The Bitcoin hash rate has recently declined sharply as mining firms have started turning off unprofitable mining rigs after the fourth Bitcoin halving. This led to the largest difficulty decrease since 2022 at -5.625%.

Source: mempool.space

The temporary drop was predicted by CoinShares in the April report, which expects, however, the hash rate to surge during the next year:

"Our model forecasts the hash rate rising to 700 Exahash by 2025, although after the halving, it could fall by up to 10% as miners turn off unprofitable ASICs." (CoinShares)

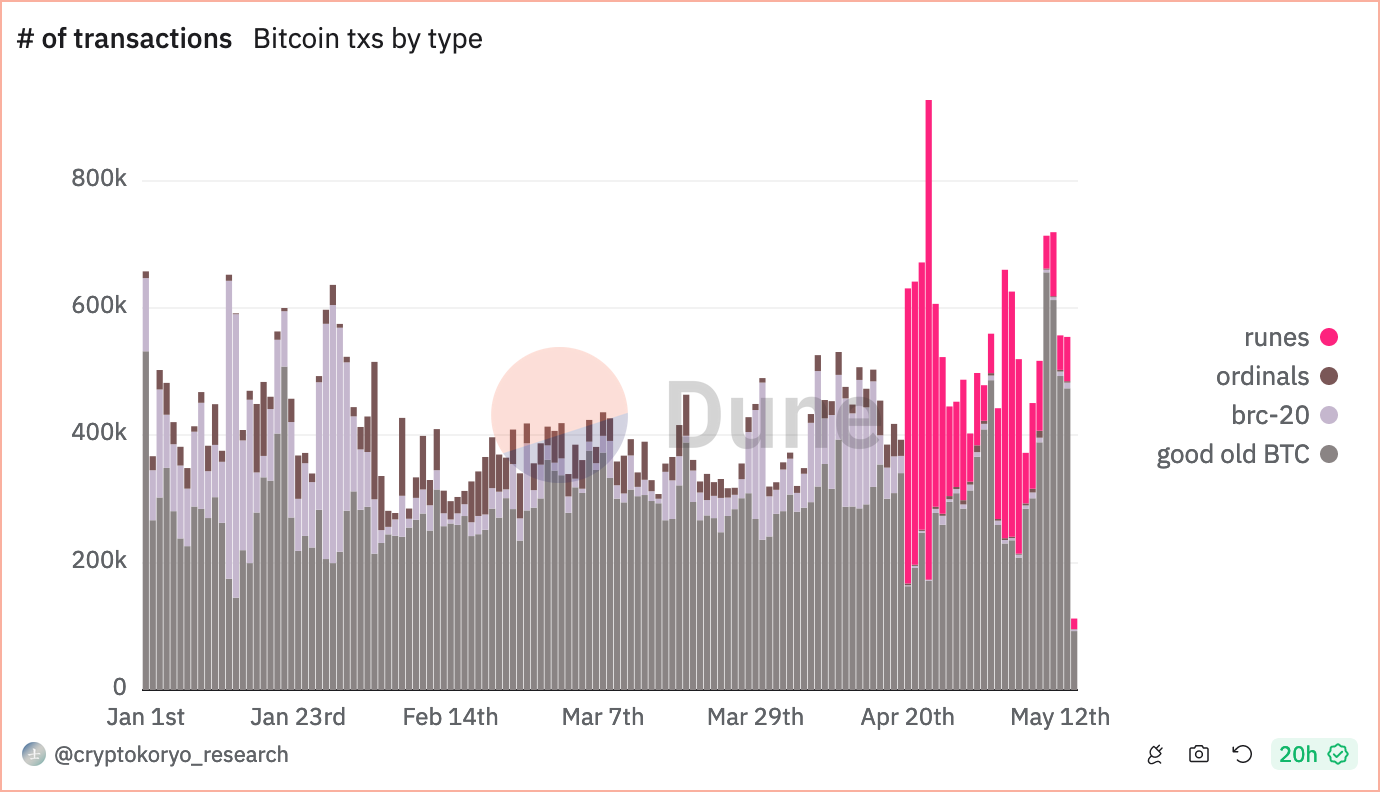

A decrease in user interest both in inscriptions and runes has also negatively impacted mining profitability. The slowdown in the Bitcoin cycle and lack of excitement after the halving have severely affected the runes and inscriptions subculture, which thrives on Bitcoin's hype. It remains to be seen if any demand comes back once bitcoin pumps.

Meanwhile, Charles Edwards highlighted in the latest Capriole Investments report that the four times in history Bitcoin Miner Price has dropped below Bitcoin Electrical Cost have proven to be incredibly rare and great long-term investment opportunities.

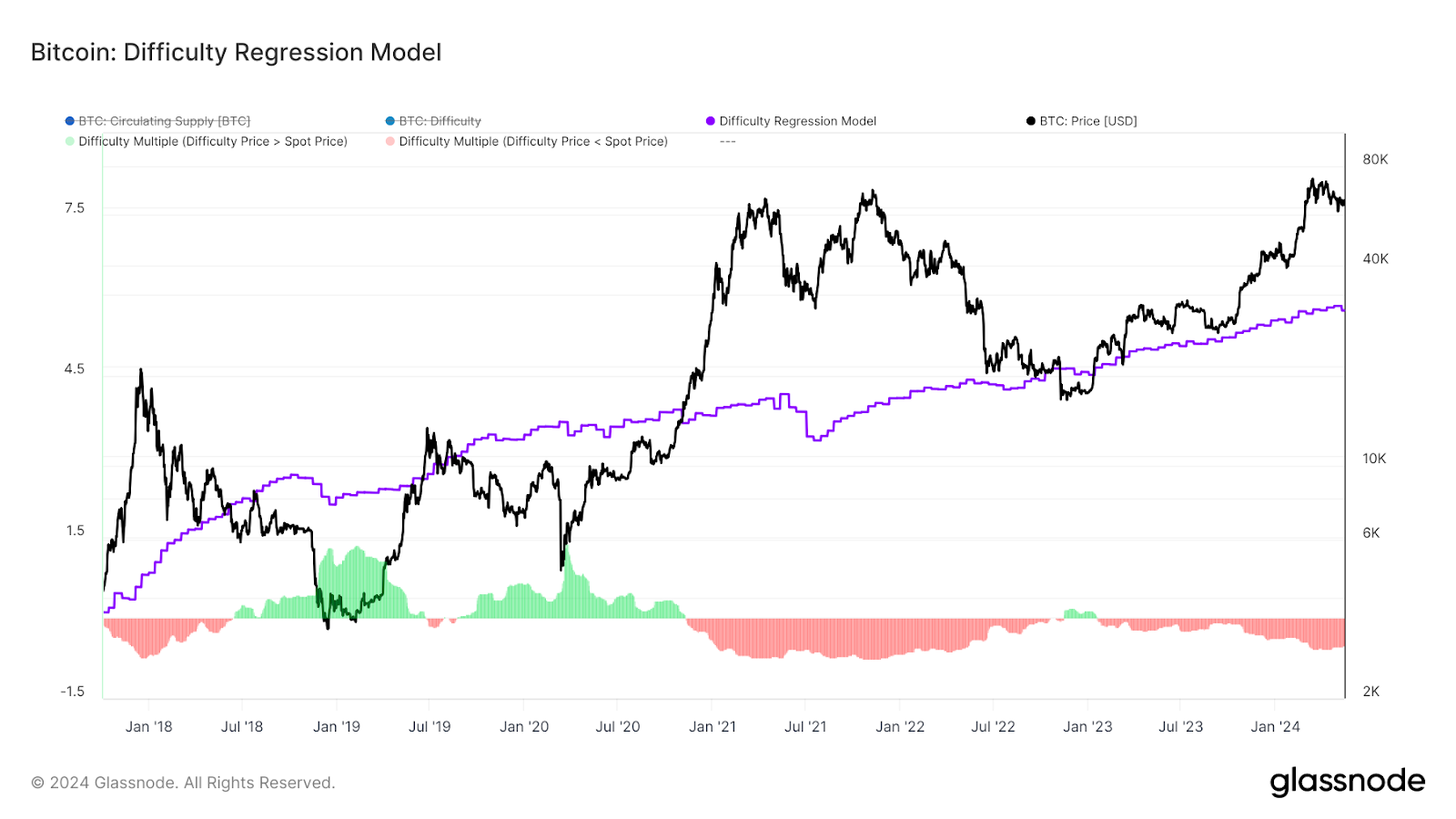

In contrast, Glassnode's Difficulty Regression Model suggests that Bitcoin trades at a substantial premium above its production cost. This implies that miners are not actually facing immediate financial pressure. As long as Bitcoin’s price remains largely where it is, we're unlikely to witness a capitulation event any time soon where miners are forced to shut down their operations at scale or sell BTC to sustain them.

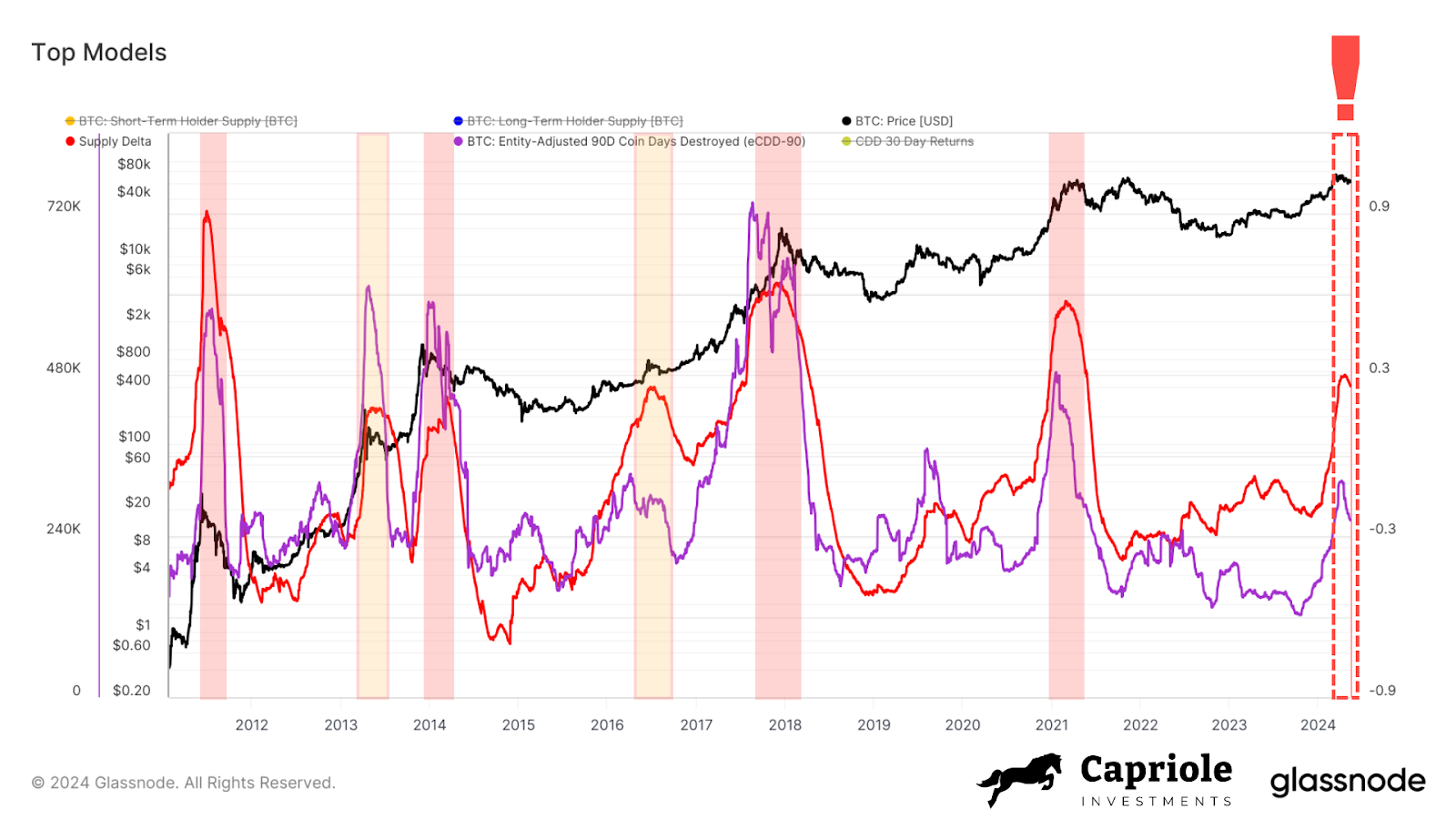

At the same time, Charles Edwards' latest analysis also points to a major warning sign from 'some of our favorite cycle top signals,' so the Bitcoin market draws a mixed picture for them, too.

"[Supply Delta and 90 Day Coin Days Destroyed—] After these metrics go vertical, it’s important to be cautious of rounded tops, which can signal the cycle top is in. Unfortunately, both metrics have formed rounded tops today. The possible exceptions here are the two mid-cycle zones highlighted in Yellow. There’s reason to believe we are at a comparable mid-cycle pit stop as the magnitude of each metric today is close to these two cases (especially Supply Delta, the Red line), not to mention the comparables with various other on-chain indicators that suggest a similar mid-cycle point." (Charles Edwards, Capriole Investments)

Regardless, this chart indicates that we should expect at least a few months (possibly up to six) of sideways chop before the trend resumes. Currently at the two-month mark, the alignment of these metrics with the “Sell in May” adage is noteworthy, suggesting a quiet Bitcoin summer ahead.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.