A critical flaw in crypto was discovered by Miles Deutscher, a 'crypto analyst and DeFi addict,' who highlighted in a series of tweets a severe fundamental problem that is beginning to surface.

(Thread)

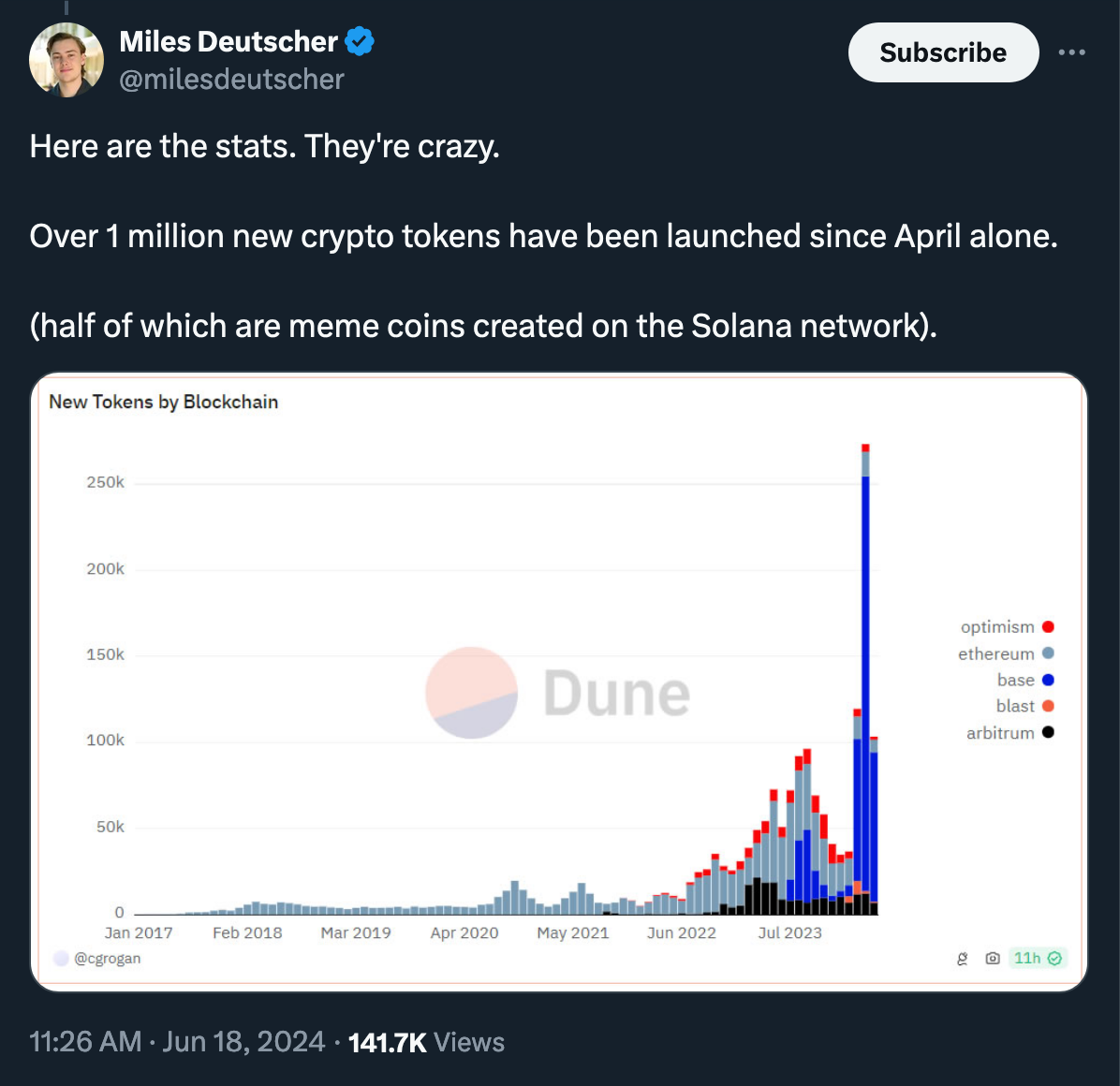

Many new entrants saw the new bullish conditions as an opportunity to launch projects for quick profits, resulting in a historic number of new crypto launches in 2024. Here are the stats, and they look crazy, yes:

(Thread)

One could argue that the numbers are inflated by the ease of deploying memecoins, and that’s true, but it’s still an insane figure. For more accurate numbers, refer to the stats from CoinGecko below, which excludes many of the smaller memecoins.

(Thread)

As Deutscher points out, this influx of tokens is a major issue and one of the main reasons why the crypto market has been struggling this year despite Bitcoin reaching new all-time highs. Why? The increasing number of token launches adds cumulative supply pressure on the market. This supply pressure stacks.

Many projects from 2021 are still unlocking, with supply stacking in every subsequent year. Current estimates suggest there’s around $150 million to $200 million of new supply pressure annually.

"Think of token dilution as inflation. If the government prints USD, this, in turn, reduces USD's purchasing power. ... [The] same in crypto. If you print more tokens, this, in turn, reduces crypto's purchasing power relative to other currencies (like USD). Altcoin dispersion is basically crypto's version of inflation." (Miles Deutscher)

"It’s really easy to print up your own money and dump it on noobs, especially when the SEC is in retreat mode in an election year like 2024. It’s really these retail investors who are the noobs at the poker table who don’t realize that they are the exit liquidity. What the VCs and other insiders want to do is they want to dump their shipcoins and buy Bitcoin with the proceeds." (Matthew Kratter, Swan Bitcoin)

(Thread)

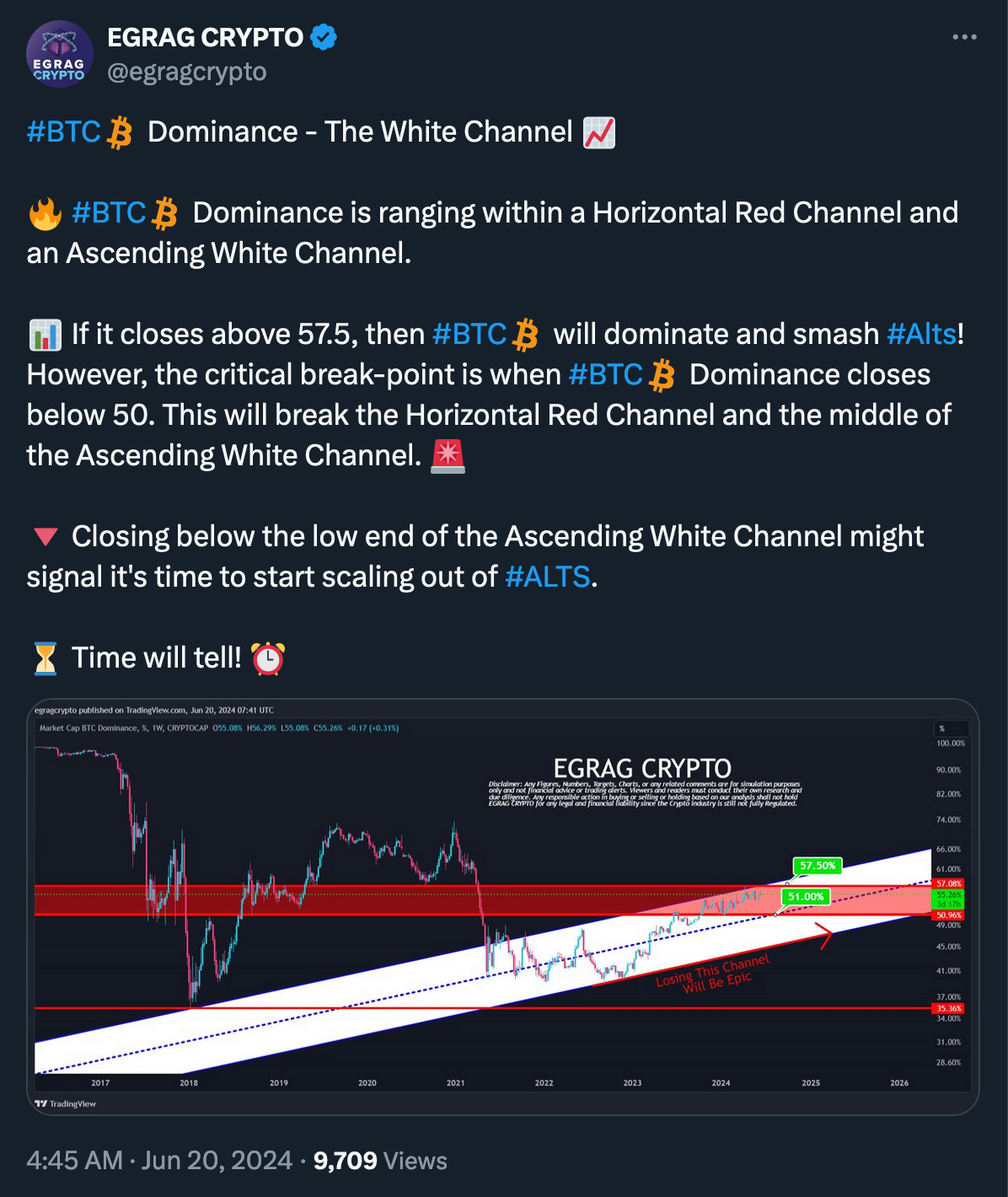

Another pseudonymous crypto analyst, meanwhile, pointed out key levels on the Bitcoin dominance chart, identifying a critical juncture that could spell either a surge in Bitcoin’s relative strength or a long-awaited altcoin uprising.

If BTC.D breaks above the 57.5 level after a prolonged consolidation in the horizontal channel (red), also breaking out of the ascending channel, it could result in a significant surge in Bitcoin dominance, potentially leaving altcoins in the dust. This appears to be a likely scenario in the event of a BTC dump.

(Thread)

Conversely, a drop in Bitcoin's dominance below the crucial 50 level could spark a strong surge in altcoin interest.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.