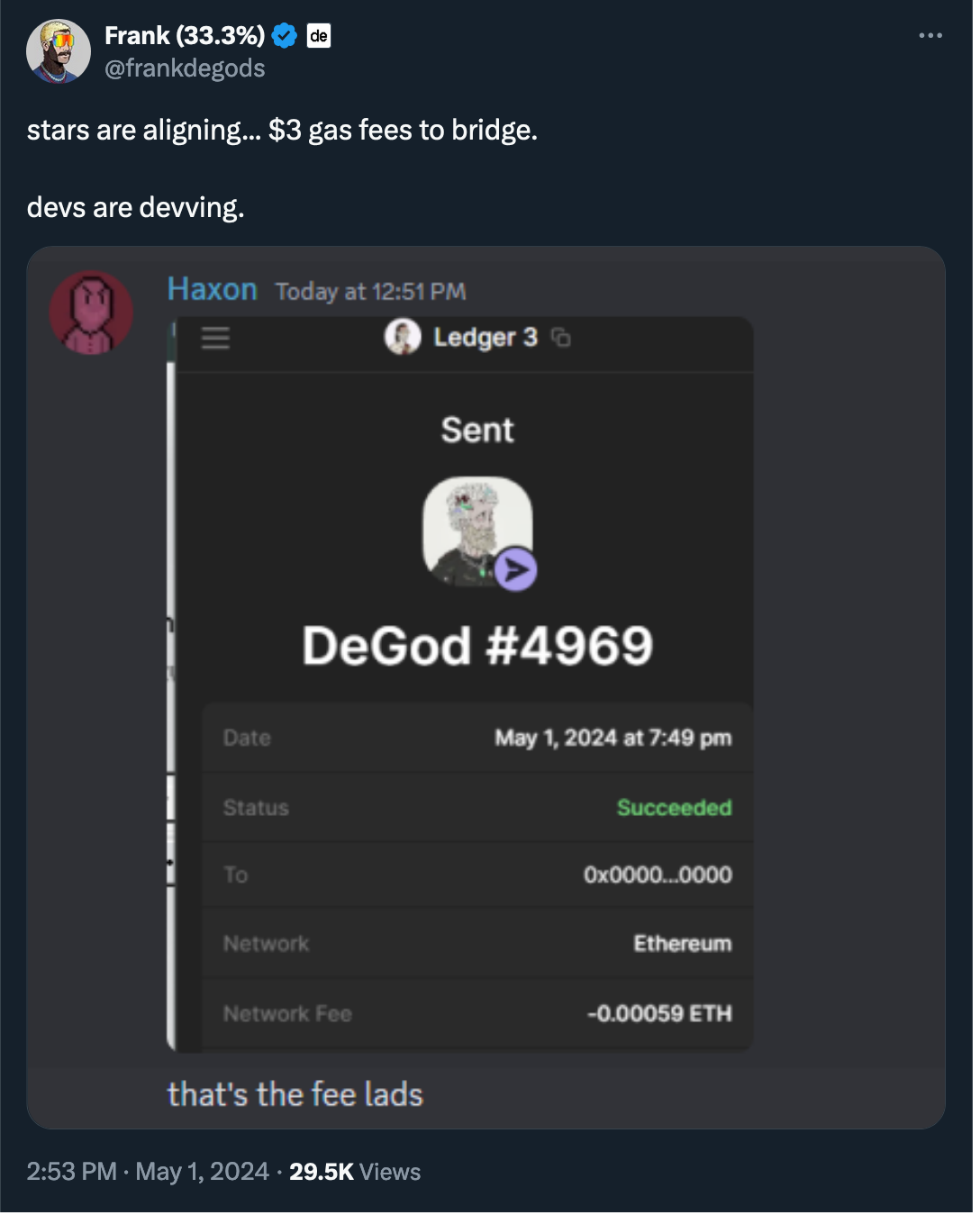

#Ethereum users are enjoying historically low gas fees, the lowest in years, resulting in significantly cheaper transactions. This makes the platform more affordable for both everyday users and developers. However, experts caution that this reduction in fees may be temporary, raising concerns about the long-term health of the network.

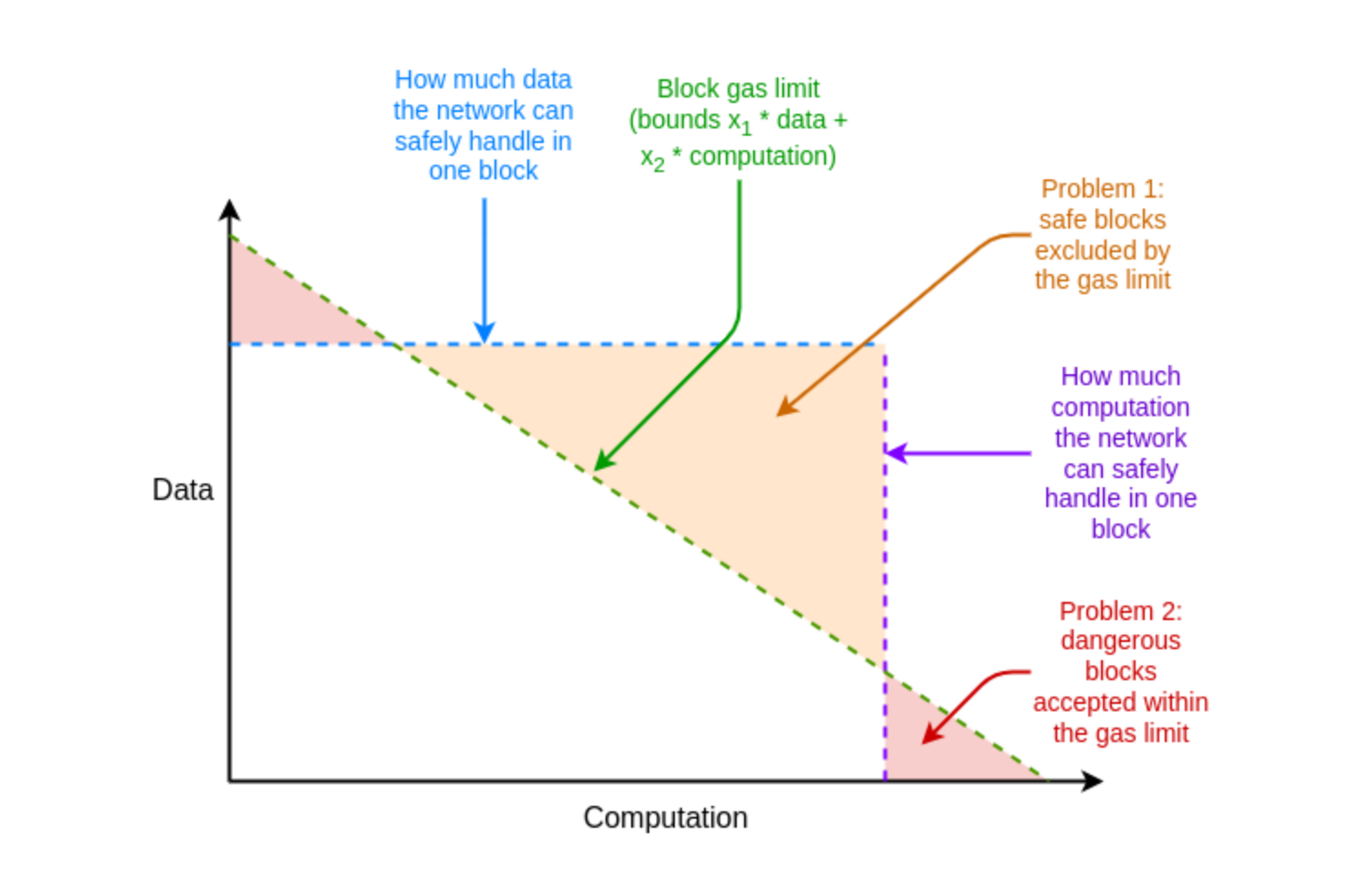

Source: Vitalik Buterin "Multidimensional gas pricing"

Gas fees refer to the transaction costs paid by blockchain users to the network, which is, in many ways, what gives tokens like Ethereum ($ETH) and Solana (SOL) their value. These fees fluctuate based on network activity—increasing during periods of high usage and decreasing when activity subsides.

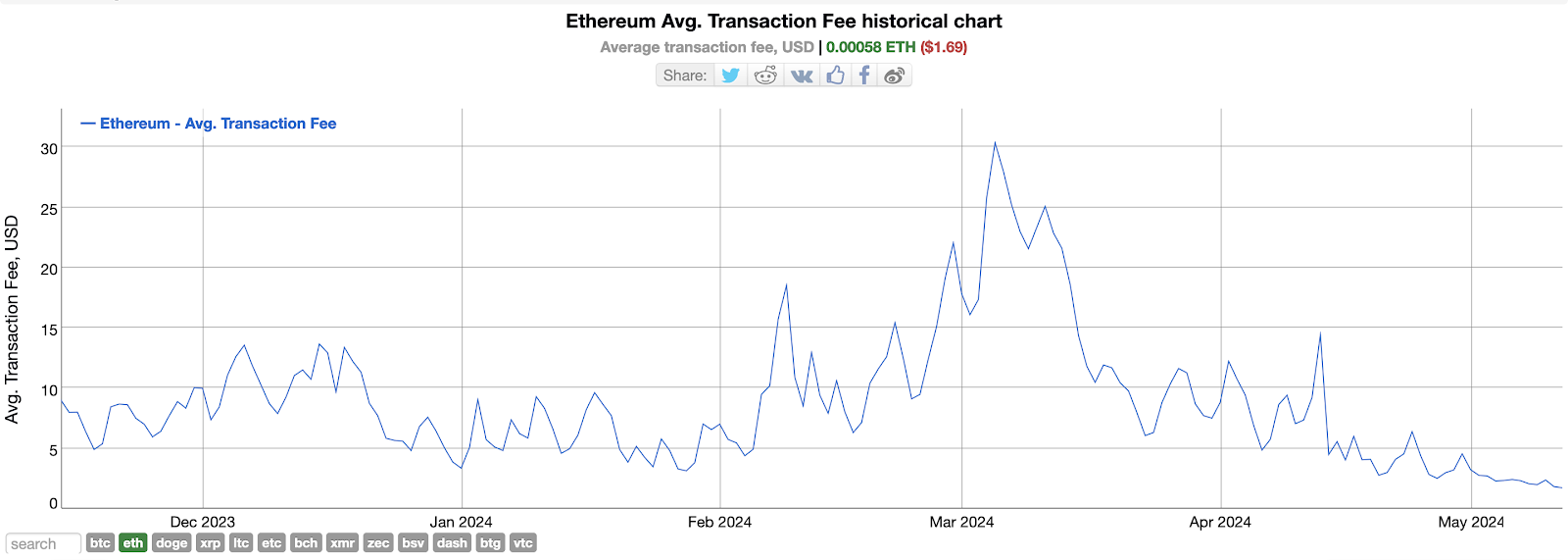

Source: BitInfoCharts

Data from BitInfoCharts indicates a 93% drop in intraday gas fees from the peak of $30 in March, significantly lowering the costs of all the transactions on the #Ethereum blockchain, including asset swaps and NFT minting.

This decrease in fees is attributed to multiple factors, including the recent Dencun upgrade, which has improved network efficiency, and a general slowdown in the network activity, aligning with a quieter phase in the broader cryptocurrency market.

While the reduction in fees is celebrated by users, concerns about the sustainability of this trend persist. The near-zero “blob fee” suggests a lack of demand for block space, which could lead to future congestion and fee spikes. Furthermore, the reduced fees may impact the earnings of miners who secure the Ethereum network.

In response to these challenges, Ethereum's founder, Vitalik Buterin, has proposed a substantial upgrade termed “multi-dimensional gas pricing.” The upgrade aims to enhance the network's flexibility in resource management, potentially increasing transaction throughput without compromising security.

Buterin's proposal immediately garnered reactions from two principal groups: Ethereum users, who expressed their excitement at the potential for lower fees on the costly mainnet, and Solana users and developers, who pointed out that Buterin's proposal closely resembles the fee model of the Solana network.

Overall, although the recent drop in gas fees provides temporary relief for Ethereum users, the long-term sustainability of these lower fees remains uncertain. The network's ability to handle future demand surges while maintaining user experience, miner profitability, and decentralization is crucial for its success. The multi-dimensional gas mechanism proposed by Vitalik is part of continued efforts to address these complex challenges.