Bitcoin has reached three new all-time highs (just not in price yet), as noted by Daniel Batten, a prominent researcher focused on Bitcoin’s environmental impact. Meanwhile, Bitcoin ETFs are now sucking up 10X more BTC than miners can produce, so with the upcoming halving in mind, CryptoQuant’s CEO expects that Bitcoin’s value could soar to $112,000 this year.

(X post)

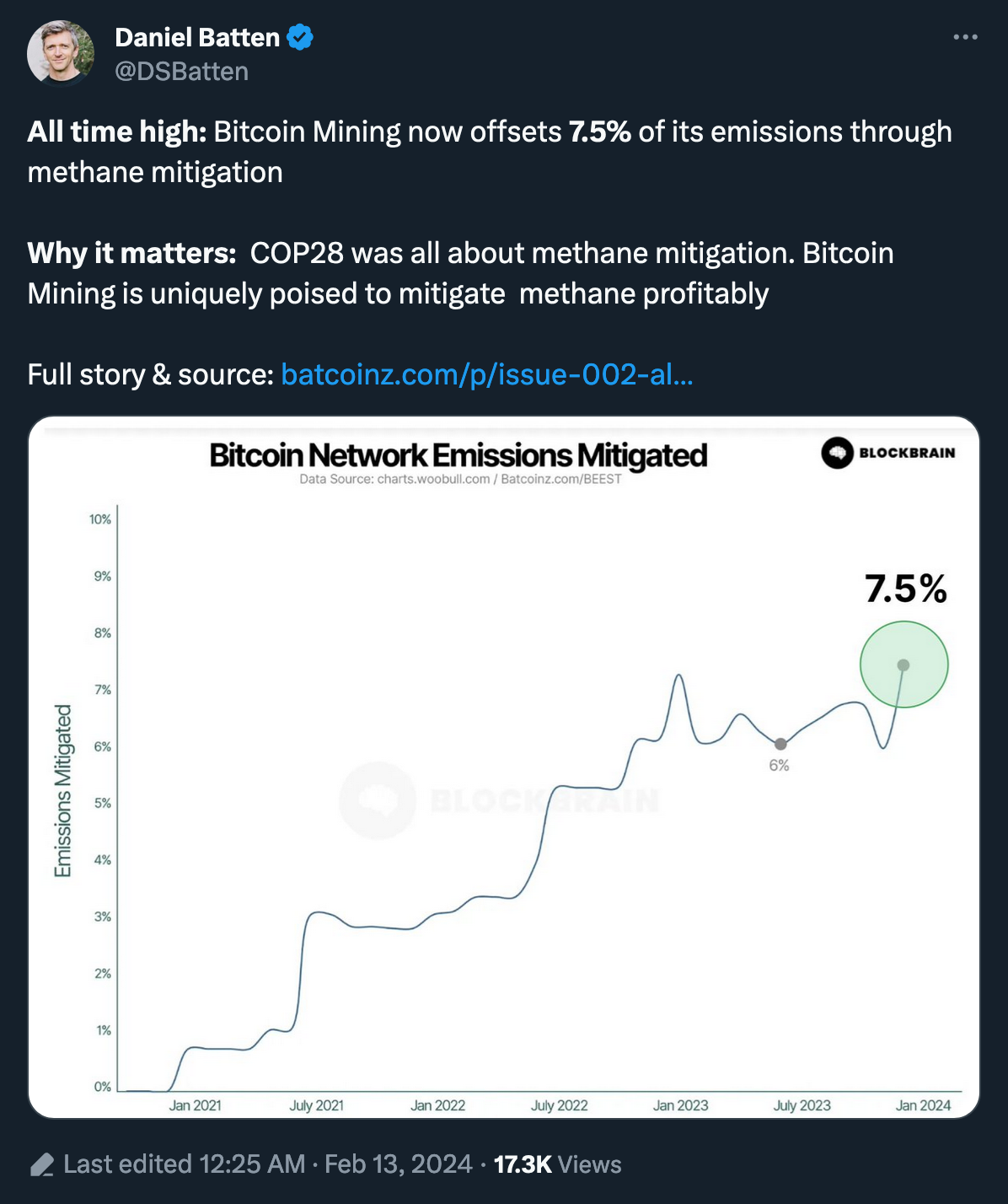

As the new all-time high #1, Batten highlights the critical achievement in methane mitigation:

“In four years, and without subsidies or purchase of offsets, Bitcoin mining is now offsetting 1 in every 13 tonnes of emissions through methane mitigation.” (Daniel Batten, The Bitcoin ESG Forecast)

(X post)

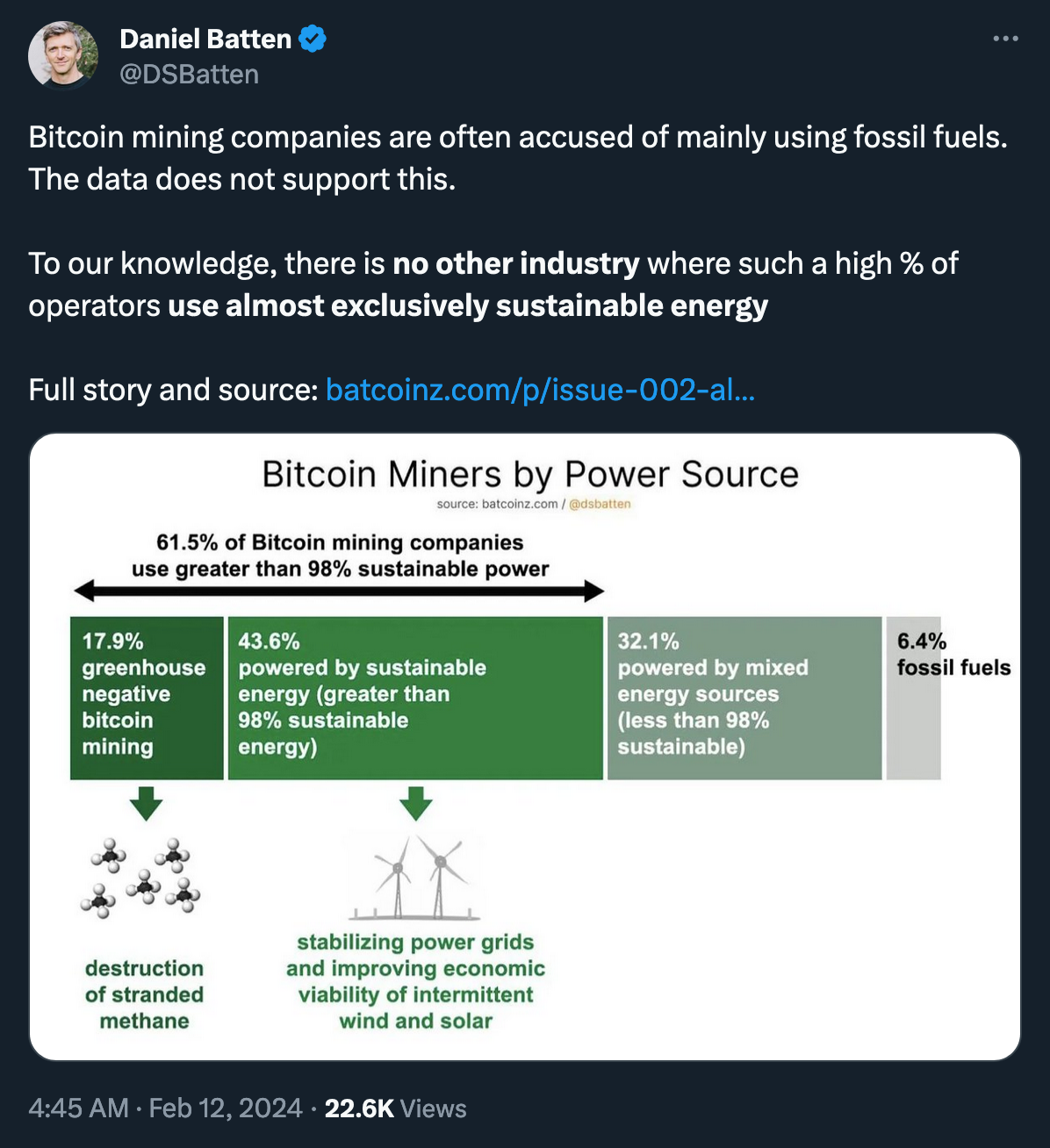

New All-Time High #2 is observed in sustainable-energy-based Bitcoin mining, with a larger percentage of miners now using 'almost exclusively' sustainable energy sources than any other industry.

(X post)

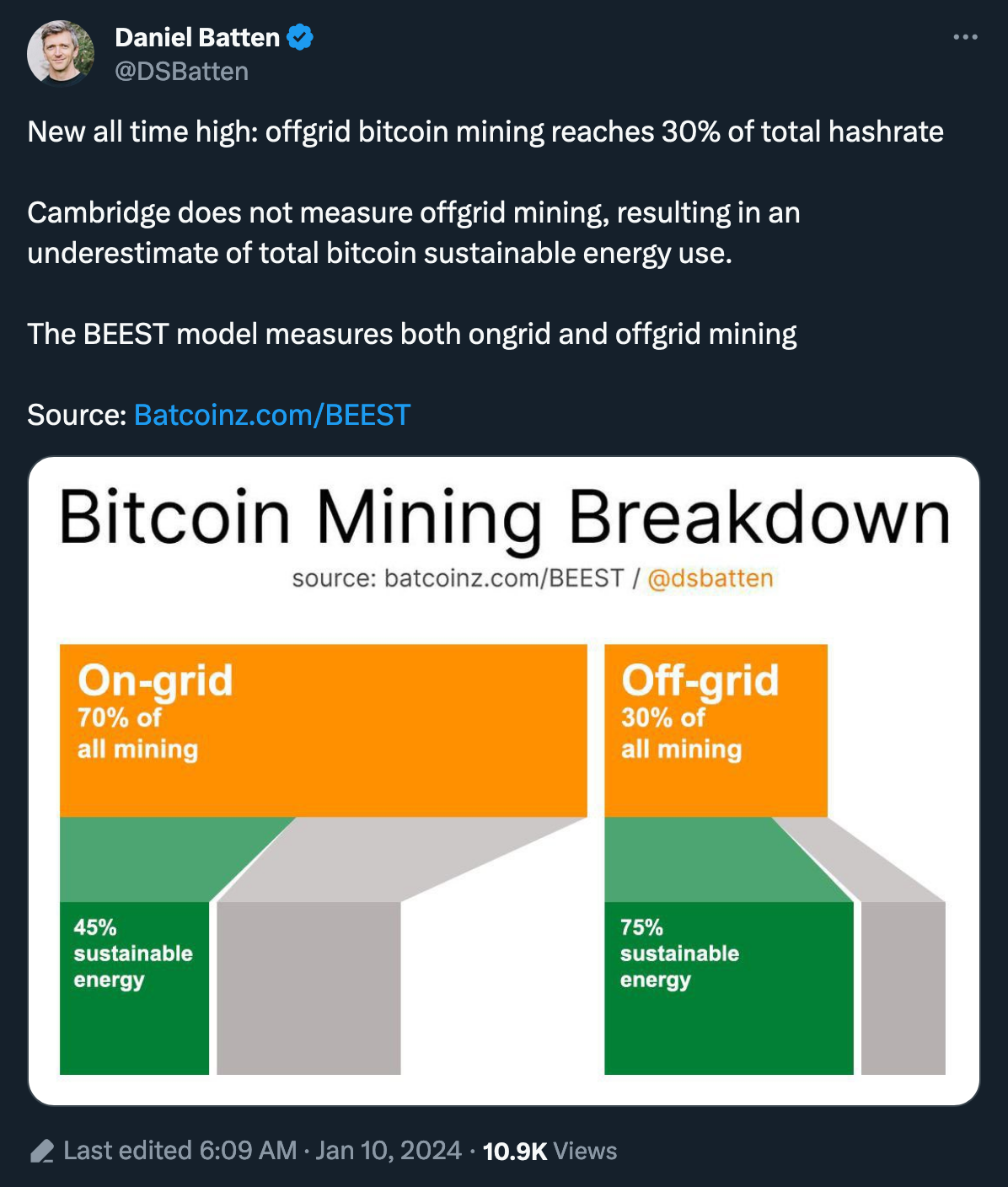

The 3rd new all-time high Batten noted is the percentage of off-grid mining due to the lowering costs of sustainable energy sources. This development offers a lucrative opportunity for miners who are driven by profit yet are finding a convergence with ecological imperatives.

(X post)

“Why miners go off-grid: Cheap power. … What this means: Unlike most industries, Bitcoin miners aren’t tied to the grid. They can get power from anyone who has energy. The energy could come from a hydro-operator, a wind farm, a solar farm, even a landfill. It could also be off-grid fossil fuel.” (Daniel Batten, The Bitcoin ESG Forecast)

(X post)

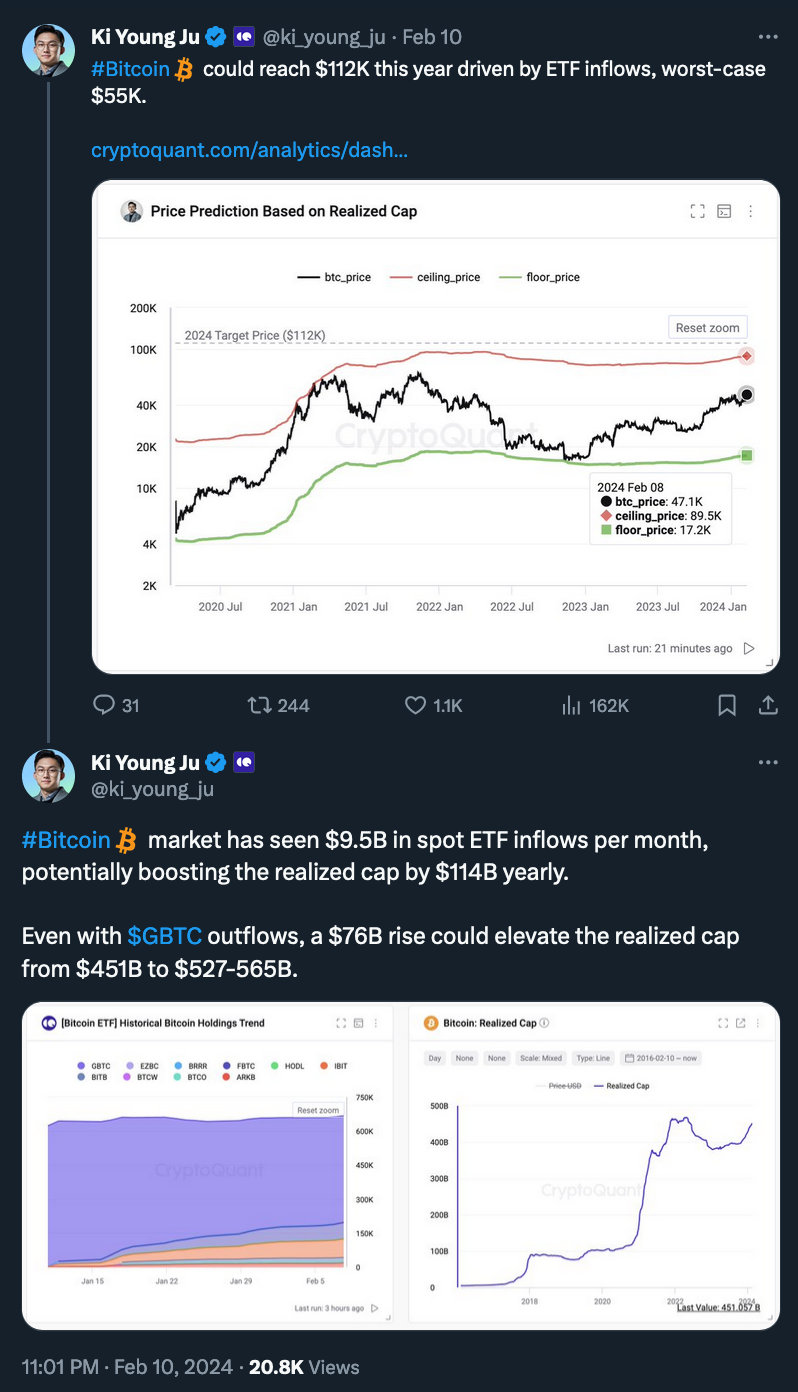

Unlike the environmental mainstream, Wall Street seems to have already gotten a taste for Bitcoin, as spot Bitcoin ETF inflows have outpaced the amount of production from miners by over ten times in recent days.

(X post)

Growing institutional capital inflows, coupled with the anticipated halving event, have led experts, including the analytics platform CryptoQuant’s CEO, to predict that Bitcoin's price could reach $112,000 by the end of this year.

(Thread)

This time, it’s actually different, argues Grayscale’s research note, as ETFs and Ordinals reshape market structure. Meanwhile, as the Cointelegraph note highlights, Bitcoin rallied towards ~$50k in the absence of retail trader FOMO and the use of high leverage, indicating that this momentum may be sustainable in the mid-term.

(Source: Technical Roundup, PDF)

“On the monthly and weekly time frames, this area is unlikely to present fresh setups. … The most meaningful monthly resistance is at $57000-$61000. … Similar to the monthly time frame, the clearest weekly resistance is at $59000. While some arguments can be made for more tentative levels around $52000, the newsletter focuses on big picture swing levels, and there aren’t (m)any in this area.” (Technical Roundup, PDF)

(Thread)

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.