A firestorm of debate has erupted in crypto Twitter over the news about a new regulatory framework that the European Parliament had passed, introducing stringent restrictions for the cryptocurrency industry. Headlines and articles varied, leading to the spread of misleading claims that the EU had "banned DeFi and crypto wallets," sparking a fair amount of panic and bewilderment with questions like "How are they even going to enforce this?" But what exactly did the EU ban, according to the official document (PDF), rather than crypto media headlines?

(Thread)

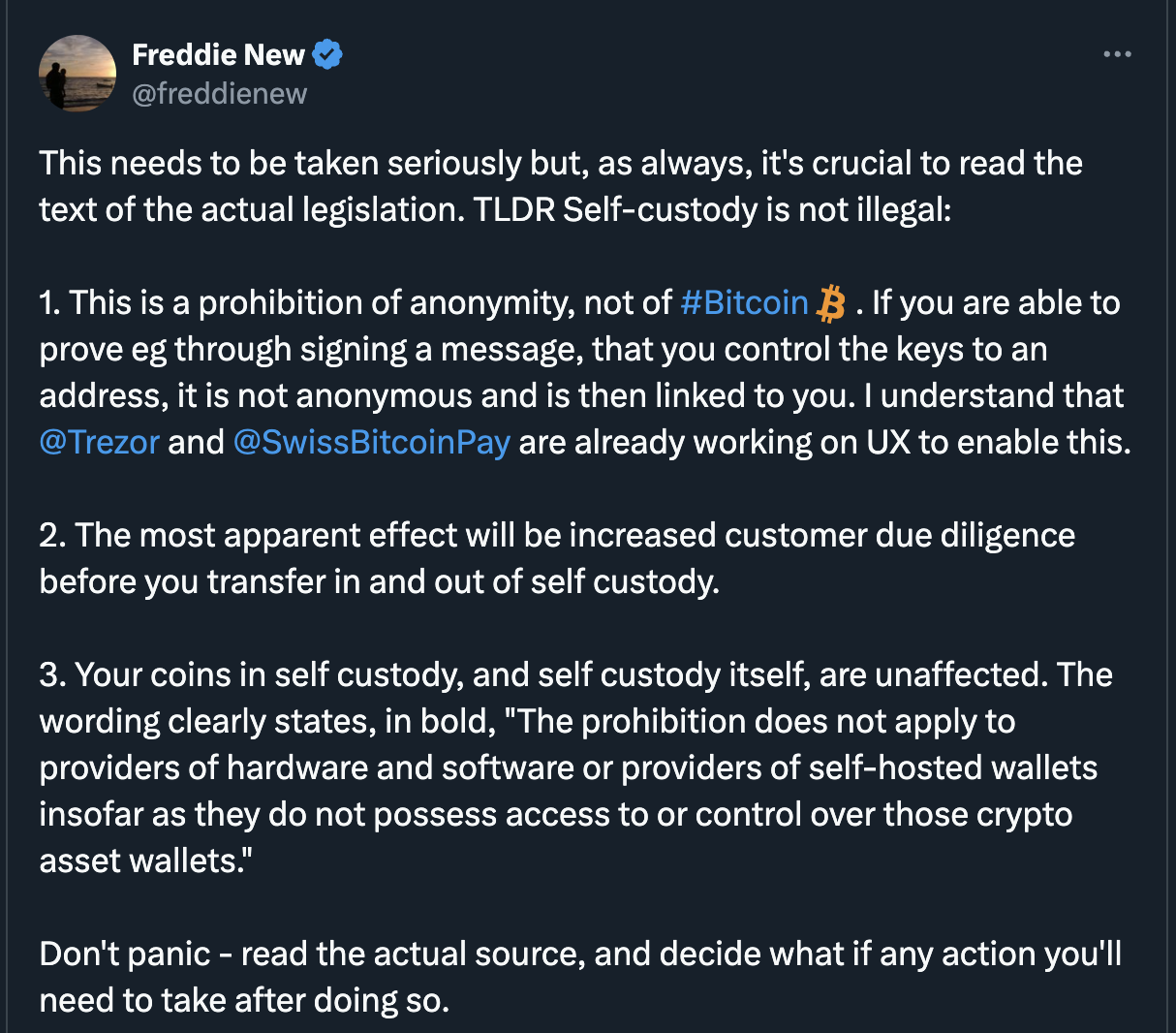

Misreports triggered panic within the crypto community, stemming from misconceptions about the EU banning anonymous crypto wallets and self-custodial payments. These reports seemingly misinterpreted comments from Patrick Breyer, a European Parliament member, about the economic and monetary policy committee's endorsement of the Anti Money Laundering Regulation (AMLR) and its final draft.

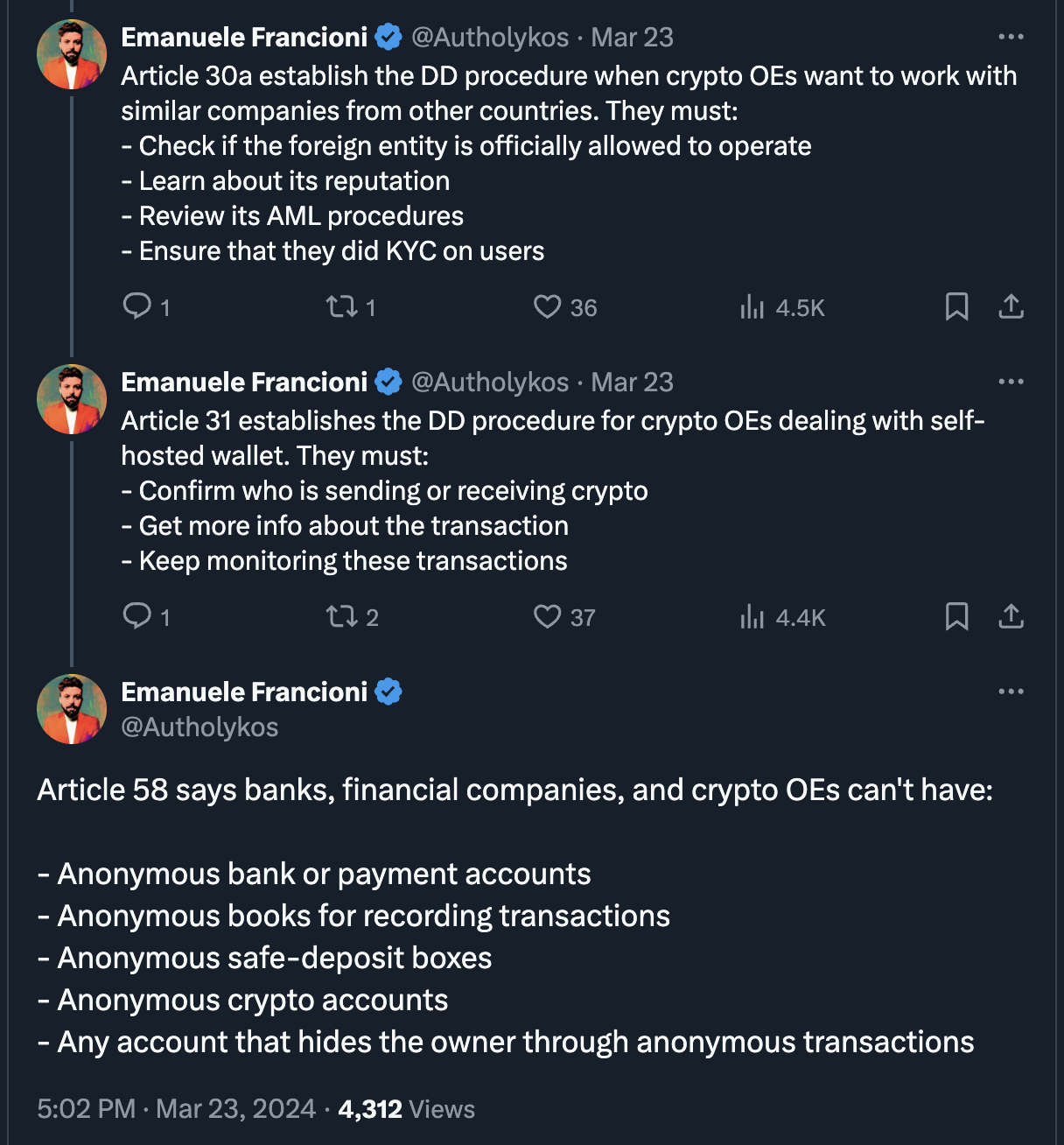

First of all, the 329-page AMLR proposal (PDF) is not solely focused on crypto regulation but targets a much wider range of various digital and non-digital sectors vulnerable to financial abuse. The parts relevant to crypto are point (93) and articles 30a, 31, and 58.

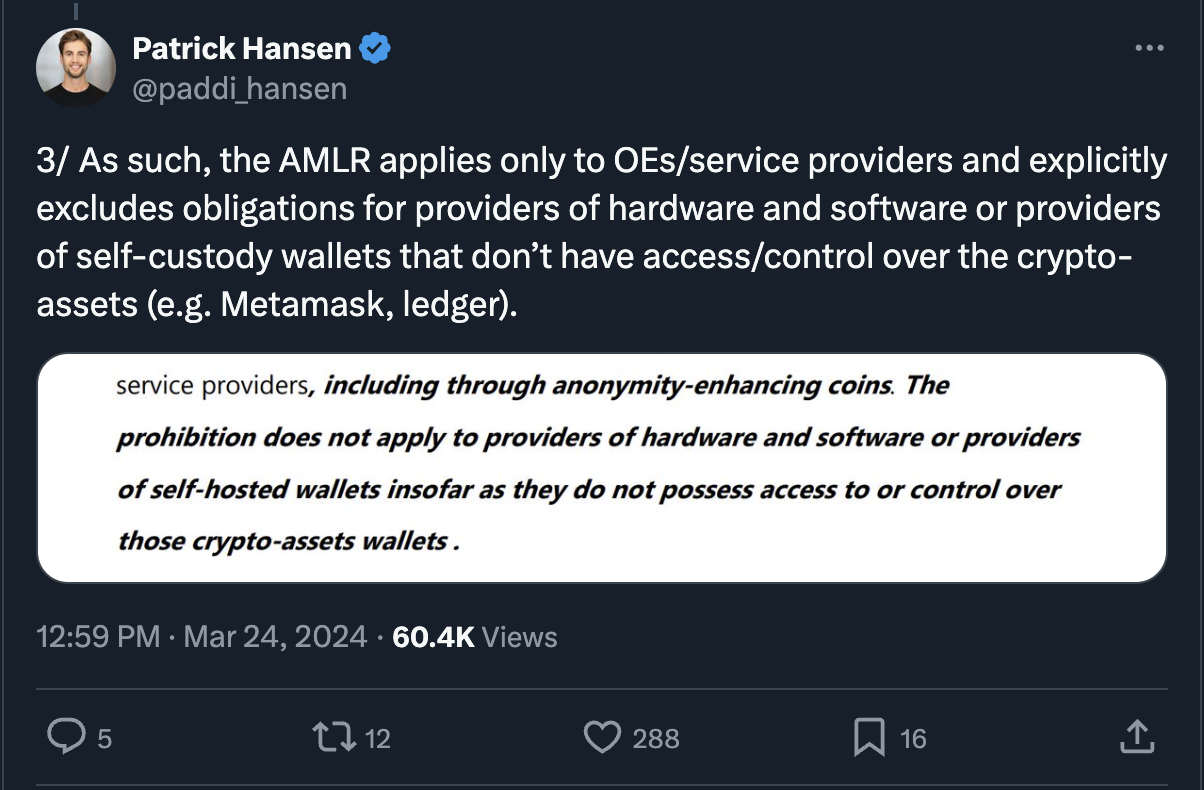

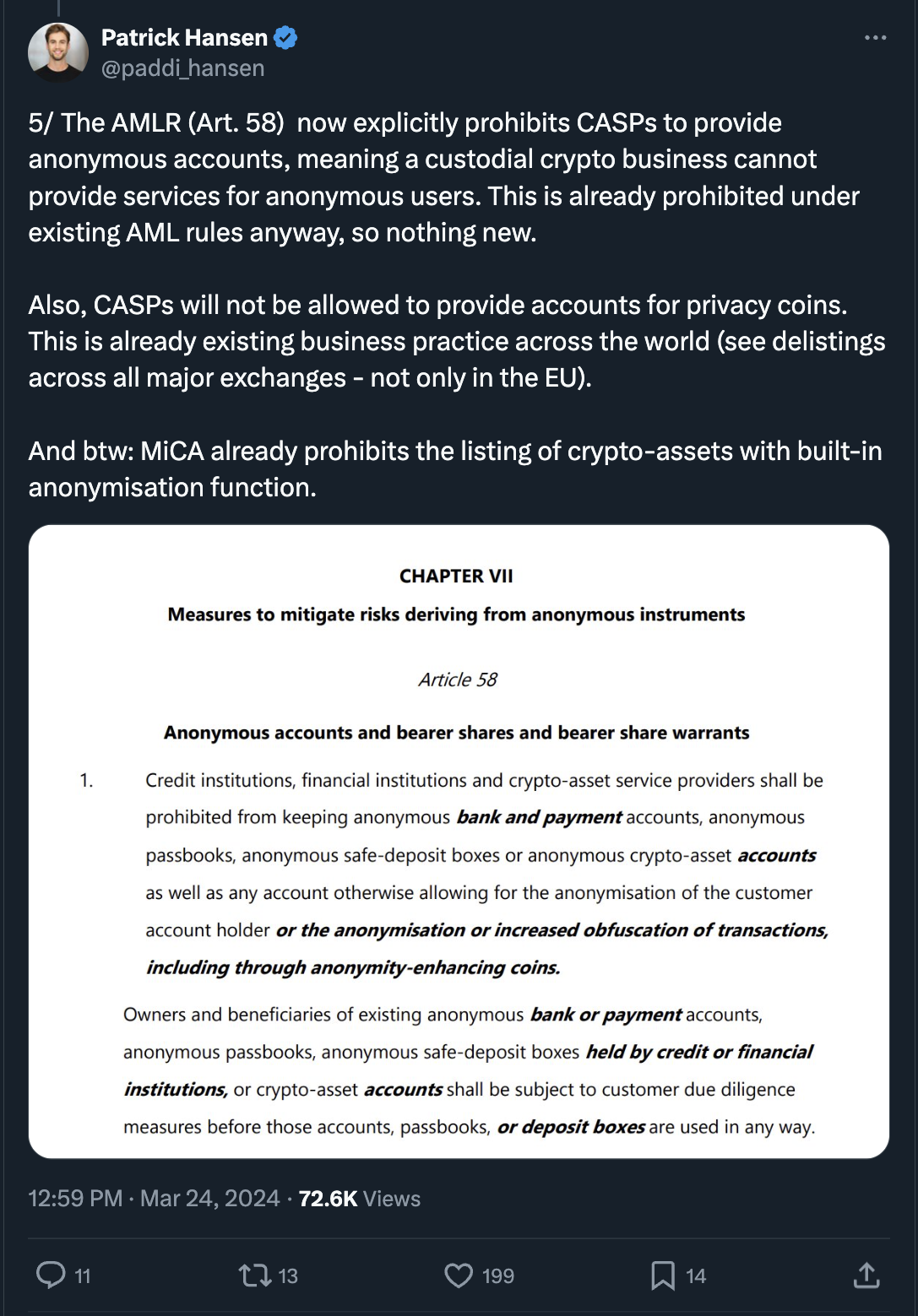

The document consistently refers to "obliged entities" (OE), which are regulated financial institutions. These include all financial institutions, extending to the so-called “CASPs” (crypto-asset service providers) and other entities like gambling services, which could be prone to AML and terrorist financing risks.

(Thread)

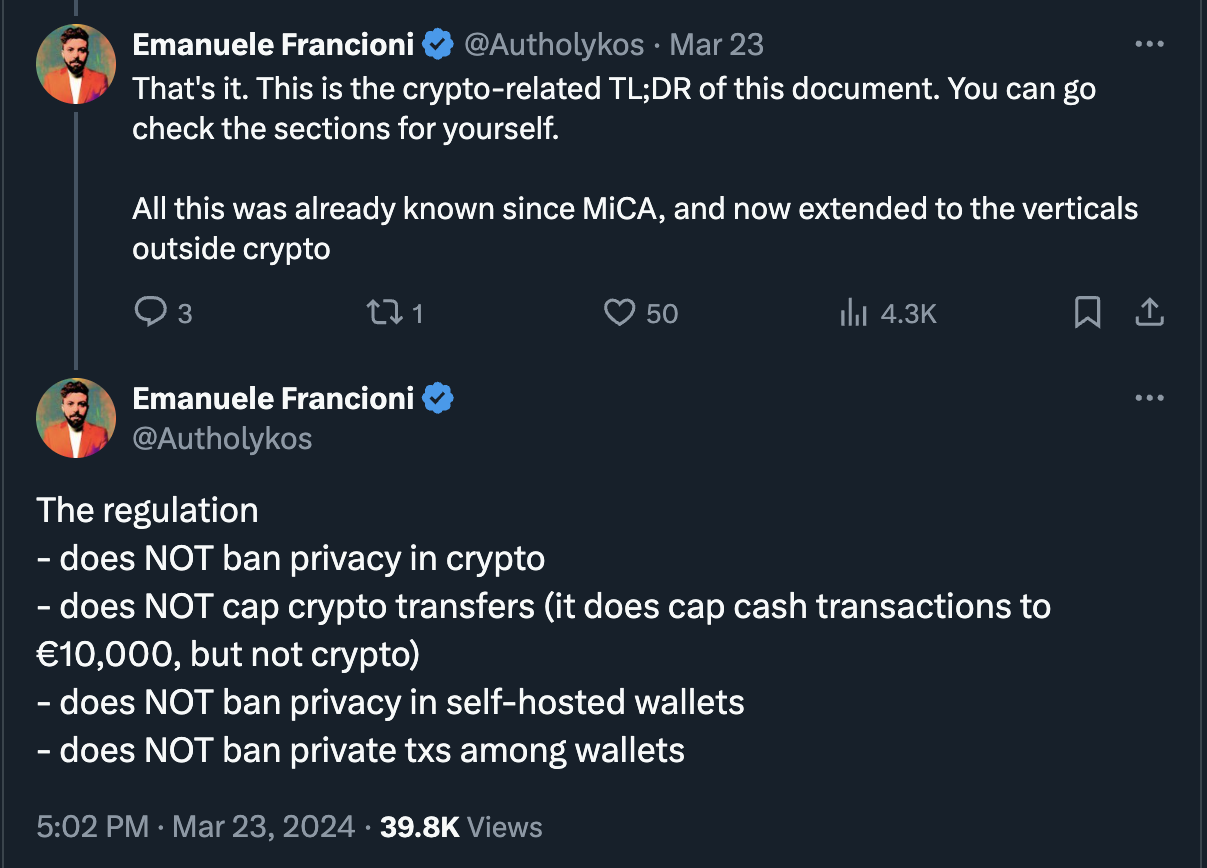

It is worth noting that much of the ‘new’ regulation mirrors existing transparency requirements for banks, exchanges, and companies without imposing bans on hardware and software providers or self-custody wallets that do not control user assets, including wallets such as Ledger, Trezor, and MetaMask.

(Thread)

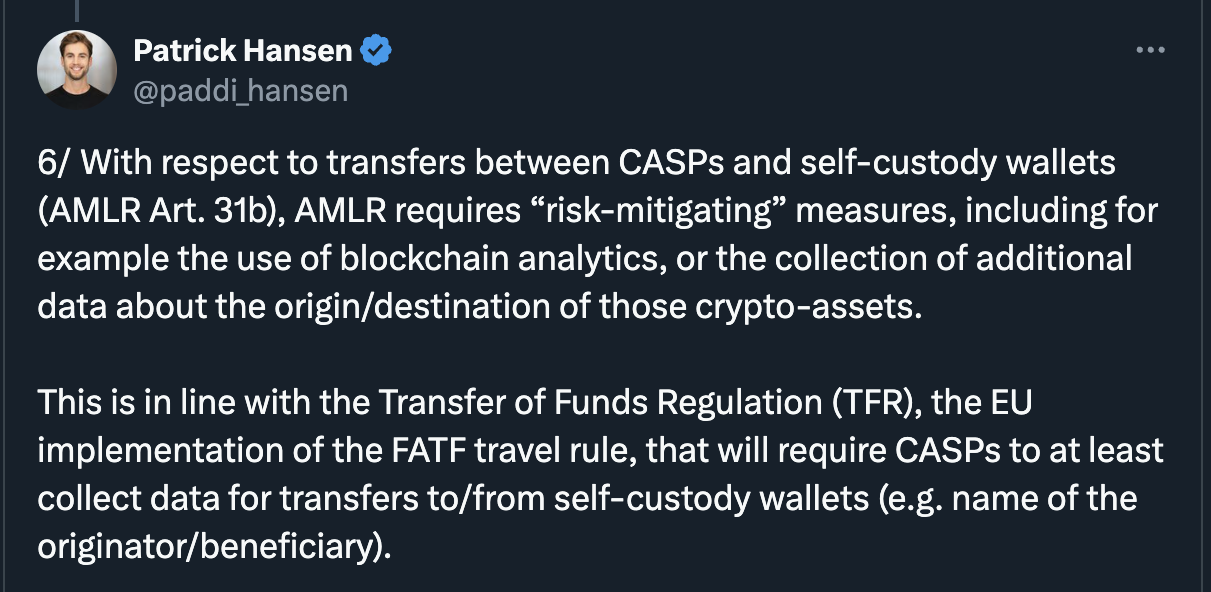

There are no restrictions on using self-custodial wallets for transactions in the EU. However, if customers opt to purchase goods or services through a CASP, such as BitPay, the provider must verify the user's identity and enforce additional KYC/AML protocols for transactions (whether single or cumulative) valued over €1,000.

(Thread)

Contrary to claims, the legislation does not mention a €3,000 limit for anonymous crypto transactions via self-custody wallets. Instead, it introduces a €10,000 threshold for large cash (not crypto) payments.

(Thread)

Lastly, the legislation will not take effect for three years, although earlier implementation is possible. The approved AMLR text needs to pass final, formal approval by the European Parliament—expected by the end of April—and the Council of the European Union. It would then be enacted three years after publication, around summer 2027.

(Thread)

It's worth noting that crypto is a small part of the framework, and much could change over time. However, it's crucial to address such legislation promptly and accurately, as overstating bans seems rather counterproductive.