Amid Bitcoin's little consolidation at its all-time high zone, altcoins, led by memecoins, have outperformed BTC in the past week, sparking discussions on whether the altcoin season is already here or about to begin.

"Looking at the ETH weekly chart, there is effectively no resistance between here and the all-time high. Take it as you will." (The Wolf Den newsletter)

Over the past three months, altcoins have rallied by approximately 64%, closely correlating with the Bitcoin market. This rally was driven by optimism surrounding spot ETFs and institutional capital inflows.

Several notable Ethereum-based altcoins, in particular, have seen a massive surge in whale transaction activity, according to Santiment's data, as ETH surpasses the $3.9K mark.

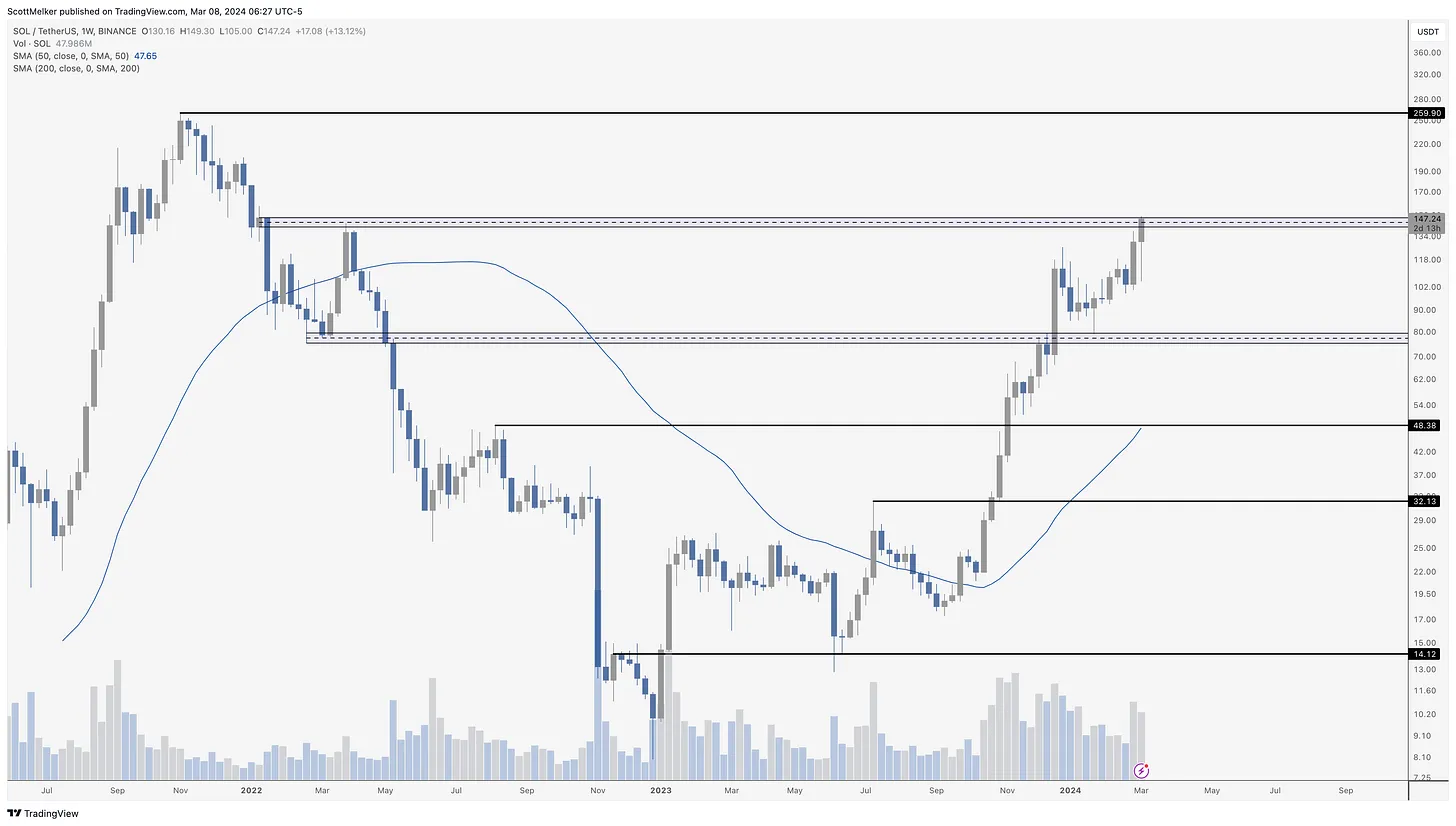

Solana investors have received good news, too, as crypto hedge fund Pantera Capital is raising funds to acquire a substantial stake in FTX's SOL holdings from the bankrupt estate.

"Solana is also pushing through the last key area of resistance (not through yet) before the all-time high." (The Wolf Den newsletter)

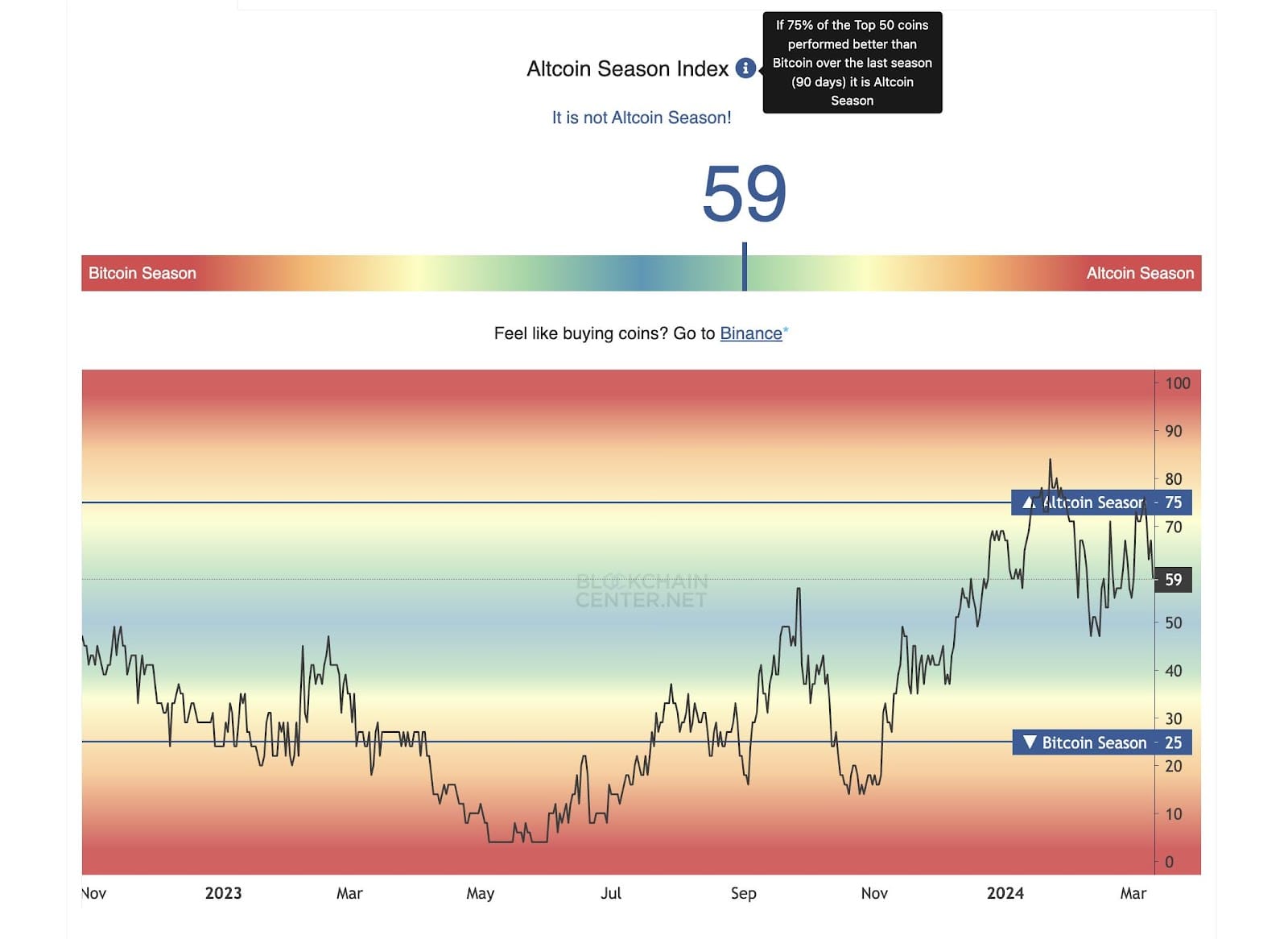

Generally, large-cap altcoins outperform Bitcoin, and the tremendous memecoin rally over the past week could be a sign that another altcoin season is ready to begin in the market... But that's technically not yet the case, according to the Altcoin Season Index by Blockchain Center: “If 75% of the top 50 coins performed better than Bitcoin over the last season (90 days), it is Altcoin Season,” a brief note reads.

Altcoin Season Index by Blockchain Center

While the Altcoin Season Index has risen over the last few weeks and months, it still falls short of declaring a full-fledged altcoin season. However, according to K33 Research's recent report, this could change soon: “Judging by history, altcoins will start outperforming about the time we are now.”

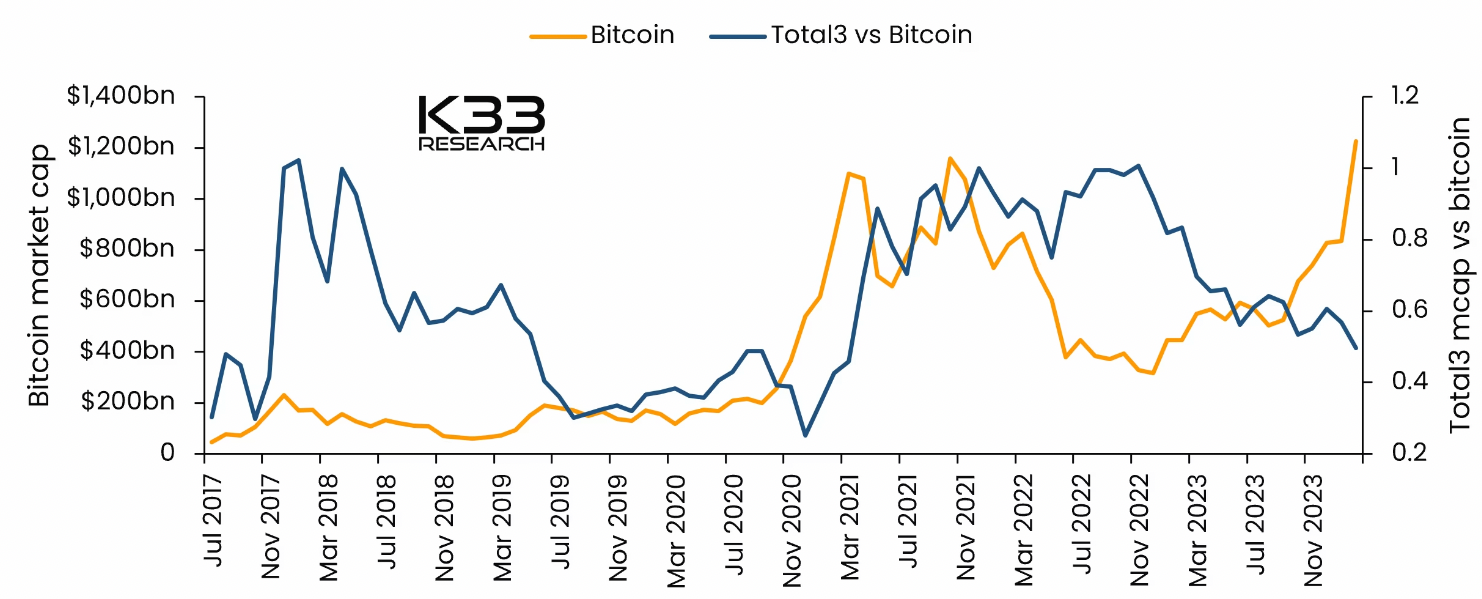

BTC vs. altcoins market cap. Source: K33 Research

As K33 Research analysts noted, with Bitcoin's market cap doubling relative to the value of all cryptocurrencies except BTC and Ether, the current setup mirrors 2020's point just before altcoins started to catch up with Bitcoin's uptrend.

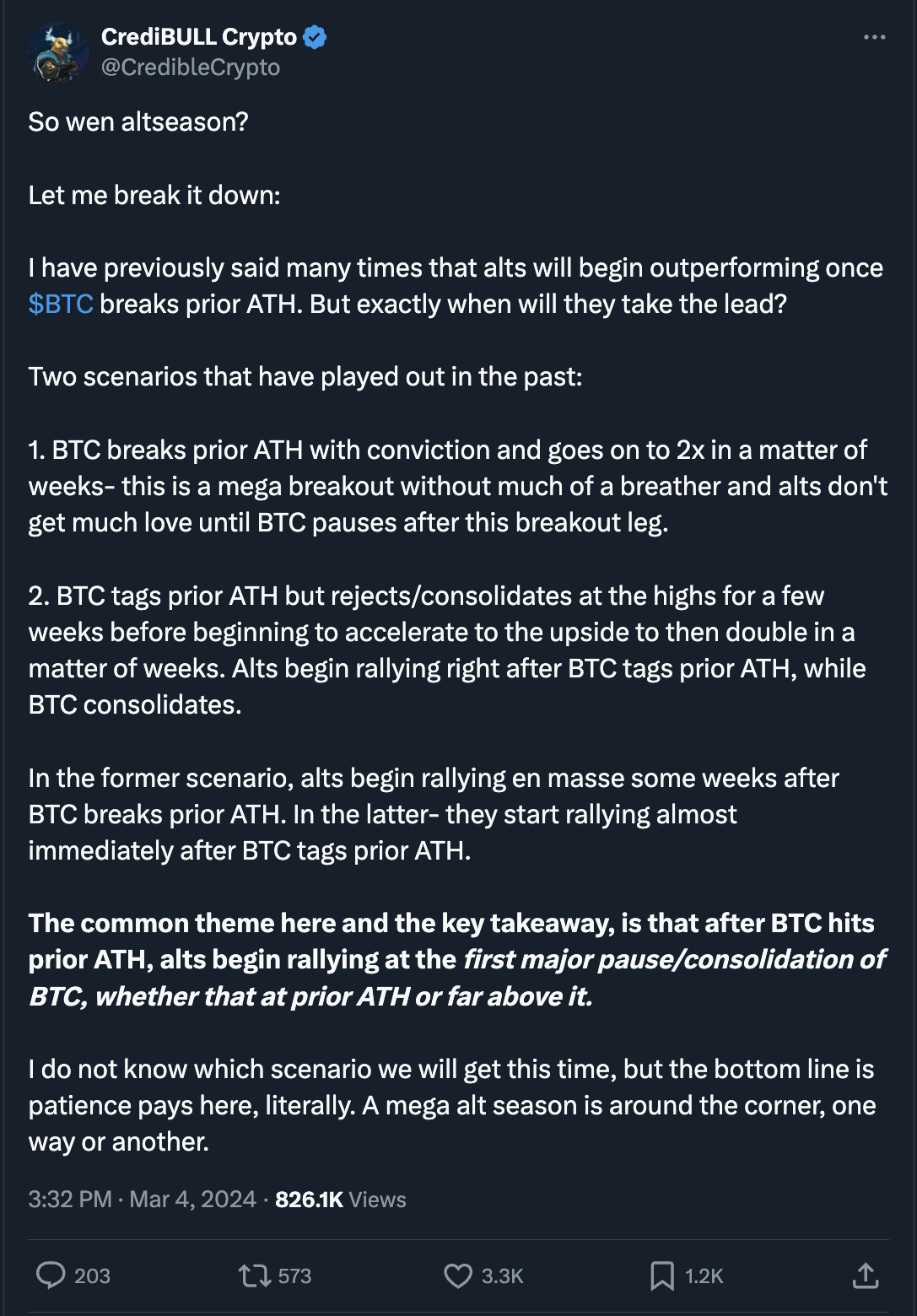

Independent analyst CrediBULL, exploring the connection between Bitcoin’s performance and the onset of altseason, outlines two potential scenarios:

"The common theme here and the key takeaway is that after BTC hits prior ATH, alts begin rallying at the first major pause/consolidation of BTC, whether that at prior ATH or far above it." (CrediBULL on X)

Another prominent crypto analyst, Michaël van de Poppe, believes the altcoin season has not yet fully commenced. He notes that altcoins still have 40-60% of their market capitalization to match the 2021 highs of over $1.1 trillion.

On his part, Cardano founder Charles Hoskinson humorously suggested that the altseason would start once $DOGE surpasses $ADA in market cap. Jokes are jokes; however, someone accumulates DOGE heavily these days, as IntoTheBlock data shows.

The graph above shows a 76% increase in the number of 'DOGE millionaires' over the past month, with a rapid rise since late February.

Dogecoin has already confirmed itself as a decent memecoin play, having rallied 100% in a couple of weeks, so there has been a lot of bullishness surrounding it, with expectations of much higher prices.

Matt Hougan, chief investment officer at Bitwise, believes that the current rally, driven by the influx of 'entirely new'—non-crypto-native—money via ETFs, will result in "more of an 'everything season' than a classic 'alts season,' " but he also warned: "Be careful out there. Lots of terrible projects get funded in exuberant bull markets, and many are already trading at crazy valuations."

(Thread)

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.