Tether, the controversial stablecoin issuer, has made a significant move into Bitcoin mining by investing in sustainable mining operations in Uruguay, sparking new debates about Tether's role in the cryptocurrency industry.

Earlier this month, the company also announced plans to “regularly allocate up to 15%” of its profits into BTC purchases and funding infrastructure.

Tether, the issuer of USDT stablecoin, has made headlines by venturing into the world of #Bitcoin mining. The company is partnering with a local licensed firm, but the official announcement did not provide specific details regarding the investment amount or the identity of the partner firm.

Tether expects that the mining facility will start operating by mid-Q3 this year, a company spokesperson told CoinDesk.

Why Uruguay?

Uruguay may not be the typical choice considering its negligible share of network hashrate compared to countries like the U.S. and Kazakhstan. Still, Tether sees potential in the country due to its impressive reliance on renewable energy sources. With over 94% of its electricity coming from wind and hydropower, Tether views this as an opportunity to embrace a more environmentally friendly approach.

This focus on sustainable mining aligns with the industry's increasing emphasis on environmentally friendly practices, especially in light of harsh criticism from opponents of proof-of-work and Bitcoin mining. Moreover, it has the potential actually to enhance the economic feasibility of renewable energy sources.

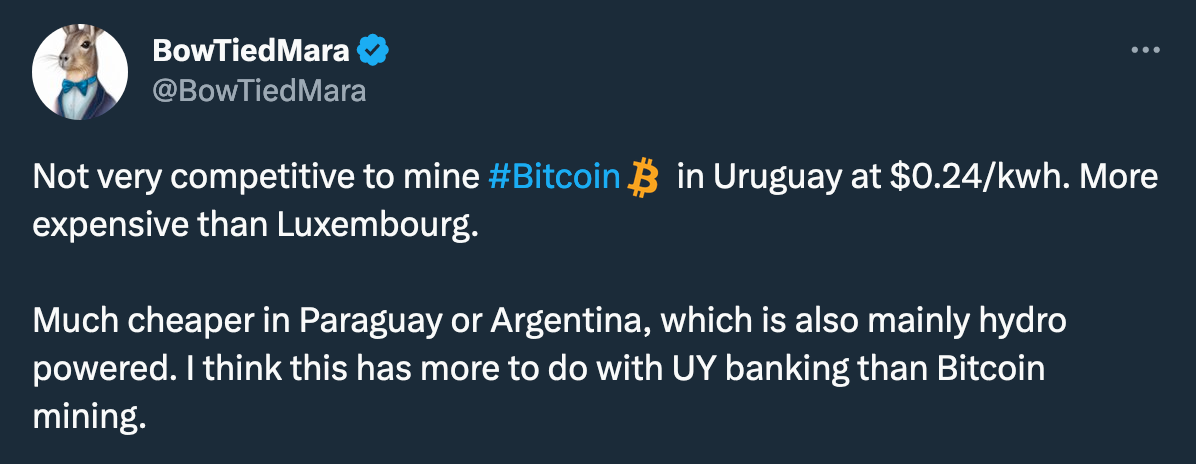

On the other hand, Uruguay is far from being the most cost-efficient jurisdiction in terms of energy costs.

And actually, Uruguay's neighbor Paraguay has experienced an influx of miners looking to tap into its unused hydropower, though this has caused a stir in that country's political and energy systems.

So, again, why Uruguay? And could it be linked to this blockchain initiative somehow (thread one, thread two)?

Even More Ground for Perpetual Tether FUD?

At the same time, Tether's investment in #mining operations raises new questions about Tether's role as a stablecoin issuer and the potential impact on the broader cryptocurrency ecosystem. Critics argue that Tether's expansion into mining represents a consolidation of power and control within the industry. These concerns revolve around the potential centralization effects and the implications for Bitcoin's decentralized nature. Furthermore, Tether's history of scrutiny regarding transparency and its association with the Bitfinex exchange has only added to the controversy surrounding its latest move.

As Tether further diversifies its operations, it becomes an even more prominent player in the cryptocurrency space. This move could potentially impact market dynamics, user trust, and regulatory considerations for stablecoins and the broader cryptocurrency market as a whole.