ETH rallied more than 20% since Monday after speculation that the SEC may be reversing its stance on ETH spot ETFs. After weeks of doubt, Bloomberg analysts raised the SEC approval odds from 25% to 75%.

Source: Polymarket

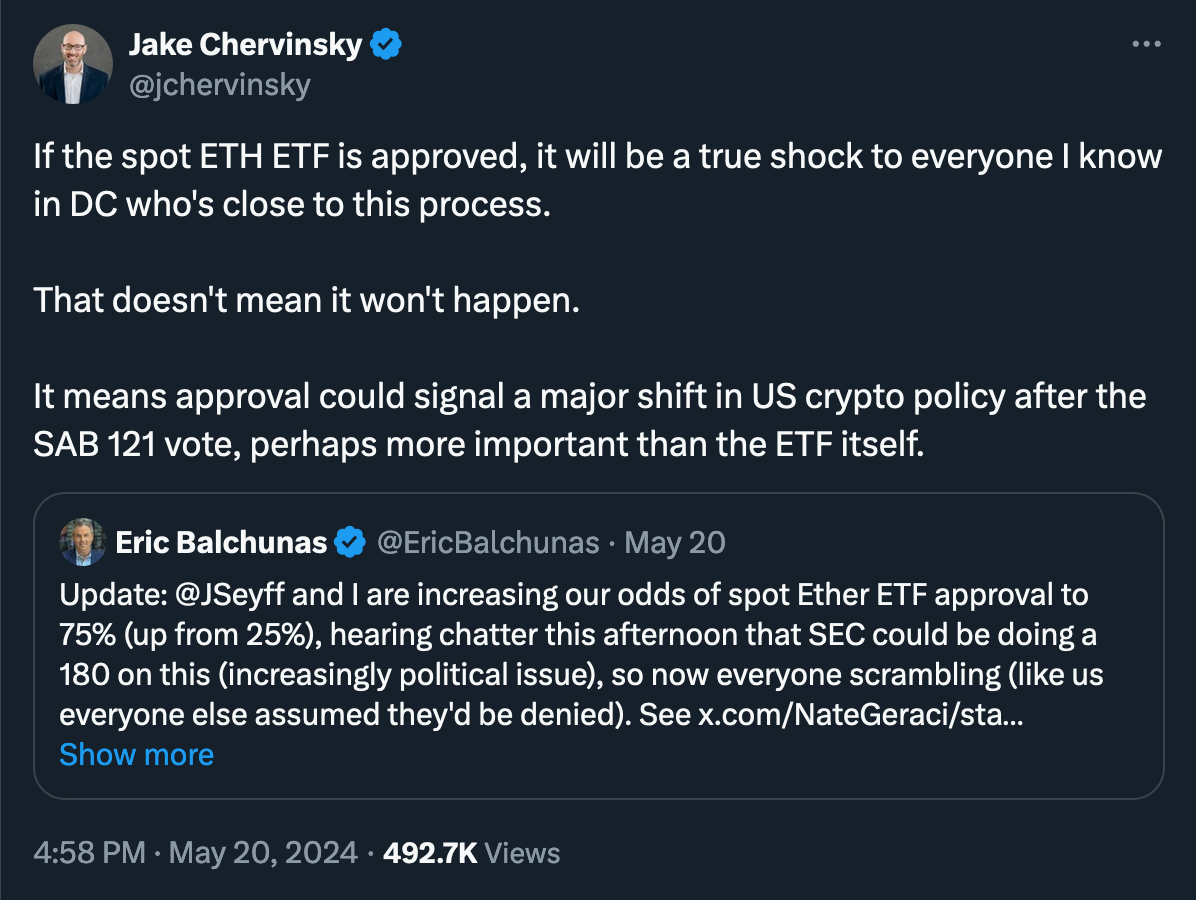

The rally comes as two Bloomberg analysts, Eric Balchunas and James Seyffart, who have gained notable influence on crypto Twitter, suddenly increased their spot ether ETF approval projections from 25% to 75%. Betting markets quickly reflected this change.

“This does not mean approval is a given, but it would be really weird for the SEC to incur the extra time and admin cost if it is planning to reject. I realize that I’m doing a 180º here, but I don’t think the SEC is that disrespectful. It’s looking like I was wrong, and the SEC will approve at least some of the proposals this week: the deadline for VanEck’s is Thursday, and for ARK/21 Shares it falls on Friday.” (Noelle Acheson, Crypto is Macro Now)

This isn't just massively positive for Ethereum; if true, it could indicate significant shifts within the SEC and/or the Biden administration.

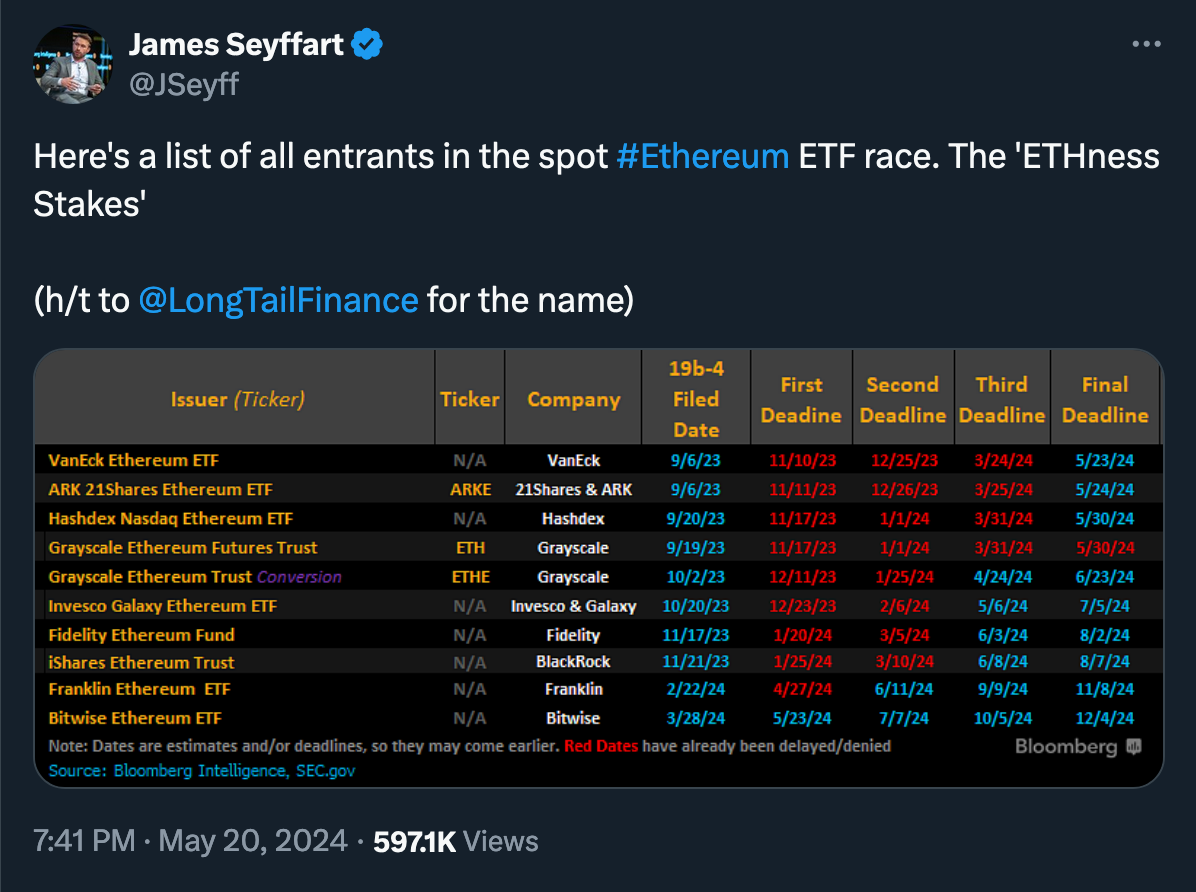

One important technicality to remember is that approval is a two-step process, as seen with Bitcoin. The first step is the 19b-4 filing, followed by the S-1 filing. If the SEC approves the 19b-4, the ETF approval is highly likely, with some time needed for the S-1 to complete the process.

“I am not expecting anything earlier than 2025 to be tradeable, including S-1 approval. However, when it does, it will have a really big positive effect on the market, even if S-1 approval takes more time. I am expecting they will approve it by May 23rd for Vaneck’s 19b-4 deadline.” (Yunus Ozkaya, Cointelegraph)

Still, industry watchers have named several reasons why the SEC might not be ready to allow spot ether ETFs to start trading—from concerns over the liquidity of ETH’s spot and futures markets to the lack of recent SEC engagement with prospective issuers (unlike the numerous meetings held with fund firms before the bitcoin ETF approvals), not to say of its previous classification as a security by the SEC.

Jake Chervinsky on XAlex Thorn on X

The unexpected move in Ether’s price highlights the high stakes tied to the SEC's potential approval of a spot ETH ETF. However, the SEC has not yet made its decision, and it could go either way. Even if approved, a short-term pullback is likely, similar to what was seen with spot BTC ETFs.

According to the IntoTheBlock data, ETH’s surge to $3,800 has put 90% of Ethereum investors In profit.

Historically, holders in profit are more likely to sell than those in loss. Thus, when the market has a large number of profitable investors, the likelihood of a selloff increases, making price tops or at least cooldowns more probable at high profitability levels.

Therefore, in the short term, there are chances for a significant price correction if the SEC rejects the ETF or a 'sell the news' event, even if they are approved.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.