Winter is over, and bitcoin could hit $100,000 in 2024, said a Standard Chartered analyst, and some arguments were made there. However, as The Block kindly reminds us in the same article, in December, his colleague at Standard Chartered predicted the bitcoin price could fall to $5000.

"The Bitcoin price has dropped below the $30,000 mark, but this breakdown can be called a false one as it rather reminds a bear trap. However, this breakout confirms the fact that Bitcoin is in an uptrend. In other case without this breakdown and with dramatic closing of the candles it may look like a whale market manipulation. If you look at past cycles, you can see that the price of Bitcoin is moving neatly along the 2019 timeframe, when the price went up also in the spring and the trend lasted until the beginning of summer. There is a possibility of repeating the fractal from 2020 and the drop may be the last before a strong rise. It is more likely that this is an upward trend," says Alexander Mamasidikov, the founder and CEO of MinePlex.

With such a context, one should not underestimate the collective wisdom of Crypto Twitter, which we will try to refer here once again.

In terms of correlation with the S&P (extremely high from around the beginning of the COVID pandemic, as a reminder), this assumption also intuitively seems correct to some OGs.

There is a widely held theory - rather unproven, albeit intuitively valid - that markets tend to follow the path of maximum pain for their participants. And from this perspective, there is no greater pain than a prolonged sideways chop.

Now, having set this basic 'max-pain' sideways scenario, let's consider two basic cases of possible deviations from it (bullish and bearish), then go back to a macro perspective.

Bullish Case

And if @CryptoMichNL gave us a general vision above, @CryptoCred provides one of the possible tradable signals for the bullish case:

"A drop below $30,000 should not be alarming, as we are likely to see sideways movement in the range of $28,000 to $32,000. There is also a chance that the drop will continue to $25,000 to $26,000, which would indicate that the price will rise even further after that.

However, if the Bitcoin price falls below $26,000 and stays at that level for a week, we can expect a drop to $20,000. But a reversal to a downward trend is unlikely, as there are many accompanying factors, such as a decrease in inflation in the United States and in the dollar index, which contribute to the capital influx into Bitcoin," says Alexander Mamasidikov, the founder and CEO of MinePlex.

[not so] Bearish Case

Basically, just a wild guess we have here from yet another pro trader:

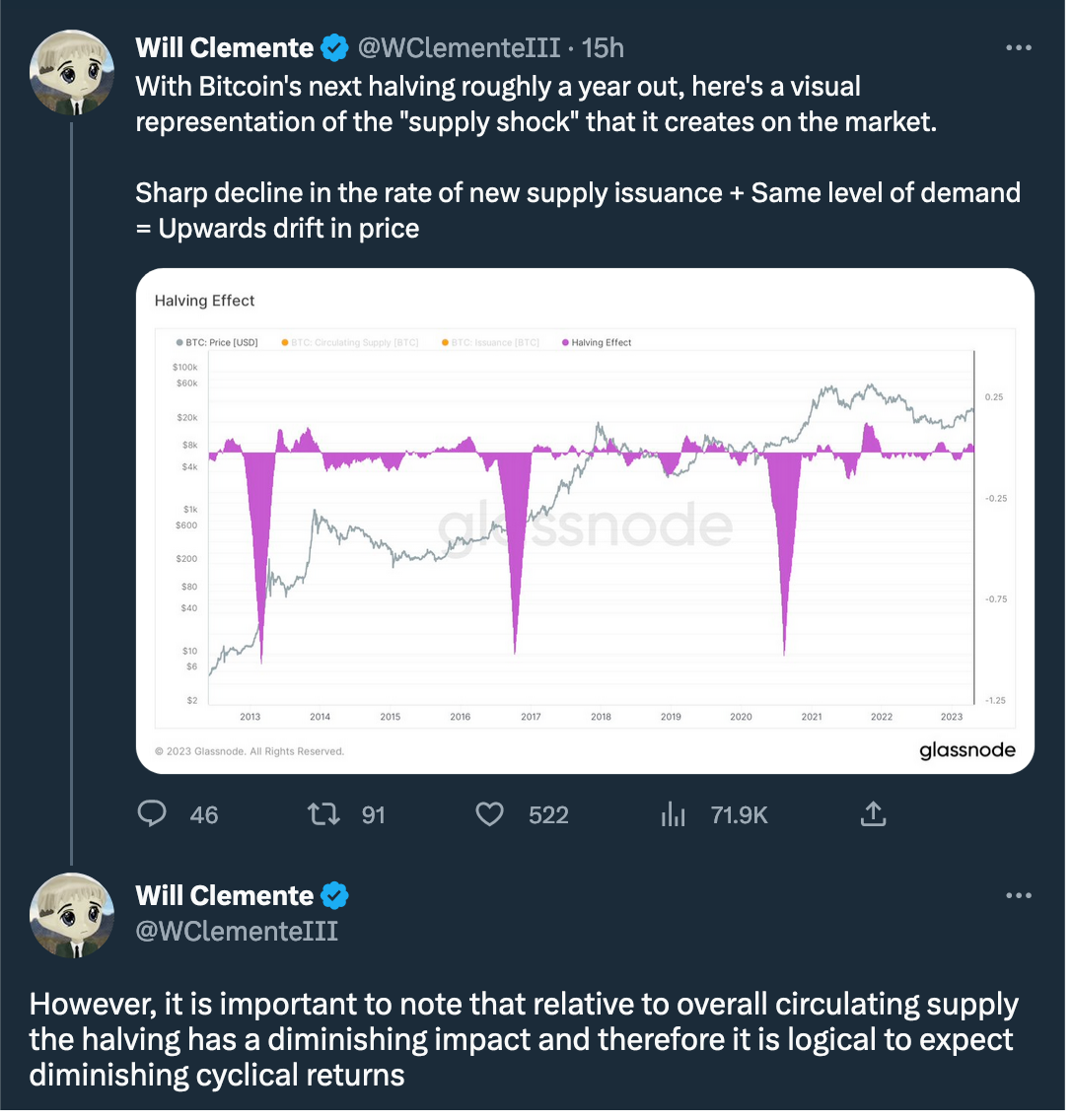

Back to Macro

In essence, now it's all about Bitcoin's value appreciation engine, again, like every ~4 years:

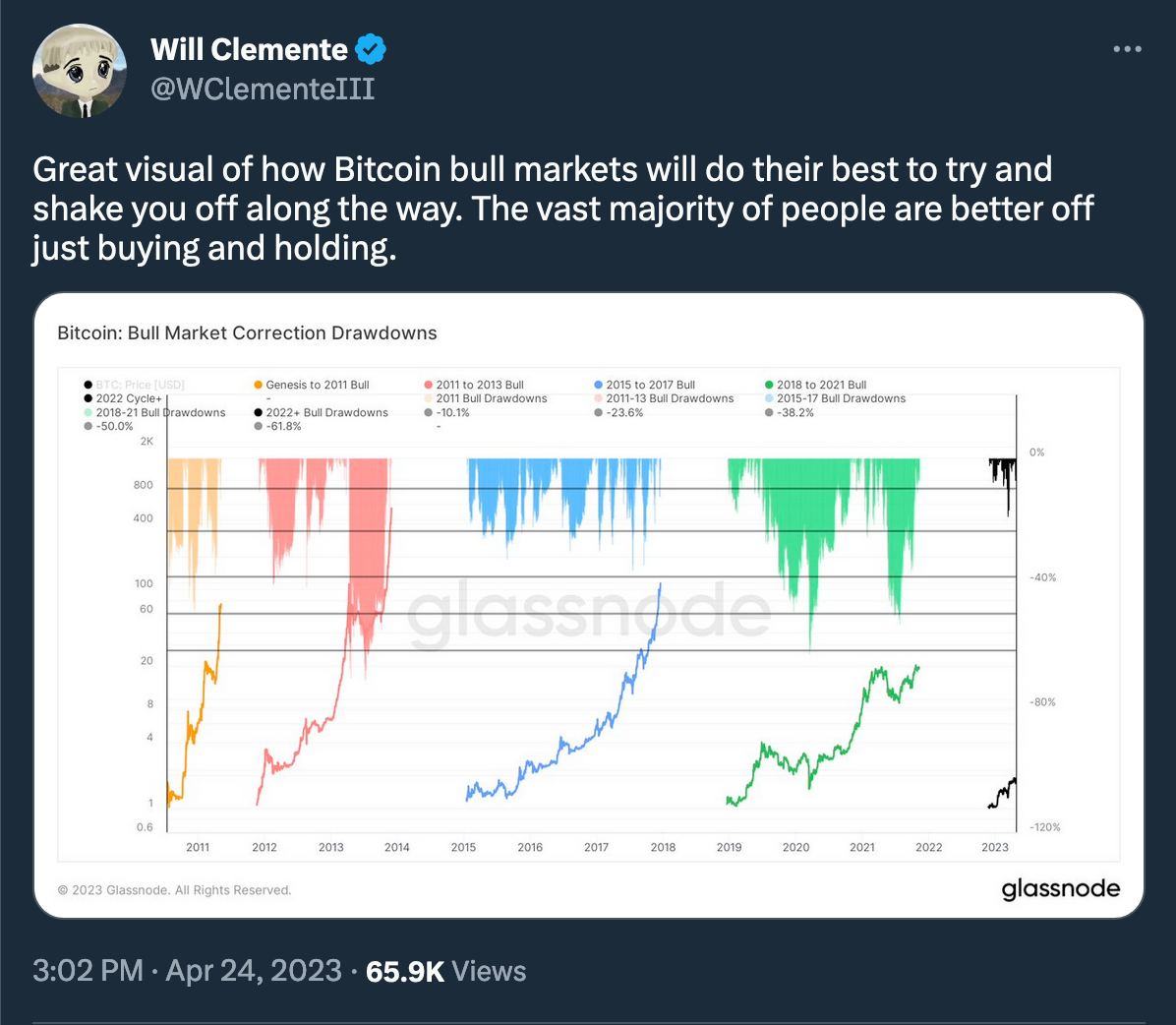

That's how it works in practice:

First of all, then, don't let the market shake you out.

Because your job for the next few months is…

And from the on-chain perspective, the bitcoin market is shifting from a prolonged regime of realized losses into profitability, and a change in the market trend is in progress.

Bonus: Bottom Sign We've Been Waiting For

Keeping in mind and in the context of the intro to this article:

The Holy Grail in Place of a Disclaimer

Don't be like that guy! Proper risk management is a must. The holy grail in trading does exist, and that is proper position sizing and risk management.

Please follow this link for a complete list of educational content from @CryptoCred, one of the most valuable resources for beginners in crypto trading.