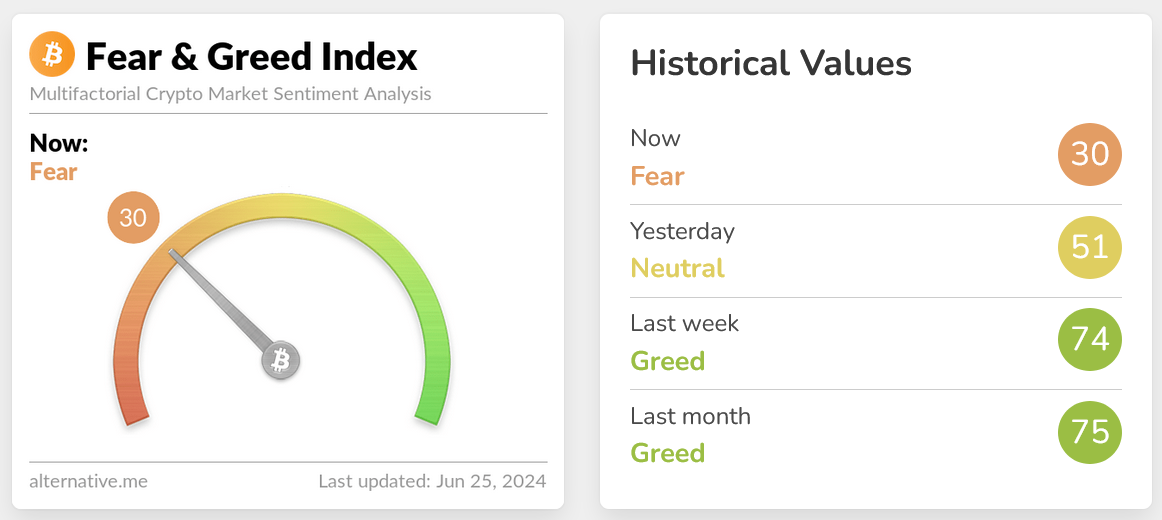

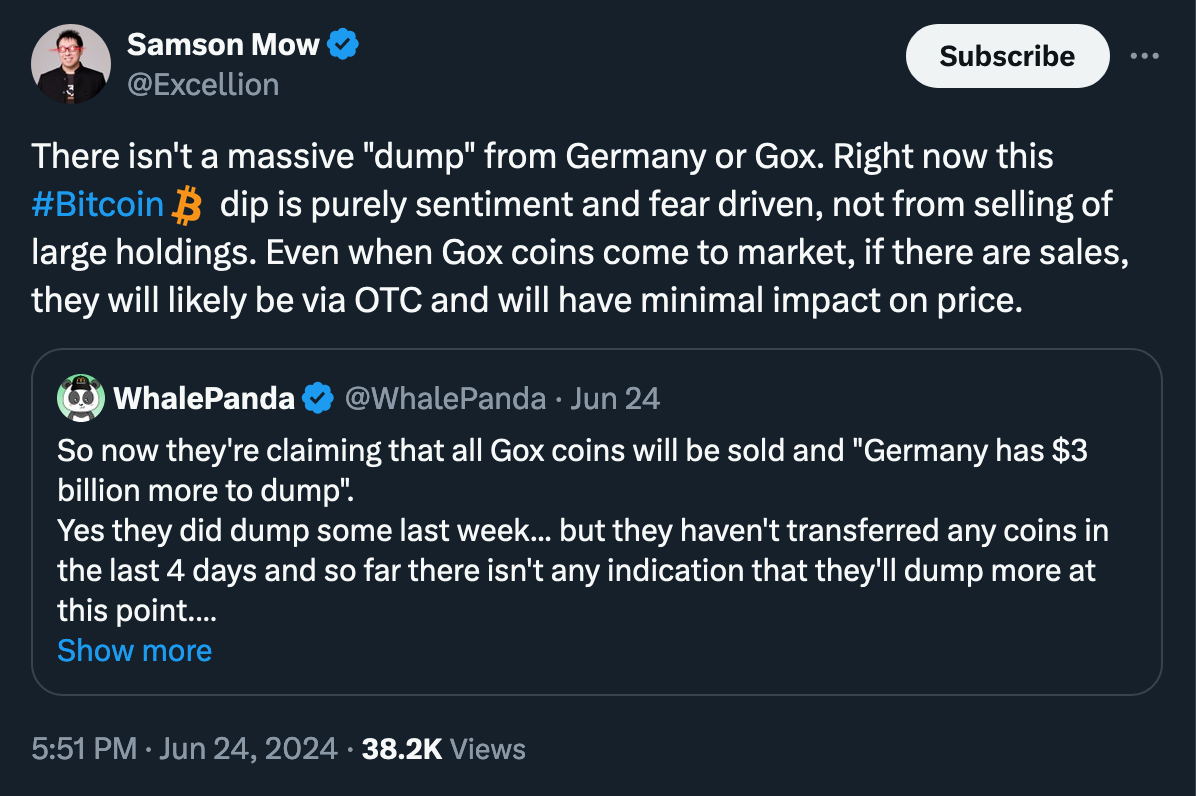

Panic has begun to set in on the crypto markets, with the Crypto Fear and Greed Index plummeting deep into the 'fear' zone amid news of an impending Mt. Gox dump and the German government offloading 900 BTC. But what is the real potential impact these distributions could have on the market?

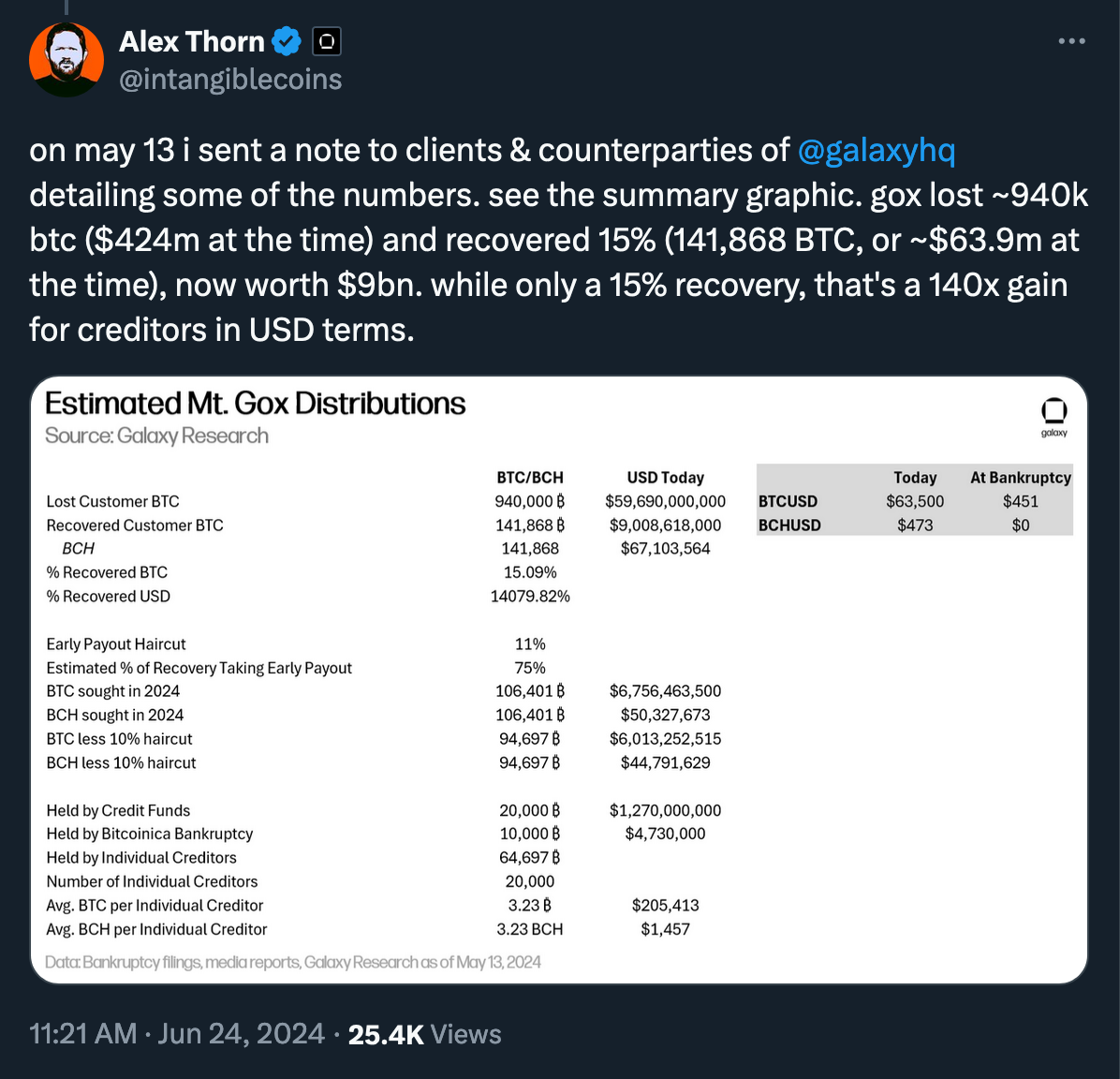

Mt. Gox, once handling 70% of global Bitcoin transactions, collapsed in 2014 due to a devastating hack. The magnitude of this disaster dwarfs anything in crypto history. It lost 940,000 Bitcoin, worth about $56.4 billion in today's prices—six times FTX's 2022 shortfall.

But just as important to us today, Mt. Gox, short for "Magic: The Gathering Online Exchange," originally served as a platform for enthusiasts of the card game, facilitating the trading of Magic cards online. Acquired by Mark Karpeles in 2011, Mt. Gox's customer base was unique, consisting of early card traders, dark web users, and tech enthusiasts. Unlike modern crypto exchanges, Mt. Gox catered to a niche audience of early adopters rather than today's casual retail traders.

(Thread)

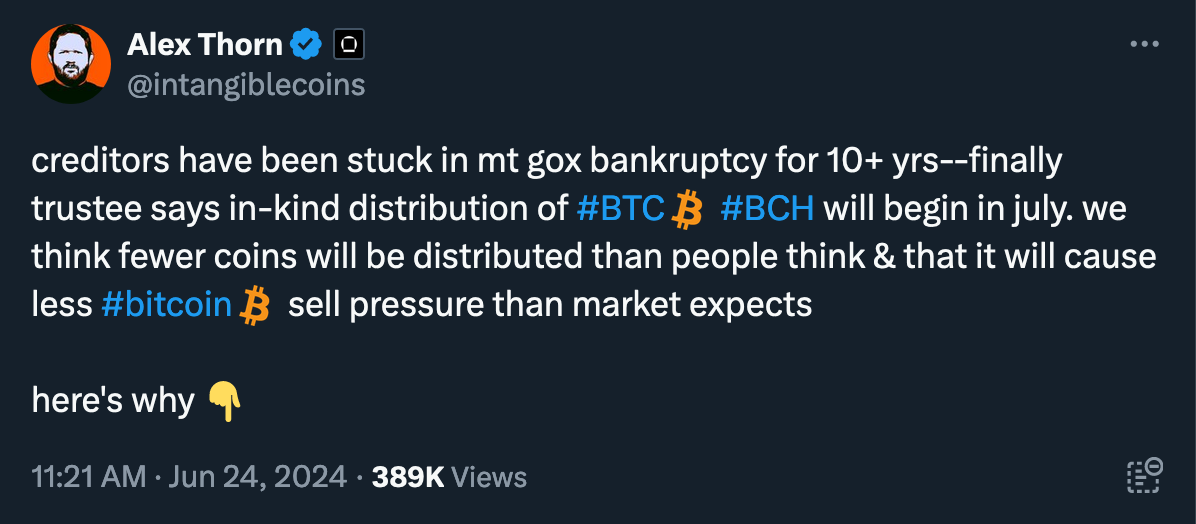

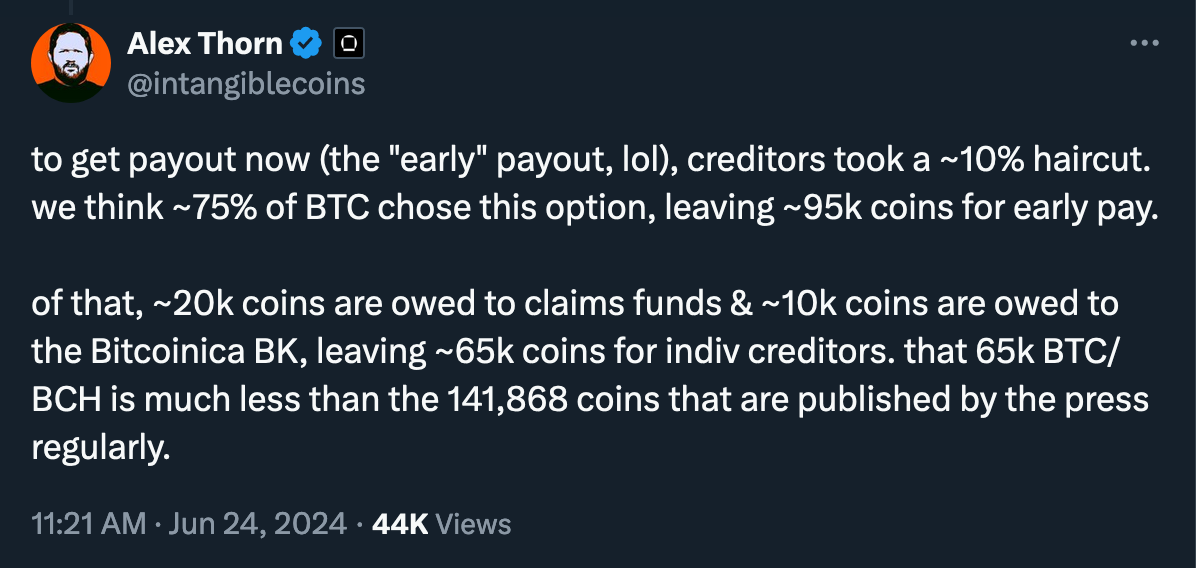

Another crucial point is that Mt. Gox creditors have had over ten years to sell their claims for USD but largely rejected such offers, indicating a strong preference to reclaim their Bitcoin. This choice holds significant implications. Will they sell now, and if so, what portion?

The claims mentioned were made at different levels—40%, 50%, or 60% on the dollar. You might wonder, "Won't the hedge funds that bought those claims dump the Bitcoin as soon as they receive it from Mt. Gox this summer?" They might, but they have also had years to hedge their investments.

(Thread)

"Here’s the breakdown: - 940,000 BTC lost - 15% were recovered, totaling 141,868 BTC - BTC price at the time of bankruptcy: $451 - Bitcoin price today: $60,000If a creditor had 10 Bitcoin on the exchange at the time of bankruptcy, valued at $4,510, receiving 15% back today would mean they are receiving 1.5 BTC, which is now worth $90,000. The percentage gain from $4,510 to $90,000 is approximately 1,896%." (Scott Melker, The Wolf Den newsletter)

(Thread)

Approximately $5.7 billion in Bitcoin is expected to be distributed in early July to credit funds, the Bitcoinica Bankruptcy, and individual creditors, depending on the price of Bitcoin at the time of repayments. This distribution largely explains the current panic selling.

(Thread)

"We have a choice: to be frustrated that locked Bitcoins—which we knew wouldn’t be locked forever—are entering the market, or to be thankful that these coins were removed from circulation for a decade, allowing prices to rise higher during more critical times than today." (Scott Melker, The Wolf Den newsletter)

Mt. Gox is offering us a final opportunity for discounted prices. While sellers may dominate the market currently, their days are numbered, and buyers will soon find relief. From this point, we may see the promising heights ahead.

(Source: Bitcoinist)

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.