The Bitcoin halving event and declining prices pushed miner revenues to near-record lows. In these survival games, miners are compelled to shut down unprofitable machines and sell off Bitcoin reserves to cover operational bills. This is known as miner capitulation, although miners are generally more stable than they appear during this price dip.

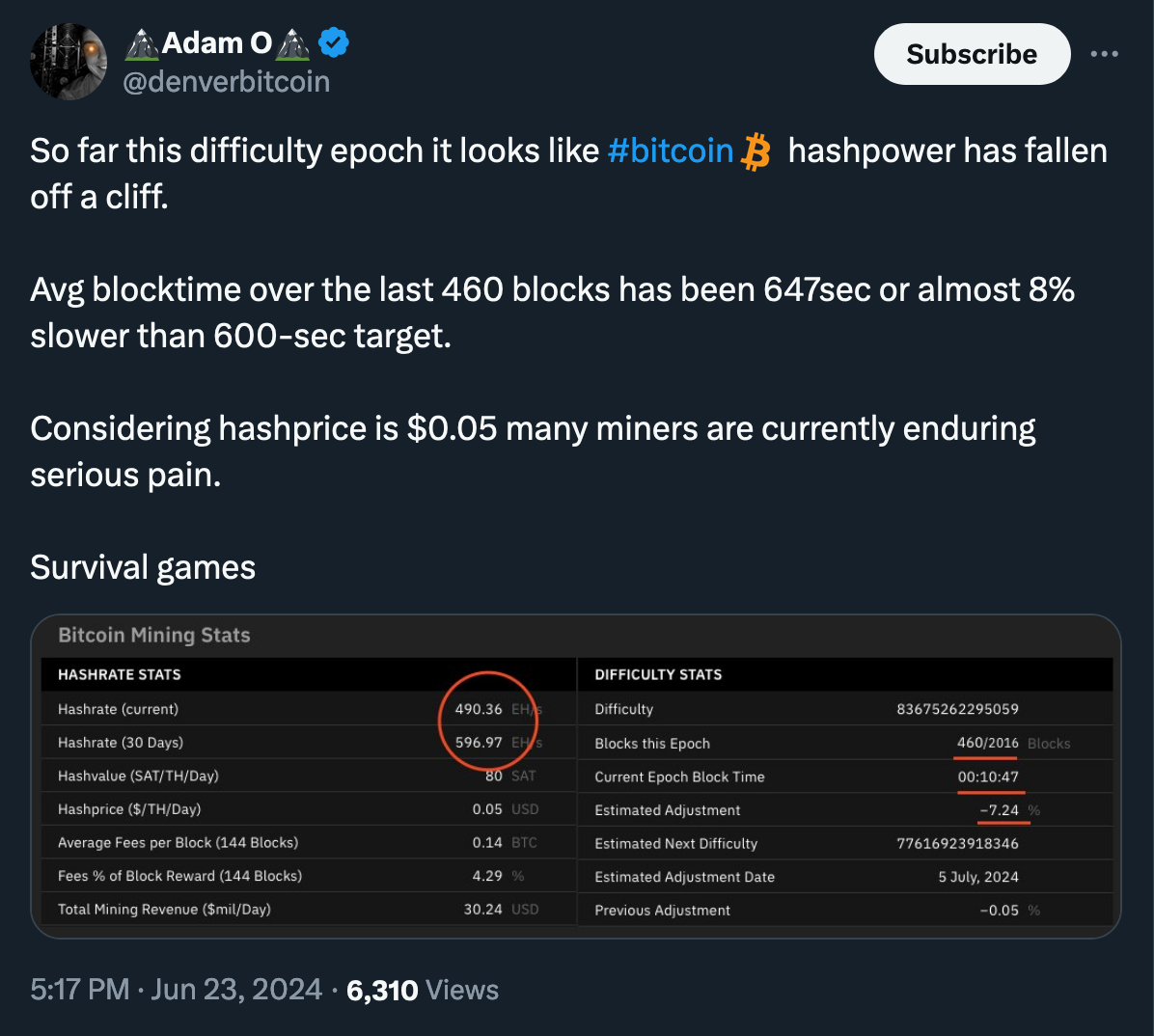

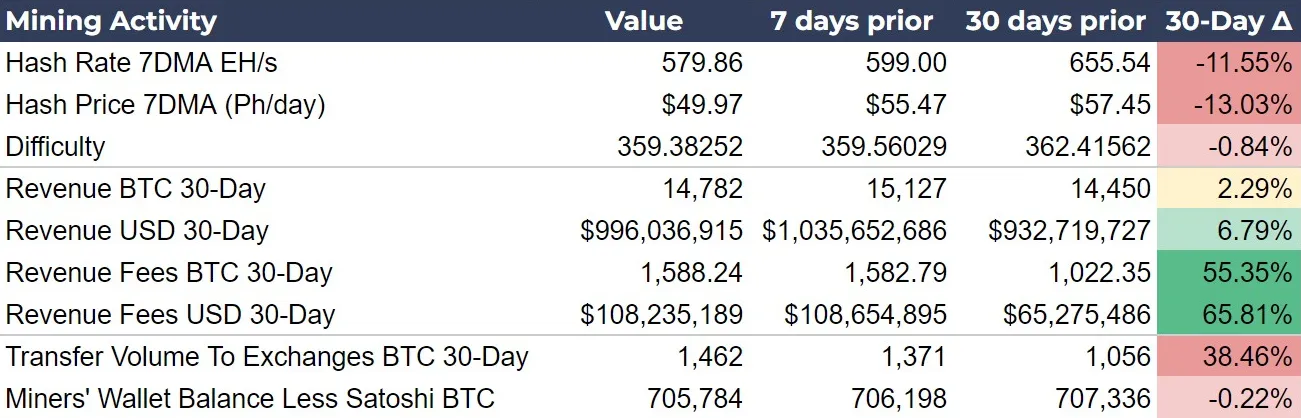

The Bitcoin network's fourth 'halving' event occurred over two months ago, yet its effects still impact miners, significantly compressing the industry's profit margins. Bitcoin's value has also declined to the lower $60,000 range. Consequently, the hashprice has fallen to approximately $0.04/TH/day, pushing towards the all-time low recorded in the aftermath of the halving.

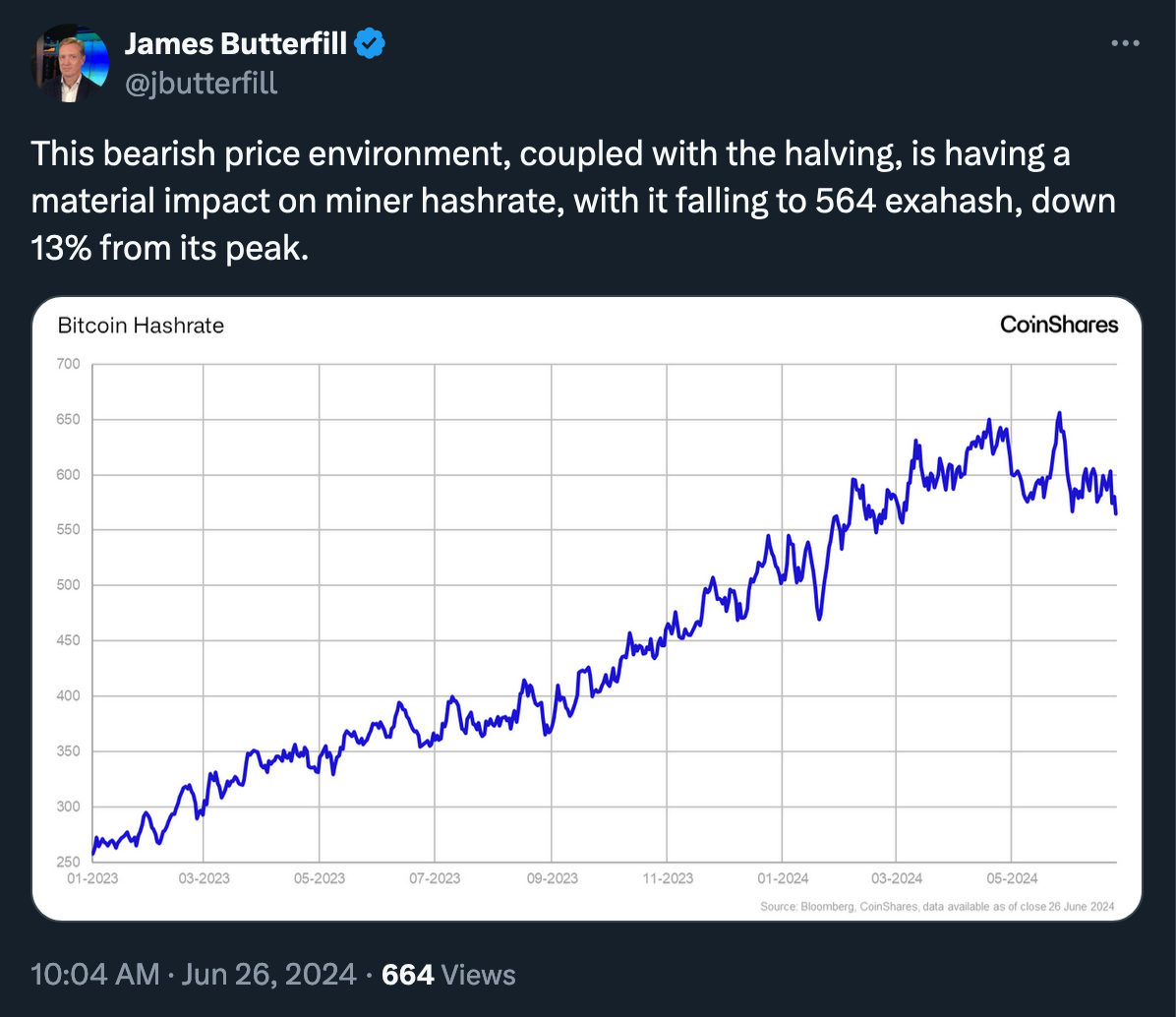

With hashprice dipping below $0.05, miners are once again finding themselves in a tight position. Bitcoin's hash rate has dropped 13% from its post-halving peak to 564 EH/s, suggesting miners are shutting down unprofitable machines due to reduced profitability.

"This is a temporary issue. This equipment did not blow up and stop working, the rigs were simply taken off-line because they were not profitable. Once the price begins to trend upward, they will be brought back online."(Ansel Lindner)

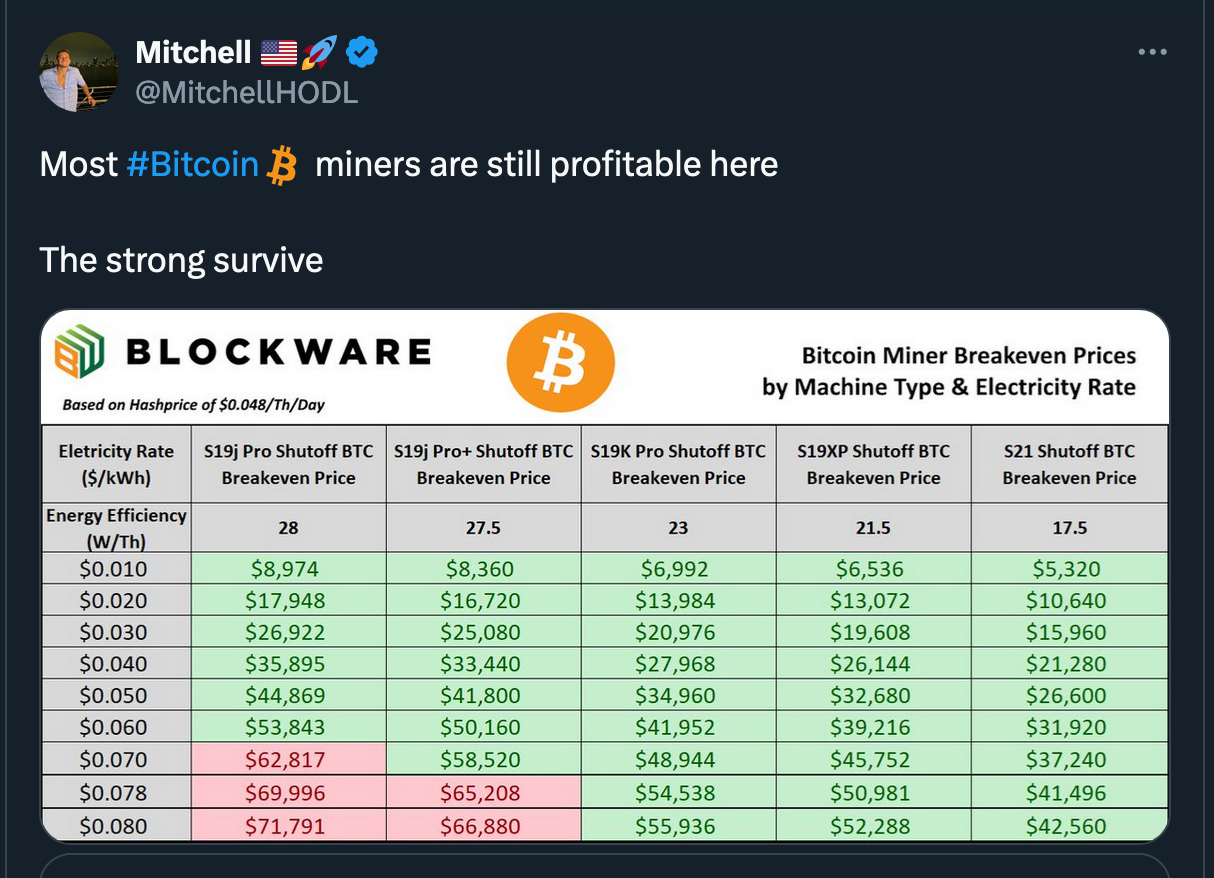

"With hashprice now down to ~$0.048/Th/Day and BTC just under $61,000, S19j Pro’s at $0.07/kWh are underwater. jPro’s still comprise a solid portion of total global hashrate, so, unsurprisingly, difficulty is dropping as these machines go in the red at certain electricity rates." (Source: Blockware Intelligence)

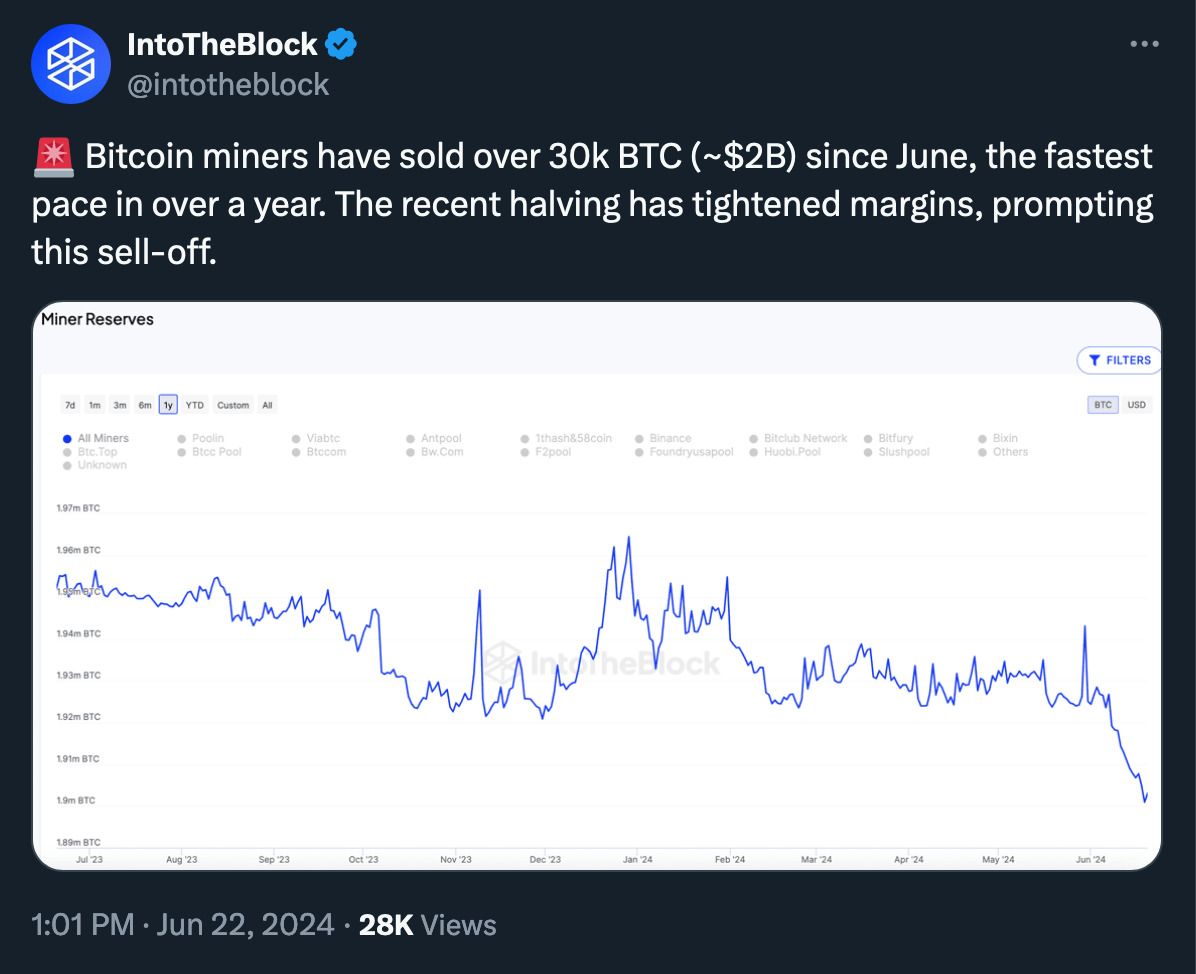

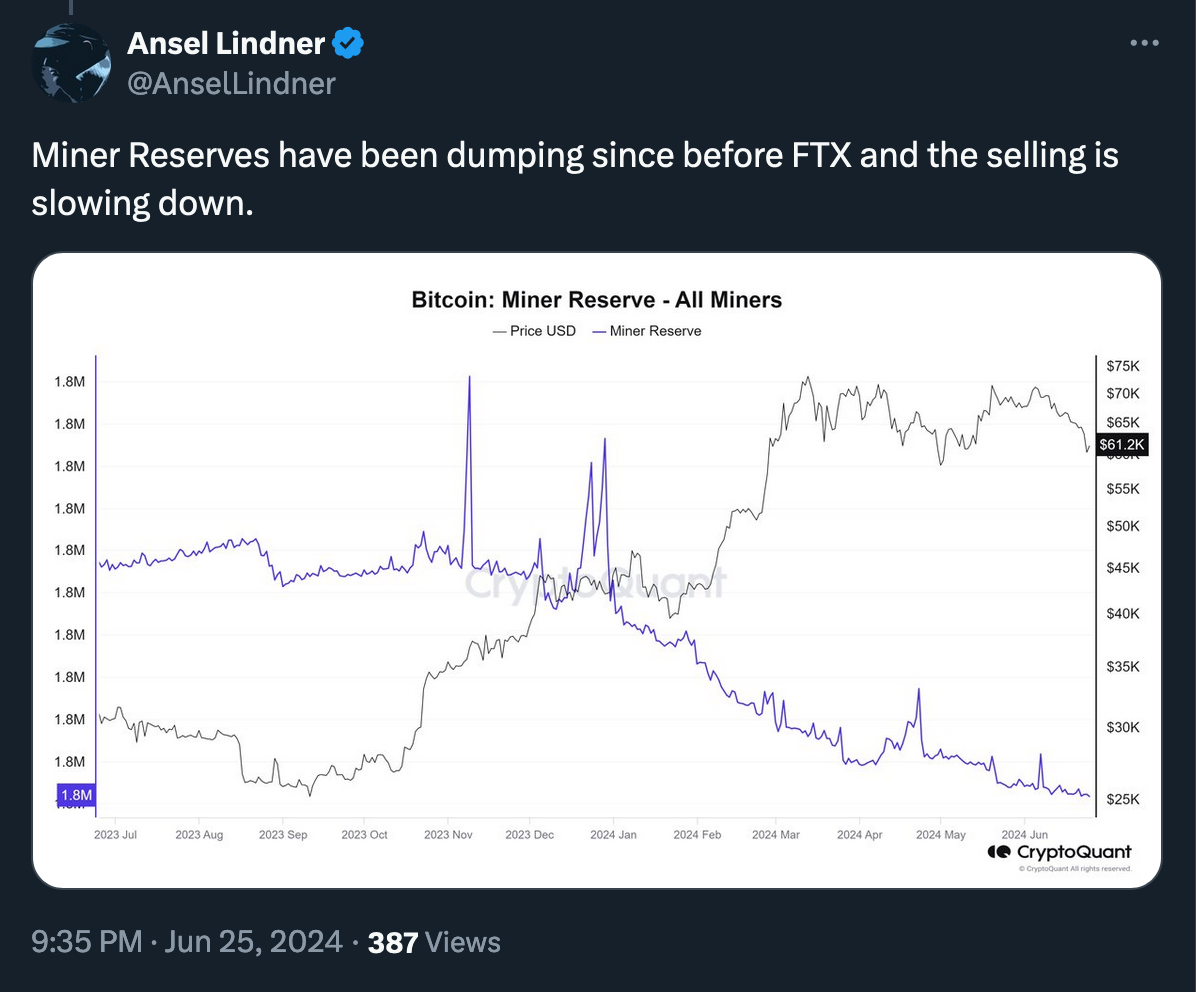

CryptoQuant data reveals increased BTC flows from miners to exchanges this month, suggesting potential cash needs. Marathon Digital, for instance, sold 1,400 BTC in early June, far exceeding their May sales of 390 BTC.

However, zooming out reveals this is not a novel trend at all; miners' bitcoin balances have been falling consistently since 2022.

"It's very safe to say that miners are selling a lot of bitcoin at the moment, but the total number is less clear. For instance, they could be using bitcoin for collateral on a loan to make it through this dip in price. That would look like a sale to these blockchain derived measures." (Ansel Lindner)

The average performance of publicly traded miners (although individual figures vary significantly) contrasts sharply with current Bitcoin market fluctuations. Over the past 30 days, the average increase in dollar terms was 19.22%, while in Bitcoin terms, it was 35.43%, highlighting the mining sector's relative strength.

"General mining stats more resilient than thought." (Ansel Lindner, BMpro)

Despite challenging prices, the broader Bitcoin mining ecosystem shows notable resilience. Public mining companies are adapting their strategies and diversifying operations. Overall, mining activity maintains stability, while network traffic indicates a healthy usage pattern, indicating a measured market response rather than panic.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.