Litecoin is showing impressive strength these days. One of the oldest forks of Bitcoin (and seemingly the most successful one), $LTC is showing clear growth in difficult market conditions, with the upcoming halving event believed to be a significant factor driving this growth.

That is, prior to the halving in #Bitcoin (called the "digital gold"), there will be another halving event – in Litecoin (also known as "digital silver"), which is to take place in about 70 days (here's a countdown) on August 2 this year.

Basically, the essence here is the same as with the Bitcoin halvings: the issue of new coins is halved approximately every four years (every 840,000 blocks in case of Litecoin). But the $LTC market reaction to this event tends to follow a rather different pattern, described in great detail in this comprehensive thread:

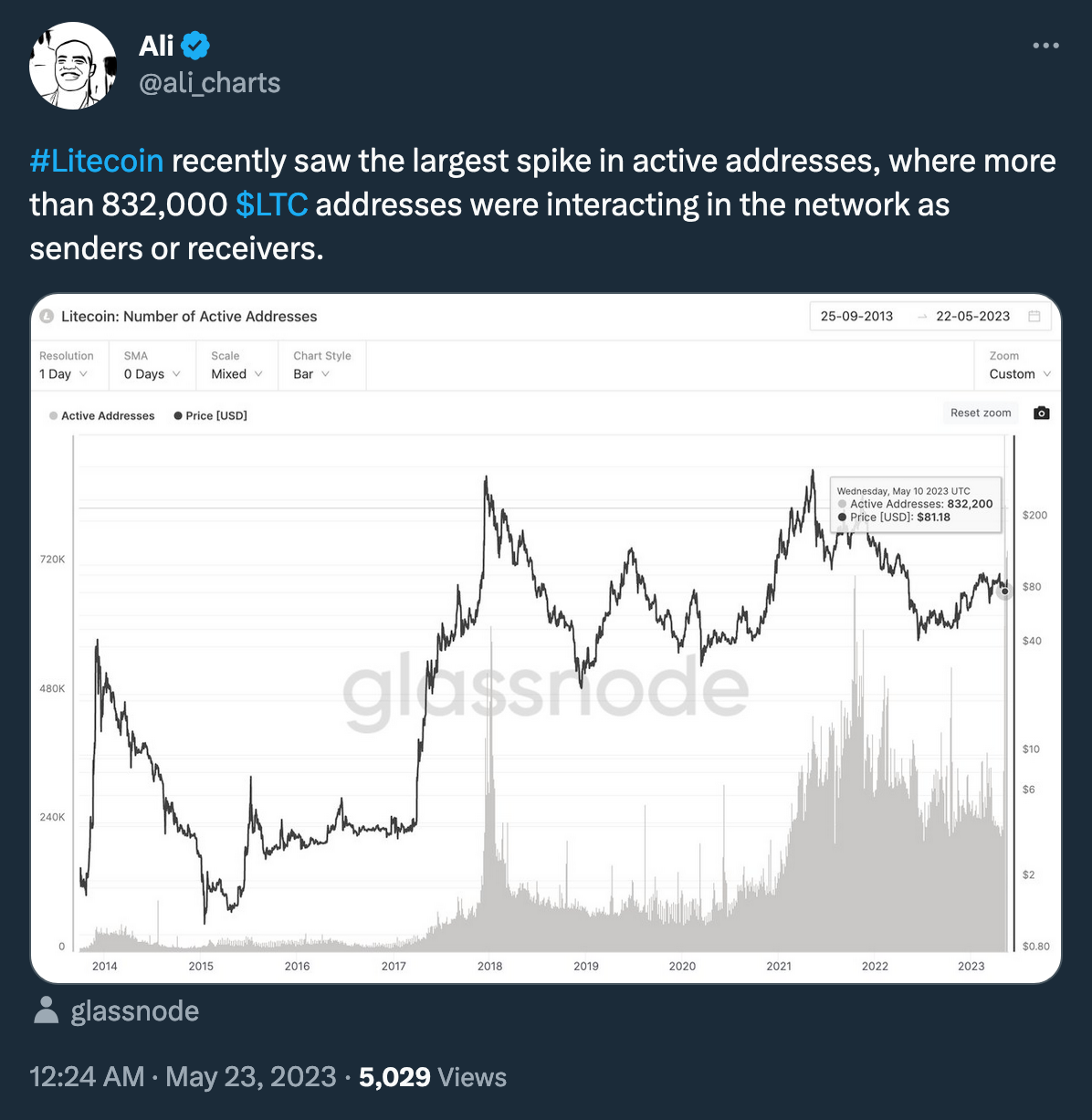

There are also some positive developments occurring within the Litecoin network in anticipation of the upcoming halving, notably with a surge in the number of active wallets, particularly:

Aside from that, according to @intotheblock, the Litecoin network has experienced significant growth in some basic parameters this year, with transactions increased by nearly 400% and approximately 50% of the LTC supply held by retail users. Additionally, 60% of LTC holders are in a profitable position, and 3,900,000 wallets have been holding LTC for over a year.

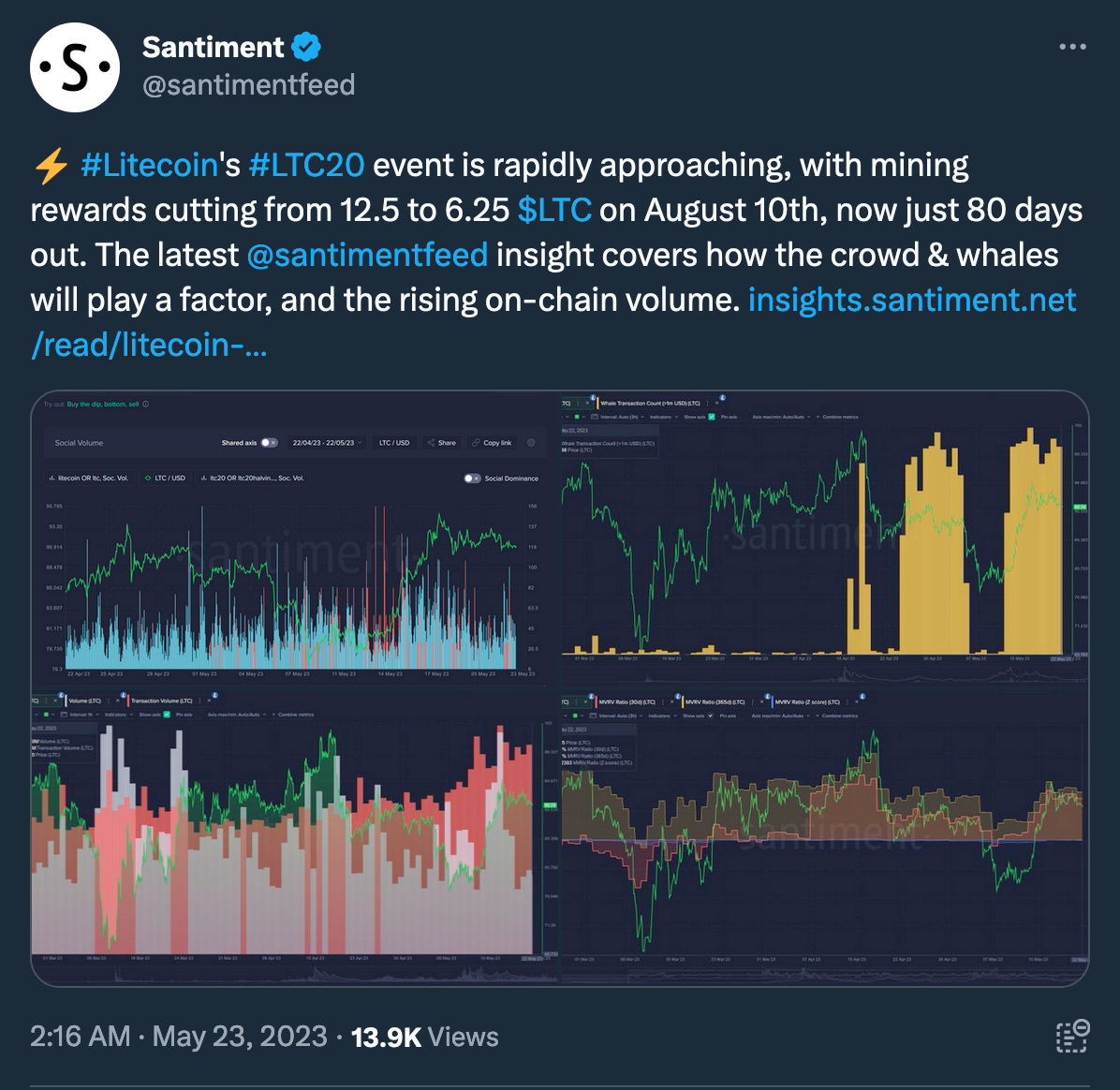

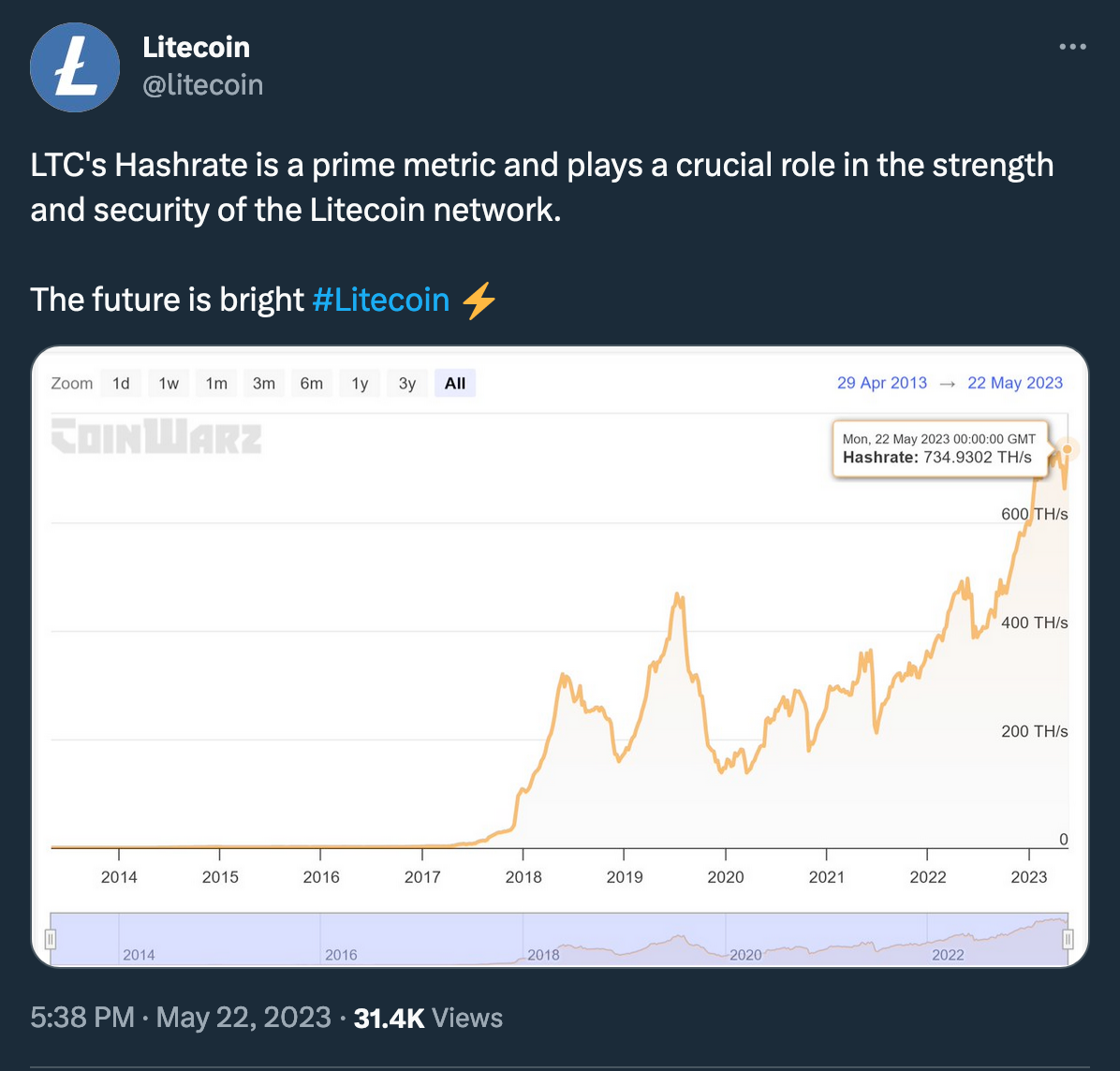

The total hash rate of the network has also increased by 25%, attributed to the adoption of the Litecoin Ordinals (which exceeded 3 million inscriptions these days, then hooray) and LTC-20 token "standard," similar to Bitcoin's BRC-20 and Dogecoin's DRC-20.

Furtheremore, @glassnode's MVRV Z-score (what's that?) for Litecoin also suggests $LTC is currently "undervalued" compared to its fair value – like "hidden gem," no less, some say:

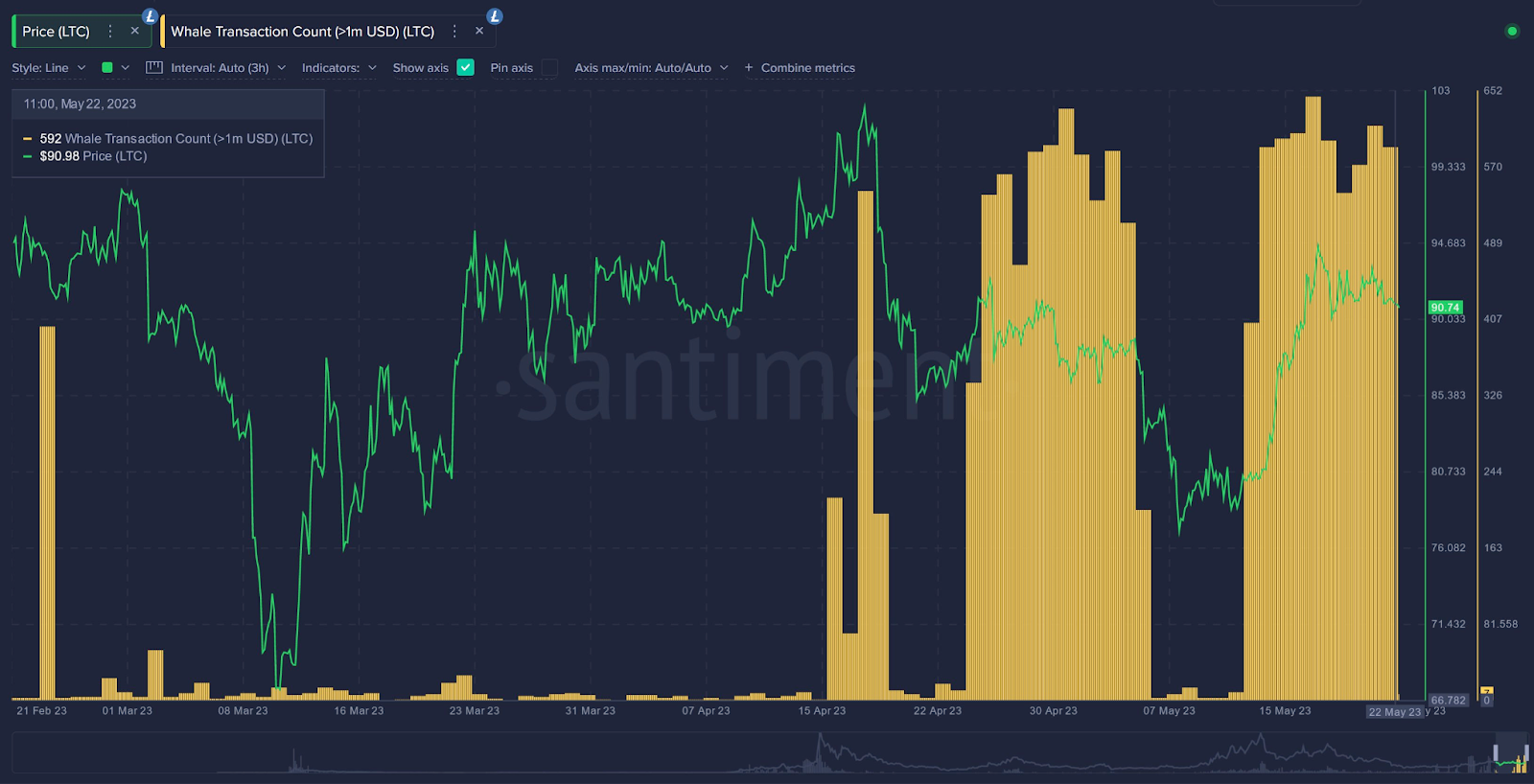

Litecoin futures open interest surging as well, according to CoinGlass data, with some descent whales activity (as for @santimentfeed), which is also rather a bullish sign:

And that leads us to some selected technical analysis:

TL;DR:

19.

— Rekt Capital (@rektcapital) January 8, 2023

Overall, here is a list of all key $LTC Halving Principles:

• #LTC rallies Pre-Halving

• Local top months Pre-Halving

• Strong retrace after local top

• Post-Halving consolidation in Accumulation Range

• Strong Post-Halving rally to new ATHs#BTC #Crypto #Litecoin