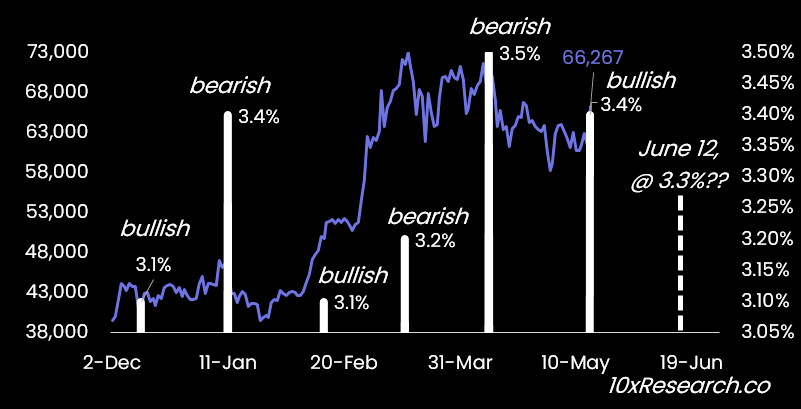

Bitcoin price movements may appear 'random,' but they all come down to critical drivers, with inflation being the primary one, according to Markus Thielen from 10x Research. To consider surpassing its all-time highs, Bitcoin needs a slowdown in United States inflation when the results are released in June.

“If inflation prints 3.3% or lower, Bitcoin should make a new all-time high,” Thielen stated in a recent report ahead of the United States Bureau of Labor Statistics releasing the Consumer Price Index (CPI) results for May on June 12. This would represent a 0.1 percentage point decrease from April's 3.4%.

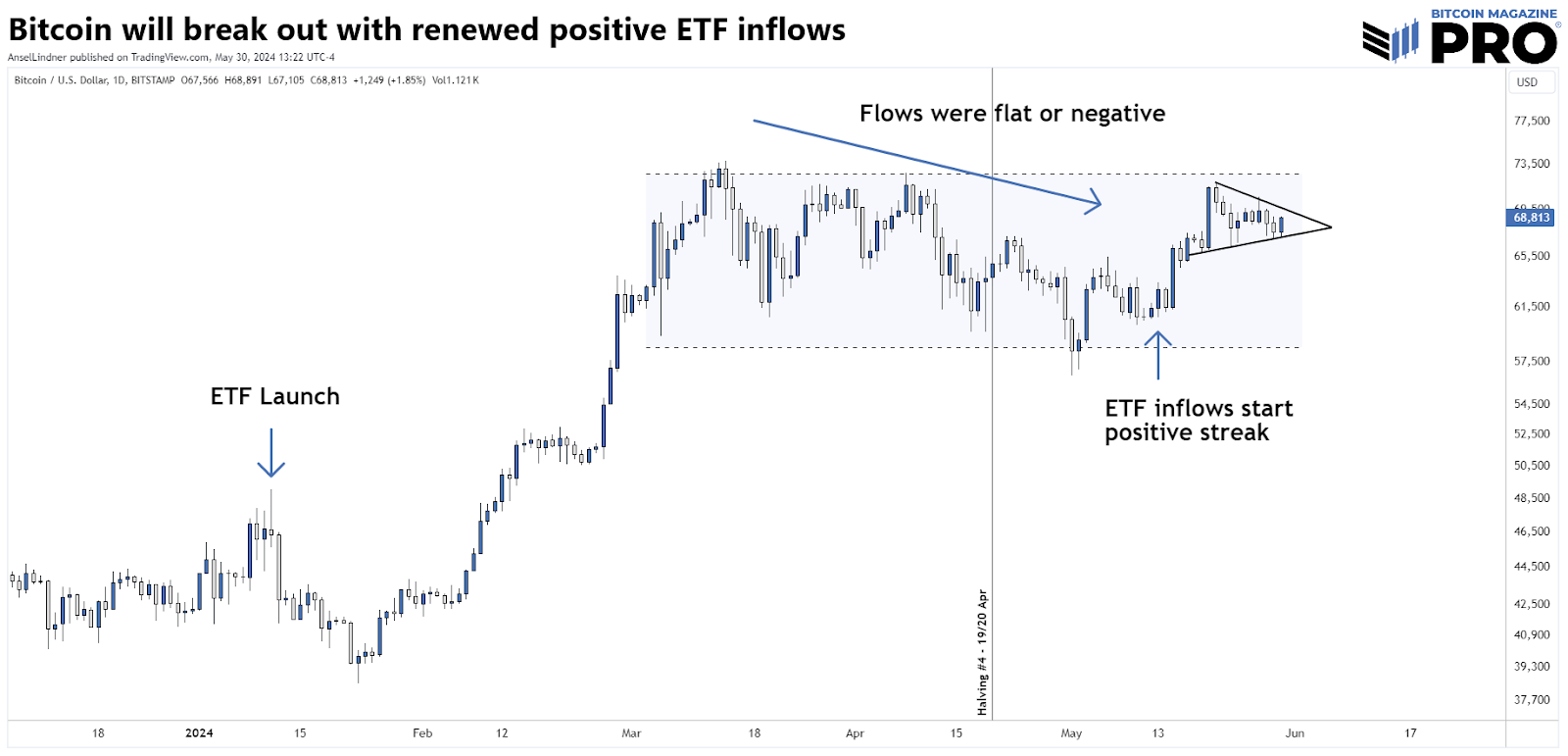

"As the next CPI data release is scheduled for June 12, we expect that Bitcoin ETF inflows will likely remain strong(er) for the next two weeks. This should help lift Bitcoin to new all-time highs." (Markus Thielen, 10x Research)

Bitcoin changes direction based on CPI higher/lower than the previous month (higher CPI, bearish Bitcoin, lower bullish) (Source)

Conversely, if CPI results are higher than expected, Bitcoin market momentum could weaken, as seen earlier this year. "It is no coincidence that Bitcoin was weak in January and stronger into March but consolidated for two months," Thielen believes.

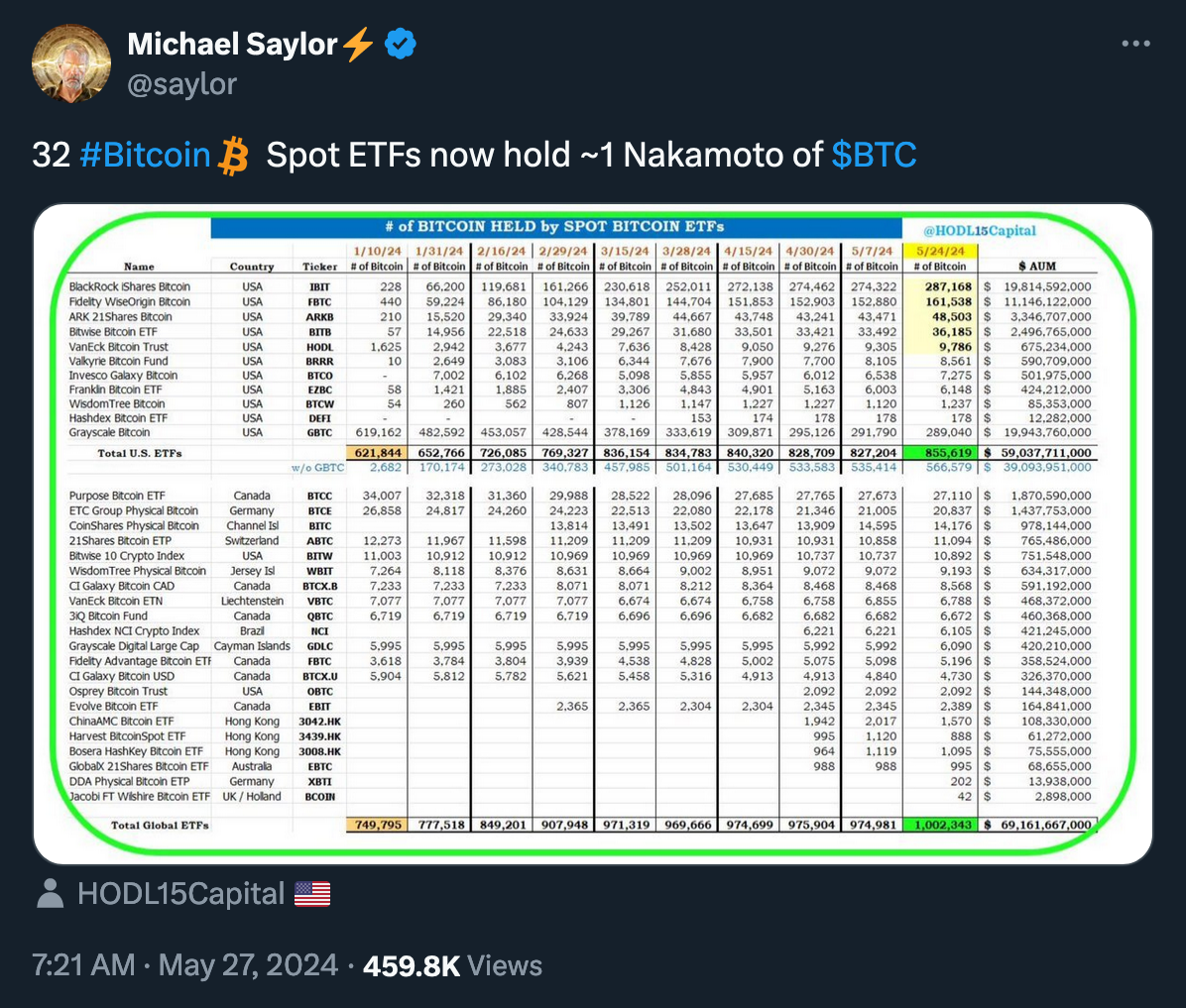

Meanwhile, Bitcoin spot ETF issuers reportedly hold a record 4.39% of the current BTC supply, reinforcing its scarcity, which is already tightened by the fourth Bitcoin halving.

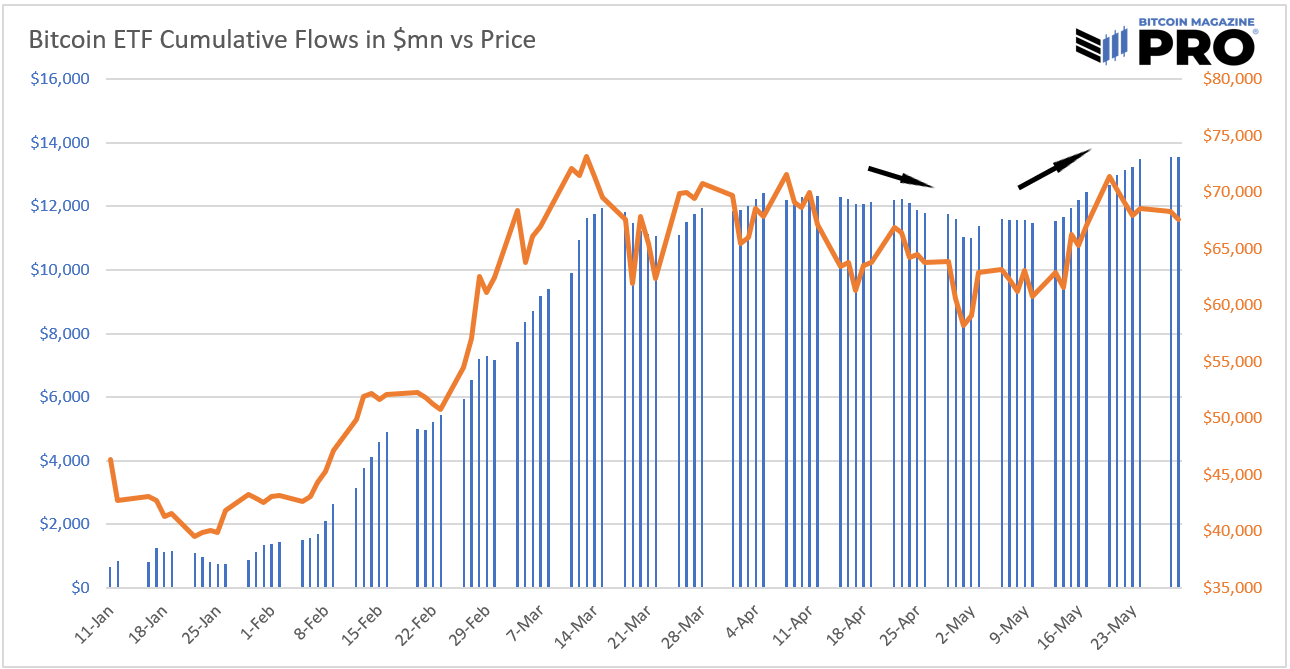

(Source: Bitcoin Magazine Pro)

As of May 30, capital inflows reportedly returned to the ETFs, with 12 consecutive days of inflows totaling over $2 billion. This trend, along with Bitcoin treasury holdings becoming mainstream, could establish a solid foundation for a new bull run, particularly if U.S. CPI data on June 12 is favorable.

(Source: Bitcoin Magazine Pro)

This favorable scenario is also supported by 'unstoppable bullish fundamentals,' detailed by Ansel Lindner in the latest BMPro report.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.