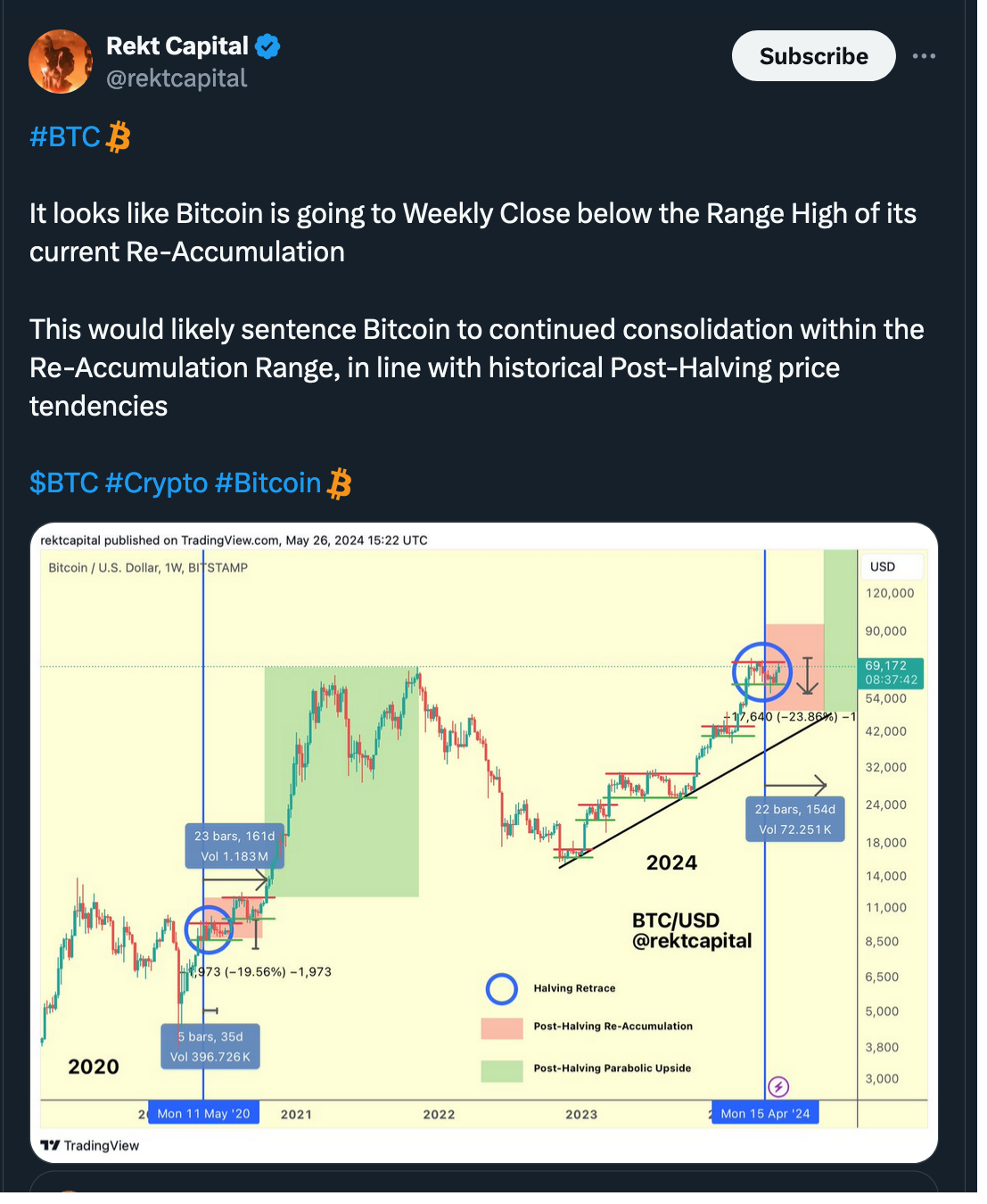

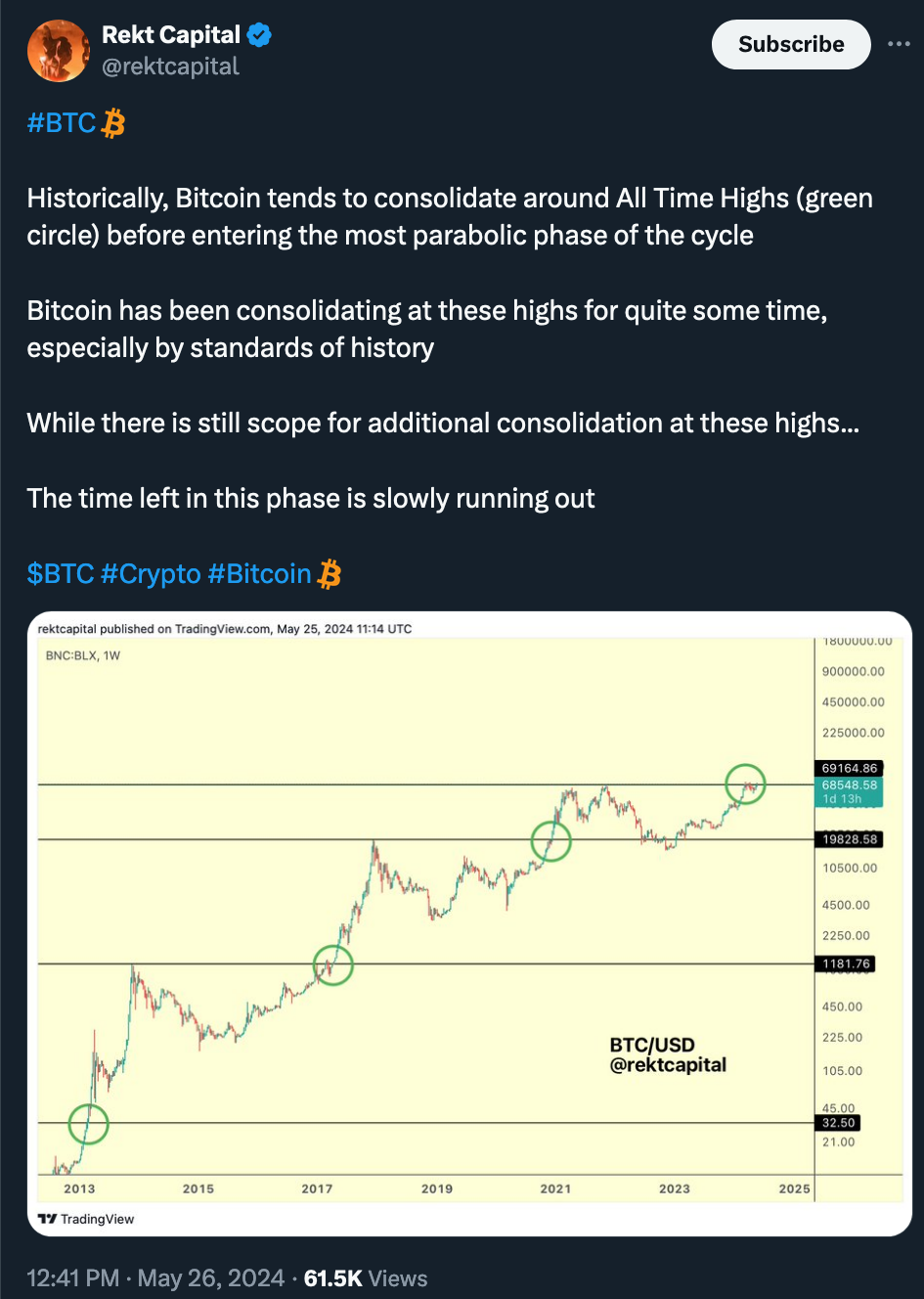

There might be 'several more weeks' of price consolidation below new all-time highs, as the BTC price has been rejected above $70,000. In macro terms, however, the odds are still skewed upward, hinting that the Bitcoin bull market is far from over.

As Bitcoin stayed near key price levels into the weekly close, liquidity thickened, with weekend trading focused on $69,000.

Across BTC order books, liquidity increased around the spot price, leading to lower volatility but upping the odds of a quick 'liquidity raid' in either direction.

Meanwhile, Bitcoin whales have resumed accumulation for the first time since the new all-time high in March, according to blockchain data by CryptoQuant, indicating that the Bitcoin bull market is still on.

Generally, whales buy Bitcoin at a faster pace during bull markets and slow down their buying when the market switches to a 'bear' mode.

Bitcoin RSI also mirrors the 2017 bull run pattern, as noted by another popular analyst on X:

Bitcoin analysis often highlights similarities between the current bull cycle and previous ones, particularly the two most recent: 2016–2017 and 2020–2021.

While 2024 has distinguished itself by producing a new all-time high before, not after a halving, plenty of data still suggests that Bitcoin’s steepest gains are still ahead, not behind us in the current market cycle.

"Bitcoin is playing out incredibly similar to early 2017," points out Jelle. "A hidden bullish divergence and choppy waters right around the previous all-time highs – before the main breakout. Clear $75,000, and this accelerates quickly."

Tactical trading is hard. Risk management and position sizing are key. Without proper risk management and position sizing, you will suck at trading on a distance.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.