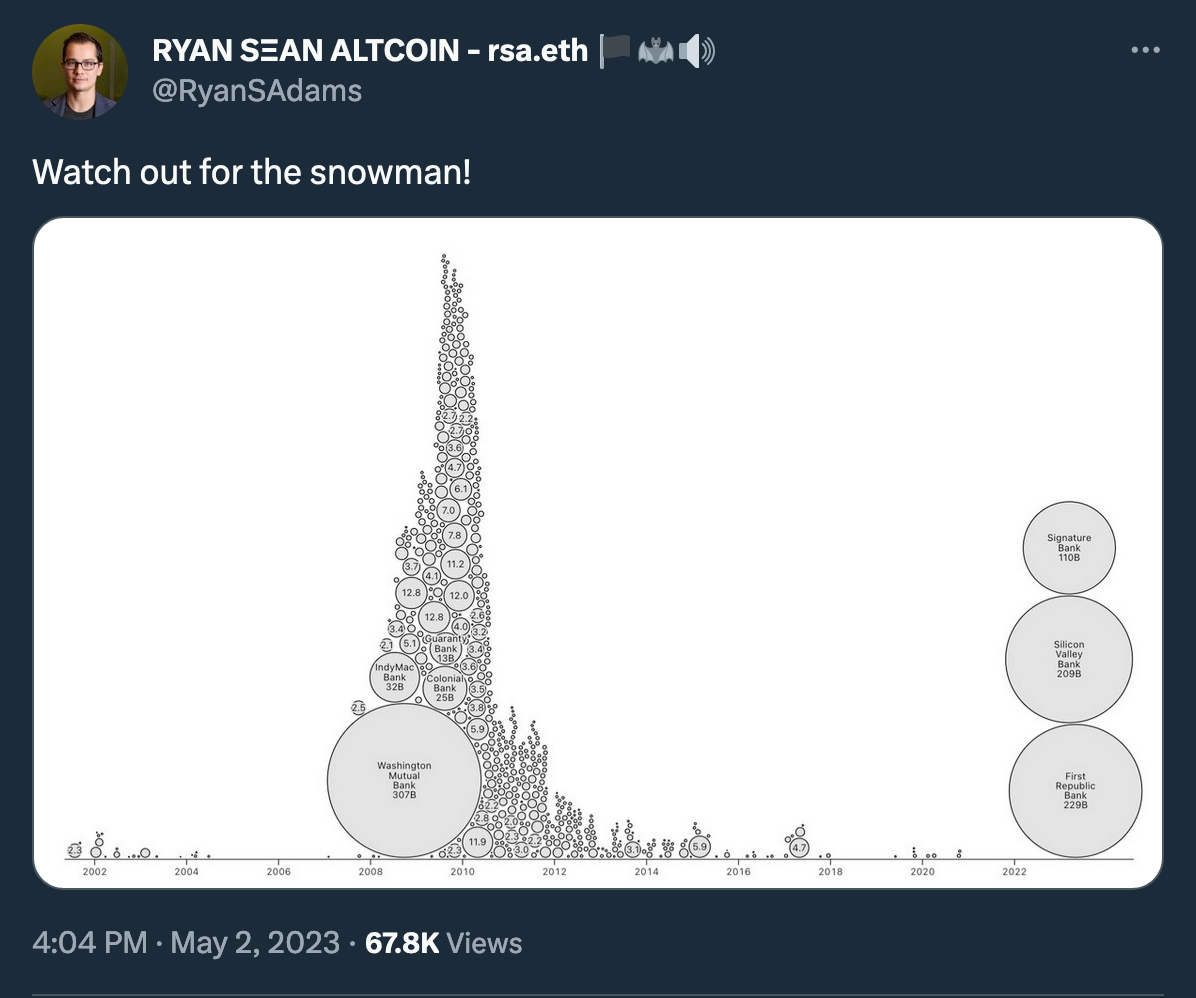

After three major banks went bankrupt in March, the second biggest bank failure in US history just happened: First Republic Bank was seized by regulators and sold to JPMorgan Chase. Now three of the top five bank failures in US history have occurred in the last four months.

The Kobeissi Letter analysts have pointed out that JP Morgan received a significant government subsidy, despite being ineligible to acquire FRC based on current regulations. JP Morgan was already the largest bank in the US before the FRC deal, holding over 16% of the country's deposits.

You can’t make this up:

— The Kobeissi Letter (@KobeissiLetter) May 1, 2023

JP Morgan just said it’s acquisition of First Republic will generate a one-time gain of $2.6 billion.

They also expect over $500 million in profit per year from the acquisition.

On top of this, the FDIC is covering $13 billion in losses and providing…

JPM stocks responded to the lucrative acquisition by rising, while those of smaller regional banks continued to plunge.

US regional banks' stocks following collapse of First Republic Bank $FRC.

— Watcher.Guru (@WatcherGuru) May 2, 2023

• PacWest: -30%

• Western Alliance: -25%

• Metropolitan Bank: -21%

• HomeStreet: -15%

• Zions Bank: -10%

• KeyCorp: -7%

• HarborOne: -6%

• Citizens Financial: -5%

For many, it feels like yet another step towards financial monopoly, with US regulators “nationalizing” the country's banking system.

With more banks experiencing financial difficulties similar to First Republic Bank, those not considered "systemically important" may be acquired by larger banking institutions, leading to further industry monopolization.

THE TOO-BIG-TO-FAIL BANKS get too-bigger-er-to-fail.

— Caitlin Long 🔑⚡️🟠 (@CaitlinLong_) May 1, 2023

JPM got govt indemnities to buy FRC & its stock price is up in the pre-mkt.

Yet again, watch what the federal bank regulators actually do, not what they say. They really really ❤️ their #TBTF banks, despite saying otherwise

Arthur Hayes expects that more banks will likely fail, but the "Too Big To Fail" (TBTF) banks will benefit due to their government lien on deposits, effectively nationalizing them and making them immune to failure, regardless of their actions. Hayes predicts (thread) that in the current market environment and with rapidly increasing interest rates, the eight TBTF banks will be required to absorb any other failing banks.

8/

— Arthur Hayes (@CryptoHayes) May 1, 2023

Due to the US debt ceiling debacle, no banks can get "bailed out" by the govt. This is the perfect point of political paralysis to capitalise on another probably several non-TBTF banks getting deaded by the FDIC.

Bob Michele, the Chief Investment Officer at J.P. Morgan Asset Management, also cautioned in a recent Bloomberg interview that the banking industry crisis is not yet resolved. More victims could emerge, particularly regional banks that do not receive government aid.

And the contagion of the banking sector has the potential to continue to spread to other countries.

Meanwhile, U.S. President Joe Biden reassured the public about the stability of the American banking system (but cautioned about the possibility of a national debt default).

“These actions are going to make sure that the banking system is safe and sound,” Biden stated.

On the other hand, all of that seems long-term "good for Bitcoin," which doesn't need even a marketing team as governments, central banks, banks, and regulators have been unintentionally promoting Bitcoin for free all these years. And the collapse of First Republic Bank and its takeover by JP Morgan, supported by the government, reinforces the case for Bitcoin as a decentralized and state-independent monetary system.

Imagine searching for a safer bank instead of just buying #Bitcoin.

— Samson Mow (@Excellion) May 2, 2023

We are witnessing the emergence of digital self-custody as the new norm.

— Michaël van de Poppe (@CryptoMichNL) April 30, 2023

With the collapse of Silicon Valley Bank, and recently First Rpueblic Bank, #Bitcoin is making self-custody easier and more accessible than ever.

I'd rather want to have my money in #Bitcoin than a bank.

So repeat after Arthur Heyes: "I will not be exit liquidity for current financial elites!"