Ethereum’s Dencun upgrade, scheduled for Wednesday, March 13, is one of the most anticipated hard forks since the Merge. Why does it matter, and what should we expect from it?

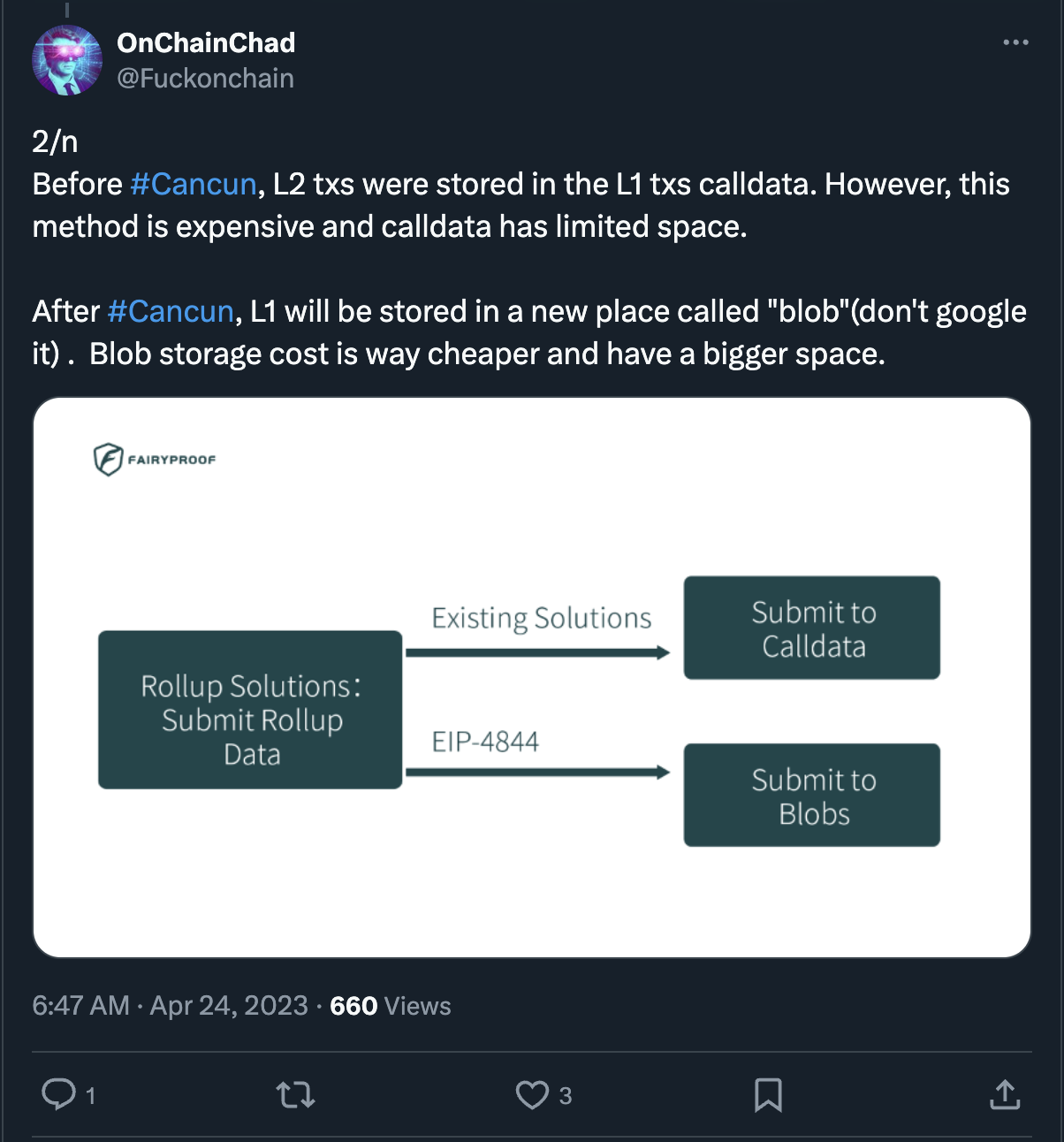

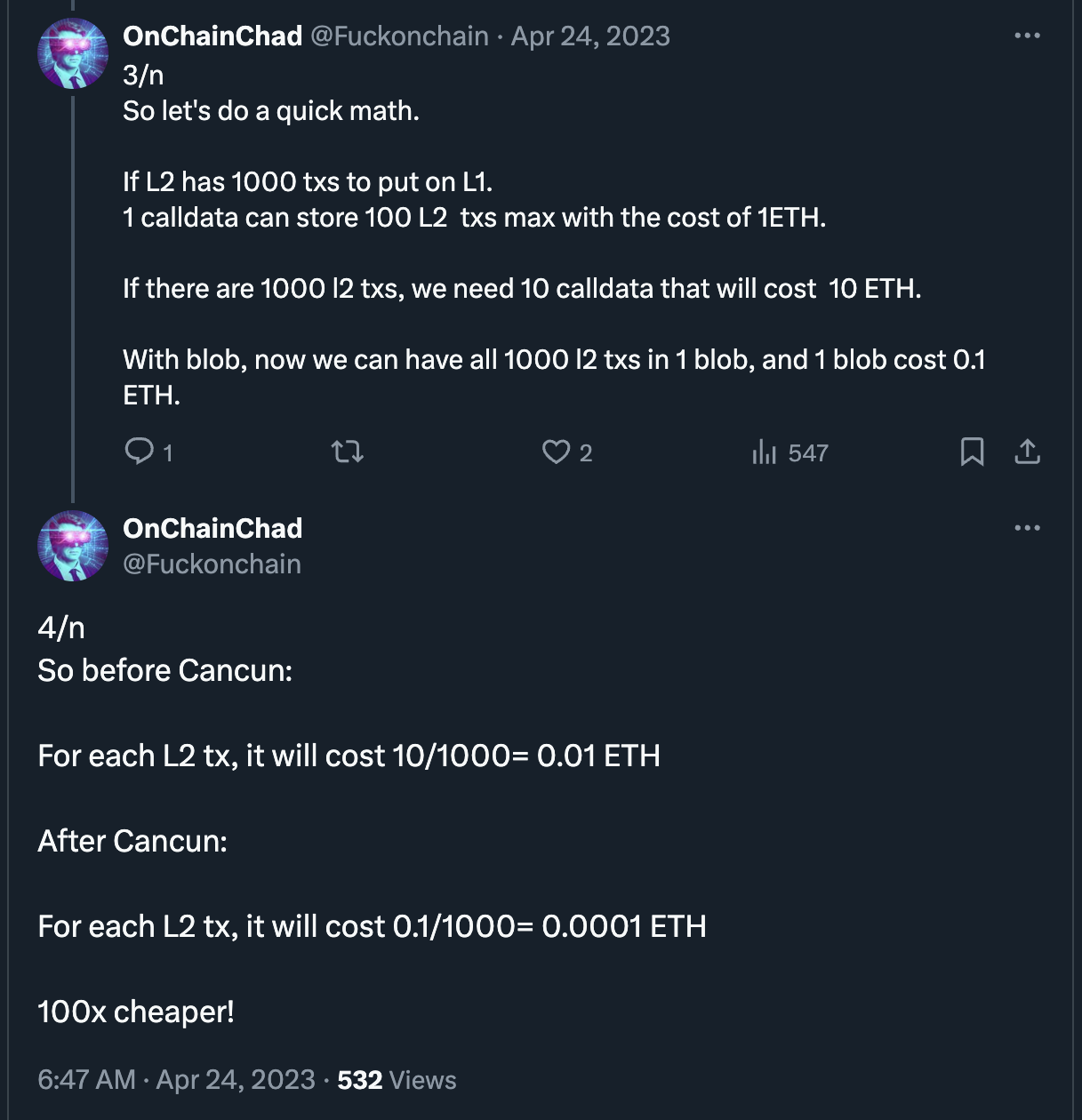

Dencun will be a milestone for layer-2 (L2) scaling solutions, as it aims to modify how data is stored on #Ethereum. This change will make data storage more accessible and cost-effective, particularly for recording layer-2 transactions. Right now, L2 submission fees constitute about 10% of all L1 fees, which are expected to decline substantially after the Dencun goes live.

(Thread)

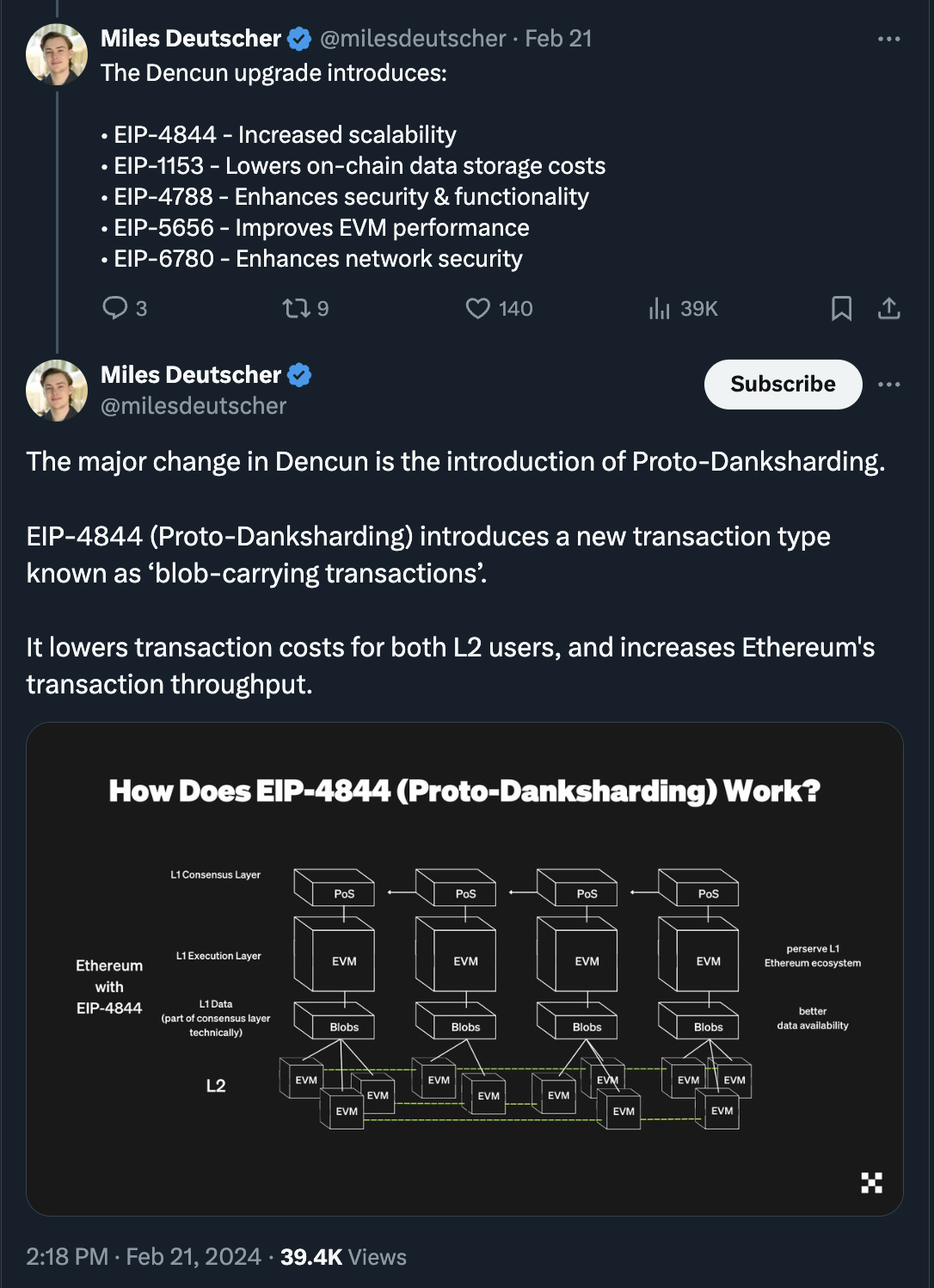

The Dencun hard fork encompasses nine different Ethereum Improvement Proposals (EIPs) for both the execution and consensus layers. The upgrade promises to significantly boost the network's scalability, efficiency, and security.

(Thread)

A key feature of the Dencun upgrade is the introduction of ephemeral data blobs through EIP-4844, also known as proto-danksharding. This feature aims to lower L2 transaction fees by enhancing data availability—a crucial move toward establishing Ethereum as a scalable settlement layer.

"This marks a significant shift in the focus of Ethereum, going from servicing users directly to servicing other blockchains directly,” said Fidelity Digital Assets Research Analyst Max Wadington.

(Thread)

However, any expectations of major changes in Ethereum's price or user base size on Wednesday should be moderated. Historically, similar to the halving, upgrades like this don't typically result in immediate price movements or user base swings.

(Thread)

Unlike Merge, Dencun hasn’t introduced any 'number-go-up' technology such as the 'triple halving' or a new yield-generating mechanism for ETH as a currency. Furthermore, this upgrade will further incentivize layer 2 solutions, diverting transactions from the ETH main chain where more fees naturally take place.

“In the short term, users who wish to benefit from this fee change must sacrifice some decentralization and security by transacting on L2s instead of Ethereum. This will certainly spur more users to bridge assets elsewhere. However, we strongly believe that transacting on Ethereum for application-specific purposes will still be considered the best option (especially for high-value transactions) in the medium term as L2 platforms continue to mature.” (Fidelity report)

However, in a research report published by JPMorgan in December, analysts predicted that the upgrade could catalyze ETH to outperform BTC in 2024.

Some Ethereum fans celebrate the Dencun's launch by joining livestream watch parties with the EthStaker developer community or Nethermind, a leading Ethereum infrastructure team.

(Source)

Indeed, Dencun represents a long-term positive development for Ethereum in many ways. However, investors are advised to treat this like any other day, and if the price reacts favorably, it will be a welcome surprise.

Lastly, as an important caution, users do not need to take any specific actions for this upgrade, so be wary of blogs, emails, or social posts that suggest otherwise.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.