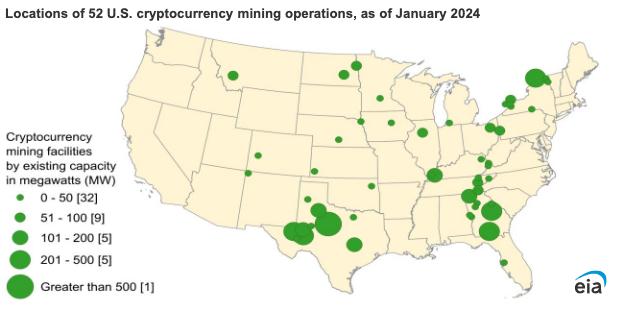

The US government has set its sights on the fast-growing crypto mining industry, launching a data-gathering initiative to evaluate its environmental impact, particularly regarding energy consumption.

The U.S. Energy Information Administration (EIA), acting on an urgent directive from the White House, is set to monitor the electricity consumption by cryptocurrency mining companies in the United States. Initially, the effort will focus on a select group of Bitcoin miners, who are required to report detailed information on their energy use and other operational statistics.

(Source: EIA)l

Crypto miners have been widely criticized in recent years for their substantial energy consumption and the consequent impact on power grids and carbon emissions. Now, the scrutiny has moved beyond mere soundbites into a formal government investigation.

The EIA will focus on how power demand for crypto mining is changing, identify the geographical concentration of mining activities, and determine the sources of electricity for these operations.

(X post)

“We do think it is a significant source of demand which is worthy of our efforts to quantify it. However, until we are able to substantiate the activity with better data, we, too, have more questions than answers,” — EIA's Glenn McGrath for Reuters

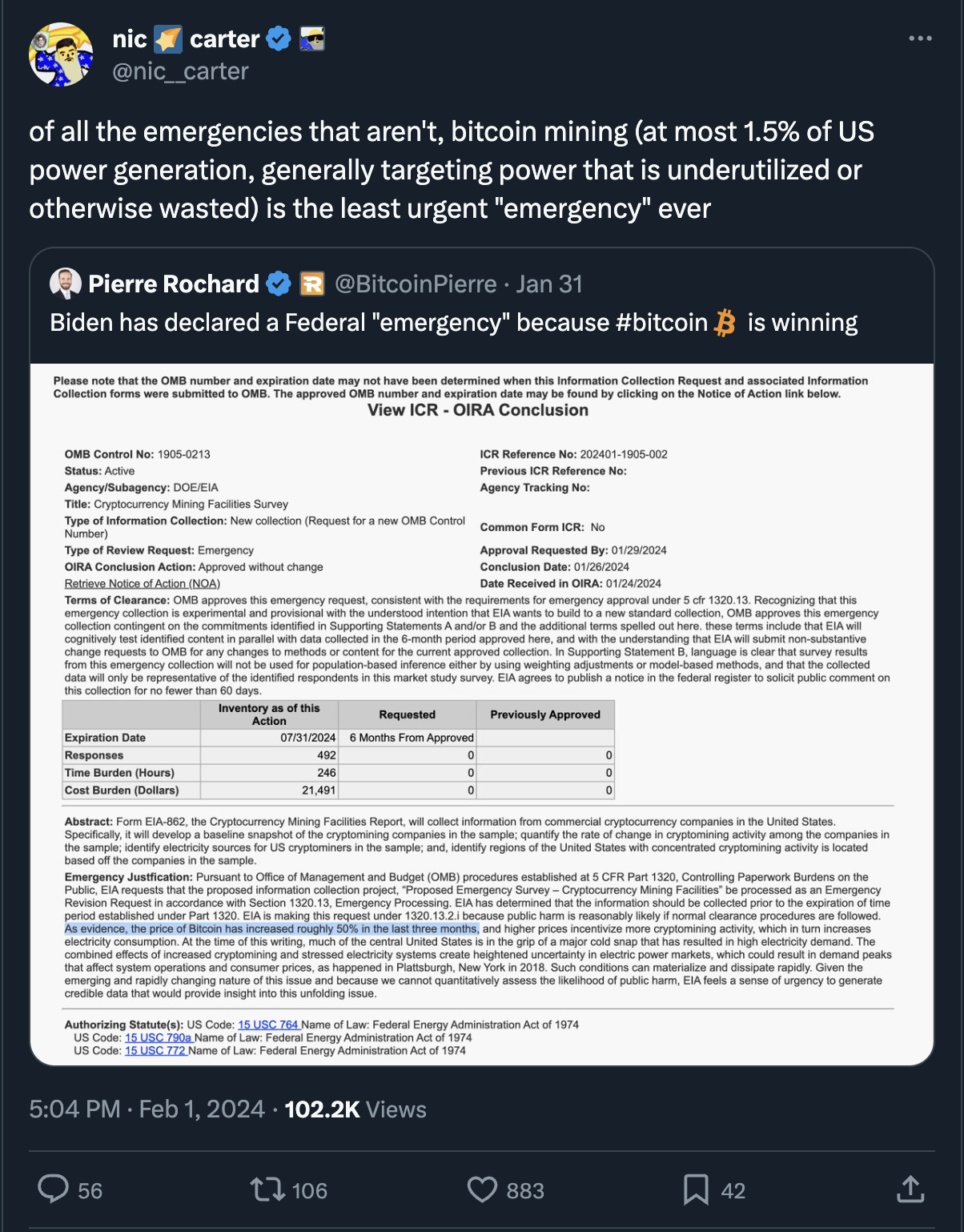

(X post)

However, Noelle Acheson of Crypto is Macro Now suggests that this new government's data collection initiative may not be such an “innocuous information-gathering exercise.” She highlights in a recent post that the initiative starts from a position far from neutral: “It looks like the PR battle over how much energy Bitcoin mining consumes is not over after all.”

“The estimate the agency came up with is between 0.6% and 2.3% of all U.S. electricity consumption. This is a wide band, but nevertheless it is couched in terms to imply that, whatever the actual figure, it’s too much.”

While the second-largest cryptocurrency, Ethereum, reduced its energy footprint significantly by transitioning to a proof-of-stake consensus model, there remains a keen interest among policymakers in the energy usage of crypto mining. This interest is also fueled by studies like one from the Rocky Mountain Institute, which estimated Bitcoin's global energy consumption at 127 terawatt-hours (TWh)—surpassing that of Norway.

“Bitcoin will eventually use half off all energy, and that is a huge positive. If it wasn't people wouldn't do it. No one is twisting their arm to mine bitcoin.” – Ansel Lindner, Bitcoin & Markets

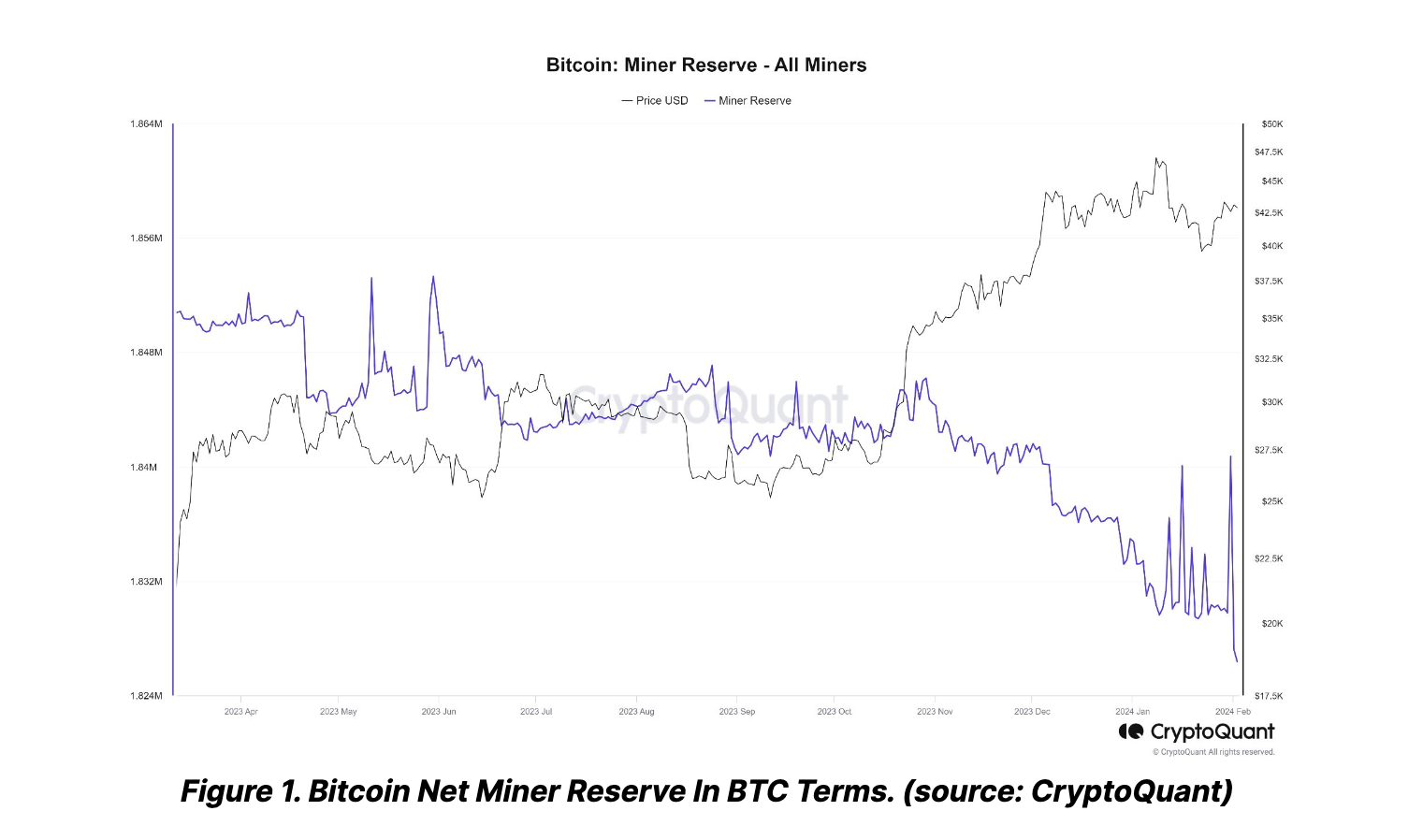

Meanwhile, Bitfinex's latest weekly report links the drop in Bitcoin prices — alongside the GBTC sell-off — to selling by miners, who used the run-up in BTC as a catalyst to exit or leverage their positions.

Miners are particularly inclined to sell ahead of the upcoming halving event, which will decrease mining rewards and affect their profitability. By selling now, miners can secure capital to upgrade their infrastructure and prepare for the upcoming profitability crunch.

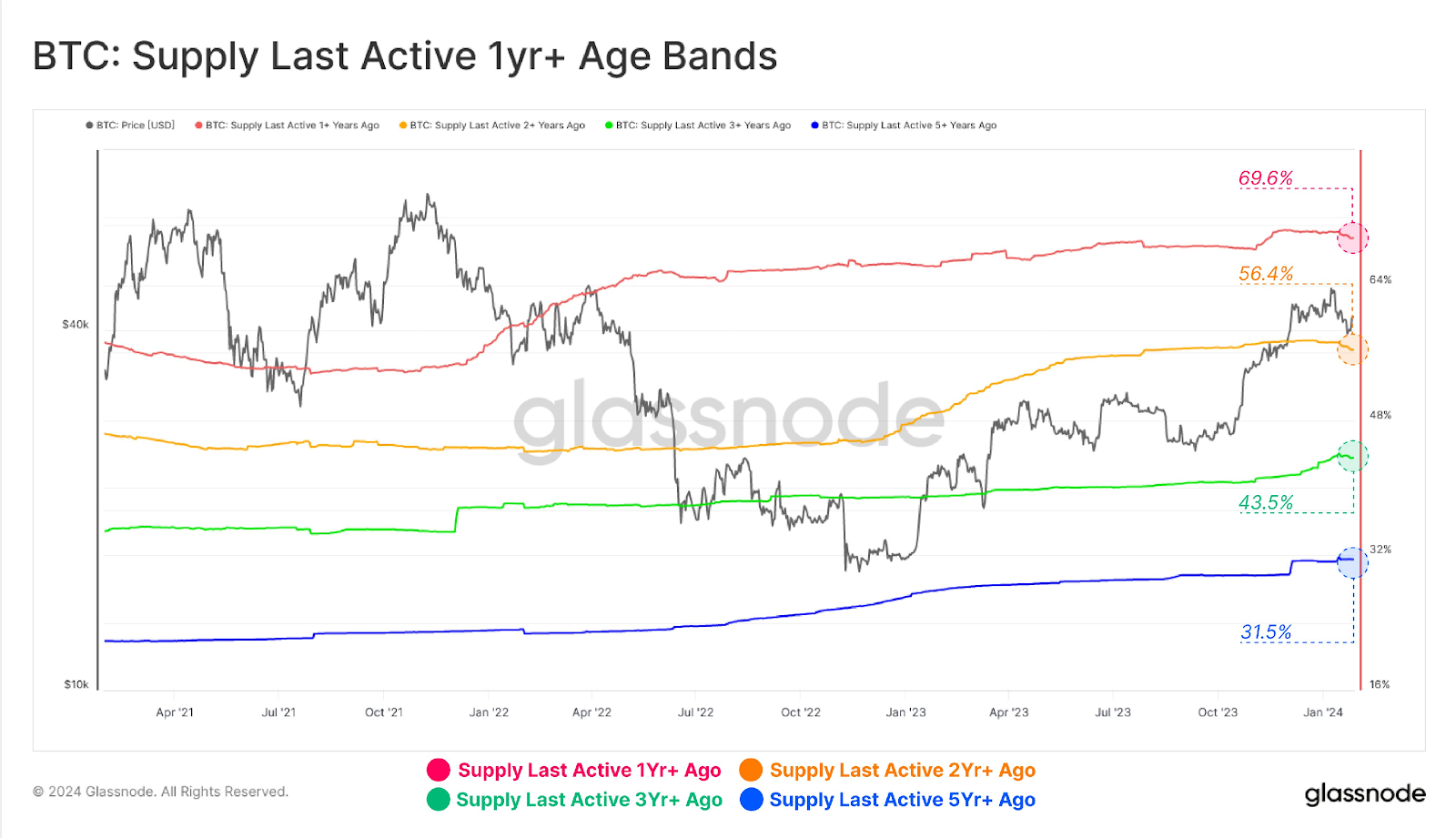

All that said, despite all the implied sell-offs and even the recent movements of some older coins, the majority of the Bitcoin supply has remained dormant, indicating that long-term holders are steadfast.

(Source: Glassnode’s The Week On-chain)

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.