Polymarket has experienced substantial and rapid growth across all measurable metrics in the first half of 2024, establishing itself as the clear leader in the prediction market sector. While crypto might be in a bear trend, prediction markets certainly aren’t.

(Thread)

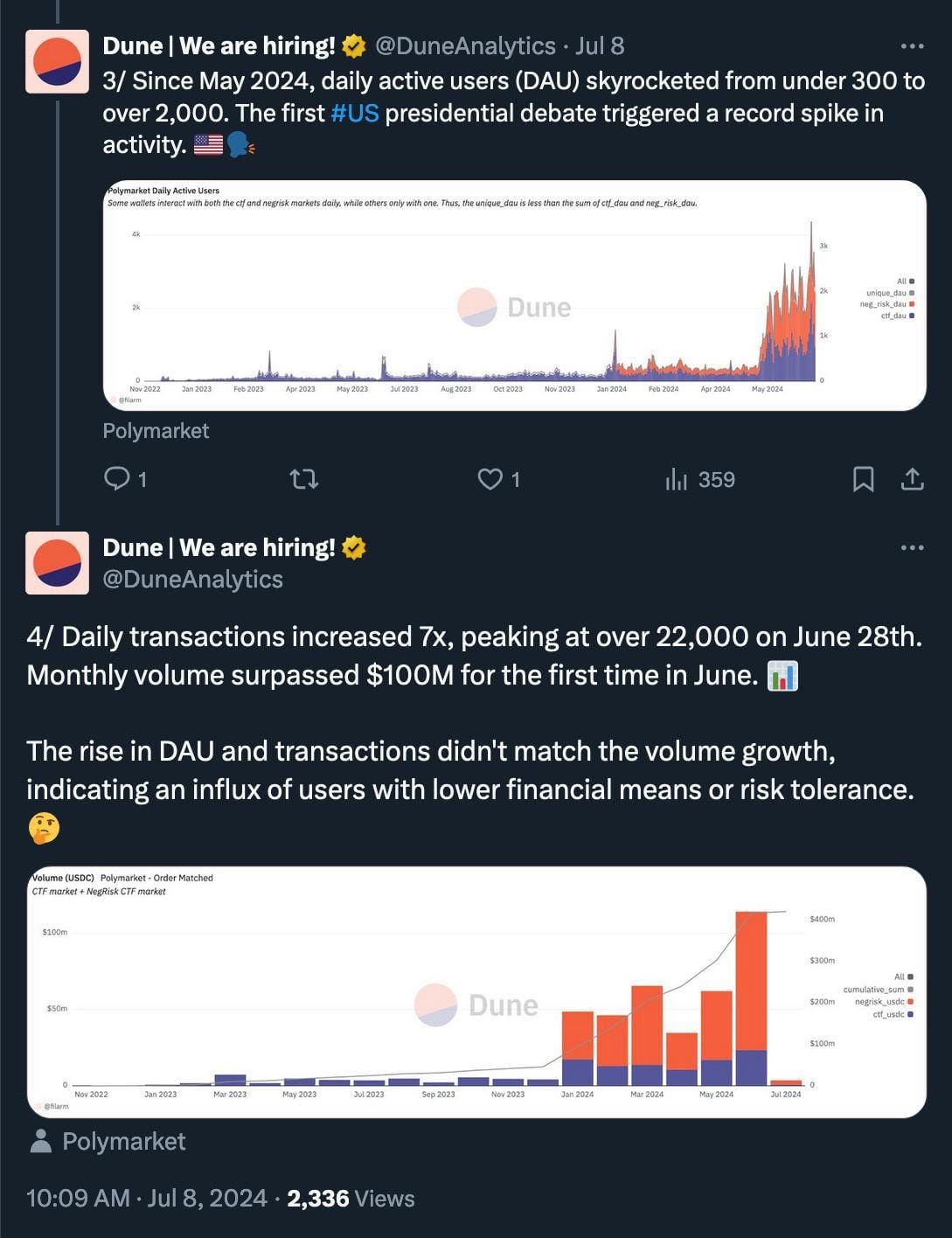

One year ago, in July 2023, the platform’s featured markets were niche and lacked broad appeal. Its market impact was limited, with a Total Value Locked (TVL) of only $5.74 million and a monthly trading volume of $6.2 million. As of today, these figures have significantly increased, reaching $50 million in TVL and $111.5 million in monthly volume, according to DefiLlama data.

(Thread)

More on how Polymarket works can be found in the Dune analysis and the official Polymarket Documetation

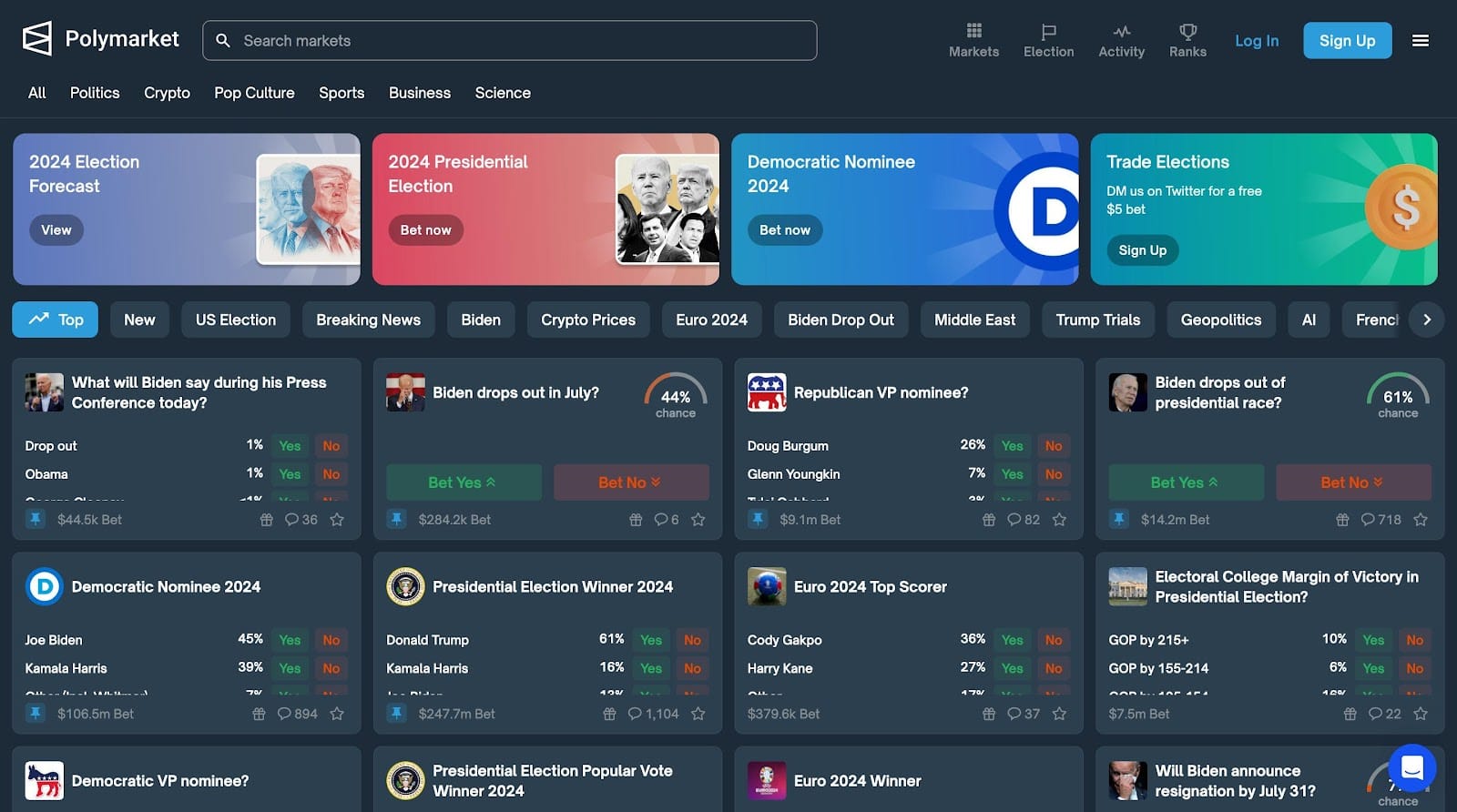

In just one year, TVL increased 8.7-fold, while monthly trading volume soared by ~18x. How did this happen? One word—politics. Polymarket users do not appear to be focused on speculating which memecoin will flip Bitcoin first; instead, they are primarily interested in betting on the outcome of the 2024 presidential election, making the platform the world’s largest 2024 presidential election prediction pool (according to Bernstein).

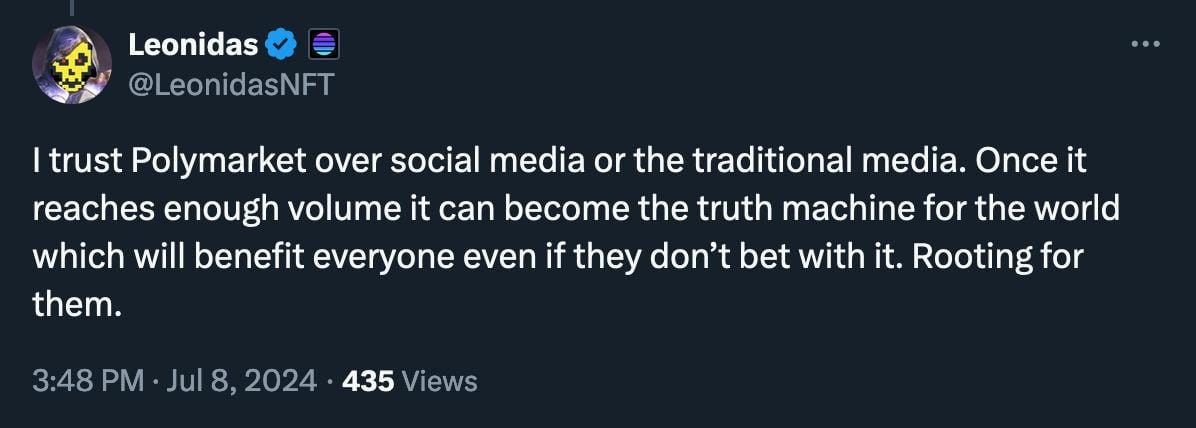

And oftentimes, prediction markets reportedly (PDF)outperform polls in forecasting elections.

“The issue facing Polymarket is that the platform essentially has only until early November to capitalize on the current political momentum. This isn’t necessarily detrimental, as Polymarket doesn’t rely on a native token. However, maintaining this product-market fit and sustaining interest beyond political events could pose a challenge for the platform.” (Scott Melker)

(Thread)

Each and every metric regarding Polymarket—daily volume, active traders, open interest, and new accounts—has shown epic growth in recent months.

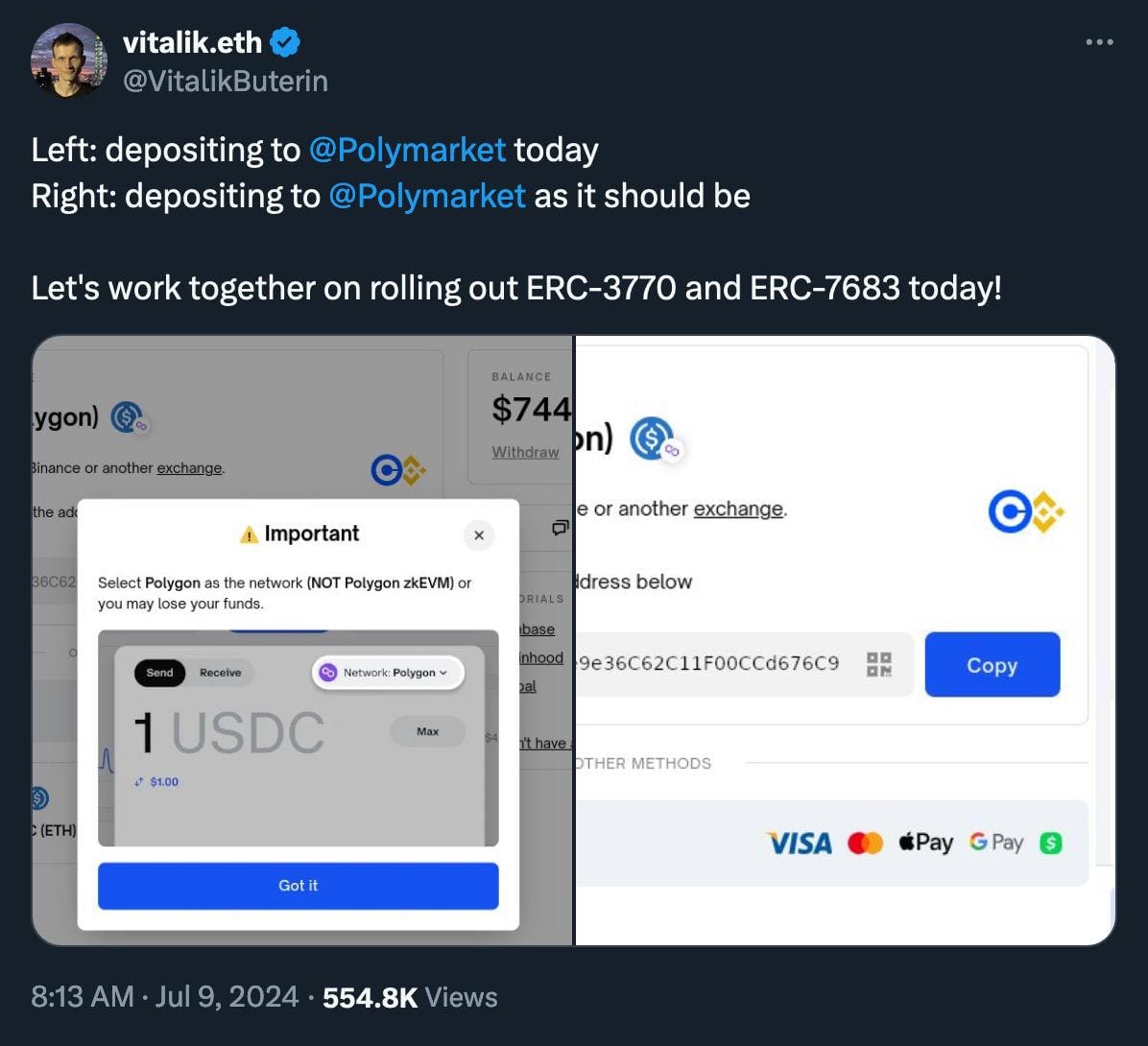

At the same time, accessing Polymarket requires familiarity with common cryptocurrency practices that are not widely understood by the general public. These include paying gas fees, connecting digital wallets, using USDC (USD Coin), and executing token transfers. As a result, the barrier to entry is high enough to suggest that some polls may be biased heavily toward the views of the crypto community.

One might also note that insider knowledge poses a valid concern for the platform.

That said, the list of cons for Polymarket is pretty short, as Scott Melker notes in his newsletter: “The platform hasn’t tarnished its name with a botched airdrop, has kept fees and spreads ridiculously low, found an explosive market fit, and has added a layer of depth to crypto’s use case in prediction markets.”

“Prediction markets are the purest technological manifestation of liberal democracy. They take free markets and free speech as inputs and output truth. In an age when centralized control of information is a systemic risk, prediction markets offer a way of cutting through misleading narratives and viewing the unvarnished truth. Prediction markets are freedom preserving technology that move societies forward.” (Yuga Cohler, an engineering lead at Coinbase, on X)

(Thread)