The Federal Reserve Chair, Jerome Powell, did not give clear signals to risk assets in the Friday commentary, leaving markets with "tons of uncertainty."

SUMMARY OF POWELL SPEECH (5/19/23):

— The Kobeissi Letter (@KobeissiLetter) May 19, 2023

1. Inflation "far above 2% objective"

2. Committed to getting inflation to 2%

3. Unclear if rates are "sufficiently restrictive"

4. Failure to lower inflation prolongs pain

5. Will "take time" to lower inflation

Tons of uncertainty ahead.

Bitcoin and Ethereum took this lack of clear signal literally, trading in a narrow range under the lost support almost the entire weekend.

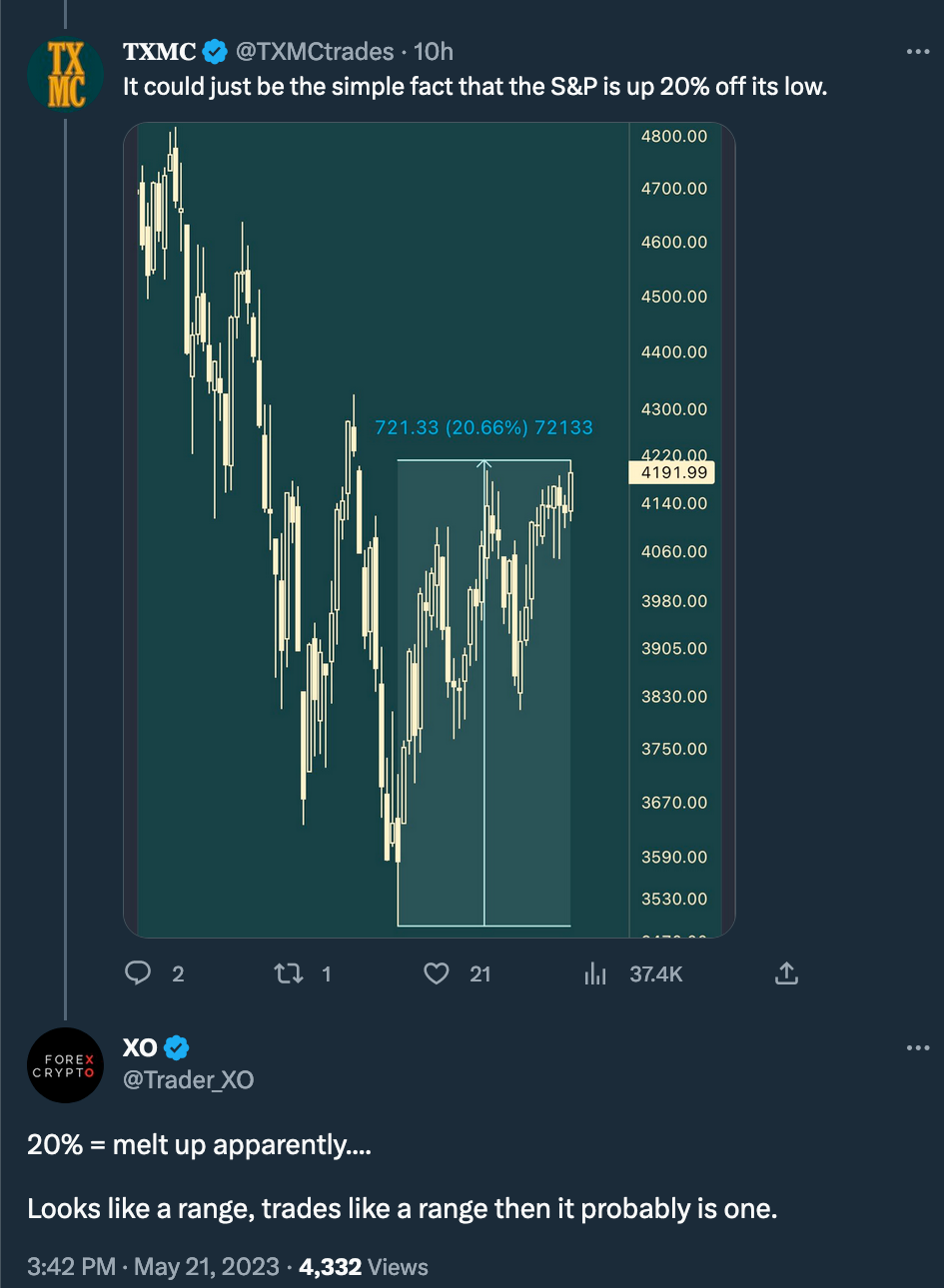

Some crypto traders, again, in the absence of a signal from the Fed, turned to the S&P 500 chart – and came to quite the opposite conclusions.

Momentum will soon break the 4200-line in the sand sending SP500 much higher!

— Henrik Zeberg (@HenrikZeberg) May 18, 2023

Stay Bearish if you like 😉🚀 https://t.co/3GTjW878bN

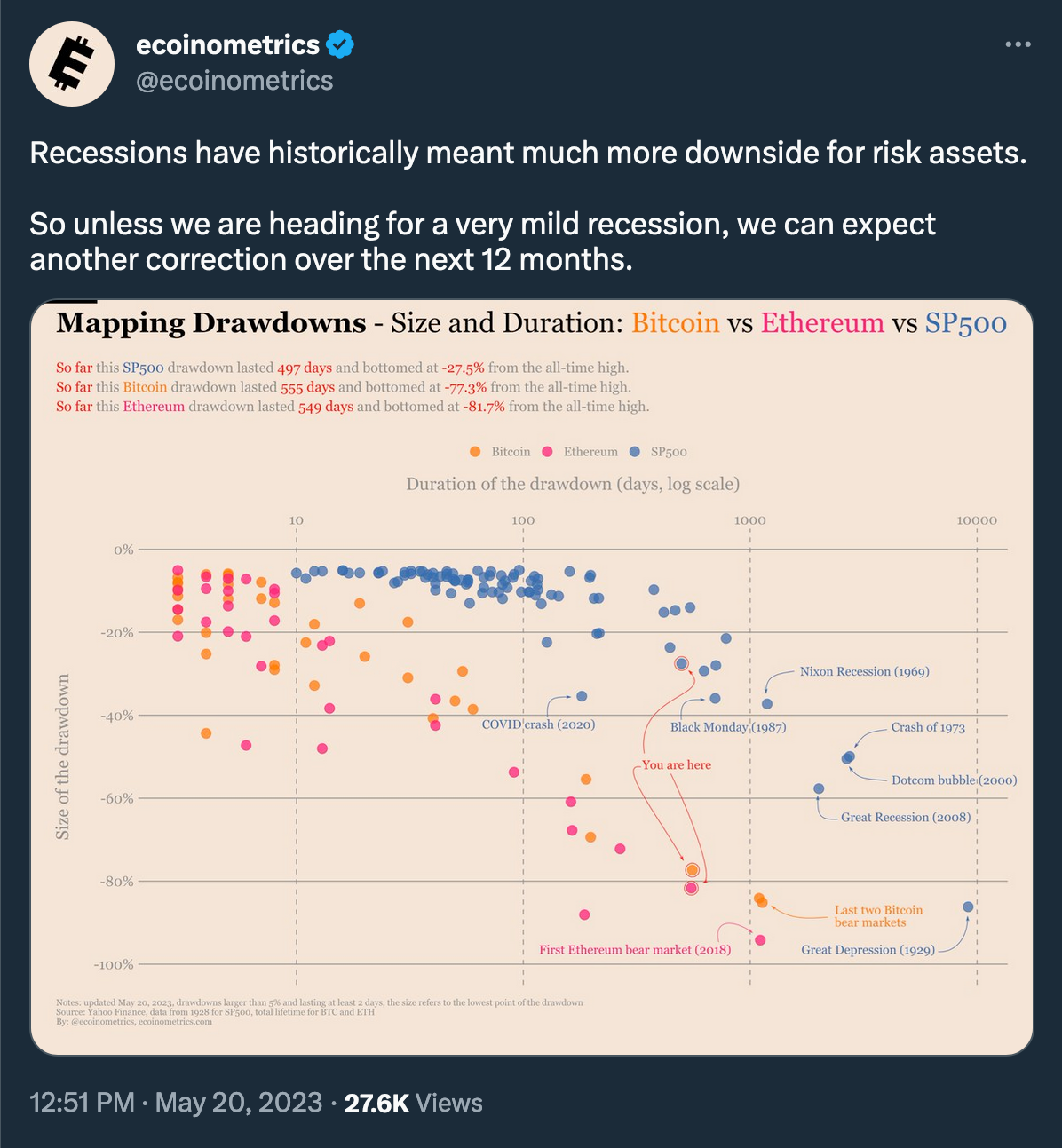

Meanwhile, in the macro context and in light of the expected recession (classical signs of which have been evident for quite some time, although some claim "this time is different")… Statistically, previous recessions meant much more downside for risk assets, as @ecoinometrics analyst points out:

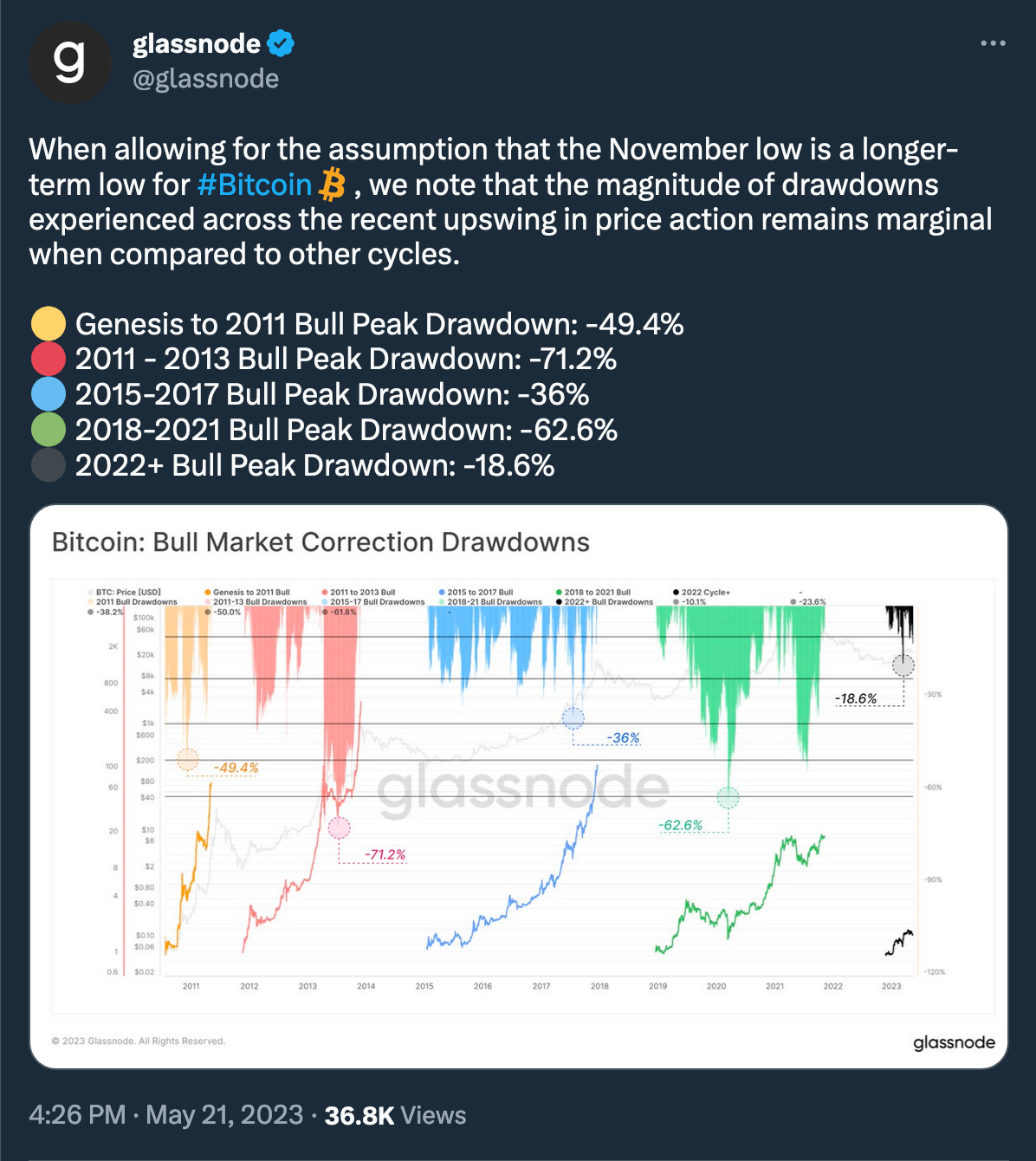

And this is what the comparison with the previous bitcoin market cycles looks like:

Glassnode analysts, in turn, noticed that in case of the November low is a longer-term low for BTC (which is supported by the price structure on the weekly timeframe, with its higher lows and higher highs), then "the magnitude of drawdowns experienced across the recent upswing in price action remains marginal when compared to other cycles:"

And turning, eventually, to the technical analysis of the BTC price chart, the lack of momentum and trading in the narrow range under the lost support (now resistance) on smaller timeframes led to a poor week closing in terms of TA.

#BTC still below ~$27600 (black) as the week slowly comes to a close

— Rekt Capital (@rektcapital) May 21, 2023

A 1W Close below ~$27600 would double-confirm a breakdown & could set $BTC up for downside continuation

Price needs to reclaim $27600 to have a chance at bullish momentum#Crypto #Bitcoin

Therefore, chances are we go further downside short-term. A thesis might be rejected in case of bulls manage to take the lead this week. So it looks like make-or-break for bitcoin and a general crypto market:

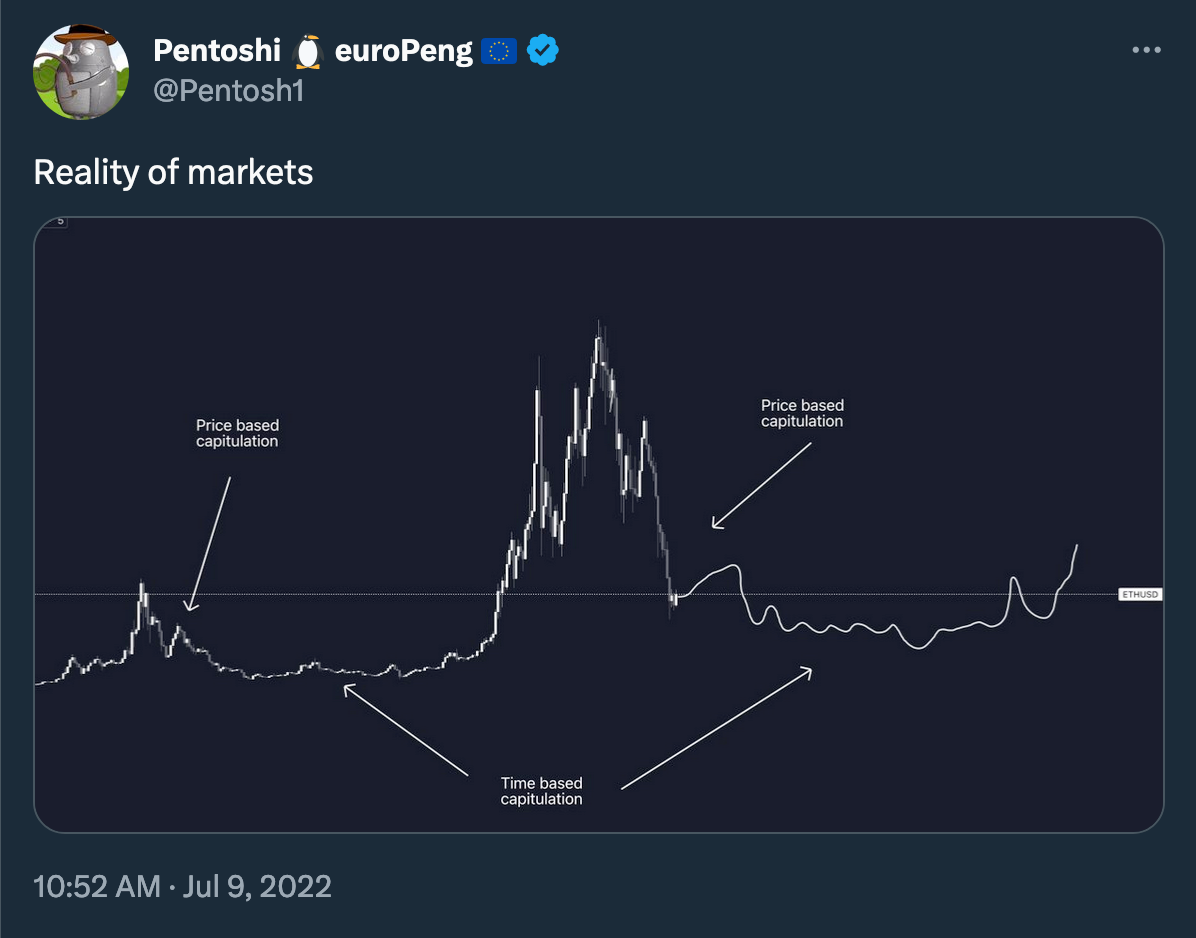

Overall, though, there is no reason to panic yet, as downside potential in the eyes of crypto analysts looks quite limited:

This year is the boring year.

— Michaël van de Poppe (@CryptoMichNL) May 21, 2023

No price acceleration, no fundamental growth, while the preparations for the next bull cycle are made during this year.

So should you.

Start learning about TA/PA & #Bitcoin and prepare yourself, during a bull you don't have the time.

When Alt Season, Sir?

The Holy Grail in Place of Your Usual Disclaimer

Proper risk management is a must. The holy grail in trading does exist, and that is proper position sizing and risk management. So before gambling on memecoins and crypto derivatives with leverage, please, do your own research.