EU-based crypto users will soon encounter a new crypto landscape as MiCA rules take effect in July. MiCA, or The Markets in Crypto Assets, is a regulatory framework that alters how both users and crypto-asset service providers can operate within the European Economic Area (EEA).

MiCA is designed to provide a clear regulatory framework for crypto-assets in the EU, including KYC and AML requirements. The stablecoin regime will take effect on June 30th, while the full regulatory framework for crypto-asset service providers (CASPs) will become applicable six months later, on December 30, 2024. For CASPs, the regulations cover a broad range of aspects, from licensing to operational management.

"MiCA is as much about job development and economic competitiveness as it is about consumer and market protection. Licensed entities must have accountable “mind and management” in an EU jurisdiction through which they can then passport their operations across the federation thanks to pan-European regulatory harmonization." (Dante Disparte for Coindesk)

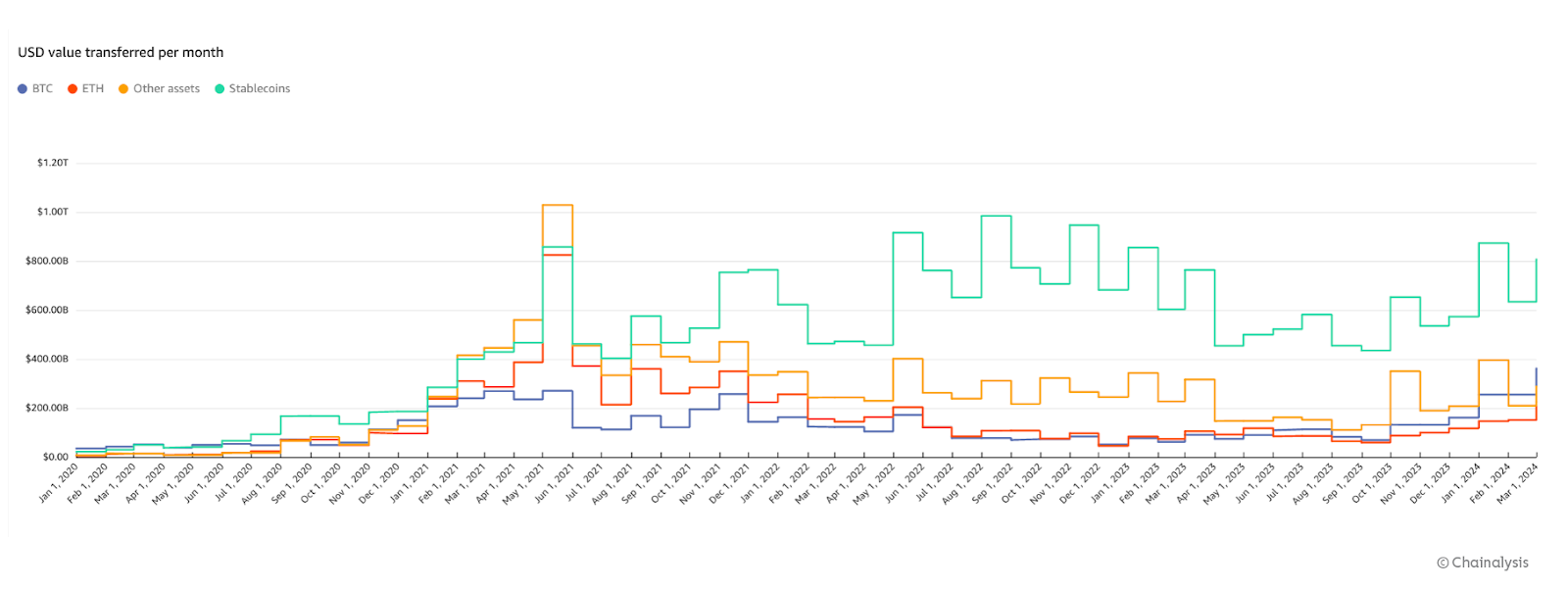

"Transaction volumes show that stablecoins are currently the biggest use case for crypto assets. That makes June 30, 2024, a major milestone for crypto asset regulation in Europe — and potentially beyond." (Chainalysis)

According to the new EU regulations for stablecoins that came into effect on June 30, issuers must obtain an electronic money license and will be subject to supervision by the European Banking Authority. Key requirements include maintaining 30% of reserves in local EU bank accounts, ensuring full reserve coverage, conducting regular audits, and disclosing relevant information. The stated aim is to mitigate financial risks and enhance system stability. However, from the perspective of stablecoin issuers, these requirements substantially increase operational costs and administrative complexity.

We already see the impact of these new rules, as Binance recently categorized stablecoins as "authorized" or "unauthorized" in response to new regulations. The exchange has designated Tether's $USDT as unauthorized, restricting its use as collateral for margin accounts in the European Economic Area. However, EEA customers can still trade, deposit, and withdraw USDT on Binance's spot market. Users have the option to convert USDT to authorized stablecoins, with $USDC expected to be among those approved.

"For the crypto industry and its existential coupling with the banking sector, MiCA marks profound change, which only the most serious players are ready for. For example, in the resurgent stablecoin category, in which the dollar is the currency of reference, MiCA marks a proverbial fiscal cliff where unregulated or non-compliant tokens will ultimately be delisted or their access greatly restricted by crypto exchanges." (Dante Disparte for Coindesk)

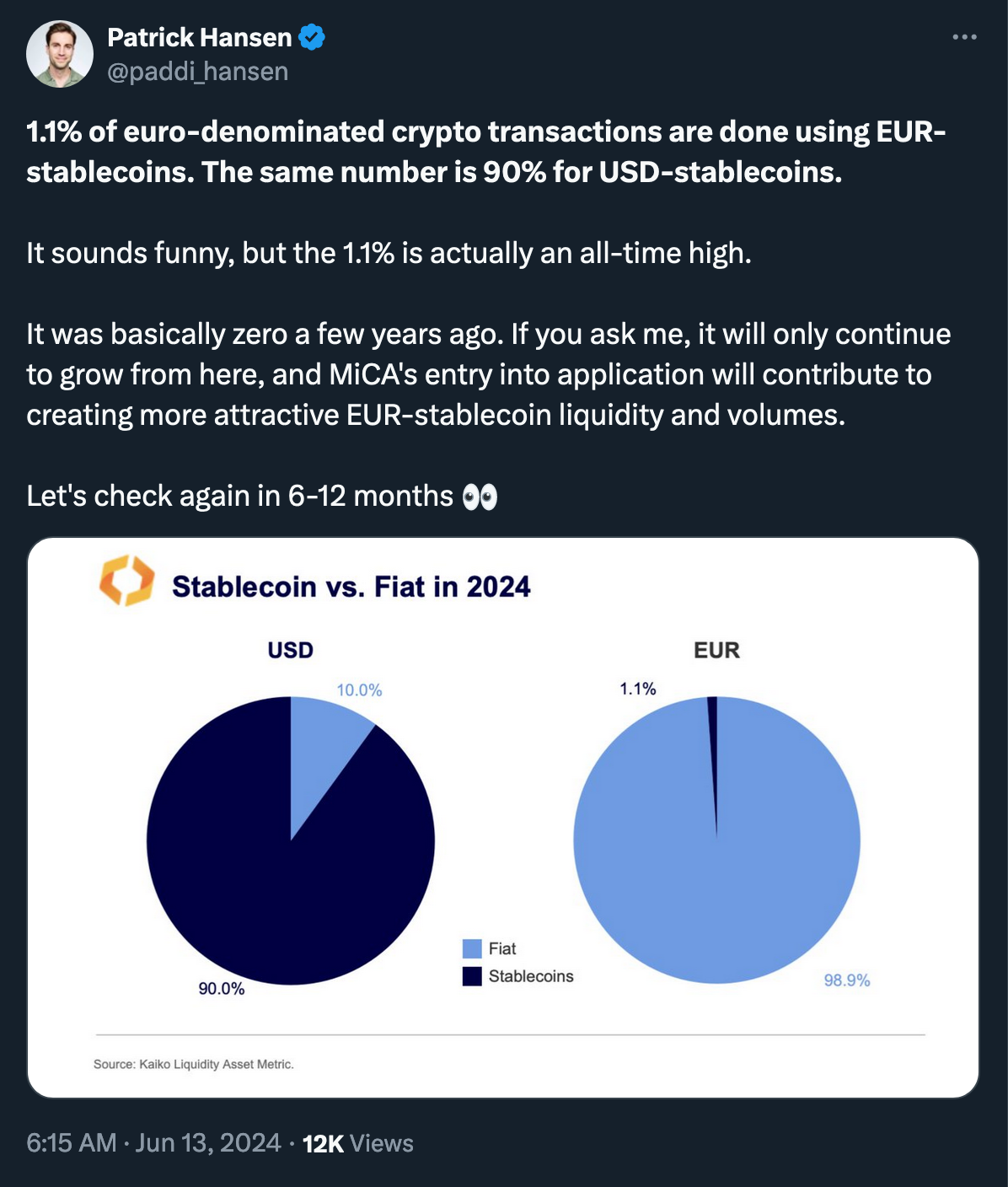

(Patrick Hansen of Circle on X)

Crypto users and businesses based in the EEA express concern regarding the potential impact of MiCA regulations on the industry. Tether's $USDT, the leading stablecoin with a market capitalization of $112 billion, may face restrictions, potentially limiting liquidity and market opportunities for EEA users. As MiCA implementation progresses, some cryptocurrency enterprises may reduce their operations in the EU. Concerns arise that stringent regulations could impede innovation in Europe's cryptocurrency sector.

MiCA is presented as a regulatory framework, but industry players and legal councils still have a lot of confusion about what exactly needs to be done to stay compliant. The European Banking Authority only published its guidelines on technical standards last week.

(Circle's Chief Strategy Officer on X)

European countries are implementing MiCA regulations at different paces. While some market participants are concerned about the new rules, others see potential benefits. Once fully implemented, MiCA's clear regulatory framework may encourage institutional investment in the crypto sector, which has historically been deemed too risky, potentially benefiting Europe's crypto industry in the long term.