As the SEC's final approval of Ethereum spot ETFs is delayed, @Bloomberg lead analysts remain optimistic about an imminent near-future launch, while other industry participants are more skeptical. Meanwhile, on-chain data has shown a surge in Ethereum staking activity, supporting rather bullish expectations from the ETH ETFs launch: with significant amounts of $ETH being locked up, the anticipated ETFs could significantly impact Ethereum’s valuation, highlighting its unique position as a tech-oriented investment compared to Bitcoin’s role as a monetary asset.

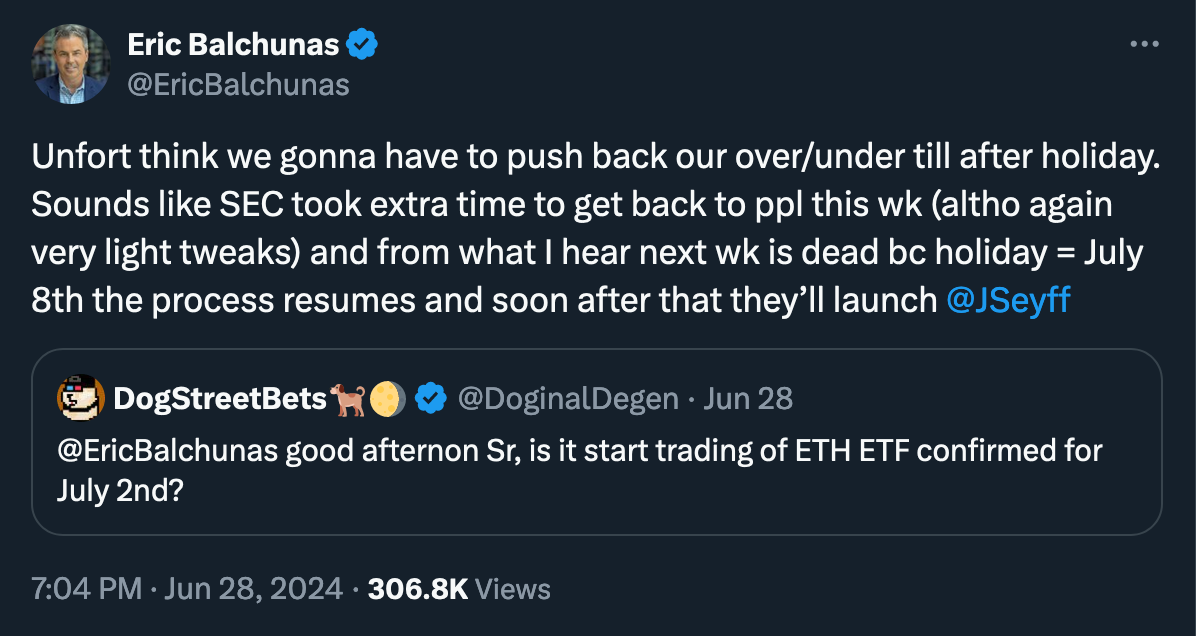

(Bloomberg Senior ETF Analyst on X)

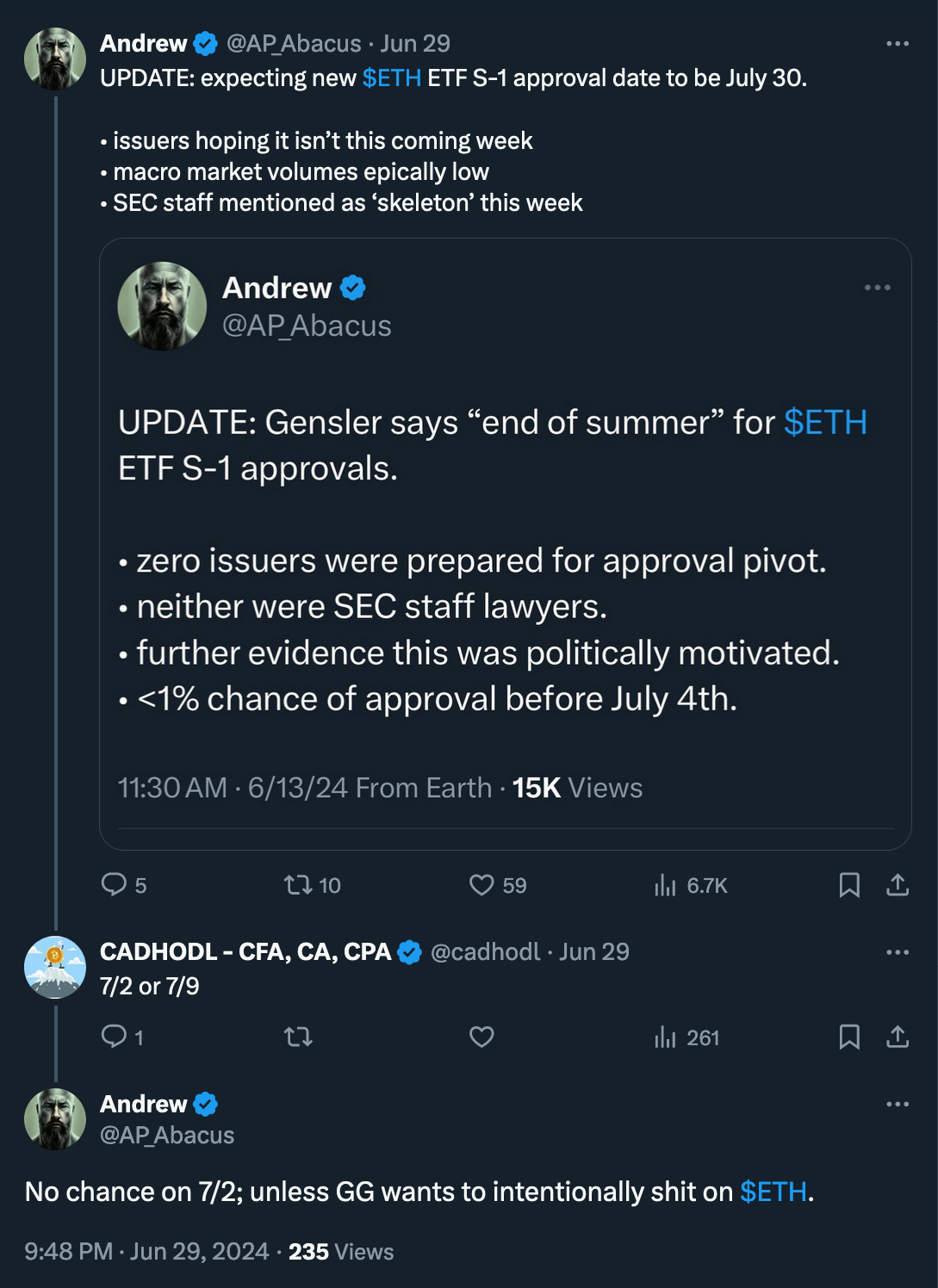

There are two competing perspectives now on the actual arrival of the Ethereum ETFs. Bloomberg analysts consistently predict it will happen sooner rather than later, while other industry participants mostly disagree.

(Source)

Regardless, due to the holiday, it will not be launched this week, providing the market additional time to find a bottom and potentially recover before the ETF's launch.

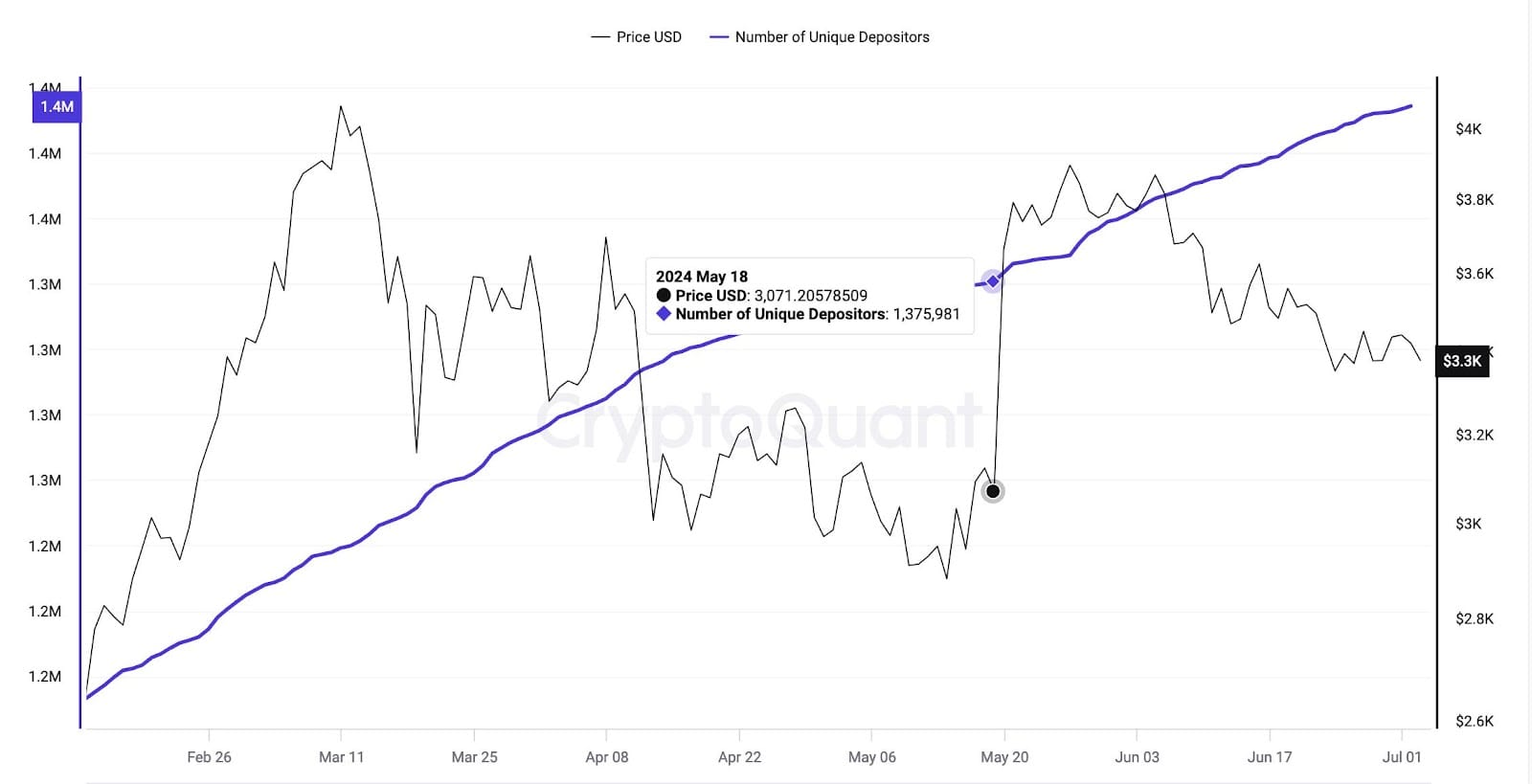

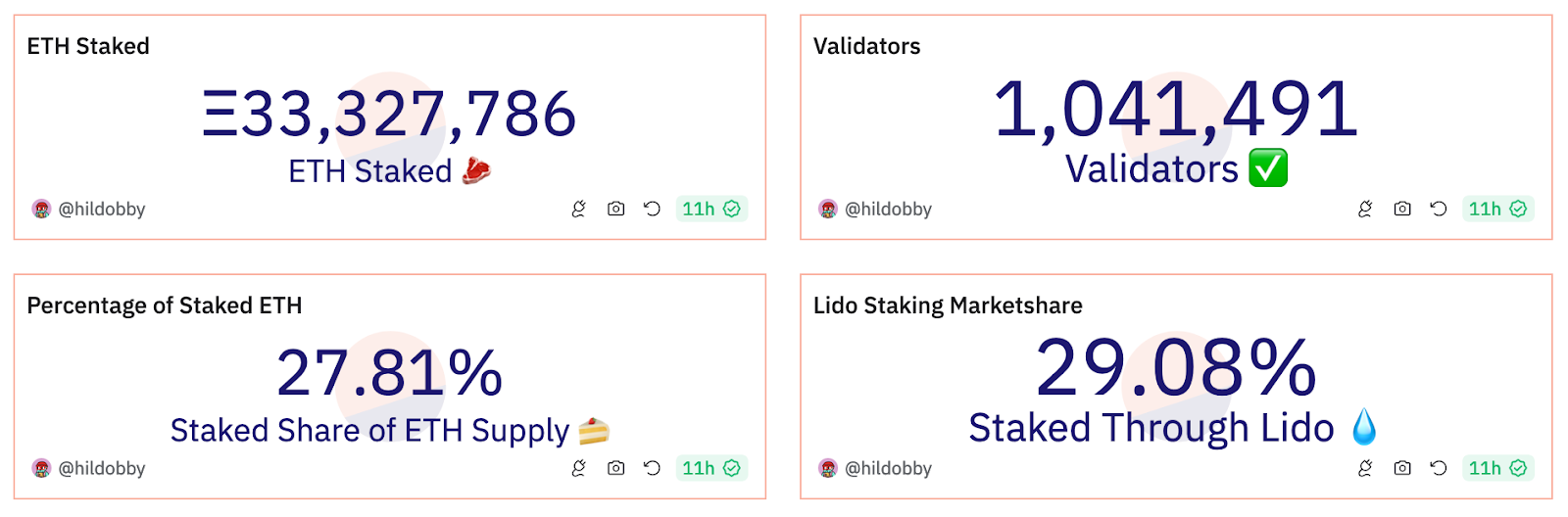

Meanwhile, on-chain data reveals significant growth in Ethereum staking over the past month, with nearly 60,000 unique depositors joining the Ethereum network since May 20, suggesting a potentially bullish outlook for the #Ethereum ecosystem.

(Source: CryptoQuant)

Interestingly, the beginning of this significant rise coincided with @Bloomberg analysts James Seyffart and Eric Balchunas raising their approval odds for the Spot Ethereum ETFs to 75%. This highlights the positive impact of Spot Ethereum ETFs on ETH, even though they have not yet begun trading.

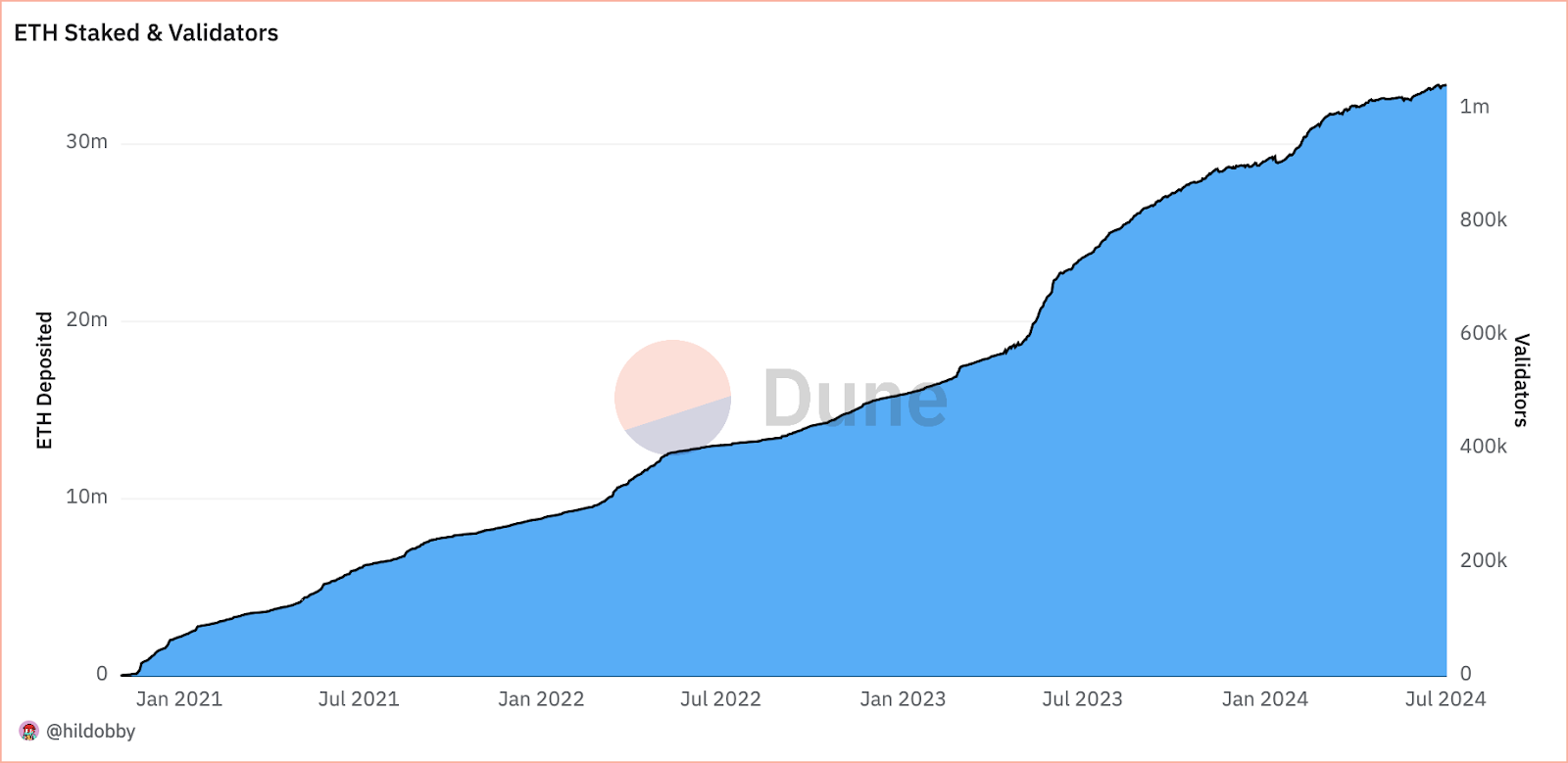

(Source: Dune Analytics)

These funds have contributed to a 4% increase in staking participation in just over a month. Increased staking participation benefits $ETH by enhancing network decentralization. Furthermore, the rise in new depositors will further reduce ETH's already declining circulating supply, as these participants must lock up a substantial amount of ETH to become validators on the network.

(Source: Dune Analytics)

Over 33 million $ETH, more than 27% of Ethereum's total supply, is currently locked up, according to Dune Analytics. This reduction in circulating supply can help mitigate potential selling pressure on ETH. As demand for Ethereum increases, the effect of these locked tokens becomes more pronounced, influencing ETH's price based on supply and demand dynamics.

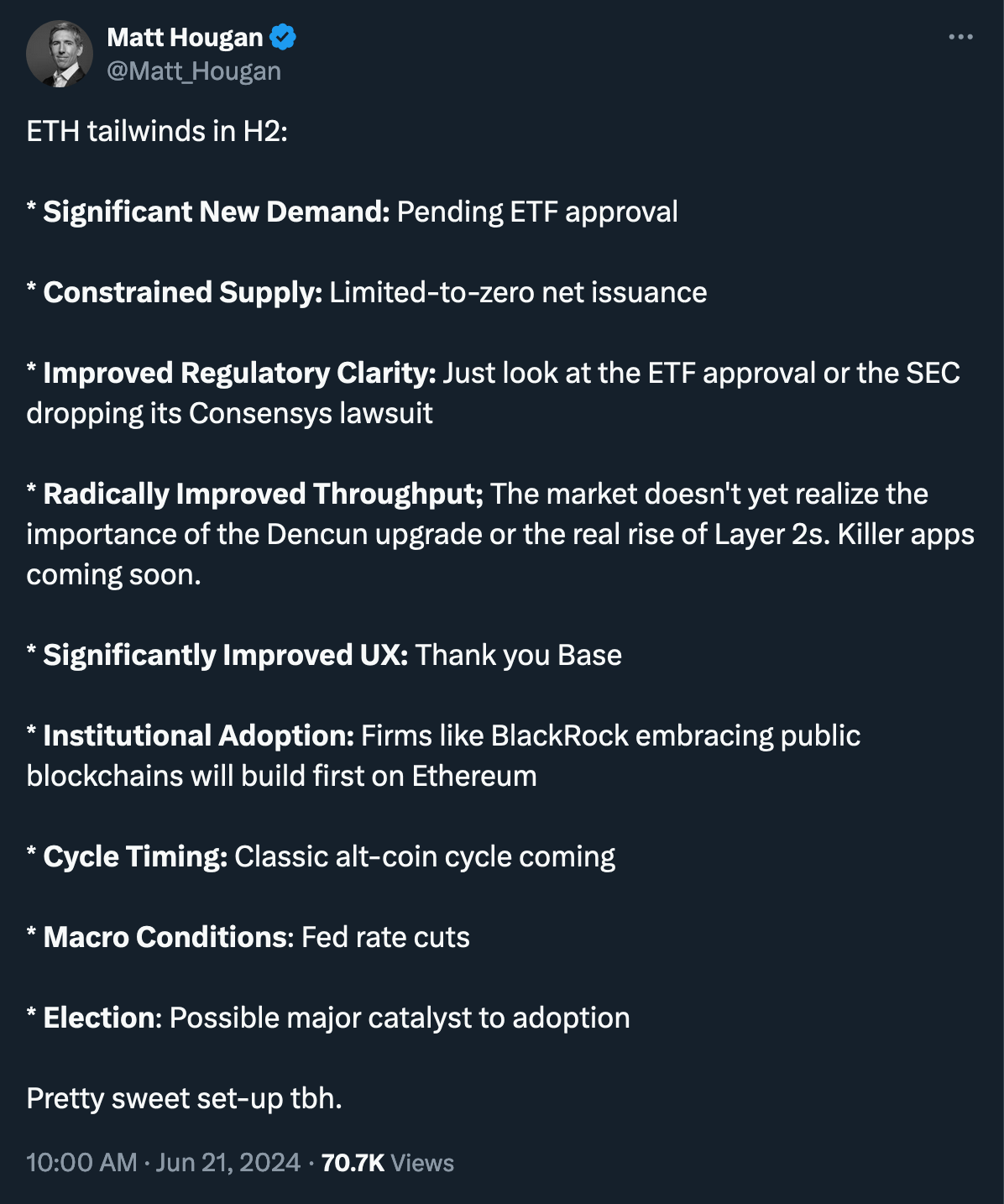

Bitwise's Chief Investment Officer Matt Hougan believes the success of Ethereum ETPs could potentially exceed the market's expectations, attracting $15 billion in their first 18 months of trading.

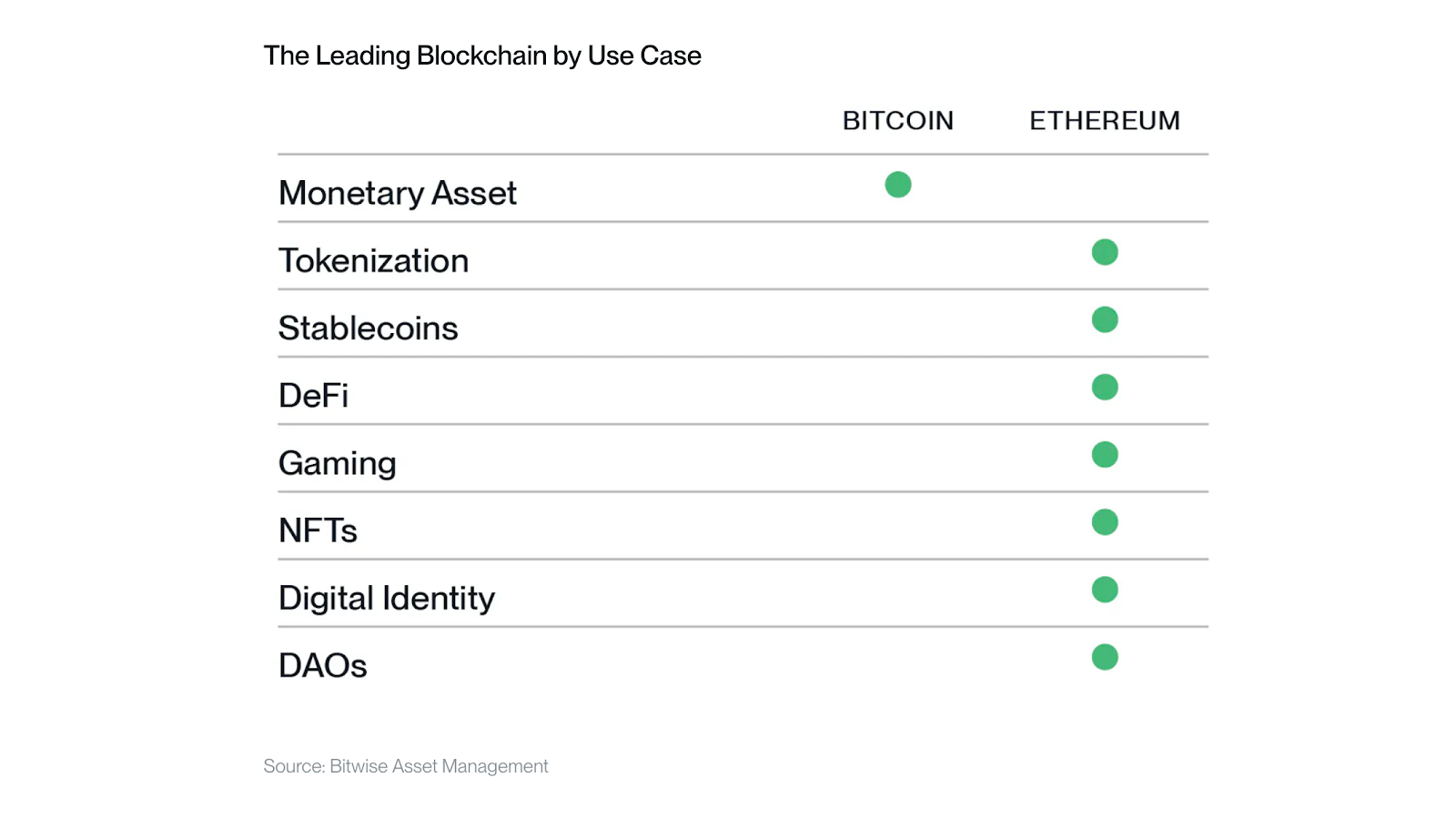

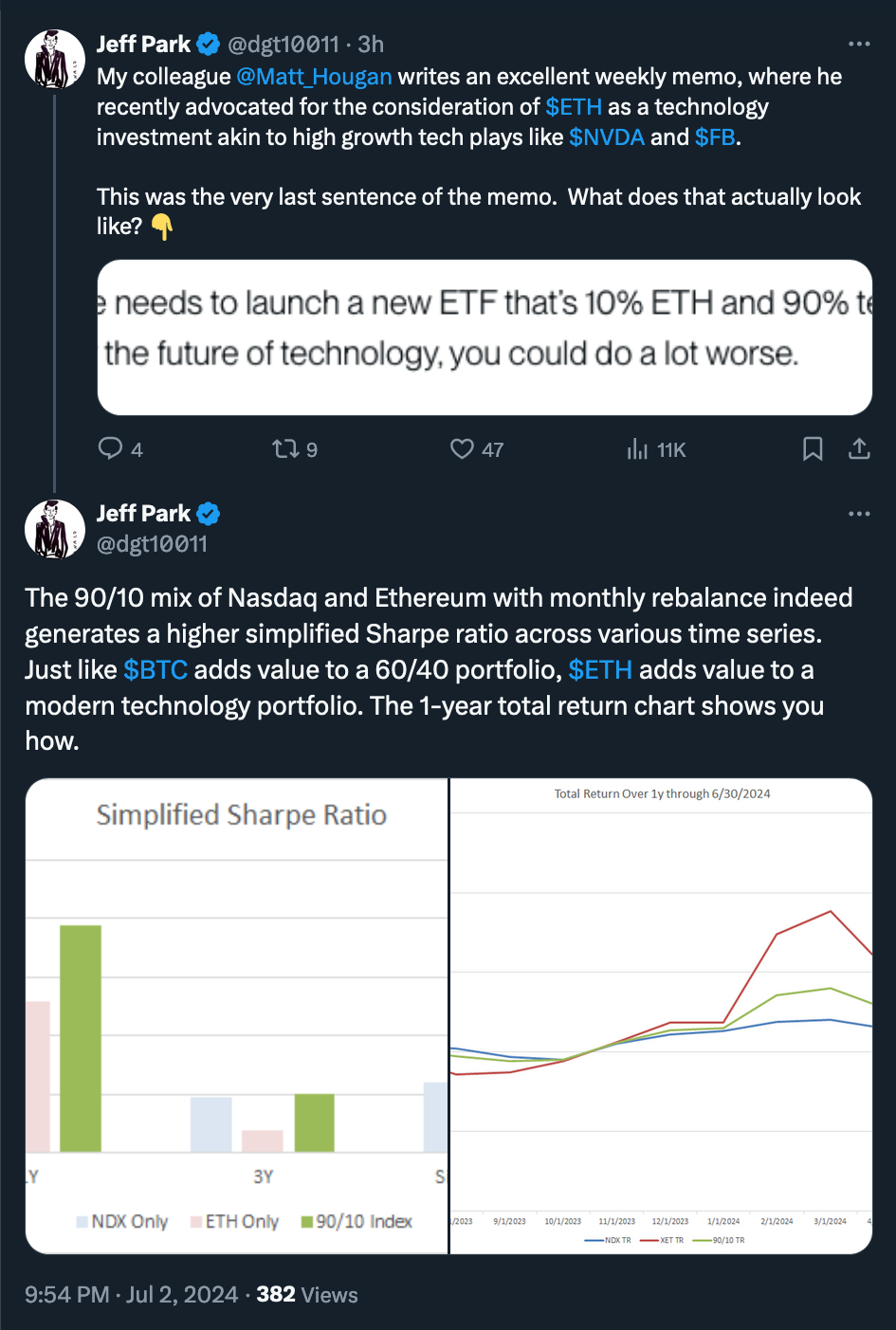

In a recent post, Matt Hougan discusses the differences between Ethereum and Bitcoin as assets of distinct classes. He anticipates that Ethereum ETPs will attract $15 billion due to Ethereum's role as a technology platform supporting various applications such as tokenization and decentralized finance. This positioning aligns Ethereum more closely with tech stocks rather than monetary assets like Bitcoin or gold.

(Source: Bitwise)

Thus, investors familiar with technology stocks may favor Ethereum as a tech investment over Bitcoin as a monetary asset. This preference would necessitate a better public understanding of Ethereum's features and broader adoption of its applications.

"This is where my sneaking suspicion comes in that Ethereum ETPs could surprise to the upside. After all, investors love technology stocks. Nearly all investors have exposure to high-growth tech plays like Nvidia and Meta, and relatively few have exposure to monetary assets like gold.It’s pretty easy for me to imagine investors selling a small amount of their tech exposure and adding ETH. I’d argue it’s easier than imagining investors carving out an entirely separate portfolio sleeve for a new monetary asset." (Matt Hougan, Bitwise Investments)

(Thread)

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.