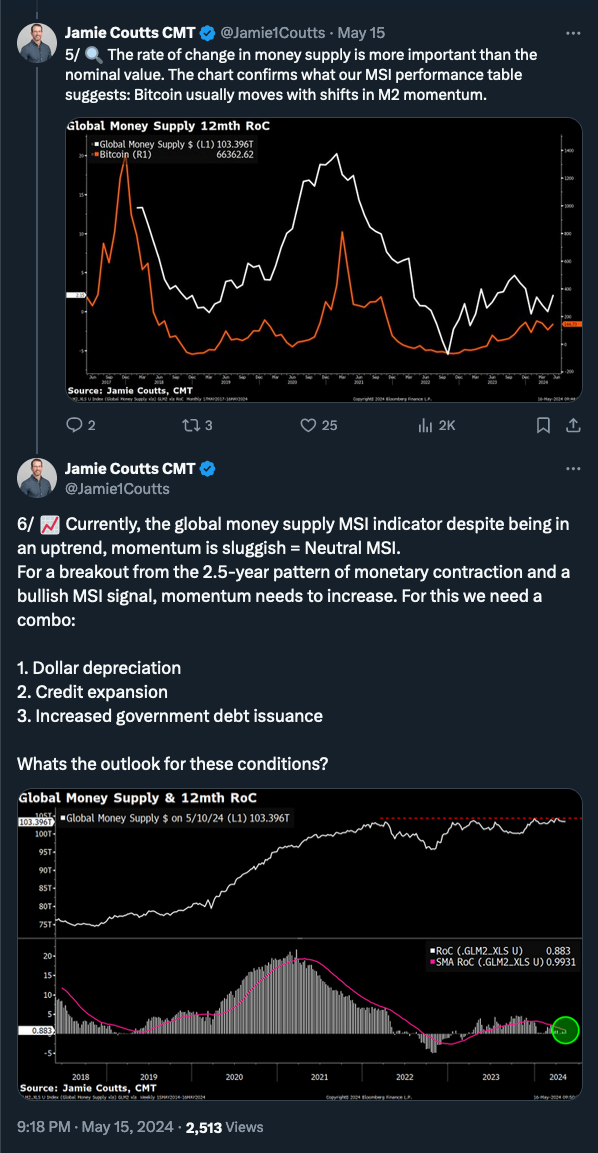

'The key for Bitcoin’s next move' lies in M2 money supply, which is now "attempting to punch through multi-year resistance," according to Jamie Coutts, chief crypto analyst at Realvision.

(Thread)

Bitcoin could consolidate for ‘4 or 5 months,’ but a big cup-and-handle pattern emerges and looks really promising, believes Charles Edwards of Capriole Investments:

"In short: the technical picture remains bullish, provided price holds above $58K. The longer we spend in the range highs, the more likely this structure will merge into a classic ‘cup and handle’ pattern which would typically see strong price appreciation following." (Charles Edwards, Capriole Investments)

(Source: Cointelegraph)

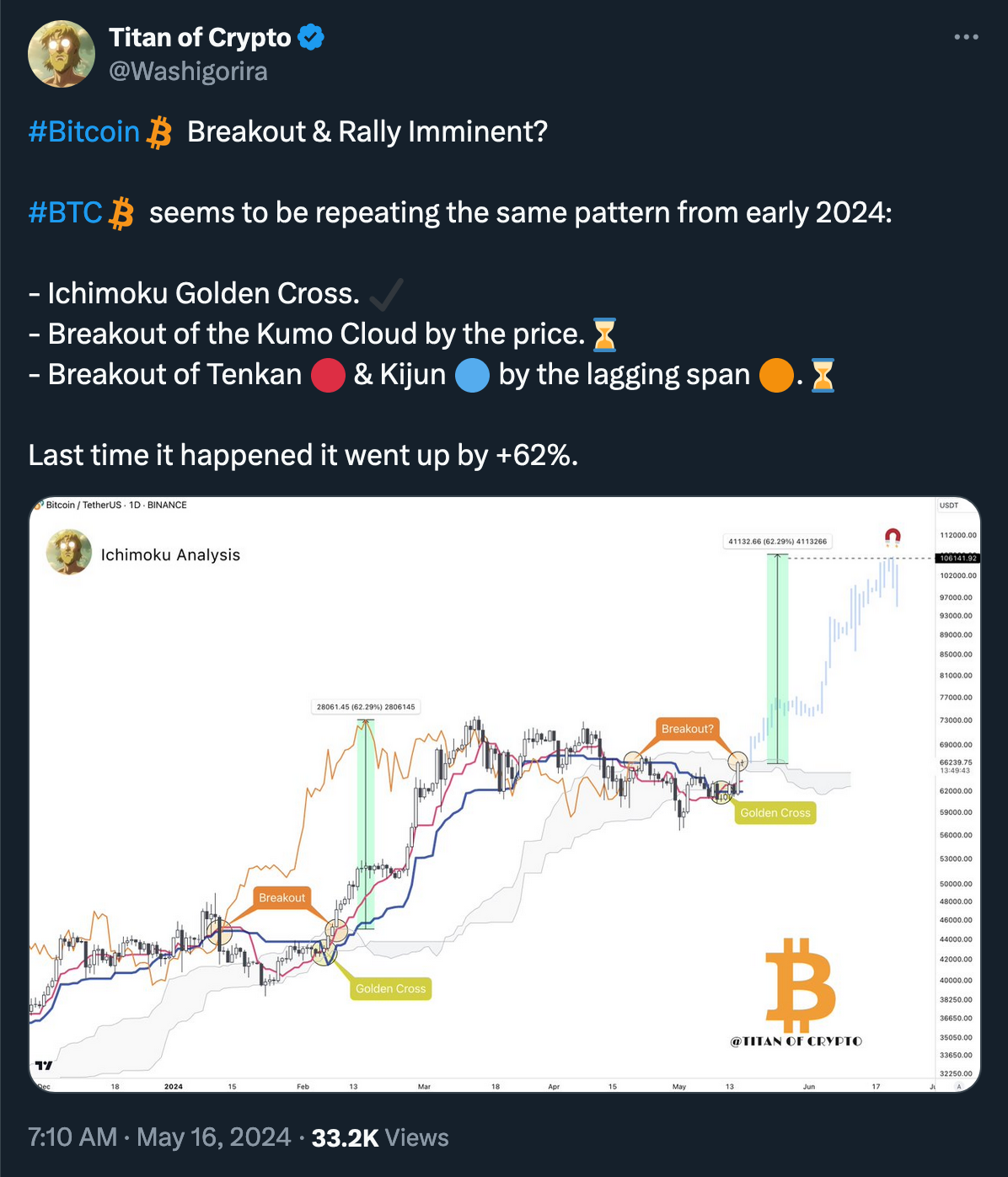

Meanwhile, other popular analysts mention 'golden crosses,' potential and accomplished, across various timeframes and indicators, noting historical patterns that support an already bullish mid- and long-term outlook.

Tactical trading is hard. Risk management and position sizing are key. Without proper risk management and position sizing, you will suck at trading on a distance.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.