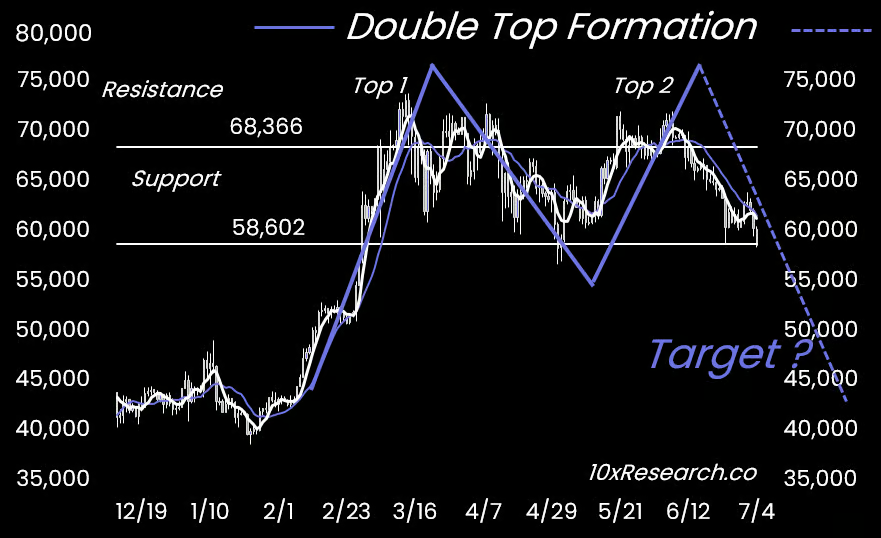

Crypto markets are trading lower, breaking below the long-term horizontal channel and confirming a double-top technical analysis pattern. This decline is attributed to renewed fears surrounding the impending Mt. Gox Bitcoin repayments and the U.S. and German governments selling. Summer's seasonal downward pressure has taken effect, and thus far, the "Sell in May and go away" adage appears to hold true.

(Source: 10x Research)

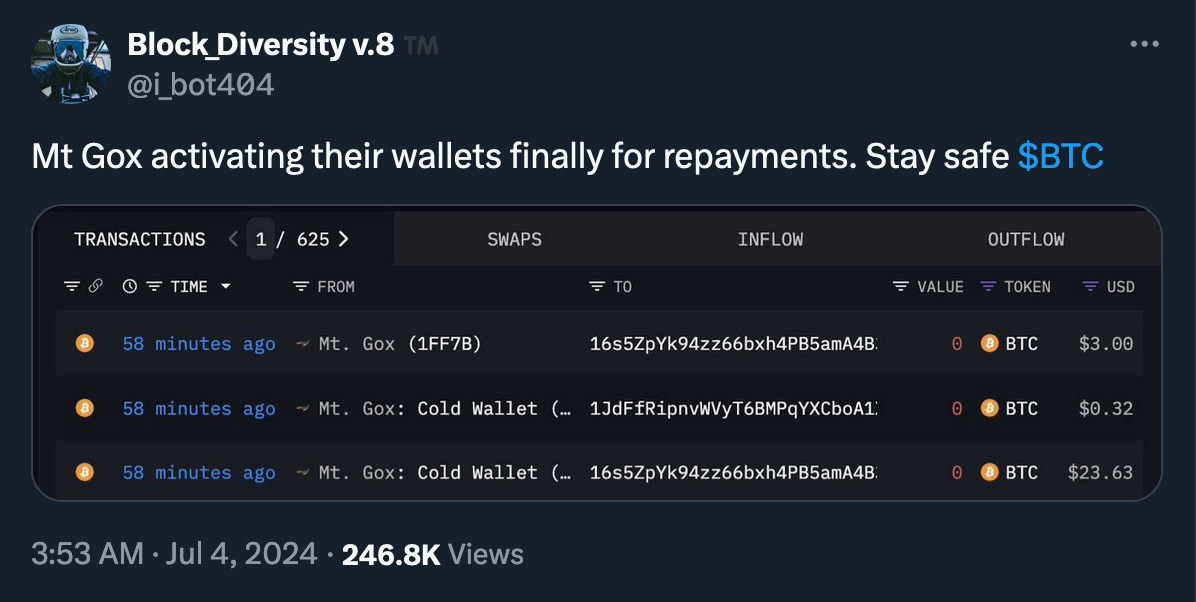

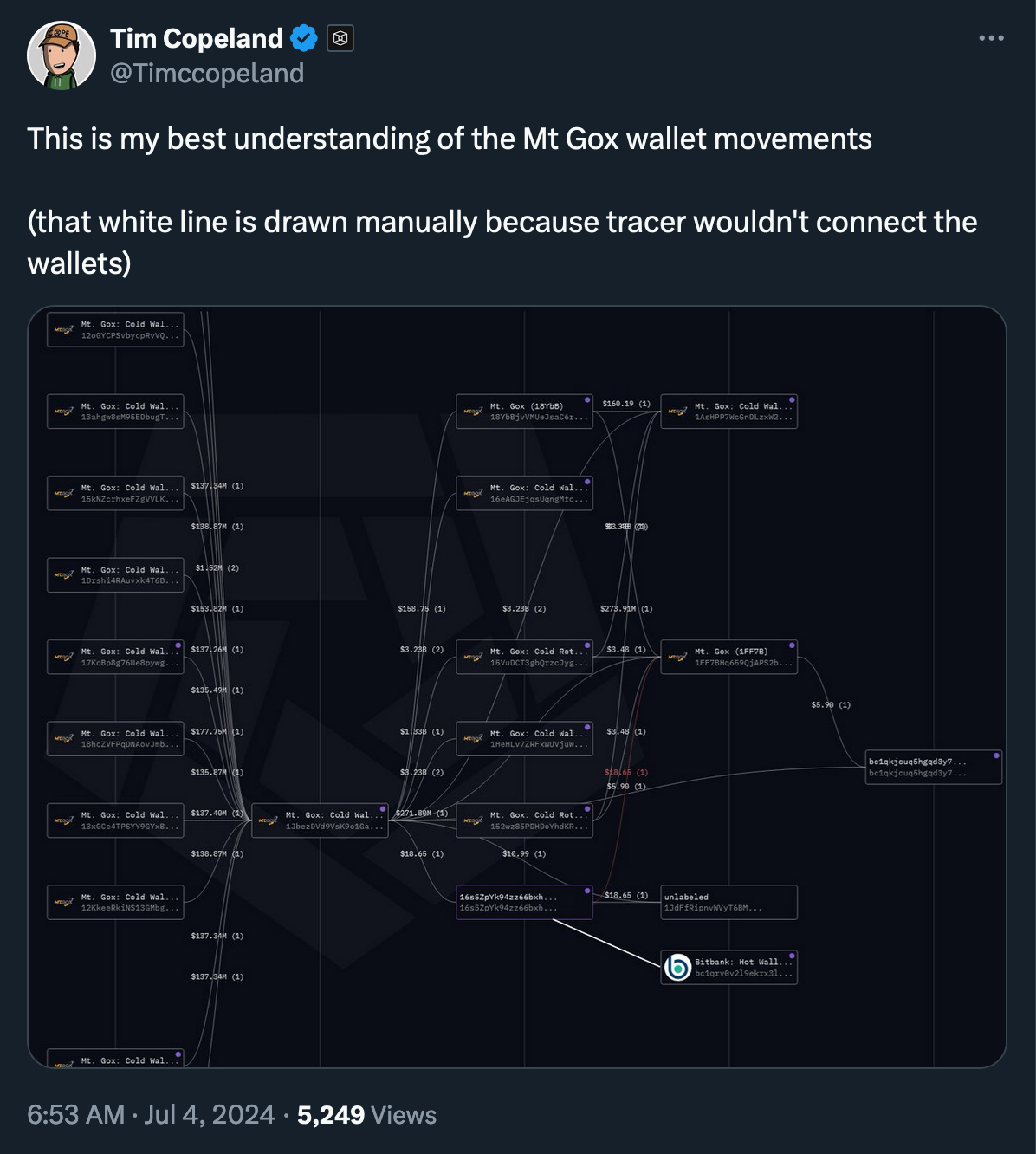

Ten years after the notorious hack, addresses labeled by Arkham as 'Mt Gox: Cold Wallet' began to move small amounts of BTC on Thursday, presumably as test transactions in preparation for the substantial customer repayments scheduled for this month.

The Block's Tim Copeland noted that one of the receiving addresses is labeled as Bitbank, one of the designated exchanges for distributing the funds.

The movements align with the official timeline, as on June 24, the rehabilitation trustee, Nobuaki Kobayashi, announced (PDF) that repayments would begin "from the beginning of July 2024." That news already triggered panic selling and a wave of liquidations in the crypto derivatives market last week.

Additionally, recent reports indicated that significant quantities of Bitcoin were being transferred, with the German and U.S. governments moving substantial amounts of confiscated funds. So, such a coincidence in timing looks particularly noteworthy.

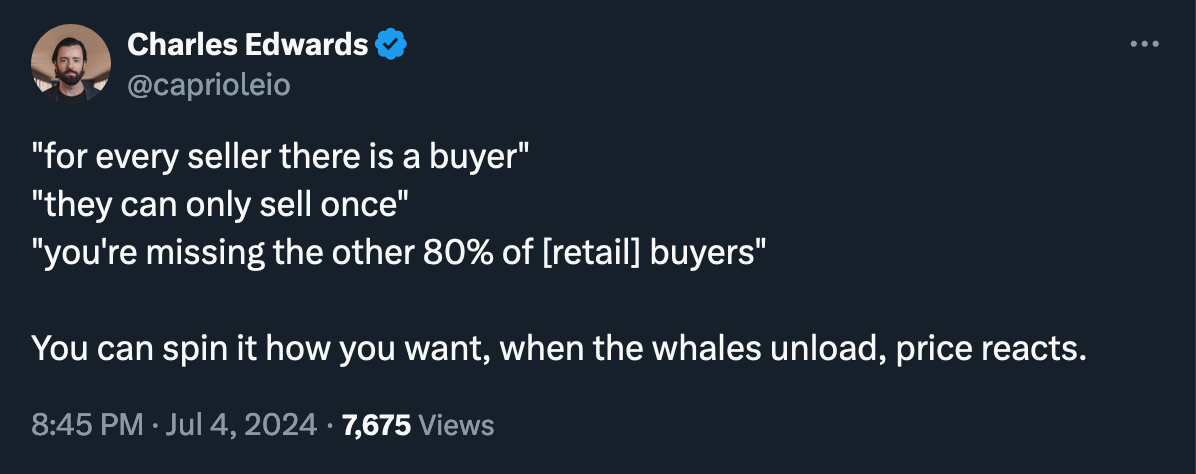

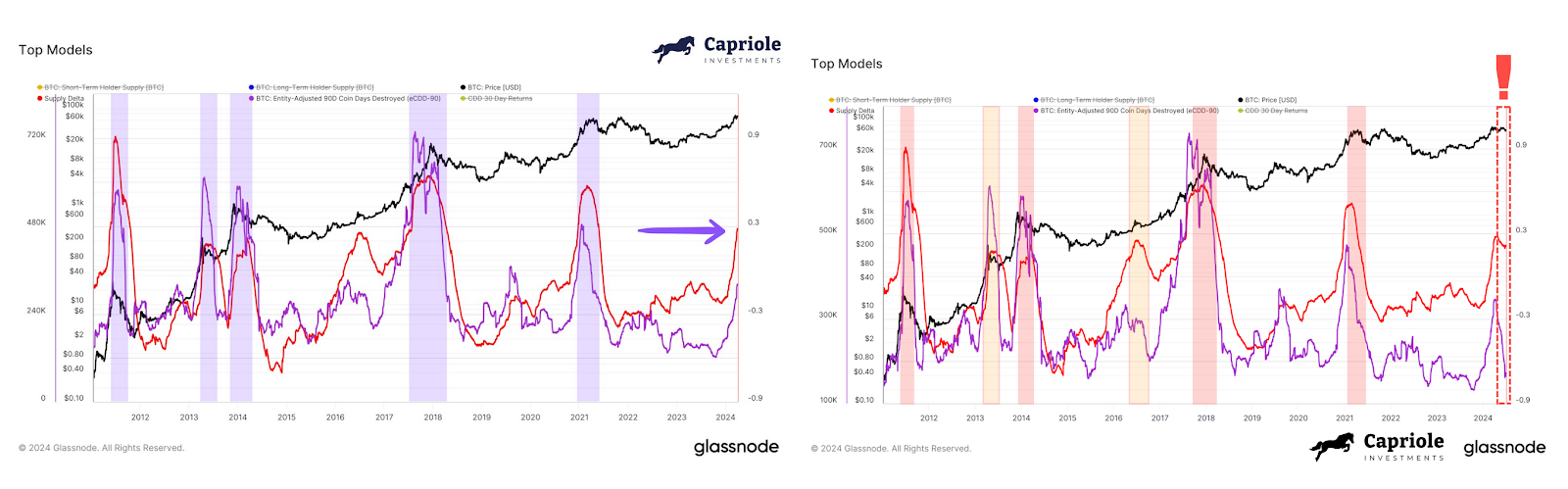

Capriole Investments founder Charles Edwards stated that several on-chain metrics indicate Bitcoin's inability to reach new highs after two retests is a "sign of weakness." In his latest newsletter, Edwards highlighted that certain highly precise on-chain metrics indicate a potential cycle top.

(Source: Capriole Investments newsletter)

"I won’t lie, I find this on-chain data hard to believe. I am surprised by the count of Bearish signals for being just two months post halving. While many of the 13 signals suggest the top is in, most also have not gone anywhere close to the level of extremity we saw in 2021 (though in 2021, this was also the case with reference to 2017)." (Charles Edwards)

According to 10x Research, $60,000 was a crucial level for Bitcoin miners and Bitcoin Spot ETF buyers. It also generally indicated the bottom of the three-month trading range.

“Bitcoin is breaking significant technical and psychological levels at $60,000. This is a key level for Bitcoin miners and Bitcoin Spot ETF buyers, and it also broadly marks the bottom (support) of the three-month trading range. Price declines could accelerate as support gets broken and sellers scramble to find liquidity. Only ill-informed traders are willing to buy here. Breaking this support could cause a sharp decline to the low $50,000s." (10x Research)

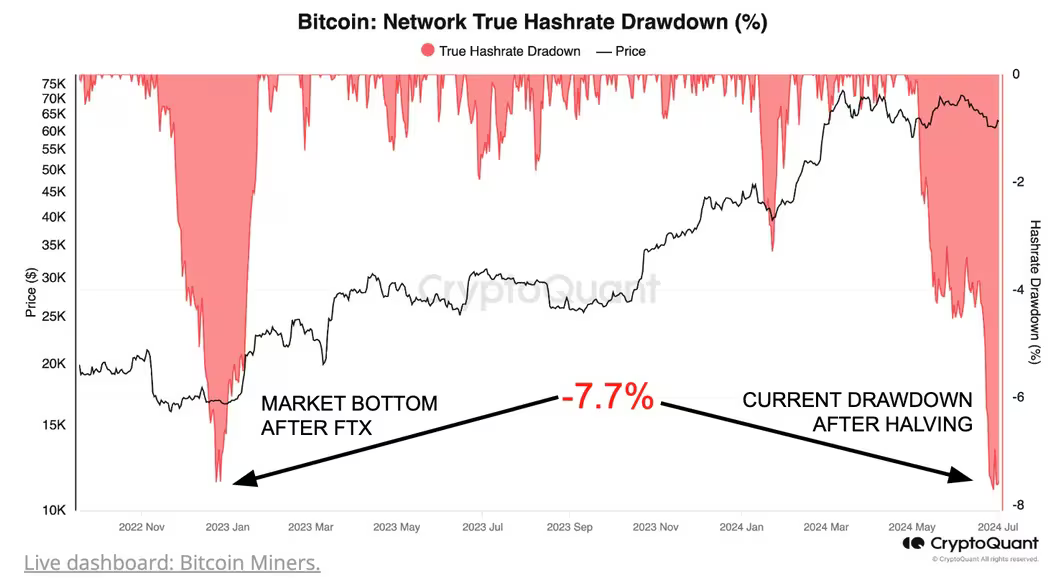

Meanwhile, miner capitulation levels are now comparable to those at the end of 2022, the market bottom after the FTX implosion, according to CryptoQuant.

(Source: CryptoQuant)

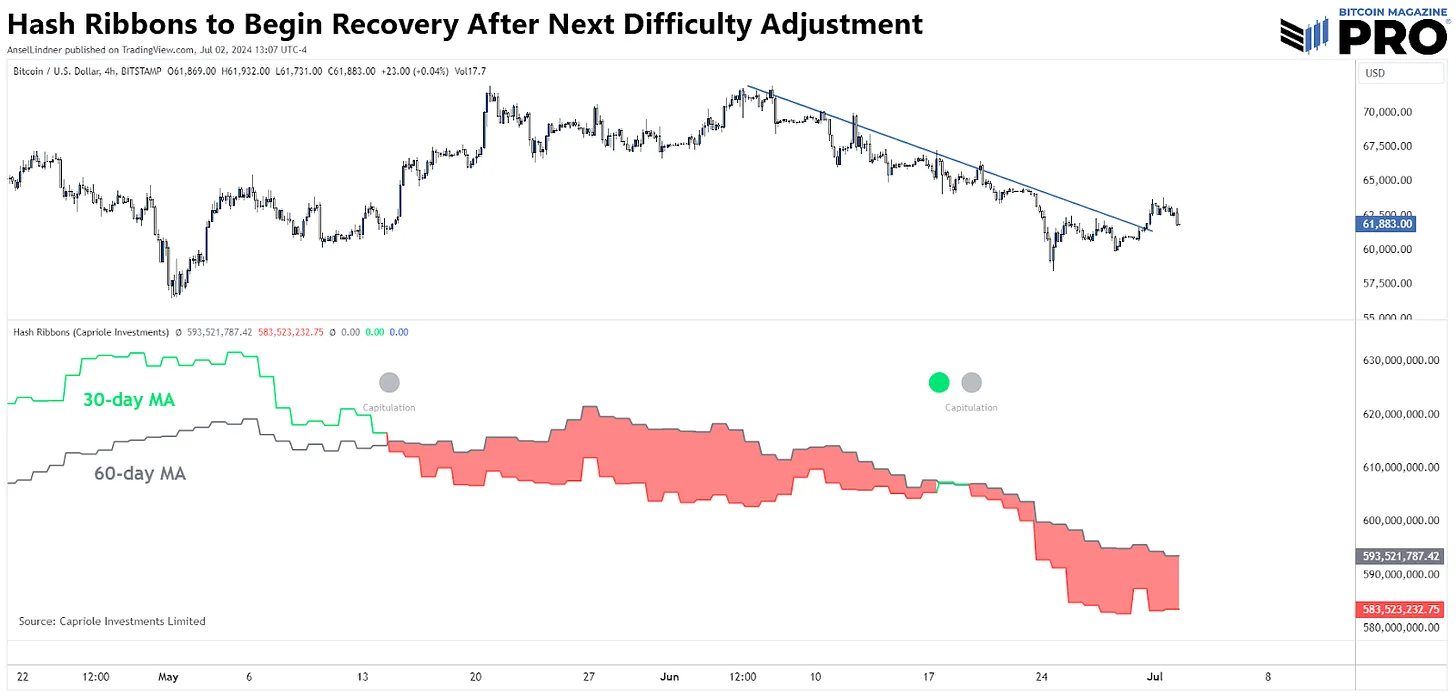

A decline in the Hash Ribbons indicator, 'a snapshot of the balance of forces on Bitcoin mining,' started to slow down and to begin recovery after the next difficulty adjustment, according to the Bitcoin Magazine Pro report.

"Hash Ribbons Will Give a Buy Signal: The Hash Ribbon indicator is a snapshot of the balance of forces on bitcoin mining. Capitulation occurs when the 30-day MA of hash rate drops below the 60-day MA. The green circle indicates “recovered,” or when the 30-day MA has recrossed the 60 DMA. The “Buy” signal comes when the 10-day MA of price crosses above the 20-day MA for price. This limits any false Buy signals." (BMPro)

Tactical trading is hard. Risk management and position sizing are key. Without proper risk management and position sizing, you will suck at trading on a distance.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.