All the attention of investors in recent days was focused on Credit Suisse, rumored to be in a difficult financial situation. The possible collapse of one of the largest giants of the financial industry reminded crypto investors of the 2008 crisis. It was then when the first cryptocurrency, Bitcoin, not controlled by central banks and resistant to censorship, was born.

Credit Suisse is one of the largest banks in the world, with about $830 billion in assets, slightly more than Lehman Brothers' assets at the time of the 2008 crash. And it equals to the entire size of the crypto market.

The bank plays an important role in the global economy. But since the beginning of 2022, Credit Suisse shares have lost 90% in price. They fell from $14.90 in Feb 2021 to $3.90 currently. Its capital ratio (CET1, capital to bank's risk-weighted assets) stands at 13.5%. This complies with international requirements and is well above the minimum capital requirement (10.5%). But investors are scared by the high level of CDS (credit default swaps) of Credit Suisse.

Credit Suisse is not the only major bank whose price-to-book is flashing warning signals. The list of banks with PtBs of under 40% includes also Deutsche Bank, Credit Agricole, Univredit, Barclays, Bank of Chaina, Societe Generale, Standard Chartered.

Credit Suisse is not the only major bank whose price-to-book is flashing warning signals. The list below is of all G-SIBs with PtBs of under 40%. A failure of one of them is likely to call the survival of the others into question. pic.twitter.com/LJA0YVrqco

— Alasdair Macleod (@MacleodFinance) October 2, 2022

On 2 October, Financial Times reported that Credit Suisse executives spent the weekend reassuring large clients, counterparties and investors about its liquidity and capital position.

If Credit Suisse or Deutsche Bank, currently demonstrating similar signals, collapse, this will shock the entire world economy.

Investors will begin to quickly exit risky assets, including BTC, which could lead to a further price decline down to $10,000. At the same time, it was the 2008 financial crisis that became the catalyst for the emergence of alternative financial assets such as cryptocurrencies.

#Bitcoin price is already pushed down to the limit, well below 200 WMA. We’ve had contagion from UST/3AC and leverage flushed already. BTC is massively shorted as a hedge.

— Samson Mow (@Excellion) October 3, 2022

Even if Credit Suisse / Deutsche Bank collapse & trigger a financial crisis, can’t see us going much lower.

It is possible that the current crisis, although it will provoke a collapse in the crypto market, in the long term will lead to a mass adoption of cryptocurrencies.

For example, the GBP/BTC trades volume reached its all-time high on September 26 at $881 million, with $70 million on average over the past two years. UK investors are frightened by their government statements about possible corporate tax cuts. It will lead to the further growth of inflation, that already reached 10% in the UK.

So far, despite the rumors around the possible collapse of Credit Suisse and Deutsche Bank, bitcoin remains stable, while fiat currency markets are shaking, with the British Pound crashing to near parity to the US dollar and Euro dipping below 1-1 for the first time since 2002.

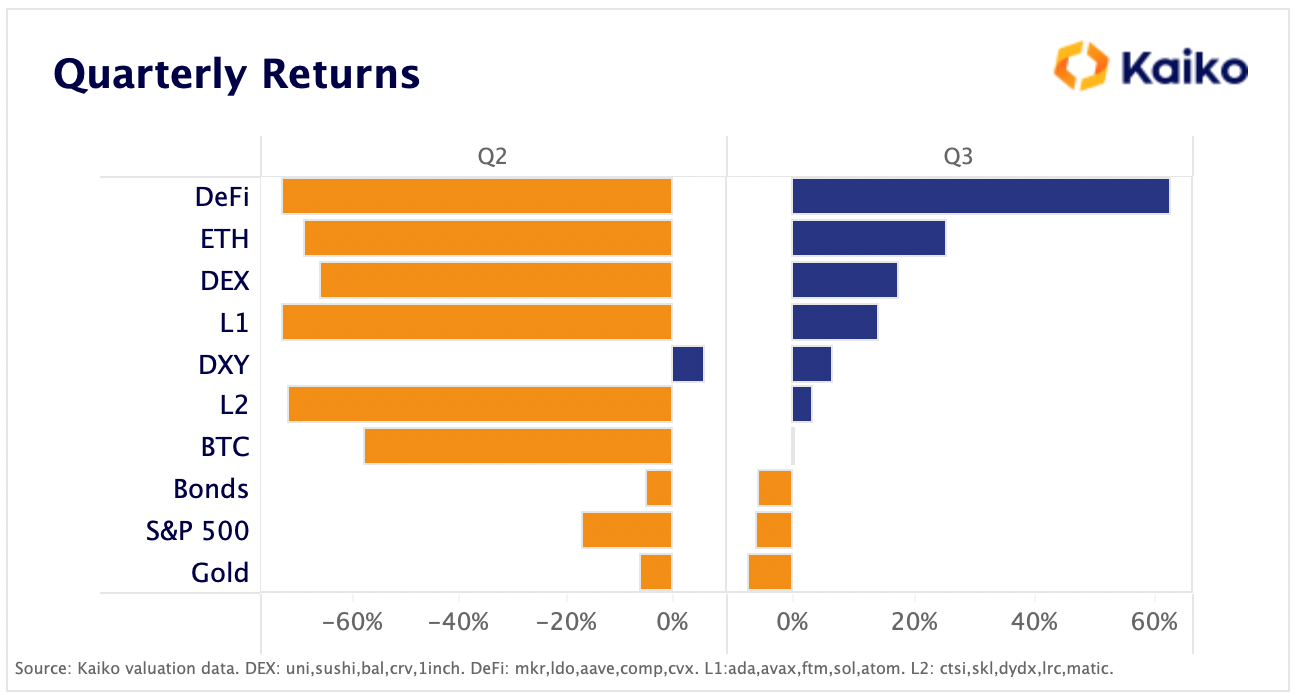

Most crypto sectors outperformed other traditional assets in Q3, recovering from double-digit losses in Q2, Kaiko analysis demonstrates.

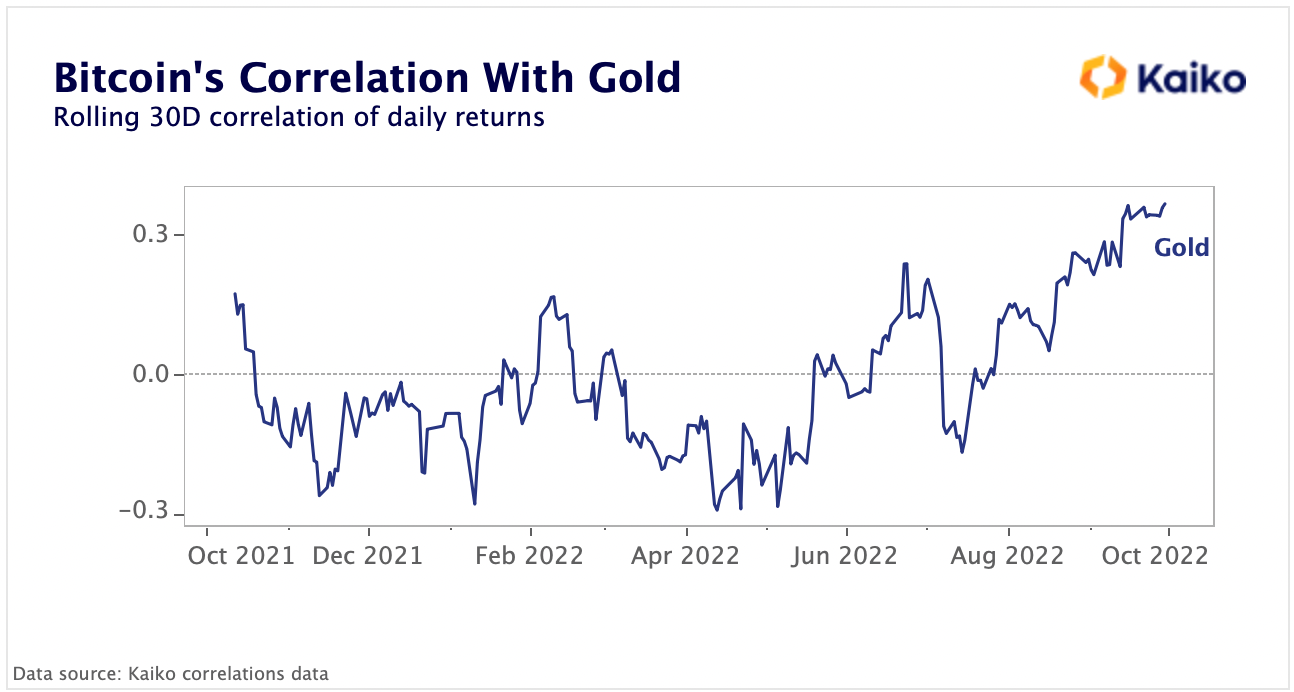

Furthermore, BTC's open interest expressed in native units (eliminating price effects) has risen by 6% in September and by over 26% in Q3 to around 380K BTC, and Bitcoin’s correlation with gold hit its highest level in more than a year last week. That means that some investors flee to cryptocurrencies as a safe-haven, fearing a further decline in traditional markets.

Over the past year bitcoin has been mostly uncorrelated with gold, with its correlation oscillating between negative 0.2 and positive 0.2.