Ethereum spot ETFs are reportedly set to launch on Tuesday, July 23, just two days before the Bitcoin conference, where Donald Trump is scheduled to deliver what is expected to be a landmark announcement. So, the next week is poised to be monumental across the board.

(Bloomberg senior ETF analyst on X)

SEC has given ‘preliminary approval’ to “at least three of eight” spot Ethereum ETF issuers to begin trading next Tuesday. Short-term market expectations in this regard are mixed:

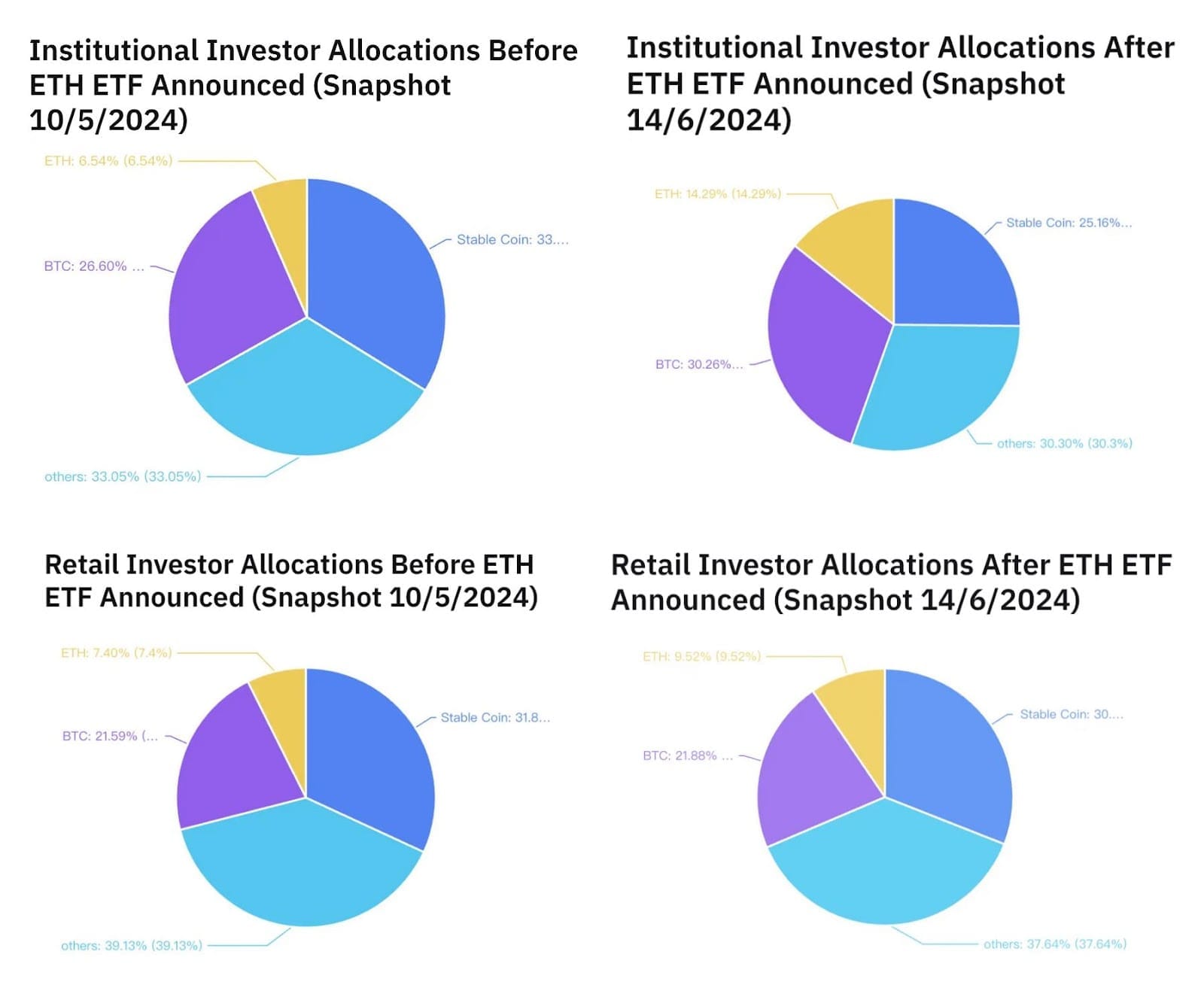

“For some, the ETH ETF launch during the market rebound is the ideal scenario; others are wary of selling pressure in the early days, similar to what happened with the launch of the Bitcoin ETF in January. It is noteworthy, however, that this time, institutions may be more bullish on Ether than retail ahead of the ETH ETF launch, as the ByBit report shows.”

— (Read more on these developments on Metatalks)*

(Source: Bybit Press)

Amidst this uncertainty, Ether hedging activity picks up in options markets as investors seek to hedge or protect existing market positions against potential price swings. This hedging activity has been more pronounced in short-term contracts, as shown by the recent increase in implied volatility for options contracts expiring on July 19 compared to those expiring on July 26.

Traders also expect Ether to outperform Bitcoin after the spot ETF launch. However, mindful of the “sell-the-fact” phenomenon after Bitcoin ETFs launched in January, they might be preparing for similar price volatility in ETH, as options data confirms.

Meanwhile, Ethereum staking activity reportedly nears an all-time high as the ETFs’ launch nears and staking rewards rise. As of writing time, more than 33 million Ethereum tokens had been staked, representing ~27.5% of the total ETH supply, according to Coinbase’s data. Ethereum staking has consistently grown, exceeding 30 million ETH in February and achieving a record high of over 33.4 million on July 12, as reported byon-chain data from Dune.

“It’s all about supply and demand,” writes Matt Hougan, Chief Investment Officer at @Bitwise. “The best way to model the potential impact of an ETP launch on a commodity’s price is to think about supply and demand. ETPs do not change the fundamentals of an underlying commodity like ETH, but they do bring new sources of demand.”

Overall, investors agree that Ethereum ETFs will attract about 20% to 30% of the capital flows in Bitcoin ETFs, which, however, might have a much greater impact on the price of $ETH.

Mr. Hougan, in his article, outlines three main reasons why Ethereum ETP flows could have an even bigger impact on $ETH than they did on Bitcoin (while mentioning many more tailwinds in X post):

- ETH’s lower short-term inflation rate

- Unlike BTC miners, ETH stakers don’t need to sell

- ~27.5% of ETH supply is staked, therefore off the market

“Everyone wants to know what will happen to the price of ETH after the spot ETPs launch. Here’s my prediction: ETP inflows will push prices to all-time highs, above $5,000.” (Matt Hougan, Bitwise Investments)

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.