Few expected the Bitcoin ETF launch to become the most successful in ETF history. Now, all eyes have turned to Ethereum. How will Ethereum ETFs compare to Bitcoin? Will they outshine expectations or fall short as many anticipate? Opinions on this vary, so let's explore some perspectives on how Ethereum will fare upon its ETF launches.

Since the launch of U.S. Bitcoin ETFs, an impressive ~$15 billion in net inflows have been poured into these products over the first five months. Now, with the green light for an ETH ETF, speculation has arisen about how future Ethereum ETFs will measure up to Bitcoin.

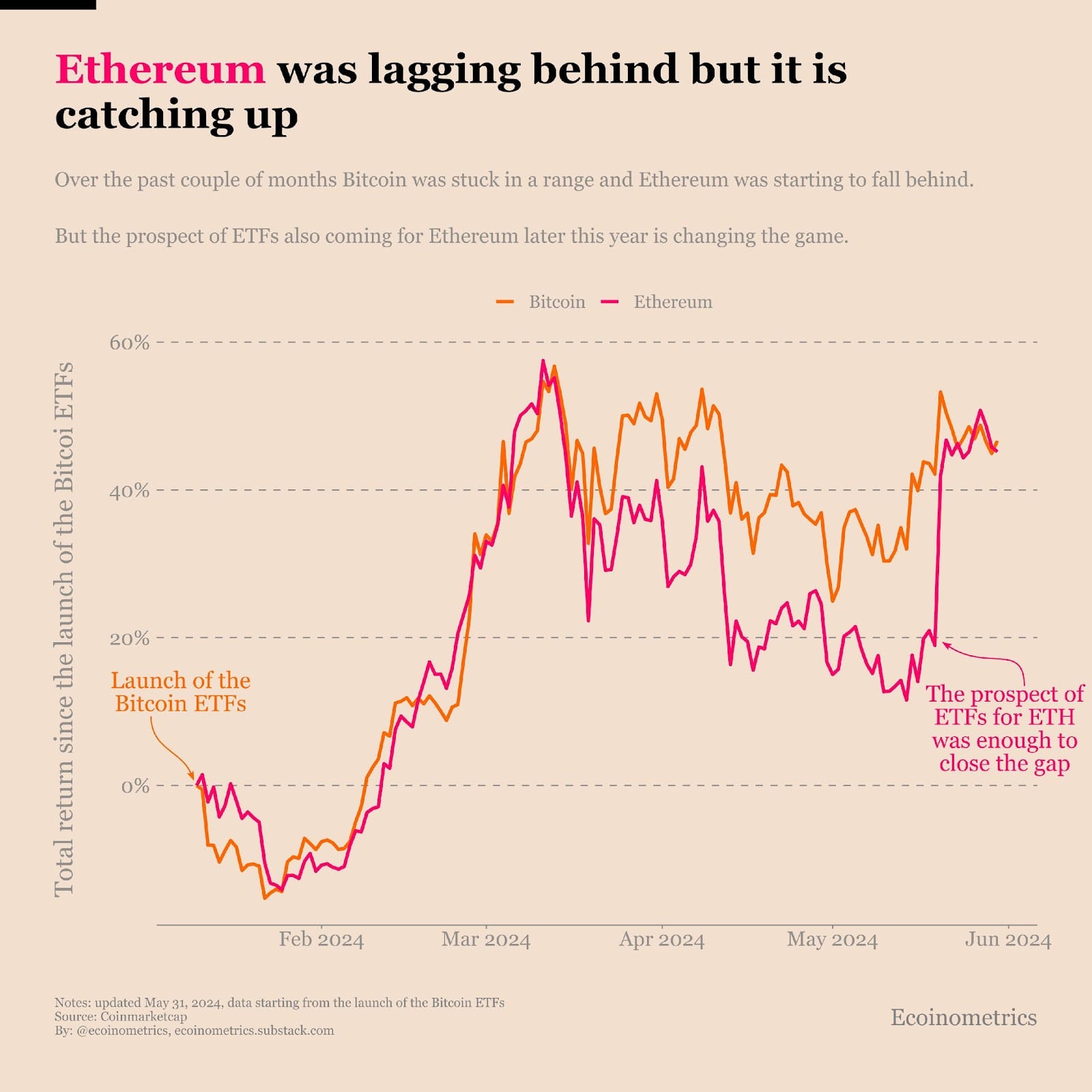

("That’s a good sign for ETH"—Ecoinometrics)

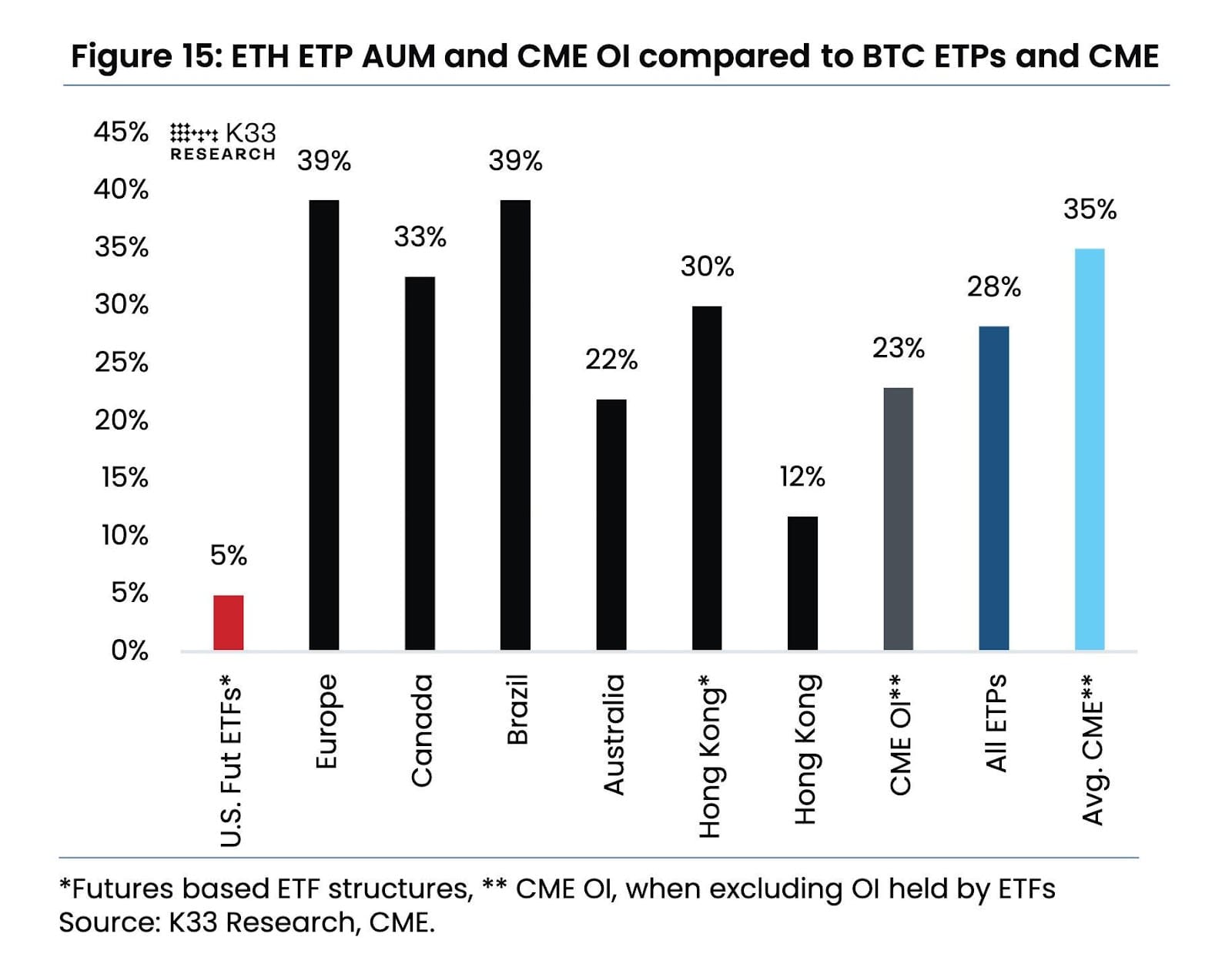

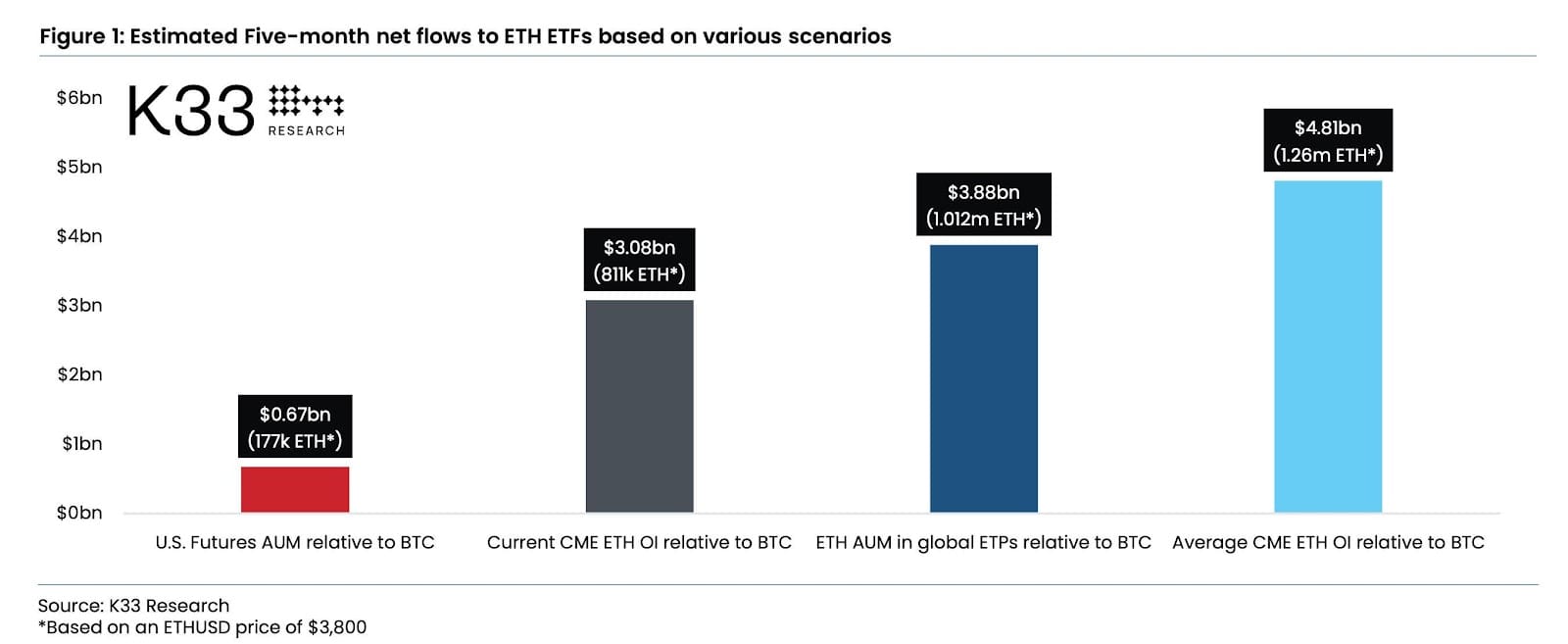

According to K33 Research, although ETH investment vehicle flows have been on a steady downtrend since November 2001, a significant trend shift is expected following the launch of U.S. spot ETH ETFs. Based on the size of similar ETH products globally and CME futures open interest relative to Bitcoin, they estimate that 750,000 to 1,000,000 ETH, representing 0.65-0.85% of ETH’s circulating supply, will be absorbed within five months. The report said that the omission of staking will not negatively impact the inflows to the ETFs.

(Source: K33 Research)

"We forecast that U.S. spot ETFs will attract $4bn in net inflows in their first five months. This estimate is based on the relative global ETH AUM market share compared to BTC of 28%, in addition to comparisons between CME’s ETH OI to that of BTC, currently sitting at 23%." (K33 Research)

It’s a big promise compared to the Ethereum futures ETF debut on the CME last year. However, brokerage firm analysts believe this lackluster launch was an outlier due to the poor timing of the market entry and does not reflect ETH’s true investment demand.

(Source: K33 Research)

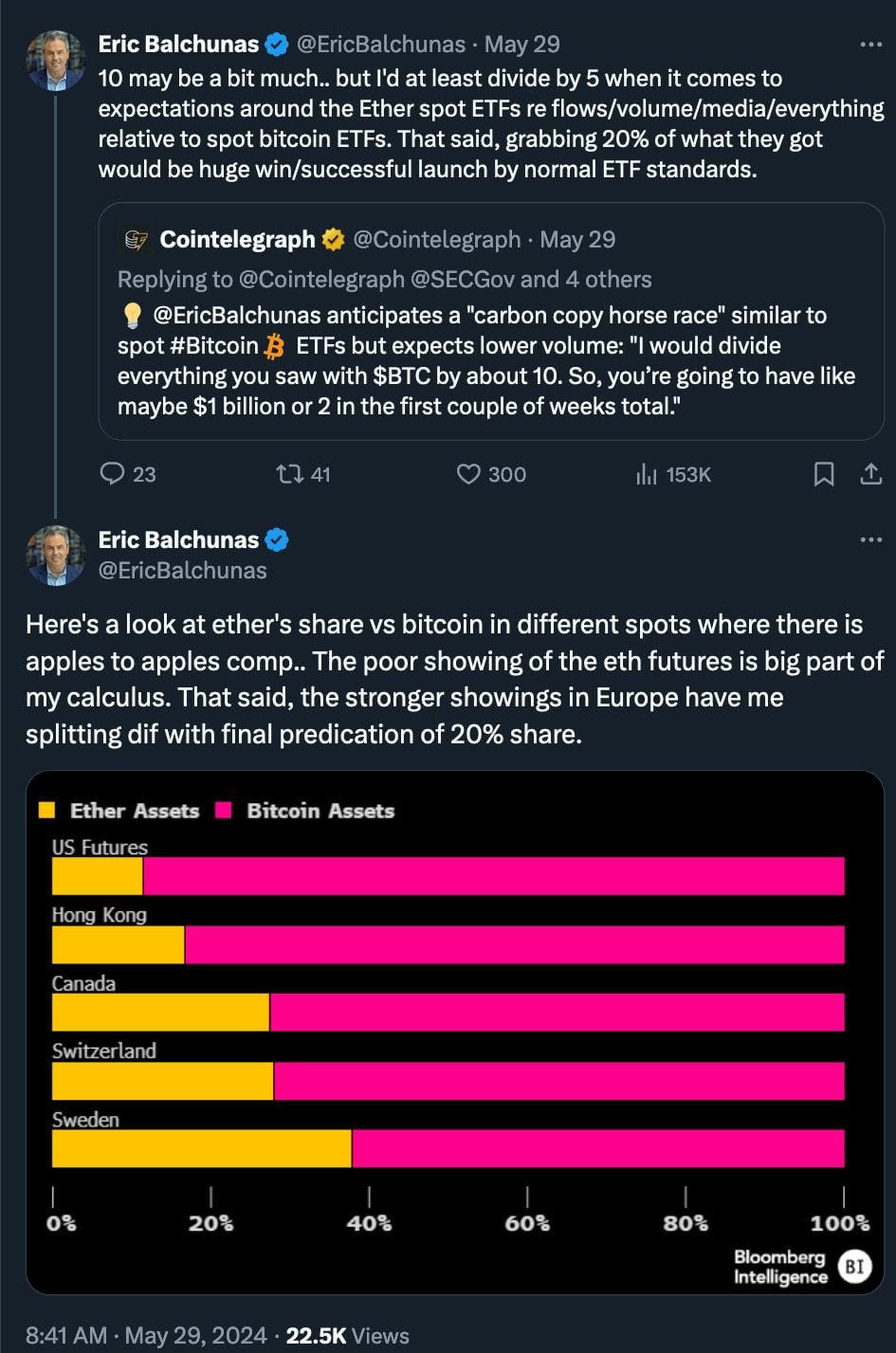

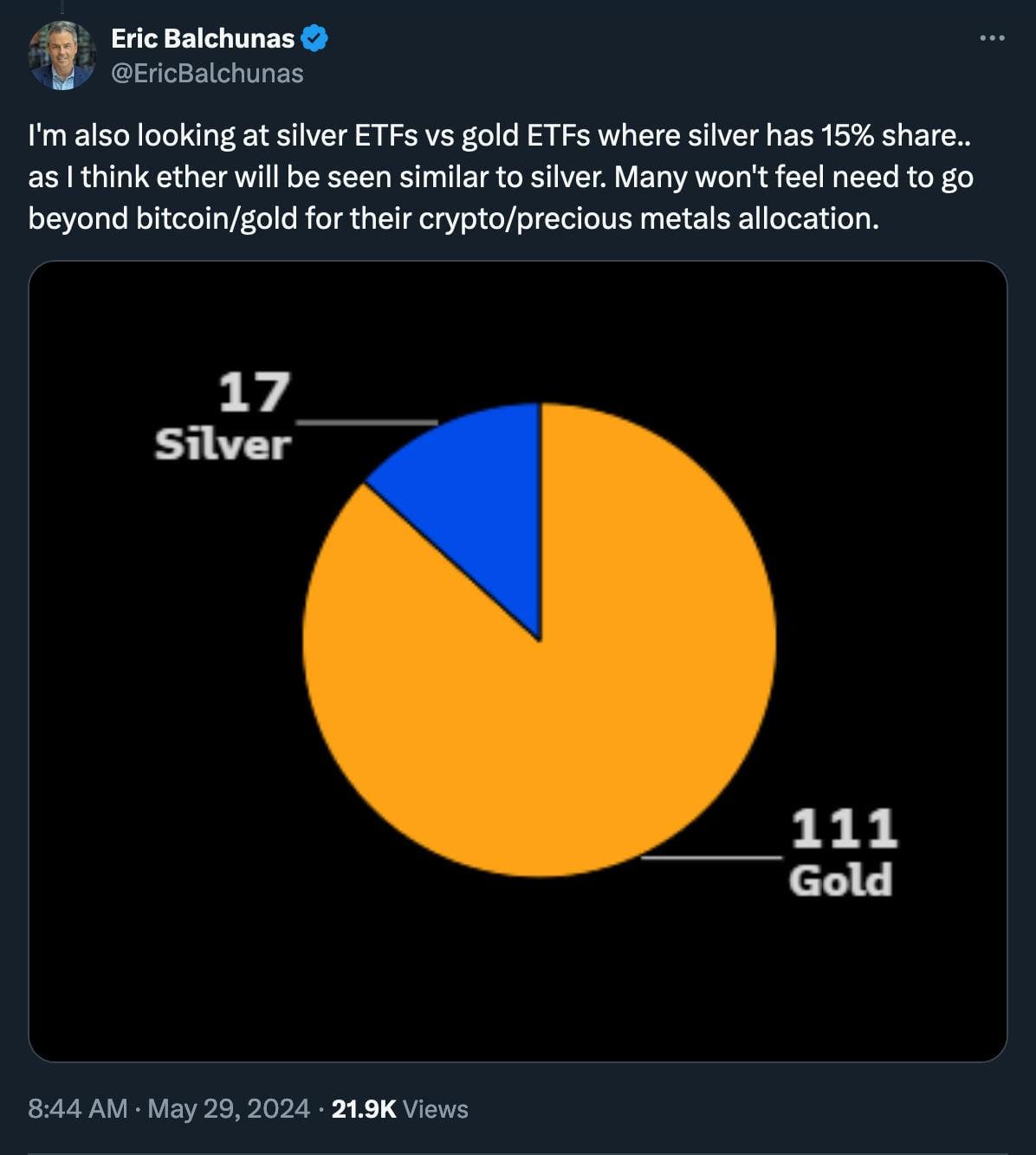

Meanwhile, Bloomberg ETF analyst Eric Balchunas predicts that Ethereum ETFs will capture 10% to 20% of what Bitcoin spot ETFs did.

Matt Hougan, CIO of Bitwise, said recently on the Bankless show:

"I don't think Ethereum ETFs will match Bitcoin ETFs, but I do believe they will still be measured in terms of many billions of dollars. The $10 billion converting some of that will involve people selling out, which means new investors will need to step in. However, I think it’s quite possible that we could see an additional $5 billion flow into Ethereum ETFs by the end of the year.”

“Could there be significantly more in future years? I definitely think that's possible. Will it be enough to drive Ethereum to new all-time highs? I believe that's also possible. If Bitcoin ETFs accumulated $12 to $13 billion in their first four months, I think Ethereum ETFs will gather less than half of that, but more than a quarter." (Matt Hougan, CIO of Bitwise)

JPMorgan analysts, on the other hand, warn that "the initial market reaction to the launch of spot Ethereum ETFs is likely to be negative," as the demand for these ETFs is expected to be "a fraction of that seen for spot Bitcoin." Many market observers also believe that outflows from the Grayscale Ethereum Trust (ETHE) could dampen "the Spot Ethereum ETF approval party" (but may create significant opportunities for traders).

Summarizing general expectations for ETH spot ETFs relative to U.S. Bitcoin ETFs, the first thing to note, as Scott Melker puts it in his recent post, is that Bitcoin's launch far exceeded expectations, achieving in five months what many thought would take a year. "The second point," according to Melker, "is acknowledging that $1 of inflows into Ethereum will not carry the same weight as $1 of inflows into the Bitcoin ETF." Thus, Ethereum ETFs can have a reasonably successful launch without reaching a proportionate scale to Bitcoin.

"My basic premise is that unless Ethereum attracts significantly more inflows relative to its size compared to Bitcoin, it probably won't surpass its all-time highs in the short-term, especially considering Bitcoin's ETF success and its current position still below its ATH." (Scott Melker's The Wolf Den newsletter)

Anything can happen, continues Melker, so it's best to sit back, temper expectations, and be pleased when the inflows arrive. Ethereum is the only other asset that can earn the ETF privilege, and Grayscale's ETHE outflows will finally be absorbed. Expect excitement to build as the final S-1 filings are submitted and marketing creates a straightforward narrative for ETH. Let the good times roll!

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.