Amid news of the U.S. Justice Department's investigation of possible Russian sanctions violations and after many people were alarmed by the record outflow of BTC from the exchange wallets, Binance suspended BTC's withdrawal twice this weekend, immediately nuking the bitcoin price and the broader crypto market's value.

Now let's deal with it step by step, record-breaking outflows first.

Typically, a crypto Twitter might interpret this as a bullish sign (coins moving from an exchange, hence they're probably not planning to be sold anytime soon), but not against this news landscape, seemingly.

Billions of dollars have been withdrawn from Binance while the price of Bitcoin continues to plummet.

— The Wolf (@WolfOfPoloniex) May 8, 2023

This is a big red flag. This sort of behavior happens during insolvency / legal risk.

To top it all off, withdrawals have stopped TWICE.

Play it safe and self-custody for now. pic.twitter.com/bcZ4MWfH7X

People wondered whether whales or insiders were "jumping ship," but it's unlikely to be true.

According to further on-chain inspection, it is likely that the Binance cold wallet was internally adjusted to a new address, and the new address did not transfer out after receiving funds.

— Wu Blockchain (@WuBlockchain) May 7, 2023

And later on, @binance confirmed a version of moving funds between the exchange's own wallets:

We’re aware that some data are showing a large volume of outflows from #Binance.

— Binance (@binance) May 8, 2023

This ‘outflow’ are actually movements between Binance hot and cold wallets due to the BTC address adjustments.

As for the suspension of BTC withdrawals (twice a day, which also matters), CZ attributed it to Bitcoin network congestion caused by the ongoing Ordinals and BRC-20 tokens craze:

…And even tried to present it as a “bull market issue“:

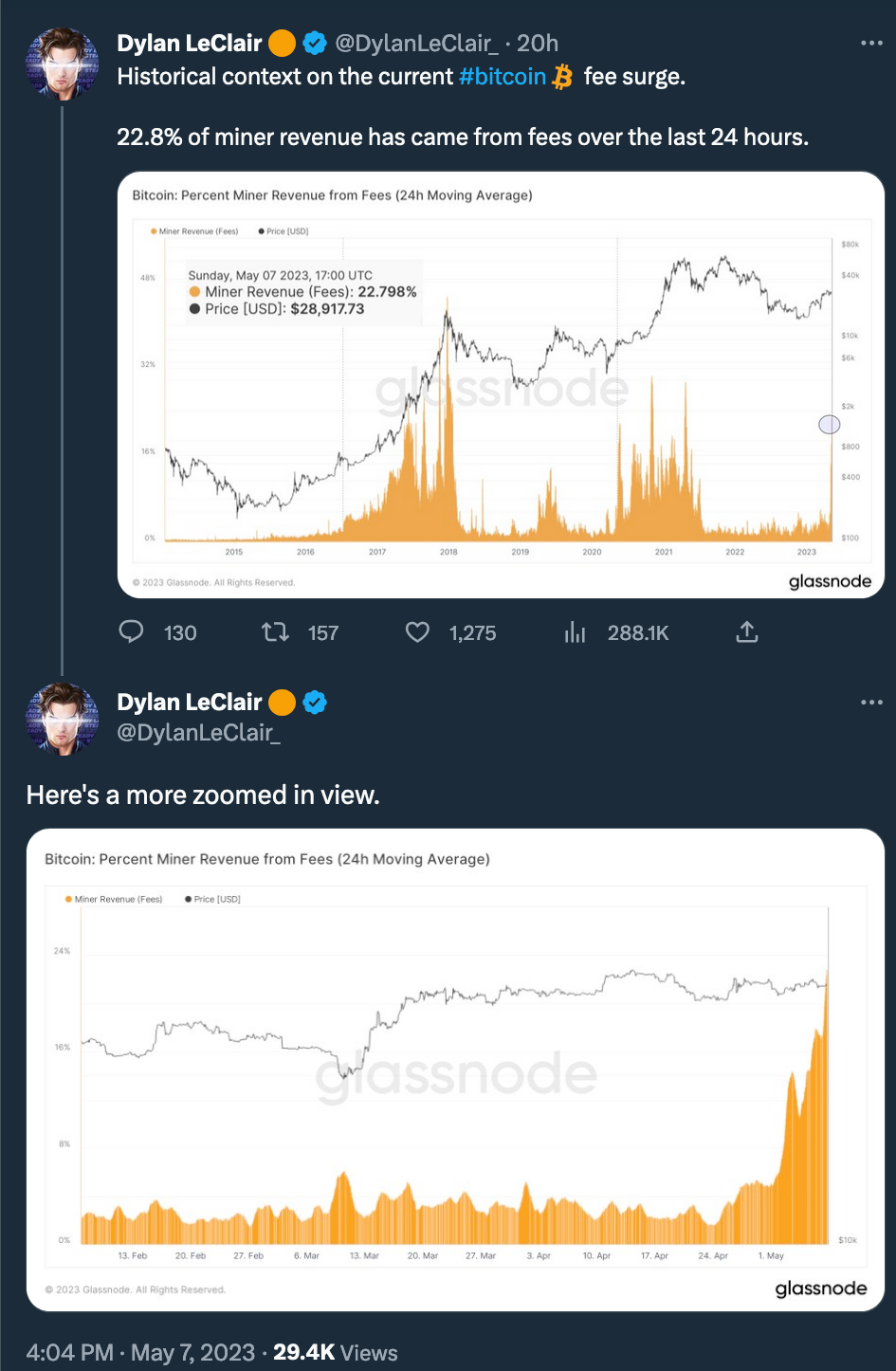

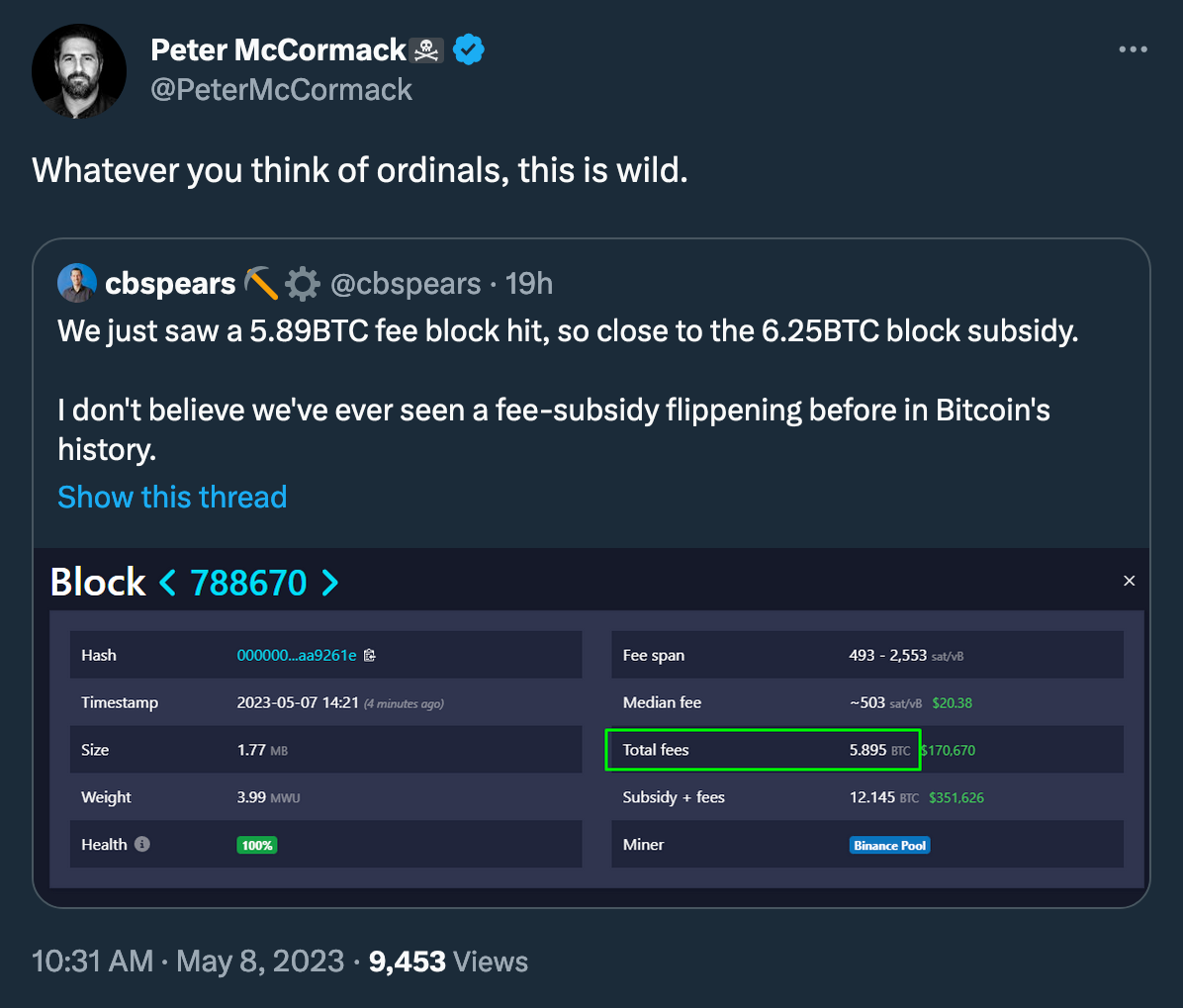

As of Sunday afternoon, the total number of unconfirmed Bitcoin transactions in the network's mempool was around 395,000, according to mempool.space. This is a significant increase from the 56,500 recorded on April 26th, according to Blockchain.com. Of course, this cannot but affect the size of transaction fees, previously observed only at the peak of the hype during bull markets.

And it feels wild enough that the Bitcoin community seems seriously concerned about BRC-20 as a form of DoS attack on the network.

On resuming withdrawals after the second pause on Sunday, Binance called it a "learning opportunity" and noted that it'd adjust withdrawals fees and work on enabling BTC Lightning Network support in the next few months.

To prevent a similar recurrence in the future, our fees have been adjusted. We will continue to monitor on-chain activity and adjust accordingly if needed.

— Binance (@binance) May 8, 2023

Our team has also been working on enabling BTC Lightning Network withdrawals, which will help in such situations.

Now, can we conclude that Binance is completely fine, the FUD surrounding it is baseless, and there's no reason to be worried? I don't think so, and Swan Bitcoin recently published a comprehensive long-read about that: "Binance: Raising Eyebrows Since 2017" (I highly recommend reading it). Just this weekend's events should probably be viewed more as a reminder of the associated risks rather than a genuine reason for panic.

And the advice from the tweet above about "playing it safe and self-custody" is always relevant. But maybe it's especially relevant these days because now the atmosphere in the market feels quite the opposite of what it was in December.

The risk of downside is significantly higher now than it was 6 months ago

— DonAlt (@CryptoDonAlt) May 8, 2023

Now that memecoins are pumping and grifters are out there scamming everyone they can there are less and less reasons to go up

Just need to find a reason to nuke