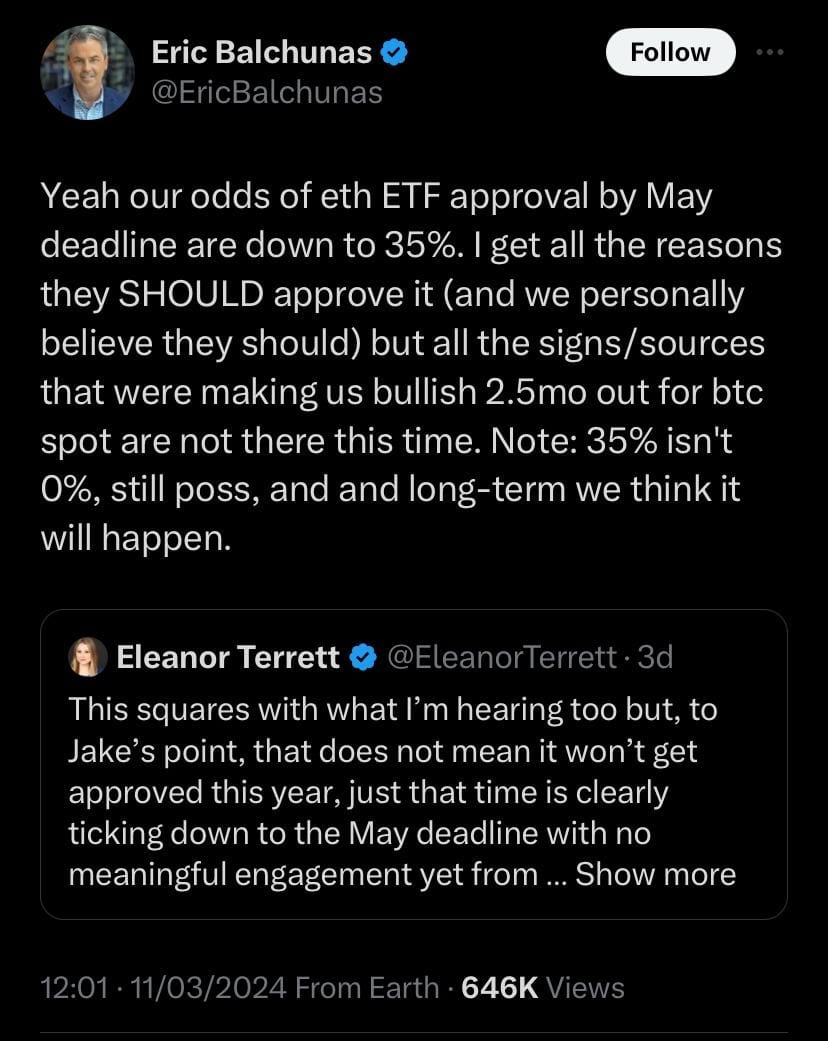

The ongoing 'radio silence' from the SEC regarding Ethereum exchange-traded funds (ETFs) filings could be a bad sign, according to Eric Balchunas, senior Bloomberg ETF analyst. Experts agree that the ETH ETF approval grows slimmer every day of the SEC's silence.

The anticipation surrounding Ethereum ETF approvals has grown in the wake of the successful Bitcoin spot ETFs' lunch. The potential ETH ETF approval suggests a significant market impact upon approval, potentially attracting a broader range of investors.

However, optimism for the SEC's near-term approval of Ethereum spot ETFs appears to diminish gradually. A key concern is the SEC's lack of communication with potential issuers, especially as the final deadline approaches without any feedback, as noted by Eric Balchunas.

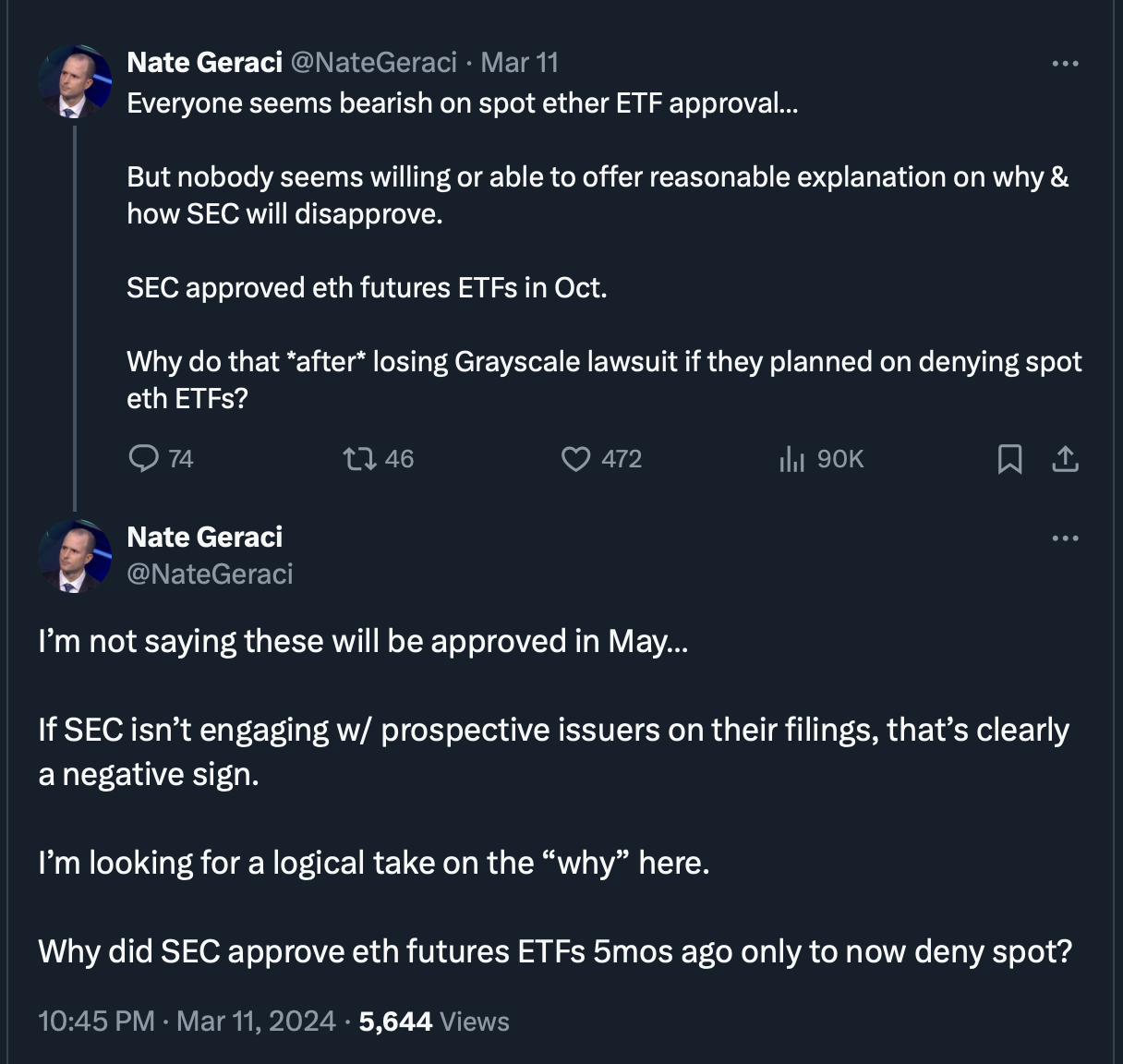

ETF Store president Nate Geraci agreed that the SEC not engaging with prospective issuers regarding their filings is clearly a negative sign. He noted, however, that it was strange for the SEC to approve several ETH futures ETF products in October only to deny spot products in May.

Fox Journalist Eleanor Terret attributed this regulatory inconsistency to SEC Chairman Gary Gensler’s belief that the approval of BTC spot ETFs already addressed industry demands.

“At the end of the day, Gensler thinks Ether is a security. He would not want to approve it unless he thought it to be a commodity like Bitcoin. All of this little stuff adds up,” - Eric Balchunas, Cointelegraph

Additionally, influential anti-crypto politicians like Senator Elizabeth Warren have expressed concerns over the SEC’s approval of Bitcoin ETFs, potentially affecting Ethereum ETF decision-making.

(X post)

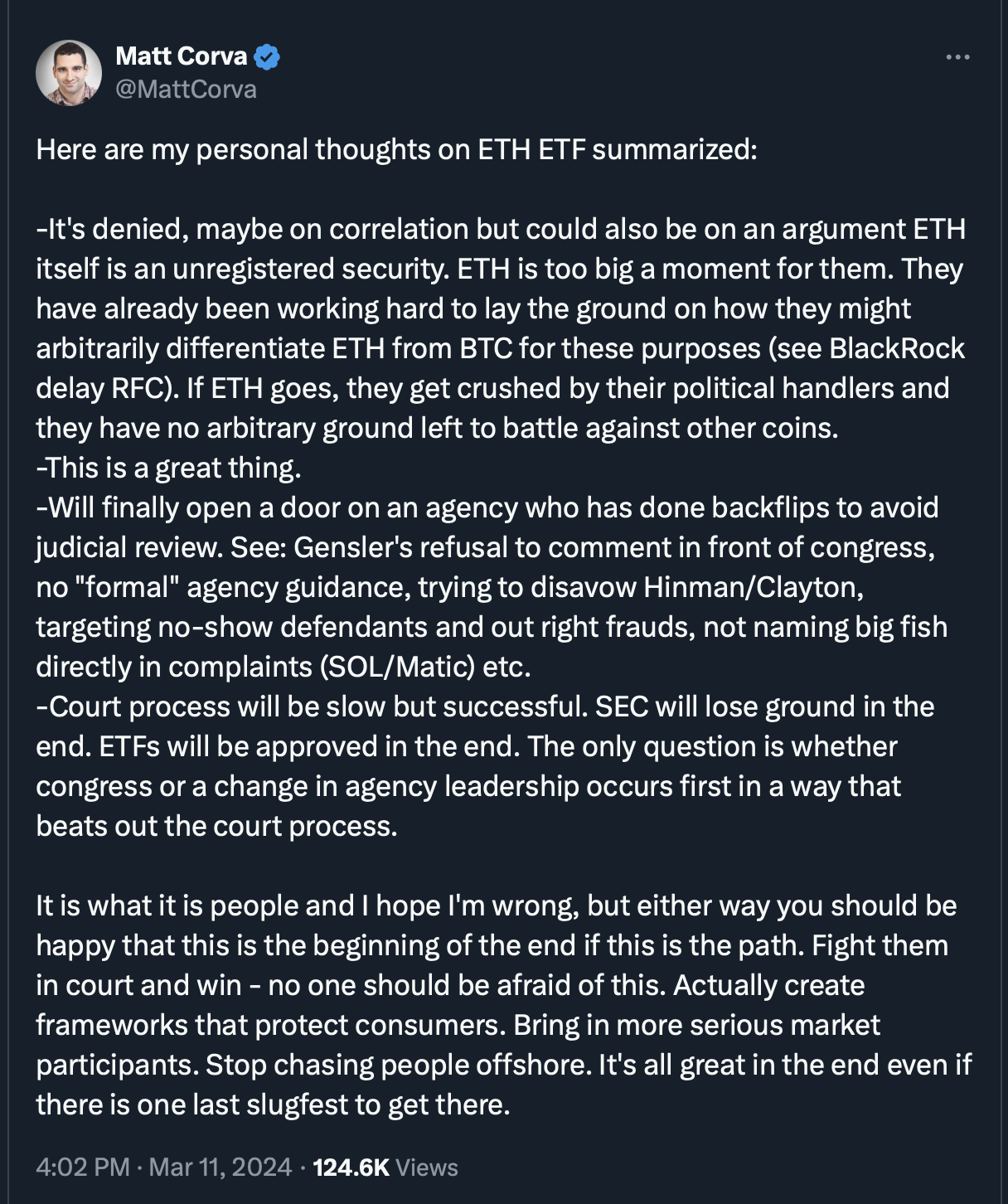

The waning optimism regarding Ethereum ETFs' approval raises concerns about the crypto market’s dynamics in the coming months. While Bitcoin spot ETFs have significantly impacted the market, the uncertainty around Ethereum ETFs may signal a more cautious approach by the SEC.

So, looking ahead, after May 15, a crucial disclosure date for Bitcoin ETFs that could have a hugely positive impact on the crypto market, as teased by Bitwise CIO Matt Hougan, May 23 might bring a significant headwind and volatility caused by a disappointing SEC decision.

Long-term, however, despite potential short-term setbacks, experts find positive aspects, agreeing that a spot Ether ETF is more a matter of when, not if.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.